Aircraft Seat Actuation System Market Report

RA08400

Aircraft Seat Actuation System Market by Aircraft Type (Linear wing and Rotary wing), Passenger Seat Class (Business Class, First Class, Premium Economy Class, and Economy Class), Type (Electromechanical and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2031

Global Aircraft Seat Actuation System Market Analysis

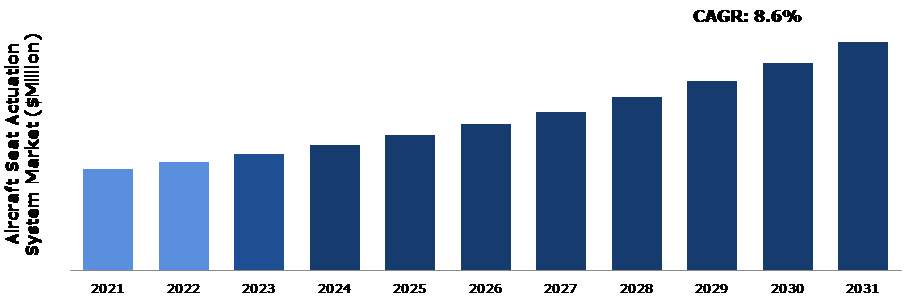

The global aircraft seat actuation system market size was $526.5 million in 2021 and is predicted to grow with a CAGR of 8.6%, by generating a revenue of $1,187.7 million by 2031.

Aircraft Seat Actuation System Market Synopsis

Aircraft seat actuation system market growth is an intelligent system that allows for aircraft seats to control and adjustment as per passenger’s comfort and preference. The solution comprises a technologically enhanced maintenance concept, ergonomic seat motion, and scalability from cockpit seats to super first-class seats. The comfort and experiences of the customers are improved by the addition of new actuators with various motion controller types. It is widely used in a broad range of aircraft types, including wide-body, regional transport, and business jets.

Lightweight, electric control motion, and self-adjusting aircraft seat actuators have been created as a result of technological breakthroughs in the field of aircraft seat actuation systems. Prior to current scenario, seat actuation systems only offered a few customization choices, jerky motions, and a restricted degree of recline. At the moment, advanced actuation systems with built-in seat adjustment features are being offered by manufacturers of aviation seat actuation systems, such as Crane (US). For instance, Collins Aerospace announced the release of their next-generation evolution seat in May 2019. This seat blends executive and commercial first-class seats. The seat is operated by a patented triple roller system for a seamless transition between seat positions with the least amount of effort. It includes a small pedestal base that gives designers the option to create the illusion of a floating seat. To suit a range of passenger sizes, it also incorporates an expanded leg rest.

The aircraft seat actuation system has a high production cost. In comparison to other aircraft seats, the technology used in aviation seat actuation systems costs 25 times higher. For instance, creating a seat with an in-flight actuation system can cost up to $250000 per seat, while a typical economy class seat can cost as little as $10000. Due to the cost, the majority of airline manufacturers only utilize these seats in luxury class sections of their aircraft. Additionally, installing an aeroplane seat actuation system is a costly process, which is anticipated to restrain the global aircraft seat actuation market demand in the upcoming years.

Due to the speed at which technology is evolving, urban air mobility (UAM) has emerged as a viable business possibility. Due to increase in traffic congestion, particularly in megacities, people are continuously looking for better and safer methods to commute to work and travel to other locations. The development of electric vertical takeoff and landing (eVTOL) aircraft is one of the major elements promoting UAM. The evolution of aircraft propulsion systems, particularly distributed electric propulsion (DEP), is a significant additional component.

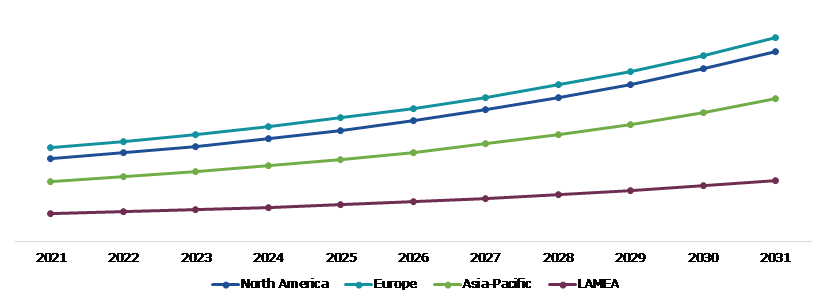

According to regional analysis, the Asia-Pacific aircraft seat actuation system market size fastest growth. In the near future, it is anticipated that the Asia-Pacific aircraft seat actuation system market demand would expand quickly. During the projected period, India and China are anticipated to be attractive markets for aircraft seat actuation system.

Aircraft Seat Actuation System Overview

The market for aircraft seat actuators is growing significantly as a result of an increase in air travelers and better customer experiences. A few other factors influencing the market's expansion include the rise in demand for lightly weighted seats and surge in aircraft manufacturers as a result of increase in number of aircraft orders. Additionally, the adoption of cutting-edge technology has a favorable influence on market expansion. However, the market expansion is being hampered by low frill airplanes due to worries about the dysfunctionality of comfort facilities.

COVID-19 Impact on the Global Aircraft Seat Actuation System Market

Due to the COVID-19 crisis, the global manufacture of aircraft seat actuation systems have been severely affected by the government-imposed travel bans and announced lockdowns. Due to COVID-19, the supply of electrical components, position sensors, and arresting brakes used in aircraft seat actuation systems have been negatively disrupted. The market for new commercial and private business planes has been negatively hampered by government travel limitations brought on by COVID-19 pandemic. As a result, the market for aircraft seat actuation systems have suffered.

As travel restrictions start to lessen in some parts of the world, demand for aircraft seat actuation systems is anticipated to increase in the near future. Owing to the closure of numerous airlines due to the COVID-19 epidemic, demand for replacement parts such as sensors and electrical components is further declining.

Rise In Demand for High-Tech Seats as a Result of Developments In Seat Technology Is Expected to Drive the Market Growth

The usage of aircraft seat actuation system market trend technology has grown significantly over time, turning it into a crucial part of the aircraft, and it is projected that this will cause the global market for these systems to grow significantly. One aspect of the surge in demand for aircraft seats is increased customer comfort. Additionally, the market for aviation seat actuation systems is expected to be driven by the rise in demand for high-technology oriented seats as a result of developments in seat technology including motion control, self-adjusting aircraft seat actuators, and its low weight. Additionally, it is projected that the increase in demand for luxury seats with seat actuators would be a major factor driving the global aviation seat actuation system market growth in the anticipated period. For instance, the premium seat class has become a common seat category on both airplanes and passenger ships. A surge in demand for low-cost airlines utilizing seat actuators is expected to result in more investment opportunities during the estimated period for the market for airplane seat actuation systems. For instance, in February 2021, All Nippon Airways, launched a new low-cost airline brand with flights connecting Japan with Oceania and Southeast Asia. All these factors are expected to drive aircraft seat actuation system market share growth in the forecast time period.

The Cost of the Aircraft Seat Actuation System Technology May Hinder the Growth of the Market

The expense of producing the airplane seat actuation mechanism is substantial. The cost of the aircraft seat actuation system technology is 25 times greater than that of other aircraft seats. For example, whereas the average economy class seat might cost up to $10000, installing an actuation system in flight can cost up to $250000 per seat. The majority of airline companies who construct airplanes only utilize these seats in the premium class sections due to the expense. The cost of installing a seat actuation system is another factor that is expected to hinder the global market for aircraft seat actuation systems during the course of the forecast period.

Urban Air Mobility (UAM) is Expected to Create New Opportunities in the Market

The rapid advancement of technology has made urban air mobility (UAM) an attractive business proposition. People are continuously looking for better and safer options to commute to work and travel to other locations as road congestion increases, particularly in megacities. The introduction of electric vertical takeoff and landing (eVTOL) aircraft is one of the primary factors promoting UAM. Another significant factor is the evolution of aircraft propulsion systems, particularly distributed electric propulsion (DEP). All of these factors might potentially lead to lucrative aircraft seat actuation systems market opportunities for large companies in the next years.

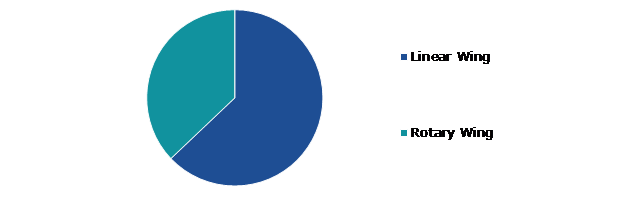

Global Aircraft Seat Actuation System Market, by Aircraft Type

By aircraft type, the market has been divided into linear wing and rotary wing. Among these, the linear wing sub-segment accounted for the dominating share in the market.

Global Aircraft Seat Actuation System Market, by Aircraft Type, 2021

Source: Research Dive Analysis

The linear wing sub-segment emerged as a dominating market share in 2021. Large payloads may be carried by linear wing types. In addition, it has a significantly greater range for holding cargo. Since the pilots' seat adjustment range is rather wide, this gives them a decent level of comfort. Therefore, this would be perfect for them, especially on long-haul flights where comfort is essential for a smooth ride. These elements are anticipated to support the market sub-segment for aircraft seat actuation systems during projected period.

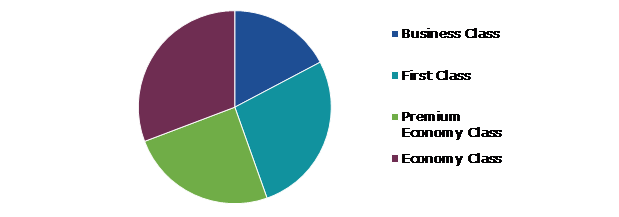

Global Aircraft Seat Actuation System Market, by Passenger Seat Class

By passenger seat class, the market has been divided into business class, first class, premium economy class, and economy class. Among these, the economy class sub-segment emerged as the dominating one in the market whereas the premium economy class sub-segment is projected to be the fastest growing during the forecast period.

Global Aircraft Seat Actuation System Market, by Passenger Seat Class, 2021

Source: Research Dive Analysis

The economy class sub-segment emerged as the dominating sub-segment in 2021. This increase is mostly attributable to the exquisite comfort and reasonable prices offered by this sub-segment. During the forecast period, a sizable increase in middle-class travelers worldwide choosing low-cost flights is anticipated to fuel the expansion of the aircraft seat actuation system market sub-segment. While main and business class cabins are much more expensive and provide better seating conditions to the consumer, premium economy class is predicted to gain more and more popularity during forecast time.

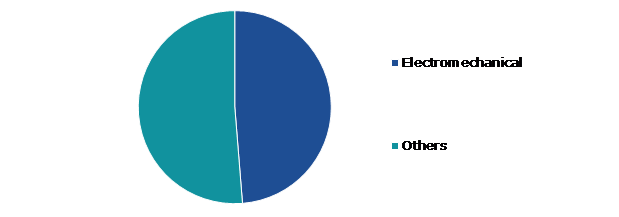

Global Aircraft Seat Actuation System Market, by Type

By type, the market has been divided into electromechanical and others. Among these, the electromechanical sub-segment emerged as the dominating one in the market.

Global Aircraft Seat Actuation System Market, by Type, 2021

Source: Research Dive Analysis

The electromechanical sub-segment has emerged as the fastest growing market share in 2031. The majority of aviation firms employ electromechanical technology since it reduces vibration from mechanical machine assemblies and equipment used in aircrafts, which is expected to drive the sub-segment market over the projected time.

Global Aircraft Seat Actuation System Market, by Region

The interventional pulmonology market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Aircraft Seat Actuation System Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Aircraft Seat Actuation System in Asia-Pacific to be the Fastest Growing

Asia-Pacific aircraft seat actuation system market analysis is anticipated to be the fastest growing market during the forecast time. Additionally, Asia-Pacific has a significant CAGR rate. Other factors propelling growth in Asia-Pacific market during the projected period include the fast urbanization of emerging nations and rise in demand for air travel among people in nations such as Australia, South Korea, and India. It is anticipated that demand for the aircraft seat actuation system market size would increase across the area due to the rise in desire for comfortable seats among travelers in this region.

The Market for Aircraft Seat Actuation System in Europe to be the Dominating

The huge number of aircraft seat actuator systems production facilities in the area is a major factor in the market's growth in Europe. Additionally, the corporations are spending more on creating cutting-edge seats for aircraft, which is expected to increase investment opportunities in the anticipated time frame.

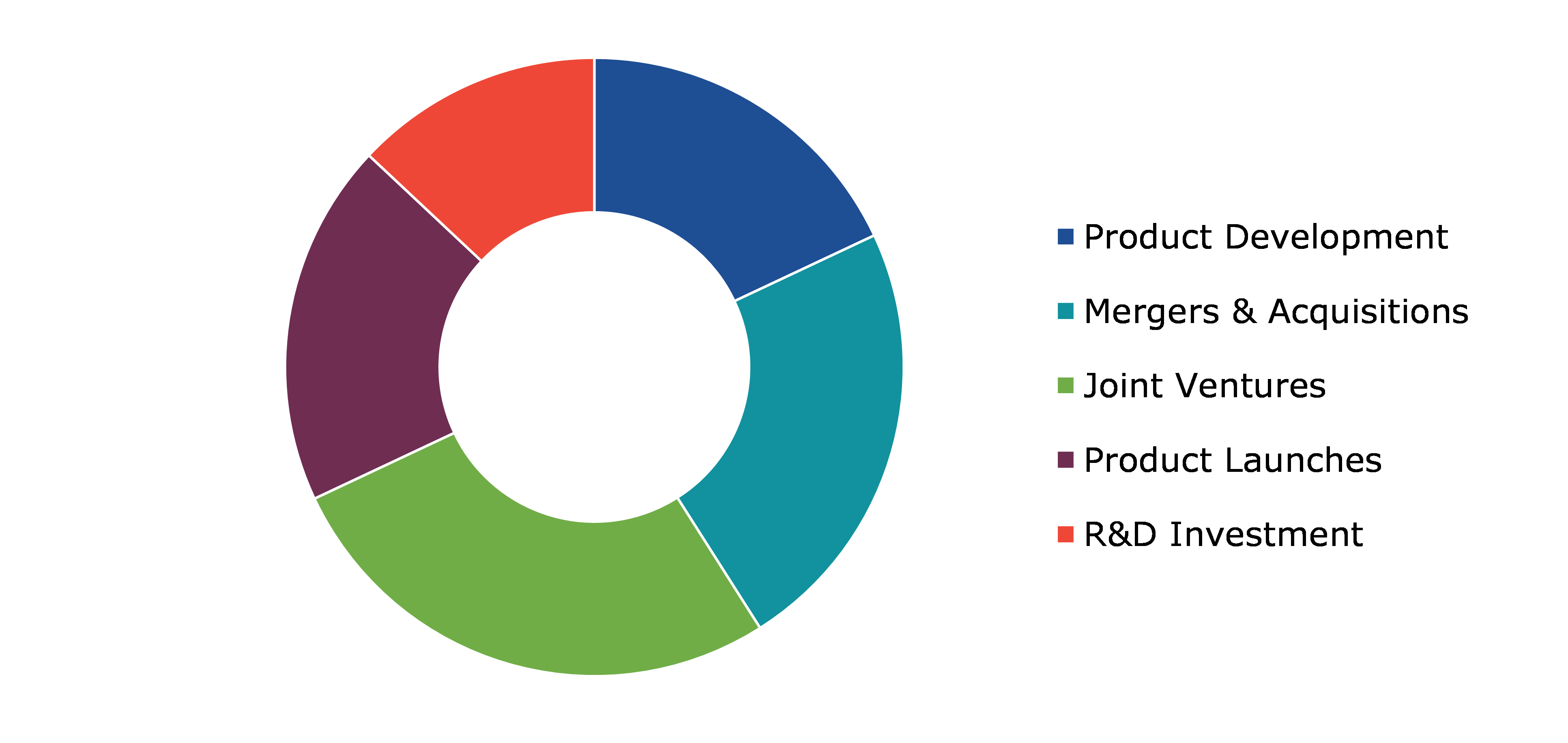

Competitive Scenario in the Global Aircraft Seat Actuation System Market

Investment and agreement are common strategies followed by major market players. For instance, in April 2020, B&D Industrial, the B&D Industrial and Kyntronics have formed a strategic partnership to develop innovative technologies for actuation and motion control solutions.

Source: Research Dive Analysis

Some of the leading interventional pulmonology market players are Moog Inc., Astronics Corporation, Crane Aerospace (United Technologies Corporation), NOOK Industries Inc., Rollon SpA, Bühler Motor GmbH, Airwork Pneumatic Equipment, Kyntronics, and among others.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | Asia-Pacific, North America, Europe, and LAMEA |

| Segmentation by Aircraft Type |

|

| Segmentation by Passenger Seat Class |

|

| Segmentation by Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global aircraft seat actuation system market?

A. The size of the global aircraft seat actuation system market share was over $526.5 million in 2021 and is projected to reach $1187.7 million by 2031.

Q2. Which are the major companies in the aircraft seat actuation system market?

A. Moog Inc., Astronics Corporation, Crane Aerospace (United Technologies Corporation), NOOK Industries Inc., Rollon SpA, Bühler Motor GmbH, Airwork Pneumatic Equipment, Kyntronics, and among others are some of the key players in the global aircraft seat actuation system market.

Q3. Which region, among others, possesses greater investment opportunities in the near future for Aircraft Seat Actuation System Market?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific aircraft seat actuation system market?

A. Asia-Pacific aircraft seat actuation system market share is anticipated to grow at 9.2%CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in Aircraft Seat Actuation System Market?

A. Product launches and mergers & acquisitions the two key strategies employed by the market's operating companies.

Q6. Which companies are investing more on R&D practices for Aircraft Seat Actuation System Market?

A. Moog Inc. and Bühler Motor GmbH are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Aircraft Seat Actuation System Market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Aircraft Seat Actuation System market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Aircraft Seat Actuation System Market Analysis, by Aircraft Type

5.1.Overview

5.2.Linear wing

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Rotary Wing

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness, 2021-2031

5.4.2.Competition heatmap, 2021-2031

6.Aircraft Seat Actuation System Market Analysis, by Passenger Seat Class

6.1.Business Class

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.First Class

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Premium Economy Class

6.3.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Economy Class

6.4.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness, 2021-2031

6.5.2.Competition heatmap, 2021-2031

7.Aircraft Seat Actuation System Market Analysis, by Type

7.1.Electromechanical

7.1.1.Definition, key trends, growth factors, and opportunities, 2021-2031

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2.Others

7.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness, 2021-2031

7.3.2.Competition heatmap, 2021-2031

8.Aircraft Seat Actuation System Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Aircraft type, 2021-2031

8.1.1.2.Market size analysis, by Passenger seat class, 2021-2031

8.1.1.3.Market size analysis, by Type, 2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis Aircraft type, 2021-2031

8.1.2.2.Market size analysis, by Passenger seat class, 2021-2031

8.1.2.3.Market size analysis, by Type, 2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Aircraft type, 2021-2031

8.1.3.2.Market size analysis, by Passenger seat class, 2021-2031

8.1.3.3.Market size analysis, by Type, 2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness, 2021-2031

8.1.4.2.Competition heatmap, 2021-2031

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Aircraft type, 2021-2031

8.2.1.2.Market size analysis, by Passenger seat class, 2021-2031

8.2.1.3.Market size analysis, by Type, 2021-2031

8.2.2.U.K.

8.2.2.1.Market size analysis, by Aircraft type, 2021-2031

8.2.2.2.Market size analysis, by Passenger seat class, 2021-2031

8.2.2.3.Market size analysis, by Type, 2021-2031

8.2.3.France

8.2.3.1.Market size analysis, by Aircraft type, 2021-2031

8.2.3.2.Market size analysis, by Passenger seat class, 2021-2031

8.2.3.3.Market size analysis, by Type, 2021-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Aircraft type, 2021-2031

8.2.4.2.Market size analysis, by Passenger seat class, 2021-2031

8.2.4.3.Market size analysis, by Type, 2021-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Aircraft type, 2021-2031

8.2.5.2.Market size analysis, by Passenger seat class, 2021-2031

8.2.5.3.Market size analysis, by Type, 2021-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Aircraft type, 2021-2031

8.2.6.2.Market size analysis, by Passenger seat class, 2021-2031

8.2.6.3.Market size analysis, by Type, 2021-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness, 2021-2031

8.2.7.2.Competition heatmap, 2021-2031

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Aircraft type, 2021-2031

8.3.1.2.Market size analysis, by Passenger seat class, 2021-2031

8.3.1.3.Market size analysis, by Type, 2021-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Aircraft type, 2021-2031

8.3.2.2.Market size analysis, by Passenger seat class, 2021-2031

8.3.2.3.Market size analysis, by Type, 2021-2031

8.3.3.India

8.3.3.1.Market size analysis, by Aircraft type, 2021-2031

8.3.3.2.Market size analysis, by Passenger seat class, 2021-2031

8.3.3.3.Market size analysis, by Type, 2021-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Aircraft type, 2021-2031

8.3.4.2.Market size analysis, by Passenger seat class, 2021-2031

8.3.4.3.Market size analysis, by Type, 2021-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Aircraft type, 2021-2031

8.3.5.2.Market size analysis, by Passenger seat class, 2021-2031

8.3.5.3.Market size analysis, by Type, 2021-2031

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Aircraft type, 2021-2031

8.3.6.2.Market size analysis, by Passenger seat class, 2021-2031

8.3.6.3.Market size analysis, by Type, 2021-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness, 2021-2031

8.3.7.2.Competition heatmap, 2021-2031

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Aircraft type, 2021-2031

8.4.1.2.Market size analysis, by Passenger seat class, 2021-2031

8.4.1.3.Market size analysis, by Type, 2021-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Aircraft type, 2021-2031

8.4.2.2.Market size analysis, by Passenger seat class, 2021-2031

8.4.2.3.Market size analysis, by Type, 2021-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Aircraft type, 2021-2031

8.4.3.2.Market size analysis, by Passenger seat class, 2021-2031

8.4.3.3.Market size analysis, by Type, 2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Aircraft type, 2021-2031

8.4.4.2.Market size analysis, by Passenger seat class, 2021-2031

8.4.4.3.Market size analysis, by Type, 2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Aircraft type, 2021-2031

8.4.5.2.Market size analysis, by Passenger seat class, 2021-2031

8.4.5.3.Market size analysis, by Type, 2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness, 2021-2031

8.4.6.2.Competition heatmap, 2021-2031

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Moog Inc

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Astronics Corporation

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Crane Aerosapce (United Technologies Corporation)

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.NOOK Industries Inc

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Rollon SpA

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Bühler Motor GmbH

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.AIRWORK PNEUMATIC EQUIPMENT

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Kyntronics

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Others

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

An aircraft seat actuation system is used for helping passengers to change the alignment of their seats by offering recliner and seat adjusting mechanisms. This system is usually available in first-class, business class, and economy-class divisions of an aircraft. In recent years, the demand for aircraft seat actuators is surging owing to the growing developments in the aerospace sector. Actuation systems use different types of actuators to enable easy movement of aircraft seats to suit the needs of passengers.

Nowadays, advanced actuation systems with in-built seat adjustment facilities are being provided by aircraft seat actuation system manufacturers. The global aircraft seat actuation system market has seen robust growth in the last few years due to the increasing demand for maintenance and retrofitting of prevailing aircraft.

Newest Insights in the Aircraft Seat Actuation System Market

Earlier, seat actuation systems were only available with a few customization choices, bouncy motions, and a limited degree of recline. In recent years, lightweight, self-adjusting, and electric control motion aircraft seat actuators have been developed owing to various technological developments in aircraft seat actuation systems. As per a report by Research Dive, the global aircraft seat actuation system market is expected to grow with 8.6% CAGR and hit $1,187.7 million in the 2022–2031 timeframe. The Asia-Pacific aircraft seat actuation system market is expected to observe speedy growth in the years to come. This is because the region has a huge demand for aircraft seat actuation systems owing to the growing demand for air travel in this region.

How are the Market Players Responding to the Rising Demand for Aircraft Seat Actuation Systems?

The rising technological advancements in aircraft seat actuators is driving the demand for aircraft seat actuation systems. Market players are greatly investing in innovative research and developments to fulfil this rising demand. Some of the foremost players in the aircraft seat actuation system market are Astronics Corporation, Crane Aerospace (United Technologies Corporation), NOOK Industries Inc., Rollon SpA, Bühler Motor GmbH, Airwork Pneumatic Equipment, Kyntronics, Moog Inc., Moog Inc., Astronics Corporation, Crane Aerospace (United Technologies Corporation), Bühler Motor GmbH, NOOK Industries Inc., Airwork Pneumatic Equipment, Kyntronics, and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a notable position in the global market.

For instance,

- In February 2018, Lufthansa Technik, a designer and producer of lie-flat business class seats for commercial airliners, partnered with Crane Aerospace & Electronics, a leading provider of critical systems and components to the aerospace and defence sectors.

- In February 2022, Unum Aircraft Seating, a designer and manufacturer of lie-flat business class seats for commercial airliners, announced about its partnership with foremost innovators in aircraft design and engineering –SCHROTH Safety Products, SabetiWain Aerospace, and Bühler Motor Aviation GmbH.

- In May 2022, Astronics Corporation, a foremost provider of cutting-edge technologies for global defence, aerospace, and other mission-critical sectors, entered into a strategic partnership with LG Display, one of the world's largest manufacturers and suppliers of thin-film transistor liquid crystal display panels, OLEDs and flexible displays. Astronics Corporation aims to bring the industry-leading OLED display technologies of LG Display to the aviation industry.

COVID-19 Impact on the Global Aircraft Seat Actuation System Market

The outbreak of the coronavirus pandemic in 2020 has negatively impacted the global aircraft seat actuation system market. During the pandemic period, the demand for aircraft seat actuation systems declined significantly owing to the execution of strict lockdowns and travel restrictions worldwide. The aircraft seat actuation system market observed a severe downfall, as many airlines halted their services during the pandemic. As per market experts, the global market is expected to observe enormous growth, after the relaxation of the pandemic, as the demand for air travel is likely to rise marvellously in the upcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com