Pest Control Services Market Report

RA08371

Pest Control Services Market by Pest Type (Insects, Rodents, Termites, Mosquitoes, and Others), End User (Residential, Commercial, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

Global Pest Control Services Market Analysis

The global pest control services market is predicted to garner $12,478.0 million in the 2020-2027 timeframe, increasing from $8,131.3 million in 2019 at a CAGR of 5.4%.

Market Synopsis

Adoption of new technologies and increasing pest caused diseases globally is estimated to fuel the pest control services market growth.

However, the severe guidelines for the approval of pest elimination products is a growth-limiting factor for the industry.

Based on regional analysis of the market, the Asia-Pacific region’s pest control services market is predicted to grow at a 6.2% CAGR by producing a revenue of $2,045.1 million in the review time.

Pest Control Services Overview

Pest control services manage, reduce, and eliminate various pests like termites, ants, bedbugs, rodents, and other similar pests from residential, commercial, and industrial places. Pest control is an important measure as these pests are carriers of harmful and dangerous disease-causing microorganisms.

Impact Analysis of COVID-19 on the Global Pest Control Services Market

The COVID-19 outbreak had a slight undesirable impact on the global pest control services market due to severe disruption of supply chains and services across the globe. However, in post lockdown period, the global industry is estimated to experience a noteworthy growth as there is increase in demand for pest control services especially from residential sectors. Also, some of the leading players are offering disinfection services during the COVID-19 lockdown period to sustain during the epidemic time. For example, in April 2020, ServiceMaster Global Holdings, Inc., a leading provider of pest and termite control, launched a new disinfection service called Disinfectix TM Disinfection Service in order to meet the increasing demand for COVID-19 disinfection. The company has been providing disinfection service by trained professionals to use against SARS-CoV-2 virus. Through this initiative, the company aimed to expand their services across the globe.

Rising Occurrence of Pest-caused Diseases Anticipated to Drive the Market

The overall pest control services market is predicted to experience a significant growth majorly owing to increasing prevalence of pest caused diseases across the globe. As per World Health Organization (WHO) estimation in 2019, dengue was the most prevalent viral infection caused by mosquitoes and pests are responsible for major viral infections such as Zika virus fever, chikungunya, tick-borne encephalitis, and other similar diseases. Also, annually, about 3.9 billion people across 129 countries are at threat of contacting dengue and the disease has accounted for about 40,000 global deaths. Such aspects are rising the demand for pest control services and is predicted to upsurge the growth of the market in the forecast time. In addition, increasing adoption of technologies like drone pest control to provide faster services to customers is estimated to surge the market growth in the review period. This growth is especially due to increasing deployment of drones for pest control inspections. Drones reduce the risk factor while reaching heights and narrow places for humans. They also save time and manpower and hence, such factors are predicted to fuel the growth of the market in the analysis time.

To know more about pest control services market drivers, get in touch with our analysts here.

Stringent Regulations is Expected to Restrain the Market Growth

Stringent government regulations are laid down in various countries for the product approval due to high toxicity of chemicals is estimated to limit market growth during the estimated time. The negative impact associated with pest control chemicals due to harmful effects on humans is further predicted to restrict the growth of the market.

Rising Utilization of Communication Tools to Create Huge Investment Prospects

Continuous incorporation of the communication tools like real time video recorders and mobile phones is estimated to generate lucrative opportunities for the pest control services market growth in the coming years. By utilizing these communication tools, the pest control service providers are able to capture real time information about the location and type of pest problems. For instance, real time communication devices like GoPro video can capture a particular pest problem and directly connect pest management professionals for corrective action management.

To know more about pest control services market opportunities, get in touch with our analysts here.

Global Pest Control Services Market, by Pest Type

By pest type, the market has been divided into insects, rodents, termites, mosquitoes and others sub-segments, of which the insects pest type accounted for highest market share and mosquitoes sub-segment is predicted to witness the fastest growth.

Source: Research Dive Analysis

The insects pest control services sub-segment accounted for dominating the market in 2019 and is expected to account for a revenue of $3,906.7 million during the analysis period. This dominance is majorly attributed to rising number of insects across the globe and this is directly impacting the pest control services demand. Further, increasing insects intolerance especially cockroaches among people is estimated to fuel demand for pest control services and fuel the growth of the sub-segment market growth in the forecast time.

The mosquitoes pest control services type is predicted to have the lucrative growth and it is anticipated to reach a revenue of $2,168.1 million by 2027, with a CAGR of 6.2%. Growing demand for mosquito controls especially in residential areas due to increasing occurrence of vector-based illnesses such as dengue, malaria, and other similar diseases is estimated to fuel the growth of the market in the analysis time.

Global Pest Control Services Market, by End User

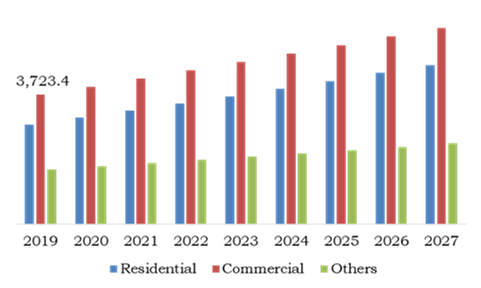

By end user, the market has been divided into residential, commercial, and others sub-segments of which the commercial end user accounted as major revenue contributor in the global market and residential sub-segment is anticipated to rise at a notable rate.

Source: Research Dive Analysis

The residential sub-segment of the global pest control services market is expected to have a lucrative growth and is estimated to surpass $4,573.8 million by 2027, with a CAGR of 5.9% during the forecast time. Surge in demand for pest control services from consumers for residential places owing to increasing prevalence of vector borne diseases in residential places is estimated to upsurge the growth of the market in the forecast time. Further, rising importance of hygiene practices is creating a necessity to eliminate pest caused diseases by regular inspection on pest growth. These aspects are predicted to impel the growth of the market.

The commercial sub-segment was a significant revenue contributor of the pest control services in 2019, it was over $3,723.4 million and is predicted to generate a revenue of $5,634.3 million by 2027, at a CAGR of 5.2%. This dominance is present because the commercial sector companies have a long-term contract with pest control service providers to keep safe and hygienic surroundings in the commercial places. Further, commercial sector is required to maintain hygiene standards and eliminate property damages caused by pests. These aspects are estimated to fuel the growth of the industry in the analysis time.

Global Pest Control Services Market, Regional Insights

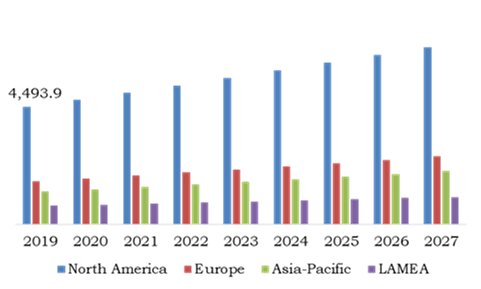

The pest control services market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Pest Control Services in North America to be the Most Dominant

The North America pest control services market accounted $4,493.9 million in 2019, is projected to maintain its dominance, and generate a revenue of $6,775.8 million by the end of 2027. This dominance is majorly owing to presence of significant service providers in North America region and this is encouraging customers to adopt advanced pest control services. Also, constant demand for termite control services from residential & commercial sectors to eliminate property damage is predicted to drive the industry growth in the forecast time.

The Market for Pest Control Services in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific pest control services market is anticipated to grow at a 5.3% CAGR and account for $2,045.1 million by 2027. The increasing urbanization in developing countries like Australia, India, and China is estimated to propel demand for pest control services especially from commercial & residential sectors is predicted to drive market growth in the analysis time.

To explore more about pest control services market, get in touch with our analysts here.

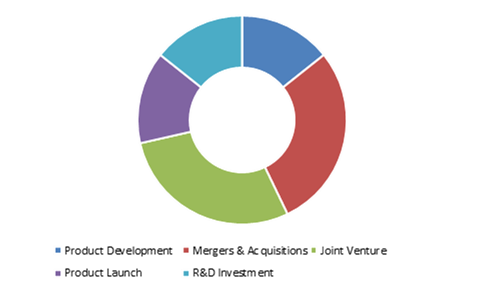

Competitive Scenario in the Global Pest Control Services Market

Collaborations and mergers are the most common strategies followed by the leading players in the market.

Source: Research Dive Analysis

The key global pest control services market players are Ecolab, Rentokil Initial plc, Rollins, Inc., The Terminix International, Anticimex, MASSEY SERVICES, INC., Aptive Environmental, ABC Home & Commercial Services, Cook’s Pest Control and Home Paramount Pest Control.

Porter’s Five Forces Analysis for Pest Control Services Market:

- Bargaining Power of Suppliers: Pest control services market has a high number of suppliers. Further, growing demand for pest control services and possibility for the new participants into the industry are delivering the negotiating power of suppliers to be moderate.

- Bargaining Power of Consumers: Pest control services market has a huge number of customers and product dependence is expected to be high. Nevertheless, consumers are progressively adopting eco-friendly substitutes due to health diseases associated with pest elimination chemicals.

Thus, the negotiation power of consumers is moderate. - Threat of New Entrants: The market needs moderate investments for the designing of most effective services and there are severe rules for product approvals are resulting moderate for the new entrants into the industry.

- Threat of Substitution: Several side effects related to utilization of chemical in pest control services is encouraging customers to adopt environmental friendly products. But, moderate availability of substitutes are resulting a moderate risk of substitutes.

- Competitiveness in the industry: Pest control services industry contains a huge number of major industry players. These participants are concentrating on acquisitions and new product launches to rise their market share in the global industry.

Thereby, the competition in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Pest Type

|

|

| Segmentation by End User

|

|

| Key Countries covered | U.S., Canada, Germany, UK, Italy, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, Argentina, GCC and Saudi Arabia |

| Key Companies Profiled |

|

Q1. What is the size of pest control services market?

A. The global pest control services market size was over $8,131.3 million in 2019 and is further anticipated to reach $12,478.0 million by 2027.

Q2. Who are the leading companies in the pest control services market?

A. Ecolab, Rentokil Initial plc, Rollins, Inc., The Terminix International, and Anticimex are some of the key players in the global pest control services market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Asia-Pacific possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific pest control services market is anticipated to grow at 6.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and collaborations are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Rentokil Initial plc, Rollins, Inc., and The Terminix International are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data pest types

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Pest type trends

2.3.End user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Collagen Peptides Market, by Pest type

4.1.Insects

4.1.1.Market size and forecast, by region, 2019 - 2027

4.1.2.Comparative market share analysis, 2019 & 2027

4.2.Rodents

4.2.1.Market size and forecast, by region, 2019 - 2027

4.2.2.Comparative market share analysis, 2019 & 2027

4.3.Termites

4.3.1.Market size and forecast, by region, 2019 - 2027

4.3.2.Comparative market share analysis, 2019 & 2027

4.4.Mosquitoes

4.4.1.Market size and forecast, by region, 2019 - 2027

4.4.2.Comparative market share analysis, 2019 & 2027

4.5.Others

4.5.1.Market size and forecast, by region, 2019 - 2027

4.5.2.Comparative market share analysis, 2019 & 2027

5.Collagen Peptides Market, by End user

5.1.Residential

5.1.1.Market size and forecast, by region, 2019 - 2027

5.1.2.Comparative market share analysis, 2019 & 2027

5.2.Commercial

5.2.1.Market size and forecast, by region, 2019 - 2027

5.2.2.Comparative market share analysis, 2019 & 2027

5.3.Others

5.3.1.Market size and forecast, by region, 2019 - 2027

5.3.2.Comparative market share analysis, 2019 & 2027

6.Collagen Peptides Market, by Region

6.1.North America

6.1.1.Market size and forecast, by pest type, 2019 - 2027

6.1.2.Market size and forecast, by end user, 2019 - 2027

6.1.3.Market size and forecast, by country, 2019 - 2027

6.1.4.Comparative market share analysis, 2019 & 2027

6.1.5.U.S.

6.1.5.1.Market size and forecast, by pest type, 2019 - 2027

6.1.5.2.Market size and forecast, by end user, 2019 - 2027

6.1.5.3.Comparative market share analysis, 2019 & 2027

6.1.6.Canada

6.1.6.1.Market size and forecast, by pest type, 2019 - 2027

6.1.6.2.Market size and forecast, by end user, 2019 - 2027

6.1.6.3.Comparative market share analysis, 2019 & 2027

6.1.7.Mexico

6.1.7.1.Market size and forecast, by pest type, 2019 - 2027

6.1.7.2.Market size and forecast, by end user, 2019 - 2027

6.1.7.3.Comparative market share analysis, 2019 & 2027

6.2.Europe

6.2.1.Market size and forecast, by pest type, 2019 - 2027

6.2.2.Market size and forecast, by end user, 2019 - 2027

6.2.3.Market size and forecast, by country, 2019 - 2027

6.2.4.Comparative market share analysis, 2019 & 2027

6.2.5.Germany

6.2.5.1.Market size and forecast, by pest type, 2019 - 2027

6.2.5.2.Market size and forecast, by end user, 2019 - 2027

6.2.5.3.Comparative market share analysis, 2019 & 2027

6.2.6.UK

6.2.6.1.Market size and forecast, by pest type, 2019 - 2027

6.2.6.2.Market size and forecast, by end user, 2019 - 2027

6.2.6.3.Comparative market share analysis, 2019 & 2027

6.2.7.France

6.2.7.1.Market size and forecast, by pest type, 2019 - 2027

6.2.7.2.Market size and forecast, by end user, 2019 - 2027

6.2.7.3.Comparative market share analysis, 2019 & 2027

6.2.8.Spain

6.2.8.1.Market size and forecast, by pest type, 2019 - 2027

6.2.8.2.Market size and forecast, by end user, 2019 - 2027

6.2.8.3.Comparative market share analysis, 2019 & 2027

6.2.9.Italy

6.2.9.1.Market size and forecast, by pest type, 2019 - 2027

6.2.9.2.Market size and forecast, by end user, 2019 - 2027

6.2.9.3.Comparative market share analysis, 2019 & 2027

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by pest type, 2019 - 2027

6.2.10.2.Market size and forecast, by end user, 2019 - 2027

6.2.10.3.Comparative market share analysis, 2019 & 2027

6.3.Asia Pacific

6.3.1.Market size and forecast, by pest type, 2019 - 2027

6.3.2.Market size and forecast, by end user, 2019 - 2027

6.3.3.Market size and forecast, by country, 2019 - 2027

6.3.4.Comparative market share analysis, 2019 & 2027

6.3.5.China

6.3.5.1.Market size and forecast, by Product, 2019 - 2027

6.3.5.2.Market size and forecast, by end user, 2019 - 2027

6.3.5.3.Comparative market share analysis, 2019 & 2027

6.3.6.India

6.3.6.1.Market size and forecast, by pest type, 2019 - 2027

6.3.6.2.Market size and forecast, by end user, 2019 - 2027

6.3.6.3.Comparative market share analysis, 2019 & 2027

6.3.7.Japan

6.3.7.1.Market size and forecast, by pest type, 2019 - 2027

6.3.7.2.Market size and forecast, by end user, 2019 - 2027

6.3.7.3.Comparative market share analysis, 2019 & 2027

6.3.8.Australia

6.3.8.1.Market size and forecast, by pest type, 2019 - 2027

6.3.8.2.Market size and forecast, by end user, 2019 - 2027

6.3.8.3.Comparative market share analysis, 2019 & 2027

6.3.9.South Korea

6.3.9.1.Market size and forecast, by pest type, 2019 - 2027

6.3.9.2.Market size and forecast, by end user, 2019 - 2027

6.3.9.3.Comparative market share analysis, 2019 & 2027

6.3.10.Rest of Asia Pacific

6.3.10.1.Market size and forecast, by pest type, 2019 - 2027

6.3.10.2.Market size and forecast, by end user, 2019 - 2027

6.3.10.3.Comparative market share analysis, 2019 & 2027

6.4.LAMEA

6.4.1.Market size and forecast, by pest type, 2019 - 2027

6.4.2.Market size and forecast, by end user, 2019 - 2027

6.4.3.Market size and forecast, by country, 2019 - 2027

6.4.4.Comparative market share analysis, 2019 & 2027

6.4.5.Latin America

6.4.5.1.Market size and forecast, by pest type, 2019 - 2027

6.4.5.2.Market size and forecast, by end user, 2019 - 2027

6.4.5.3.Comparative market share analysis, 2019 & 2027

6.4.6.Middle East

6.4.6.1.Market size and forecast, by pest type, 2019 - 2027

6.4.6.2.Market size and forecast, by end user, 2019 - 2027

6.4.6.3.Comparative market share analysis, 2019 & 2027

6.4.7.Africa

6.4.7.1.Market size and forecast, by pest type, 2019 - 2027

6.4.7.2.Market size and forecast, by end user, 2019 - 2027

6.4.7.3.Comparative market share analysis, 2019 & 2027

7.Company profiles

7.1.Ecolab

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Rentokil Initial plc

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.Rollins, Inc.

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.The Terminix International

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.Anticimex

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.MASSEY SERVICES, INC.

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.Aptive Environmental

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8. ABC Home & Commercial Services

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.Cook’s Pest Control

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.Home Paramount Pest Control

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

Pests are considerably smaller beings that are known to cause a lot of damage to human property. These creatures mostly dwell underground or tend to dig their way into other objects. One of the most common ones found are termites – found in most wooden objects such as doors as well as furniture. The tiny species of ants burrow through the wood, eventually making it weaker leading it to break or see immense damage. Many professionals have over time found a way to neutralize the effect of these pests using different equipments and chemical mixtures. These services are found all throughout the globe and are highly effective in making homes and the surroundings pest proof.

Consequences of COVID-19 on the Industry

The widespread effect of the pandemic was felt by every industry worldwide including the pest control service market. The disruption of the supply chain caused a considerable drop in the sales, but this soon changed. Upon the various countries going back to normal functioning, housing societies started demanding for pest control services after a long gap of facilities being non-functional. Many key players, along with pest control, also offered sanitization services to their customers in view of the COVID-19 effect. These factors gradually helped the industry to recover immensely in terms of profits and sales.

Key Developments in the Industry

Many industry experts have been working on several innovations and experiments to ensure better results of their pest control services which can also last longer. These initiatives have been helping the pest control service market grow even better.

In December 2020, American Pest, a provider of Integrated Pest Management (IPM) solutions along with excellent customer service, acquired Intrastate Pest Control Co. and its sister company, Valley Termite and Pest Control, LLC, a pioneer in a more ecological way of managing pest control in the case of mice, bugs, termites, and more. The primary goal of both the organizations, through this merger is to provide excellent service to the customers and making their homes safer to live in.

Similarly, another firm with a goal to make living spaces pest free, witnessed a merger that expanded its services beyond the boundaries. In January 2021, Rentokil, one of the leading organizations known for their advanced pest control techniques and services, acquired over eight new companies in the U.S. This move has helped the organization gain a strong foothold in over 15 states currently. This move also helped in adding over 900 employees into the organization, which is expected boost the growth of the company further.

Two years later, in March 2021, Terminex, one of the largest providers of pest control in the world, acquired Pest Solutions, a Portland, Oregon, based organization that boasts of an eco-friendly approach in pest control. This collaboration is predicted to boost their extensive growth in the Portland market but with a ‘Green As Can Be’ approach.

Forecast Analysis of the Global Pest Control Service Market

A recent report published by Research Dive states that the global pest control service market is expected to gain revenue of over $12,478.0 at a stable CAGR of 5.4% by 2027. The North American region has played a vital role, in adding on to the growth of the market. Many areas in the world face an immense risk of illnesses such as dengue, Zika Virus fever, tick-borne encephalitis and more. These are caused due to the mosquitoes and other smaller pests that may seem harmless, but do more damage than others. Various organizations have come up with innovative methods such as the utilization of drones to spray pest repellent while controlling the spread of pests to various areas. Additionally, many globally renowned firms such asEcolab, Rollins, Inc., Anticimex, Aptive Environmental, Cook’s Pest Control, Rentokil Initial plc, The Terminix International, SERVICES, INC., ABC Home & Commercial Services, and Home Paramount Pest Controlhave been working on even more means to enhance their pest control services further in the form of new product launches, mergers, partnerships and more.

Various technical experiments and advancements have led to quick and effective solutions for pest infestations. Though some guidelines may prove to be a minor limitation, the constant need to make homes safer to live in has added to the demand for pest control services, which in turn is helping the market grow further.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com