Digital Therapeutics Market Report

RA00691

Digital Therapeutics Market by Product (Software and Devices), Application (Diabetes, Obesity, Cardiovascular Disease, Central Nervous System, Respiratory Disease, Smoking Cessation, Gastrointestinal Disease, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

Global Digital Therapeutics Market Analysis

The global digital therapeutics market was valued at $3,003.40 million in 2020 and is projected to reach $12,695.60 million by 2028, registering a CAGR of 20.0%.

Market Synopsis

Increased prevalence of chronic diseases among millennial and geriatric population is expected to drive the digital therapeutics market size in the forecast time period.

However, lack of reimbursement facilities in the developing countries is likely to restrain the digital therapeutics market share growth in the coming years.

According to the regional analysis of the market, the Asia-Pacific digital therapeutics market is anticipated to grow at a CAGR of 20.00%, by generating a revenue of $2,069.40 million during the review period.

Digital Therapeutics Overview

Digital therapeutics is the evidence based treatment provided by the healthcare companies for various chronic diseases like obesity, diabetes, and mental disorders. With the help of digital therapeutics, the patients are able to monitor their health conditions regularly and take proper steps to reduce or manage the disease symptoms by the guidelines mentioned in the applications, software, or devices.

COVID-19 Impact on the Global Digital Therapeutics Market

The occurrence of COVID-19 pandemic has proved to have a positive impact on digital therapeutics market size growth. As the impact of COVID-19 pandemic has been severe on the health and wellbeing of the people across the world, the fear of infection and its severe symptoms have settled in the patients. Amid high rate of corona virus transmission and prevalence of serious symptoms, many patients have deliberately delayed their regular hospital visits and consultations for any other disease. Also, the healthcare professionals delayed many surgeries and restricted many outpatient visits to contain the deadly virus for transmitting. Due to this, the patients have shifted or modified their treatment mode towards more safe and secure way of treatment option i.e. digital therapeutics. Also, owing to increasing number of obesity cases in the lockdown period, many companies focused on developing and launching new obesity monitoring software which has raised the revenue of many companies. Such factors are anticipated to raise the digital therapeutics market revenue in the coming years.

Increasing Cases of Chronis Diseases to Surge the Market Growth

Rapidly increasing cases of chronic and lifestyle related diseases like diabetes and mental disorders among millennial due to lifestyle changes like less physical exercise and unhealthy food eating habits is expected to drive the digital therapeutics market share growth in the forecast time span. Many people across the world suffer from various diseases such as high blood pressure. Thus, digital therapeutics provides such patients with the safest and accurate treatment measures for preventing diseases. Also, rising number of geriatric population, across the world is further anticipated to raise the growth of digital therapeutics market size in the next few years. Moreover, less cost of treatment by digital therapeutics compared to traditional doctor visits is further anticipated drive the digital therapeutics market share growth in the future.

To know more about global digital therapeutics market drivers, get in touch with our analysts here.

Lack of Awareness about the Availability of Digital Therapeutics among People to Restrain the Market Growth

Digital therapeutics is a new and emerging mode of treatment and not many people are aware of it. Thus, this factor is likely to restrain the digital therapeutics market share growth in the forecast time. Also lack of awareness about the usability of digital therapeutics software among the patients is further likely to impede the digital therapeutics market share growth of the next few years.

Development of Product Portfolio by Major Companies to Fuel the Market Growth

Improvements in the existing digital therapeutics products and new product launches are expected to drive the digital therapeutics market share growth in future. Major market players in the digital therapeutics market have started focusing on developing and launching new products to meet the rising demand for advanced treatment options for various diseases like diabetes and mental illness. Such factors are anticipated to drive the digital therapeutics market size growth in future.

To know more about global digital therapeutics market opportunities, get in touch with our analysts here.

The global digital therapeutics market by product is segmented into Software and devices. Software sub-segment is projected to generate maximum revenue and is also expected to register the fastest growth. Download PDF Sample ReportDigital Therapeutics Market

By Product

Source: Research Dive Analysis

Software sub-segment is anticipated to have the fastest market growth and generate a revenue of $8,385.10 million in 2028. The sub-segment growth is due to the fact that software is easily installed on the patients’ smartphones and is a convenient way of continuously monitoring health and disease status of the patient. Also, many companies have started to launch advanced software for various diseases which analyze disease physiology at the roots. These factors are likely to flourish the market growth in the next few years.

Digital Therapeutics Market

By ApplicationThe global digital therapeutics market by application is segmented into Diabetes, obesity, cardiovascular disease, central nervous system, respiratory disease, smoking cessation, gastrointestinal disease, and others. Diabetes sub-segment is projected to generate maximum revenue and obesity sub-segment to generate fastest growth.

Source: Research Dive Analysis

The diabetes sub-segment is predicted to have a dominating market share in the global market and register a revenue of $2,543.60 million during the forecast period. The sub-segment is projected to show an impressive growth in future owing to increasing number of diabetes cases among people worldwide. Diabetes is the medical condition in which the blood sugar level fluctuates from the optimum level. Various digital therapeutics software are available in the market which help in regularly monitoring diabetes level of the patients. Also, the software provides evidence based interventions to reduce and maintain the diabetes level of the patient. These factors are anticipated to boost the digital therapeutics market size in the coming years.

Obesity sub-segment is anticipated to have the fastest market growth and generate a revenue from $2,404.00 million in 2028. The increase in the revenue of the sub-segment owes to the rapidly growing number of obese people across the world. People, worldwide, are suffering from obesity and overweight issues due to unhealthy life style like unhealthy food eating habits and lack of physical exercise. Digital therapeutics are widely used to maintain body weight. These factors are expected to witness a major growth in the coming years.

Digital Therapeutics Market

By RegionThe digital therapeutics market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Digital Therapeutics in North America to be the Most Dominant

The North America digital therapeutics market accounted $1,201.30 million in 2020 and is projected to register a revenue of $4,951.30 million by 2028. The growth is attributed to presence of major digital therapeutics companies in the region like Medtronic Plc.. Also, growing geriatric population and prevalence of chronic diseases in them are further expected to boost the digital therapeutics market size growth in the next few years.

The Market for Digital Therapeutics in Asia-Pacific to Observe Fastest Growth

The Asia-Pacific digital therapeutics market is expected to observe fastest growth and register a revenue of $2,069.40 million in the predicted time span. The growth of the region is subjected to rapidly increasing cases of chronic disorders like high blood pressure in the middle-aged people. Apart from this, major market players have now started investing in launching new products in the region to boost the healthcare facilities in the region. These factors are likely to flourish the digital therapeutics market growth in the next few years.

Competitive Scenario in the Global Digital Therapeutics Market

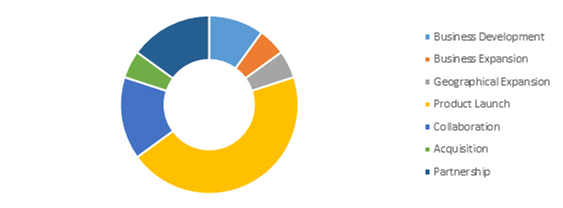

Product launches and acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

The companies involved in the digital therapeutics market are Noom, Livongo Health, Omada Health, WellDoc, Pear Therapeutics, Proteus Digital Health, Propeller Health, Akili Interactive Labs, Better Therapeutics, and Happify.

Porter’s Five Forces Analysis for the Global Digital Therapeutics Market

- Bargaining Power of Suppliers: The suppliers in the digital therapeutics market are high in number. Several companies are working on product innovation and development.

Thus, the bargaining power suppliers is moderate. - Bargaining Power of Buyers: Buyers are growing in number and have huge bargaining power, they demand best and advance products at low prices. This increases the pressure on the manufacturing companies to offer the best service in a cost-effective way. Thus, buyers can freely choose the product that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: New companies entering the digital therapeutics market are adopting new digital therapeutics launches in the market in minimum time frame.

Thus, the threat of the new entrants is high. - Threat of Substitutes: As most patients prefer traditional method of visiting doctors along with getting a proper treatment for their disease with a physical prescription, this treatment substitute can slow down the growth of digital therapeutics market.

Thus, the threat of substitutes is high. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players. These companies are launching their new products in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What are digital therapeutics examples?

A. Digital therapeutics examples are Sleepio for insomania and Daylight for anxiety

Q2. What do digital therapeutics do?

A. Digital therapeutics provide evidence-based interventions for chronic diseases such as diabetes and mental disorders.

Q3. Why are digital therapeutics important?

A. Digital therapeutics are important to regularly monitor and maintain health conditions in patients like mental disorders.

Q4. What is a prescription digital therapeutic?

A. Prescription digital therapeutics are software programs that physicians prescribe as a form of treatment.

Q5. Who can prescribe digital therapeutics?

A. Any healthcare provider or healthcare insurance organization can prescribe digital therapeutics..

Q6. Is Omada Health FDA approved?

A. Yes Omada Health is FDA approved.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By Product trends

2.3.By Application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.8.1.Stress point analysis

3.8.2.Raw material analysis

3.8.3.Manufacturing process

3.8.4.Application analysis

3.8.5.Operating vendors

3.8.5.1.Raw material suppliers

3.8.5.2.Product manufacturers

3.8.5.3.Product distributors

3.9.Strategic overview

4.Digital Therapeutics Market, by Product

4.1.Overview

4.1.1.Market size and forecast, by Product

4.2.Software

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country 2020 & 2028

4.3.Devices

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country 2020 & 2028

5.Digital Therapeutics Market, by Application

5.1.Overview

5.1.1.Market size and forecast, by Application

5.2.Diabetes

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country 2020 & 2028

5.3.Obesity

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country 2020 & 2028

5.4.Cardiovascular Disease

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country 2020 & 2028

5.5.Central Nervous System

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2020-2028

5.5.3.Market share analysis, by country 2020 & 2028

5.6.Respiratory Disease

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region, 2020-2028

5.6.3.Market share analysis, by country 2020 & 2028

5.7.Smoking Cessation

5.7.1.Key market trends, growth factors, and opportunities

5.7.2.Market size and forecast, by region, 2020-2028

5.7.3.Market share analysis, by country 2020 & 2028

5.8.Gastrointestinal Disease

5.8.1.Key market trends, growth factors, and opportunities

5.8.2.Market size and forecast, by region, 2020-2028

5.8.3.Market share analysis, by country 2020 & 2028

5.9.Others

5.9.1.Key market trends, growth factors, and opportunities

5.9.2.Market size and forecast, by region, 2020-2028

5.9.3.Market share analysis, by country 2020 & 2028

6.Digital Therapeutics Market, by Region

6.1.Overview

6.1.1.Market size and forecast, by region

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by Product, 2020-2028

6.2.3.Market size and forecast, by Application, 2020-2028

6.2.4.Market size and forecast, by country, 2020-2028

6.2.5.U.S.

6.2.5.1.Market size and forecast, by Product, 2020-2028

6.2.5.2.Market size and forecast, by Application, 2020-2028

6.2.6.Canada

6.2.6.1.Market size and forecast, by Product, 2020-2028

6.2.6.2.Market size and forecast, by Application, 2020-2028

6.2.7.Mexico

6.2.7.1.Market size and forecast, by Product, 2020-2028

6.2.7.2.Market size and forecast, by Application, 2020-2028

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by Product, 2020-2028

6.3.3.Market size and forecast, by Application, 2020-2028

6.3.4.Market size and forecast, by country, 2020-2028

6.3.5.Germany

6.3.5.1.Market size and forecast, by Product, 2020-2028

6.3.5.2.Market size and forecast, by Application, 2020-2028

6.3.6.UK

6.3.6.1.Market size and forecast, by Product, 2020-2028

6.3.6.2.Market size and forecast, by Application, 2020-2028

6.3.7.France

6.3.7.1.Market size and forecast, by Product, 2020-2028

6.3.7.2.Market size and forecast, by Application, 2020-2028

6.3.8.Spain

6.3.8.1.Market size and forecast, by Product, 2020-2028

6.3.8.2.Market size and forecast, by Application, 2020-2028

6.3.9.Italy

6.3.9.1.Market size and forecast, by Product, 2020-2028

6.3.9.2.Market size and forecast, by Application, 2020-2028

6.3.10.Rest of Europe

6.3.10.1.Market size and forecast, by Product, 2020-2028

6.3.10.2.Market size and forecast, by Application, 2020-2028

6.4.Asia Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by Product, 2020-2028

6.4.3.Market size and forecast, by Application, 2020-2028

6.4.4.Market size and forecast, by country, 2020-2028

6.4.5.China

6.4.5.1.Market size and forecast, by Product, 2020-2028

6.4.5.2.Market size and forecast, by Application, 2020-2028

6.4.6.Japan

6.4.6.1.Market size and forecast, by Product, 2020-2028

6.4.6.2.Market size and forecast, by Application, 2020-2028

6.4.7.India

6.4.7.1.Market size and forecast, by Product, 2020-2028

6.4.7.2.Market size and forecast, by Application, 2020-2028

6.4.8.South Korea

6.4.8.1.Market size and forecast, by Product, 2020-2028

6.4.8.2.Market size and forecast, by Application, 2020-2028

6.4.9.Singapore

6.4.9.1.Market size and forecast, by Product, 2020-2028

6.4.9.2.Market size and forecast, by Application, 2020-2028

6.4.10.Rest of Asia Pacific

6.4.10.1.Market size and forecast, by Product, 2020-2028

6.4.10.2.Market size and forecast, by Application, 2020-2028

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by Product, 2020-2028

6.5.3.Market size and forecast, by Application, 2020-2028

6.5.4.Market size and forecast, by country, 2020-2028

6.5.5.Latin America

6.5.5.1.Market size and forecast, by Product, 2020-2028

6.5.5.2.Market size and forecast, by Application, 2020-2028

6.5.6.Middle East

6.5.6.1.Market size and forecast, by Product, 2020-2028

6.5.6.2.Market size and forecast, by Application, 2020-2028

6.5.7.Africa

6.5.7.1.Market size and forecast, by Product, 2020-2028

6.5.7.2.Market size and forecast, by Application, 2020-2028

7.Company profiles

7.1.Noom

7.1.1.Company overview

7.1.2.Operating business segments

7.1.3.Product portfolio

7.1.4.Financial Performance

7.1.5.Recent strategic moves & developments

7.2.Livongo Health

7.2.1.Company overview

7.2.2.Operating business segments

7.2.3.Product portfolio

7.2.4.Financial Performance

7.2.5.Recent strategic moves & developments

7.3.Omada Health

7.3.1.Company overview

7.3.2.Operating business segments

7.3.3.Product portfolio

7.3.4.Financial Performance

7.3.5.Recent strategic moves & developments

7.4.Welldoc

7.4.1.Company overview

7.4.2.Operating business segments

7.4.3.Product portfolio

7.4.4.Financial Performance

7.4.5.Recent strategic moves & developments

7.5.Pear Therapeutics

7.5.1.Company overview

7.5.2.Operating business segments

7.5.3.Product portfolio

7.5.4.Financial Performance

7.5.5.Recent strategic moves & developments

7.6.Proteus Digital Health

7.6.1.Company overview

7.6.2.Operating business segments

7.6.3.Product portfolio

7.6.4.Financial Performance

7.6.5.Recent strategic moves & developments

7.7.Propeller Health

7.7.1.Company overview

7.7.2.Operating business segments

7.7.3.Product portfolio

7.7.4.Financial Performance

7.7.5.Recent strategic moves & developments

7.8.Akili Interactive Labs

7.8.1.Company overview

7.8.2.Operating business segments

7.8.3.Product portfolio

7.8.4.Financial Performance

7.8.5.Recent strategic moves & developments

7.9.Better Therapeutics

7.9.1.Company overview

7.9.2.Operating business segments

7.9.3.Product portfolio

7.9.4.Financial Performance

7.9.5.Recent strategic moves & developments

7.10.Happify

7.10.1.Company overview

7.10.2.Operating business segments

7.10.3.Product portfolio

7.10.4.Financial Performance

7.10.5.Recent strategic moves & developments

In the recent years, digital therapeutics have turned into an exciting, extremely competitive new frontier in the healthcare sector. Digital therapeutics offers evidence-based therapeutic interventions to patients through software applications, and helps in preventing, managing or treating a wide range of mental, physical, and behavioral disorders. Usually hyped to be just as medically effective as pharmaceuticals, digital therapeutics development prices are considerably less than typical pharmaceuticals, which typically take huge funds to reach to the market. But huge cost is just one of a prominent factors that is enticing more and more people to take digital therapeutics seriously.

With growing digital advancements in the healthcare industry, the market for digital therapeutics has been progressively increasing. Digital therapeutics, which is a sub-category of digital health, consist of software-based medical treatments with proven medical efficiency. It can substitute or enhance treatments that conventionally have been offered through medication or in-person care, with software-based treatments.

Present digital therapeutics start-ups consider disorders as diverse as Type 2 diabetes, autism, addiction, and musculoskeletal injuries. Owing to the changes in the regulatory conditions and consumer behavior, increased implementation of digital therapeutics seems likely. Moreover, the growing adoption of smartphones across the world has contributed in changing the way patients are monitored. Also, novel developments in virtual reality (VR) and artificial intelligence (AI) personal assistance are primarily transforming the way some medical disorders are being treated.

Recent Trends in the Digital Therapeutics Industry

With time, there have been numerous developments in the digital therapeutics industry owing to the growing need for advanced healthcare services for a growing pool of geriatric population and people with other disorders. As per a report by Research Dive, the global digital therapeutics market is expected to garner $12,695.60 million by 2028. Market players are greatly investing in novel launches and research for boosting the efficiency of digital therapeutics.

Some of the leading players of the digital therapeutics market are Pear Therapeutics, Better Therapeutics, Noom, Propeller Health, Livongo Health, Omada Health, Proteus Digital Health, Akili Interactive Labs, WellDoc, Happify, and others. These players are focused on developing strategies such as partnerships, novel developments, mergers and acquisitions, and collaborations to achieve a leading position in the global market. For instance,

- In June 2021, Fitterfly, an Indian digital therapeutics firm, introduced a digital recovery programme for diabetic patients who have contracted COVID-19 infection.

- In October 2021, Pear Therapeutics, Inc., a biotechnology and software company offering prescription digital therapeutics (PDTs), in partnership with Avalere Health, a health care business consulting firm, introduced the Pear Prescription Digital Therapeutics Digest at the AMCP’s (Academy of Managed Care Pharmacy’s) 2021 Nexus conference.

- In November 2021, GIANT Health, an international community of people whose business is health, formally introduced the Digital Therapeutics conference track, co-curated by Research2Guidance (R2G), a foremost global management consultancy focusing in the digital health arena, as part of the GIANT Health Event 2021 held on November 30 - December 1, 2021. R2G is intended to offer pioneering insights from their global DCT 2021 report on how digital tools as well as companies support digital therapeutics decentralized clinical trials; and the vital role of digital therapeutics as a patient engagement tool, real world data source, and recruitment platform.

Impact of the COVID-19 Pandemic on the Global Digital Therapeutics Market

The sudden onset of the coronavirus pandemic has positively impacted the global digital therapeutics sector. The pandemic has generated global disturbance as individuals, healthcare sector, and governments struggled to combat the disaster. In the pandemic period, digital healthcare start-ups have undertaken significant initiatives for offering remote medical assistance and care for patients infected by the virus. The adoption of digital therapeutics has greatly fueled since the outbreak of the pandemic as maintaining a functioning healthcare sector that offers remote health care became imperative. This clearly signifies that the demand for digital therapeutics is expected to upsurge and boost the market growth in the coming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com