Biosimilar Market Report

RA00580

Biosimilar Market by Product (Monoclonal Antibodies, Recombinant Hormones, Immunomodulators, Anti-inflammatory Agents, and Others), Application (Oncology Diseases, Blood Disorders, Chronic & Autoimmune Diseases, Growth Hormone Deficiencies, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Biosimilar Market Analysis

The global biosimilar market size is predicted to garner $83,836.40 million in the 2021–2028 timeframe, growing from $14,477.30 million in 2020, at a healthy CAGR of 24.90%.

Market Synopsis

Strategic alliances among market players, along with growing demands for biosimilar across the globe, are expected to accelerate the growth of the biosimilar market.

However, complexities in manufacturing biosimilar are some of the growth-restricting factors for the market.

According to the regional analysis, the Asia-Pacific biosimilar market size is anticipated to grow during the review period and generate a revenue of $21,965.10 million, with CAGR of 25.50% due to increasing demand for biosimilar in the region.

Biosimilar Overview

Biosimilar is a medicine that has almost same function and structure of the biologic drugs manufactured by different companies. Biosimilars are licensed by the US Food and Drug Administration (FDA). The main aim of biosimilars is to reduce the cost of healthcare system and to grow access to treatment in the forthcoming years as costly biological drugs lose patent protection.

Covid-19 Impact on Biosimilar Market Shares

The novel coronavirus pandemic severely affected several industries. The global biosimilar market experienced negative growth during this period. Disruption in manufacturing capacity and supply chain during the COVID-19 period is one of the factors that might have affected the market for biosimilar. Furthermore, the negative growth of the market is owing to challenges faced by pharma companies in development of biosimilar. Also, FDA approvals are reduced for non-COVID therapeutics due to pandemic which is expected to delay the process of drug approvals or launches, thereby hindering the market growth. All such factors are expected to negatively affect the biosimilar industry.

Increasing Demand of Biosimilar Drugs due to Their Cost-effectiveness to Surge the Market Growth

The global biosimilar industry is witnessing a massive growth mainly due to increasing demand for biosimilar drugs due to their cost-effectiveness. According to American Journal of Managed Care, biosimilars are cost effective and have 20–30% lower prices than their parent counterparts. Moreover, biosimilars have low R&D costs; all such factors may fuel the growth of the global biosimilar market.

Furthermore, biosimilar industry is booming because government is highly supporting in the development and approval of biosimilars. For instance, US Food and Drug Administration (FDA), in July 2021, revealed that they have approved the biosimilar insulin product for type-1 and type-2 diabetes, and this will offer patients cost effective, safe, and high quality options for treating diabetes. These types of factors are predicted to drive the growth of the market.

To know more about global biosimilar market trends, drivers, get in touch with our analysts here.

High Cost of Biosimilar to Restrain the Market Growth

Biosimilar is highly complex and costly in terms of manufacturing and production. Also, biosimilar requires technical capabilities, significant investments, scientific standards, clinical trial expertise, and quality systems. These are some of the factors anticipated to hinder the market value of the biosimilar in the next few years.

Patent Expiry of Biologics and Research on New Biosimilars to Create Massive Investment Opportunities

The global biosimilar market is spreading at a very fast pace due to increasing demand for new biosimilars as in the 20th century most of the biologic drugs lost the patent protection. Moreover, most of the best selling drugs are going to be expired in upcoming years and this will bring new opportunities in the biosimilar industry. All such factors are positively affecting the biosimilar market growth.

Furthermore, biosimilar industry already has leading market players innovating strategies to attract customers. For example, in 2019, Amgen, American multinational biopharmaceutical company and Allergan, American global pharmaceutical company launched two biosimilars for cancer treatment in US market. All such types of product launch, innovations, and strategic alliances will accelerate the overall functional beverage market and it will bring lucrative market opportunities for key players in the upcoming years.

To know more about global biosimilar market trends, opportunities, get in touch with our analysts here.

Based on type, the market has been divided into Monoclonal Antibodies, recombinant hormones, immunomodulators, anti-inflammatory agents, and others sub-segments of which the Monoclonal Antibodies sub-segment is projected to generate the maximum revenue as well as show the fastest growth. Download PDF Sample ReportBiosimilar Market

By Type

Source: Research Dive Analysis

The monoclonal antibodies type sub-segment is predicted to have a dominating share as well as fastest market growth in the global market and register a revenue of $29,987.30 million during the forecast period. Monoclonal antibodies have large applications in autoimmune disorders, treatment of cancer, osteoporosis, and rising incidents of insulin dependent diabetes globally. These factors and strategic alliances may bolster the growth of the sub-segment during the forecast period and increase biosimilar market demand.

Biosimilar Market

By ApplicationOn the basis of end-user, the market has been sub-segmented into Oncology diseases, blood disorders, chronic & autoimmune diseases, growth hormone deficiencies, and others sub-segments. Among the mentioned sub-segments, the Oncology diseases sub-segment is predicted to show the fastest growth as well as dominant market share.

Source: Research Dive Analysis

The oncology diseases sub-segment of the global biosimilar market growth is projected to be the dominant as well as have the fastest growth and surpass $29,241.40 million by 2028, with an increase from $4,933.80 million in 2020. This growth in the market can be attributed to growing number of cancer patients and availability of biosimilars at low costs. These elements may increase the demand for sub-segment and biosimilar market demand.

Biosimilar Market

By RegionThe biosimilar market share was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Biosimilar in Europe to be the Most Dominant

The Europe biosimilar market accounted $5,863.30 million in 2020 and is projected to register a revenue of $34,121.40 million by 2028. The extensive growth of the Europe biosimilar market is mainly driven by factors such as rising incidence of chronic disorders, implementing the patent expiry of biologic products, the emergence of new players, and the launch of new biosimilars. These are some of the factors that are fueling the market growth across the globe. These factors will ultimately drive the demand for the biosimilar market across the region.

The Market for Biosimilar in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific biosimilar market is expected to rise at a CAGR of 25.50%, by registering a revenue of $21,965.10 million by 2028. The growth shall be a result of presence of pharmaceutical companies and large R&D investment in development of biosimilars.

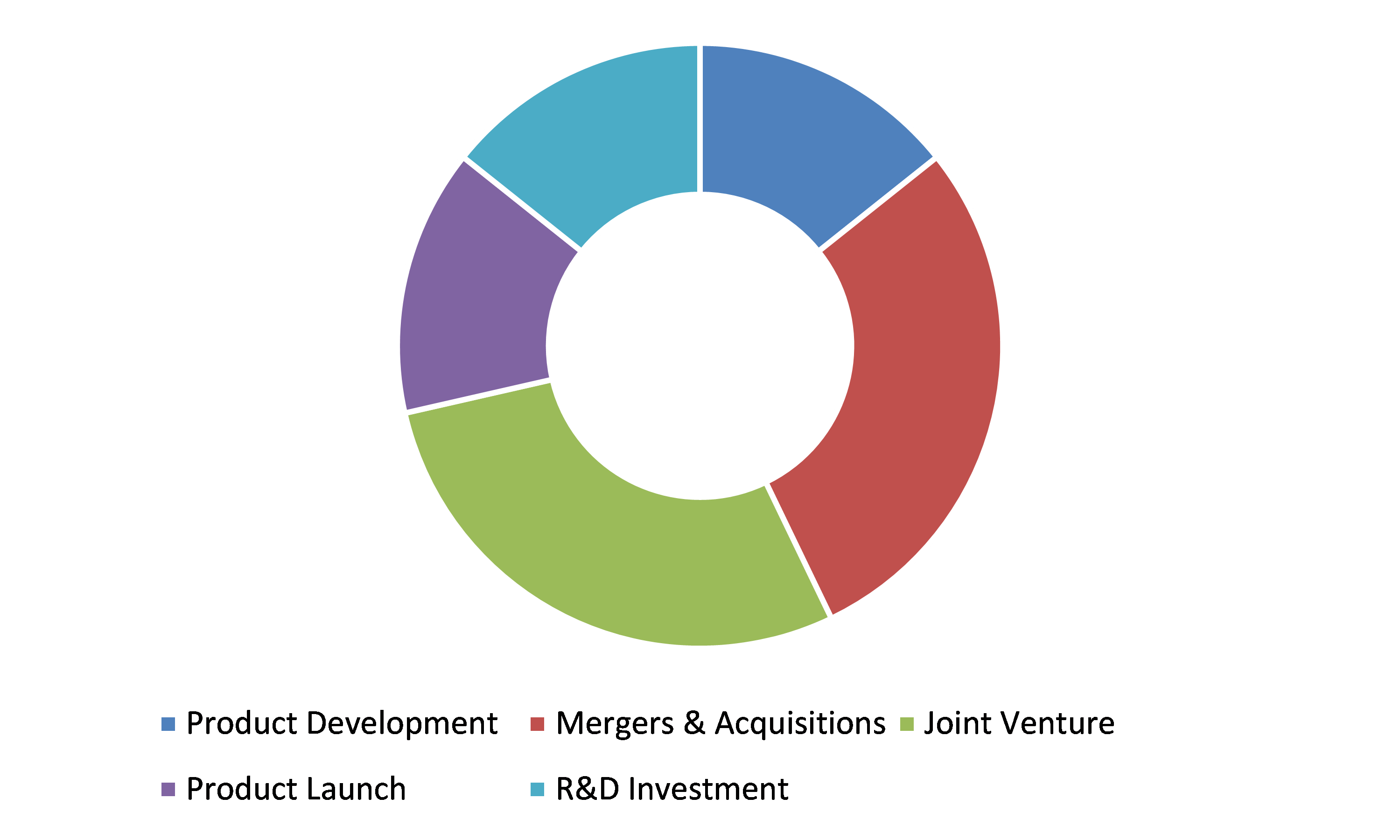

Competitive Scenario in the Global Biosimilar Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading biosimilar market players are Merck Serono (Merck Group), Teva Pharmaceutical Industries Ltd., Novartis (Sandoz), Synthon Pharmaceuticals, Inc., LG Life Sciences, Celltrion, Biocon, Hospira, Genentech (Roche Group), and Biogen idec, Inc.

Porter’s Five Forces Analysis for the Global Biosimilar Market:

- Bargaining Power of Suppliers: The product suppliers of biosimilar market are high in number and are larger and more globalized. Bargaining power of supplier depends upon production process and raw material requirement. So, there will be less threat from the suppliers.

Thus, the bargaining power of suppliers is low. - Bargaining Power of Buyers: Buyers have huge options to select from different biosimilars; this has increased the pressure on the biosimilar providers to offer the best product. This gives the buyers the option to freely choose biosimilar products that best fit their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: Companies entering the biosimilar market are adopting various innovations, but difficulty and time required for FDA approval for drugs are some of the factors that can strict the entry of new drug in the biosimilar market.

Thus, the threat of the new entrants is low. - Threat of Substitutes: There is no substitute available for biosimilars; Whenever customer demand is satisfied with any of the services or products, they will adopt such product and services.

Therefore, threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Novartis (Sandoz) and Synthon Pharmaceuticals, Inc. These companies are launching their value-added services in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global biosimilar market?

A. The size of the global biosimilar market was over $14,477.30 million in 2020 and is projected to reach $83,836.40 million by 2028.

Q2. Which are the major companies in the biosimilar market?

A. including Novartis (Sandoz) and Synthon Pharmaceuticals, Inc. are some of the key players in the global biosimilar market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific Biosimilar market?

A. Asia-Pacific biosimilar market is anticipated to grow at 25.50% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By product type trends

2.3.By Application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.8.1.Stress point analysis

3.8.2.Raw material analysis

3.8.3.Manufacturing process

3.8.4.Sales Channel analysis

3.8.5.Operating vendors

3.8.5.1.Raw material suppliers

3.8.5.2.product type manufacturers

3.8.5.3.product type distributors

3.9.Strategic overview

4.Biosimilar Market, by Product type

4.1.Overview

4.1.1.Market size and forecast, by product type

4.2.Monoclonal Antibodies

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country 2020 & 2028

4.3.Recombinant Hormones

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country 2020 & 2028

4.4.Immunomodulators

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region, 2020-2028

4.4.3.Market share analysis, by country 2020 & 2028

4.5.Anti-Inflammatory Agents

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region, 2020-2028

4.5.3.Market share analysis, by country 2020 & 2028

4.6.Others

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast, by region, 2020-2028

4.6.3.Market share analysis, by country 2020 & 2028

5.Biosimilar Market, by Application

5.1.Overview

5.1.1.Market size and forecast, by Sales Channel

5.2.Oncology diseases

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country 2020 & 2028

5.3.Blood Disorders

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country 2020 & 2028

5.4.Chronic and autoimmune diseases

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country 2020 & 2028

5.5.Growth Hormones

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2020-2028

5.5.3.Market share analysis, by country 2020 & 2028

5.6.Others

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region, 2020-2028

5.6.3.Market share analysis, by country 2020 & 2028

6.Biosimilar Market, by Region

6.1.Overview

6.1.1.Market size and forecast, by region

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by product type, 2020-2028

6.2.3.Market size and forecast, by Application , 2020-2028

6.2.4.Market size and forecast, by country, 2020-2028

6.2.5.U.S.

6.2.5.1.Market size and forecast, by product type, 2020-2028

6.2.5.2.Market size and forecast, by Application ,2020-2028

6.2.6.Canada

6.2.6.1.Market size and forecast, by product type, 2020-2028

6.2.6.2.Market size and forecast, by Application , 2020-2028

6.2.7.Mexico

6.2.7.1.Market size and forecast, by product type, 2020-2028

6.2.7.2.Market size and forecast, by Application , 2020-2028

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by product type, 2020-2028

6.3.3.Market size and forecast, by Application , 2020-2028

6.3.4.Market size and forecast, by country, 2020-2028

6.3.5.Germany

6.3.5.1.Market size and forecast, by product type, 2020-2028

6.3.5.2.Market size and forecast, by Application , 2020-2028

6.3.6.UK

6.3.6.1.Market size and forecast, by product type, 2020-2028

6.3.6.2.Market size and forecast, by Application , 2020-2028

6.3.7.France

6.3.7.1.Market size and forecast, by product type, 2020-2028

6.3.7.2.Market size and forecast, by Application , 2020-2028

6.3.8.Spain

6.3.8.1.Market size and forecast, by product type, 2020-2028

6.3.8.2.Market size and forecast, by Application , 2020-2028

6.3.9.Italy

6.3.9.1.Market size and forecast, by product type, 2020-2028

6.3.9.2.Market size and forecast, by Application , 2020-2028

6.3.10.Rest of Europe

6.3.10.1.Market size and forecast, by product type, 2020-2028

6.3.10.2.Market size and forecast, by Application , 2020-2028

6.4.Asia Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by product type, 2020-2028

6.4.3.Market size and forecast, by Application , 2020-2028

6.4.4.Market size and forecast, by country, 2020-2028

6.4.5.China

6.4.5.1.Market size and forecast, by product type, 2020-2028

6.4.5.2.Market size and forecast, by Application , 2020-2028

6.4.6.Japan

6.4.6.1.Market size and forecast, by product type, 2020-2028

6.4.6.2.Market size and forecast, by Application , 2020-2028

6.4.7.India

6.4.7.1.Market size and forecast, by product type, 2020-2028

6.4.7.2.Market size and forecast, by Application , 2020-2028

6.4.8.South Korea

6.4.8.1.Market size and forecast, by product type, 2020-2028

6.4.8.2.Market size and forecast, by Application , 2020-2028

6.4.9.Australia

6.4.9.1.Market size and forecast, by product type, 2020-2028

6.4.9.2.Market size and forecast, by Application , 2020 2028

6.4.9.3.Comparative market share analysis, 2020 & 2028

6.4.10.Rest of Asia Pacific

6.4.10.1.Market size and forecast, by product type, 2020-2028

6.4.10.2.Market size and forecast, by Application , 2020-2028

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by product type, 2020-2028

6.5.3.Market size and forecast, by Application , 2020-2028

6.5.4.Market size and forecast, by country, 2020-2028

6.5.5.Latin America

6.5.5.1.Market size and forecast, by product type, 2020-2028

6.5.5.2.Market size and forecast, by Application , 2020-2028

6.5.6.Middle East

6.5.6.1.Market size and forecast, by product type, 2020-2028

6.5.6.2.Market size and forecast, by Application , 2020-2028

6.5.7.Africa

6.5.7.1.Market size and forecast, by product type, 2020-2028

6.5.7.2.Market size and forecast, by Application , 2020-2028

7.Company profiles

7.1.Merck Serono (Merck Group)

7.1.1.Company overview

7.1.2.Operating business segments

7.1.3.Application portfolio

7.1.4.Financial Performance

7.1.5.Recent strategic moves & developments

7.2.Teva Pharmaceutical Industries Ltd.

7.2.1.Company overview

7.2.2.Operating business segments

7.2.3.Application portfolio

7.2.4.Financial Performance

7.2.5.Recent strategic moves & developments

7.3.Novartis (Sandoz)

7.3.1.Company overview

7.3.2.Operating business segments

7.3.3.Application portfolio

7.3.4.Financial Performance

7.3.5.Recent strategic moves & developments

7.4.Synthon Pharmaceuticals, Inc.

7.4.1.Company overview

7.4.2.Operating business segments

7.4.3.Application portfolio

7.4.4.Financial Performance

7.4.5.Recent strategic moves & developments

7.5.LG Life Sciences

7.5.1.Company overview

7.5.2.Operating business segments

7.5.3.Application portfolio

7.5.4.Financial Performance

7.5.5.Recent strategic moves & developments

7.6.Celltrion

7.6.1.Company overview

7.6.2.Operating business segments

7.6.3.Application portfolio

7.6.4.Financial Performance

7.6.5.Recent strategic moves & developments

7.7.Biocon

7.7.1.Company overview

7.7.2.Operating business segments

7.7.3.Application portfolio

7.7.4.Financial Performance

7.7.5.Recent strategic moves & developments

7.8.Hospira

7.8.1.Company overview

7.8.2.Operating business segments

7.8.3.Application portfolio

7.8.4.Financial Performance

7.8.5.Recent strategic moves & developments

7.9.Genentech (Roche Group)

7.9.1.Company overview

7.9.2.Operating business segments

7.9.3.Application portfolio

7.9.4.Financial Performance

7.9.5.Recent strategic moves & developments

7.10.Biogen idec, Inc.

7.10.1.Company overview

7.10.2.Operating business segments

7.10.3.Application portfolio

7.10.4.Financial Performance

7.10.5.Recent strategic moves & developments

Biosimilars are biologic drugs that have the same function and structure and are made of proteins or pieces of proteins, either artificial or natural. Interestingly, biosimilars must be made in a living system like bacteria and yeast, unlike other drugs. The main functions of biosimilars are to stimulate the body’s immune system and to identify and destroy cancer cells more effectively. Although biosimilars are called as “exact copies” of biologic drugs, however, they’re different in many ways based on their source of formation and paths for FDA approval. Such approved biosimilars like Zarxio, Hulio, Avsola, etc. are widely utilized for cost saving in healthcare systems.

Forecast Analysis:

The increasing demand for biosimilar drugs due to their cost-effectiveness is the main factor estimated to drive the global biosimilar market growth by 2028. In addition, encouraging support from governments in the development and approval of biosimilars is expected to further boost the market growth during the analysis timeframe. Moreover, patent expiry of biologics along with increasing R&D activities on new biosimilars are the factors projected to offer ample market growth opportunities during the forecast years. However, high complexities in manufacturing biosimilars is expected to impede the global biosimilar market’s growth by 2028.

Regionally, the biosimilar market in the Europe region is anticipated to have an extensive growth and gather a revenue of $34,121.40 million in the 2021-2028 timeframe due to dominant prevalence of chronic disorders, existence of new market players, and launch of new and advanced biosimilars. In addition, the patent expiry of biologic products is also estimated to boost the market growth in the Europe region during the analysis years.

According to the report published by Research Dive, the global biosimilar market is anticipated to garner a revenue of $83,836.40 million, growing rapidly at a CAGR of 24.90% in the 2021–2028 timeframe. Some significant players of the biosimilar market include Synthon Pharmaceuticals, Inc., LG Life Sciences, Hospira, Teva Pharmaceutical Industries Ltd., Biogen idec, Inc., Novartis (Sandoz), Celltrion, Genentech (Roche Group), Merck Serono (Merck Group), Biocon, and many others.

Key Market Developments:

The prominent organizations operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global biosimilar market to grow exponentially. For instance:

In January 2022, AbbVie, an American pharmaceutical company, submitted applications to both the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) to seek approval for upadacitinib (RINVOQ) to treat non-radiographic axial spondyloarthritis, or, nr-axSpA. Rinvoq is a selective JAK inhibitor that is currently being analyzed in many immune-related inflammatory diseases. AbbVie also assessed the efficacy and safety of Rinvoq in adult nr-axSpA patients.

In December 2021, South Korea’s Samsung Group announced its decision to acquire Biogen Inc., a renowned US based drug maker for some neurological conditions like Alzheimer’s and dementia. The Nasdaq-listed Biogen’s acquired shares are worth $42 billion, and the company is all set to produce huge operating profits at a stable rate. In addition, this acquisition will mark Samsung’s largest transaction.

In January 2022, Amneal Pharmaceuticals Inc., an American-based generics and specialty pharmaceutical company, announced its acquisition of Saol Therapeutics’ Baclofen franchise, a leading biotech pharmaceutical company. This acquisition will help Amneal expand its institutional, commercial, and specialty portfolio in neurology, and will also promote the infrastructure before its entry in the global biosimilar market.

Covid-19 Impact on the Market:

The outbreak of the Covid-19 pandemic had a negative impact on all businesses and industries, including the global biosimilar market due to disruptions in the manufacturing capacity and supply chain across the world. Strict lockdowns, travel bans, and mobility restrictions imposed by governments across the globe led to several challenges faced by the pharma companies. In addition, FDA approval for non-COVID therapeutics also reduced greatly which delayed the process of launching new biosimilars, thus hampering the market revenue.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com