Biochar Market Report

RA03862

Biochar Market by Feedstock (Agricultural Waste, Animal Manure, Bamboo-based, and Others), Production Method (Pyrolysis, Gasification, and Others), Application (Agriculture, Livestock Feed, Building Materials, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2031

Global Biochar Market Analysis

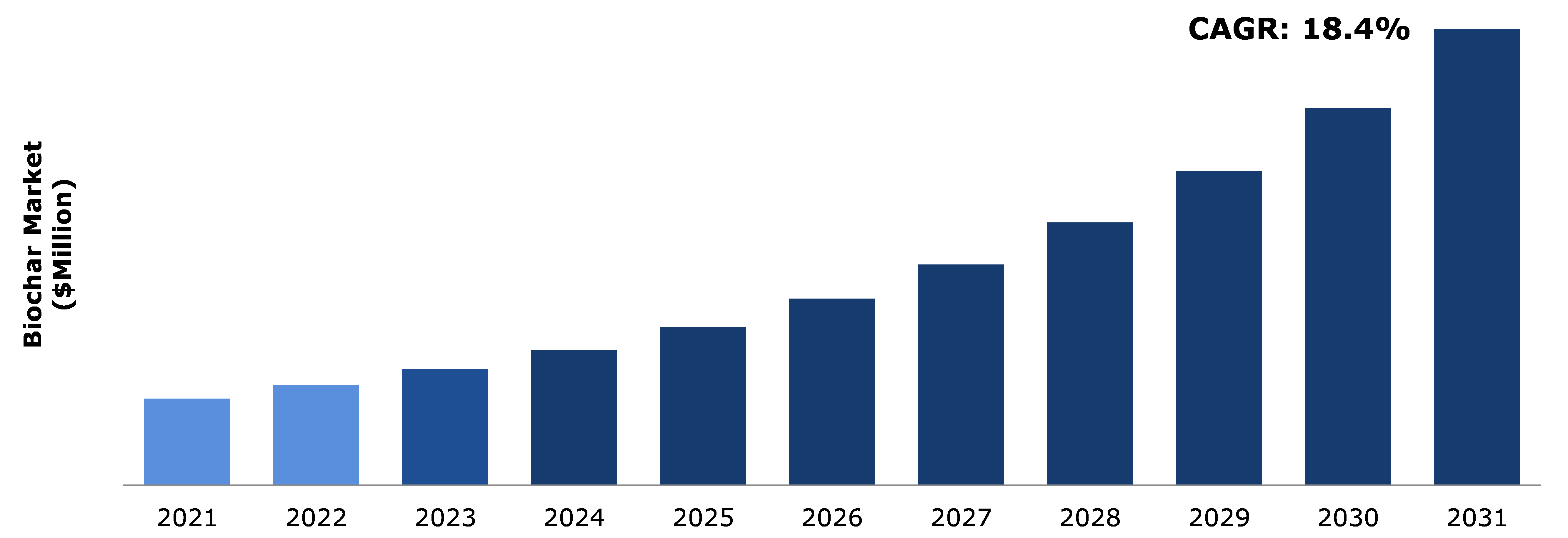

The Global Biochar Market Size was $447.7 million in 2021 and is predicted to grow with a CAGR of 18.4%, by generating a revenue of $2,366.4 million by 2031.

Global Biochar Market Synopsis

Biochar market is gaining huge popularity across the world owing to growing applications in agriculture, horticulture, and soil remediation sector. Biochar is sustainable, highly adsorbent, and specially produced biochar that is widely used for soil amendment. The use of biochar improves soil fertility, reduced greenhouse emissions as it is rich in carbon which helps in improving soil health. Biochar has a high degree of chemical and microbial stability. The highly porous structure of biochar facilitates the growth of beneficial soil micro-organisms.

When biochar is applied in excess, it can lead to soil erosion and soil compaction. This factor is anticipated to restrain the biochar market size in the upcoming years which will affect agricultural productivity.

Biochar facilitates the development of a sustainable ecosystem as it reduces carbon emissions which is anticipated to boost the biochar market growth during the analysis timeframe. This is because biochar acts as a carbon sink that can store huge amount of carbon underground for thousands of years which helps in reducing the harmful carbon emissions into the atmosphere. Additionally, biochar is produced from sustainable resources such as woody biomass, crops, animal manure which do not have a negative environmental impact. These factors are anticipated to drive excellent opportunities in the biochar industry.

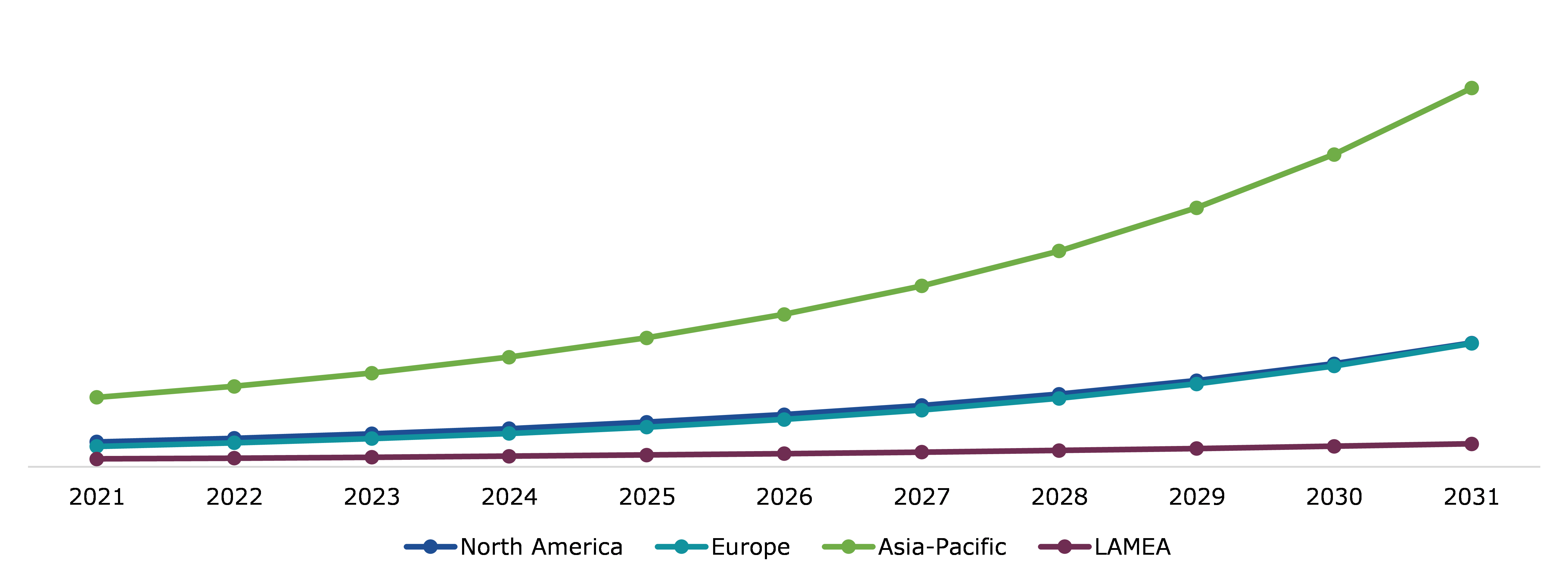

According to regional analysis, the Asia-Pacific biochar market accounted for the highest market share in 2021 and the Europe region is estimated to show the fastest growth during the forecast period. This growth is majorly owing to the presence of leading biochar-producing countries namely China, Australia, and others. Also, China is one of the leading producers of biochar accounting for highest biochar producer in world.

Biochar Market Overview

Biochar is a charcoal-like substance that is produced by the production of organic material and agricultural waste such as biomass using the process called pyrolysis. Biochar is produced using a specific process that reduces soil contamination and safely stores carbon. Biochar is produced during pyrolysis process with zero or no oxygen environment. The biochar produced from manure is enriched with nutrients compared to the wood-based biochar.

COVID-19 Impact on Global Biochar Market

The COVID-19 crisis has disrupted the functioning of several industries due to the closure of manufacturing units, social distancing norms, and government regulations. However, the biochar industry has shown resilience during the pandemic as it is a sustainable method for biochar production. The biochar is produced from agricultural waste and biomass and agricultural activity was included under essential activities during the pandemic. Additionally, during the pandemic, the biochar companies have received funding which is estimated to boost the biochar market share. For instance, in October 2021, Standard Biochar (SBC) has received $2 thousand funding from three US-based institutions namely Standard Biochar (SBC) are Finance Authority of Maine (FAME), Coastal Enterprises (CEI), and Maine Technology Institute (MTI). This will help the company in purchasing biochar equipment’s. Also, the company can produce the highest quality biochar in the form of pure carbon.

Biochar Helps in Improving Soil Fertility, Promotes Food Security, and Helps in Waste Management which is Estimated to Drive Market Growth

Biochar helps in improving soil fertility which promotes food security. This is majorly owing to the porous structure of biochar that is a habitat for various micro-organisms which leads to bioavailability and is a reservoir of water and nutrients. Biochar is widely used as a soil additive that promotes plant growth and is an effective sink for sequestering harmful carbon emissions. Also, the crops enriched with biochar face low risk of reduced crop yield especially during the dry season. Additionally, biochar lowers the need for chemical fertilizers, as essential soil nutrients such as phosphorous and nitrogen are retained by biochar application. Biochar application prevents the growth of mildews and molds by binding toxins that prevent its leaching into ground and surface water. Biochar helps in effectively addressing climate change, as it can store 50% of carbon from the feedstock. These factors are anticipated to boost the biochar market size during the analysis timeframe.

To know more about global biochar market drivers, get in touch with our analysts here.

Risk of Contamination and Soil Compaction Linked with Excessive Use of Biochar to Restrain Market Growth

Excessive use of biochar in agriculture causes soil erosion. The biochar produced from sewage of wastewater can lead to soil compaction as this biochar shows the presence of heavy metals such as nickel, chromium, zinc, and copper. These factors are anticipated to restrain the biochar market share during the forecast period.

Growing Applications of Biochar in Buildings Sector to Generate Excellent Opportunities

Biochar is being widely used in the building sector owing to its crucial properties such as high-water absorption and low thermal conductivity. These are the vital properties that help in regulating humidity and insulating the buildings. Additionally, biochar can act as an indoor plaster, by combining biochar at a ratio of up to 50% with cement, lime, clay, and mortar. These biochar-based indoor plasters have excellent breathing and insulation properties that help in maintaining humidity levels. Additionally, biochar prevents condensing of air and dampness on walls that occurs due to the formation of molds on the surface of walls. The biochar-based insulation can be used for the construction of warehouses, schools, libraries, buildings, and other areas. These factors are anticipated to boost the biochar market demand during the forecast period.

To know more about global biochar market opportunities, get in touch with our analysts here.

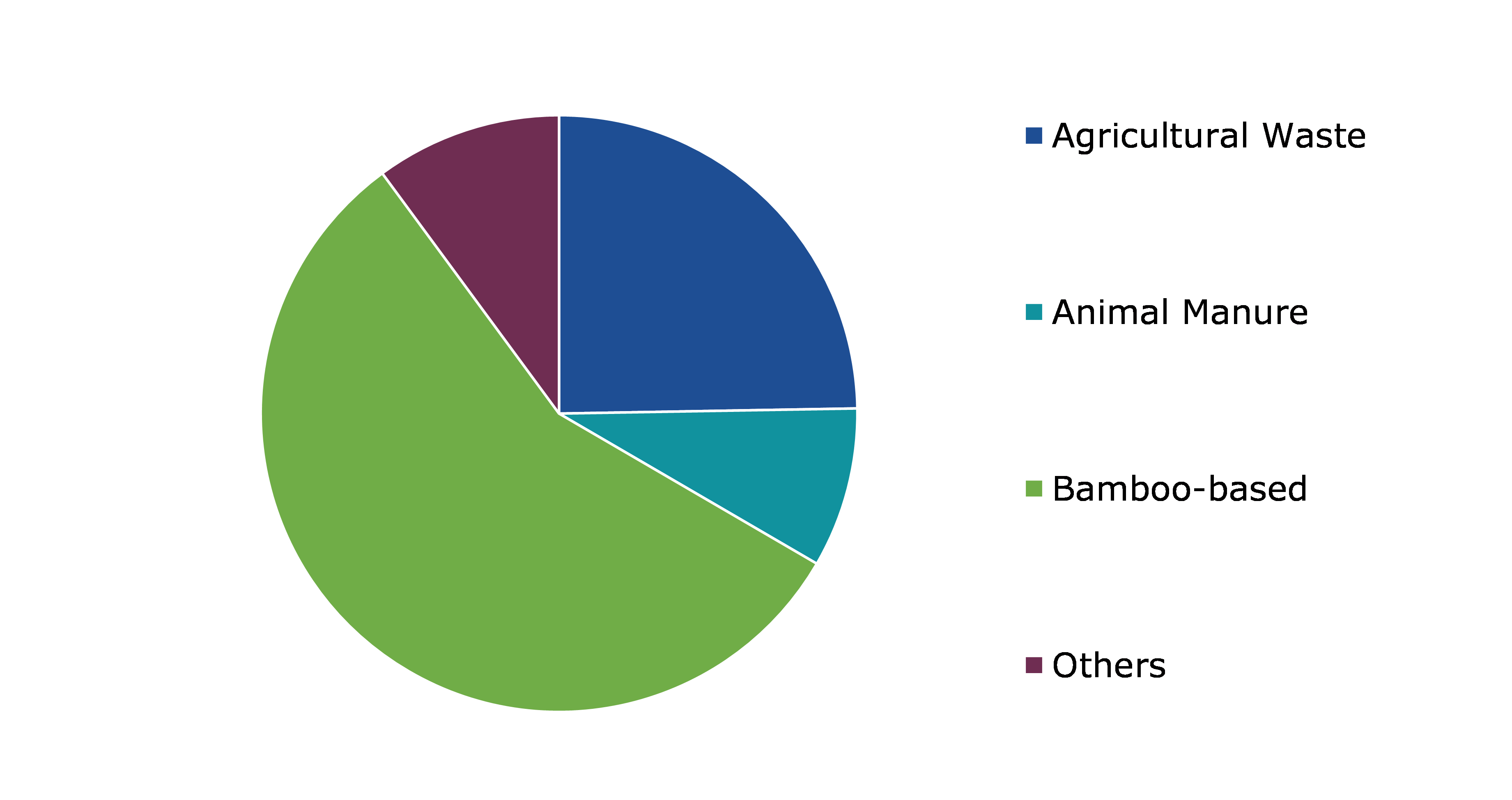

Global Biochar Market, By Feedstock

Based on feedstock, the market has been divided into agricultural waste, animal manual, bamboo-based, and others. Out of these, the bamboo-based sub-segment accounted for the dominant market share in 2021 and it is estimated to show the fastest growth during the analysis period.

Global Biochar Market Size, By Feedstock, 2021

Source: Research Dive Analysis

The bamboo-based sub-segment accounted for the highest market size in 2021 and it is projected to show the fastest growth during the analysis timeframe. The production of biochar from bamboo-based feedstock helps in producing a stable form of soil carbon, and the biochar produced from bamboo or woody biomass has naturally porous structure that offers enhanced aeration, improves the nutrient retention of soil, and enhances the water holding capacity of the soil. Biochar acts as a refuge for soil microbiology and it is a crucial building block for resilient soils. Bamboo-based biochar acts as a soil amendment and optimizes the water-holding capacity of the soil. Thus, it shows great promise for its use in organic fertilizer.

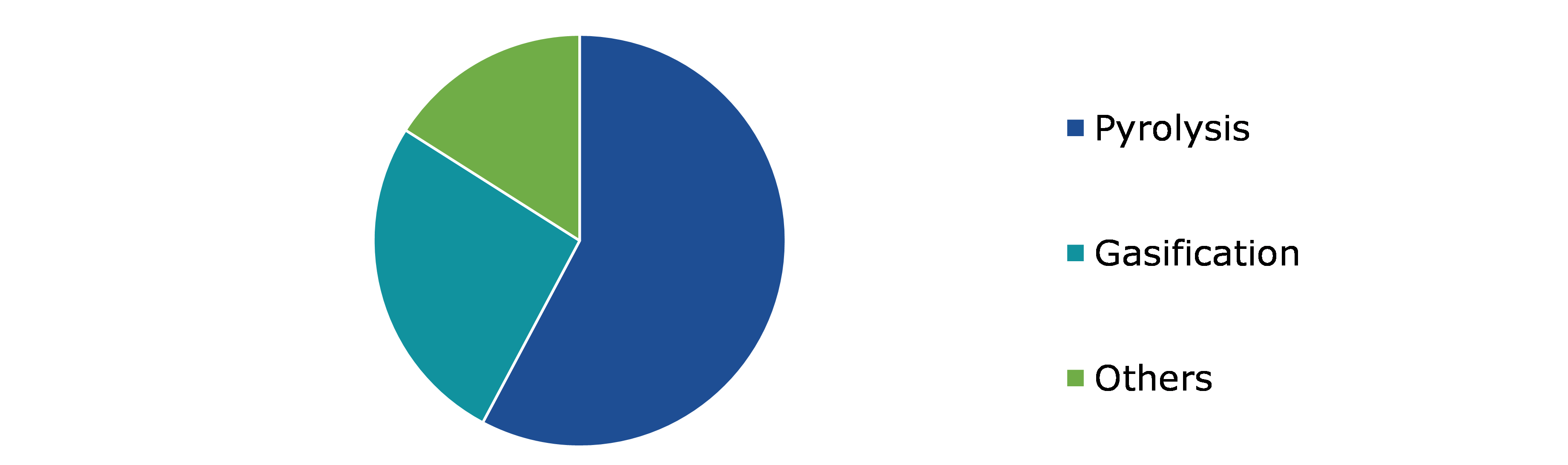

Global Biochar Market, by Production Method

Based on the production method, the analysis has been divided into pyrolysis, gasification, and others. The pyrolysis sub-segment accounted a dominant market share in 2021 and is estimated to show the fastest growth during the projected timeframe.

Global Biochar Market Analysis, By Method, 2021

Source: Research Dive Analysis

The pyrolysis sub-segment of the global biochar market is anticipated to show the fastest growth during the forecast period. Pyrolysis is the most traditional and widely used method for the production of biochar. Pyrolysis is the process of heating biomass at a high temperature of around 250-900 °C. Pyrolysis is a cost-efficient and inexpensive technology that can produce biochar from different feedstocks. Pyrolysis helps in reducing a large amount of waste that enters landfill thereby reducing pollution and the emission of greenhouse gases. Pyrolysis is a thermochemical process that converts feedstock such as biomass into bio-oil, syngas, and biochar. The heat generated during this process can be reused for other purposes.

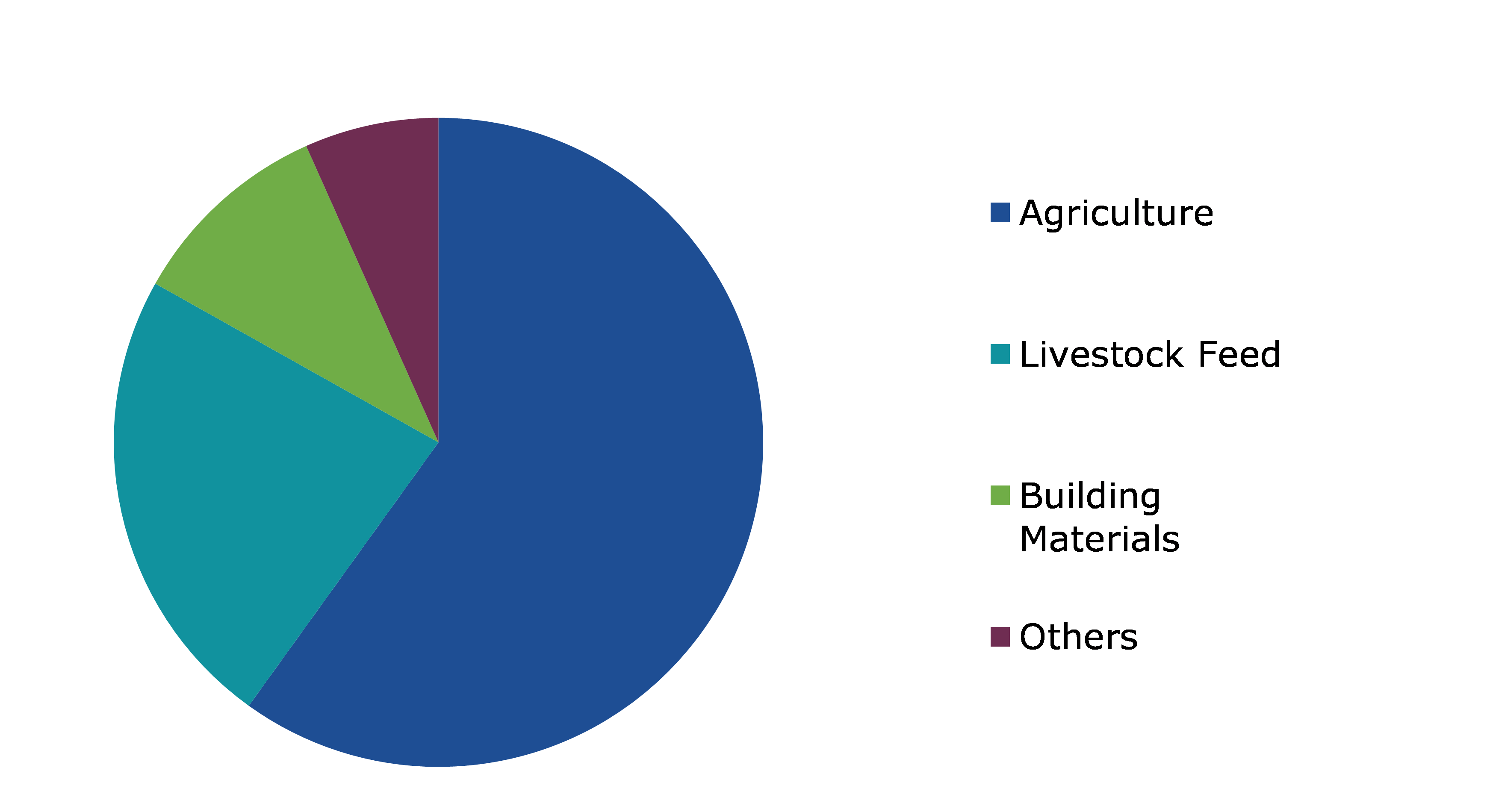

Global Biochar Market, by Application

Based on application, the market has been divided into agriculture, livestock feed, building materials, and others. Among these, agriculture sub-segment has accounted for dominant market share in 2021, and it is estimated to show the fastest growth during the forecast period.

Global Biochar Market Growth, by Application, 2021

Source: Research Dive Analysis

The agriculture sub-segment accounted for a dominant market share in 2021. Biochar is used in the agriculture sector as it acts as a soil conditioner that helps in improving soil productivity ad fertility. The use of biochar as a soil amendment increases the water-holding capacity of the soil, boosts aeration, and helps in the retention of essential nutrients. The farmers can produce organic-carbon-based fertilizer by mixing their organic waste such as wood, slurry, ash, and others with biochar. The use of biochar in agricultural fields improves soil porosity, density, texture, and particle size distribution. Biochar also prevents soil contamination by preventing pesticides from entering the surface water. These factors are anticipated to boost the biochar industry opportunities in the agriculture sector.

Global Biochar Market, Regional Insights

The biochar market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Biochar Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Biochar in Asia-Pacific Accounted for Dominant Market Share in 2021

The Asia-Pacific biochar market registered the highest market size in 2021. Asia-Pacific biochar market growth is driven by the presence of leading biochar producing countries namely China and Australia. Also, biochar market is rapidly expanding across India, Japan, South Korea, and other countries. The biochar production in China has crossed 300,000 tons in 2021 owing to growing biochar demand from the agricultural sector. In Australia, biochar has wide range of applications in the industrial sector which is a low-cost and sustainable alternative. For instance, Australia produces 9 million tons of concrete each year and the use of high-quality biochar can store huge amounts of carbon.

The Market for Biochar in Europe to be the Fastest Growing

The share of the Europe biochar market is anticipated to grow at the fastest rate during the analysis period. Europe biochar market is evolving rapidly and in terms of production capacity, the biochar production in Europe was around 35,000 tons in 2021. Germany, Austria, Switzerland, Sweden are the leading biochar-producing countries in Europe. Spain, Portugal, and other countries also hold significant potential in biochar production. The biochar production capacity in Europe was doubled in just 2 years from 2018 to 2020.

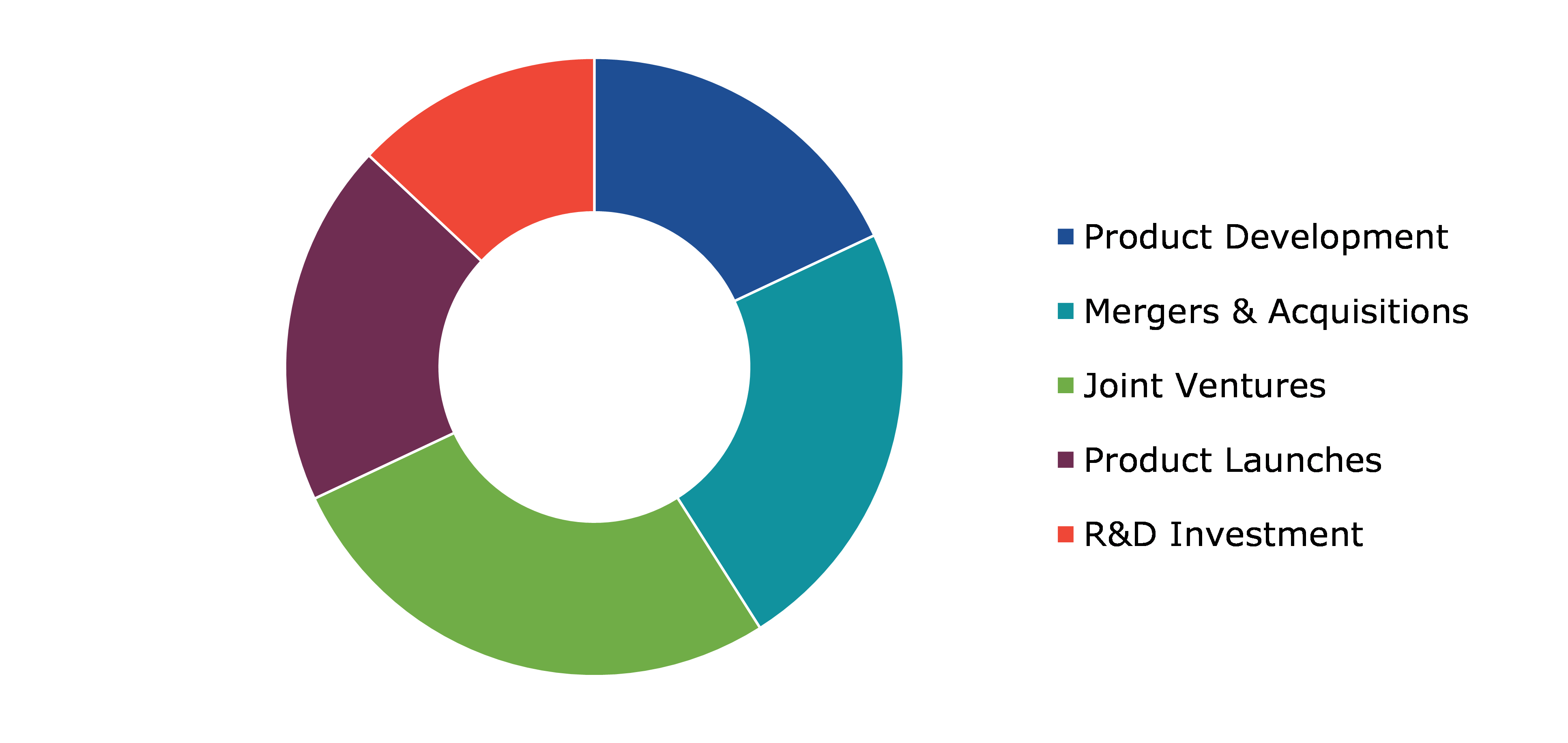

Competitive Scenario in the Global Biochar Market

Product launches, investments, and partnerships are common strategies followed by major market players. For instance, in June 2021, Airex Energy, the leading biochar producer, established a partnership with SUEZ Group, to industrialize the recovery of biomass residues on a large scale that can be used for the production of biochar. This partnership aims at achieving carbon neutrality and increasing the fertility of agricultural soils.

Source: Research Dive Analysis

Some of the leading biochar market players are Agri- tech Producers, LLC, Airex Énergie Inc., American BioChar, ECOERA, Biochar Now, Bioforcetech Corp., Chargrow USA LLC, Pacific Biochar Benefit Corporation, Phoenix Energy, and ARSTA Eco PVT LTD.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Feedstock |

|

| Segmentation by Production Method |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global biochar market?

A. The size of the global biochar market was over $447.7 million in 2021 and is projected to reach $2,366.4 million by 2031.

Q2. Which are the major companies in the biochar market?

A. Chargrow USA LLC, Pacific Biochar Benefit Corporation, and Phoenix Energy are some of the major players operating in the biochar market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Europe region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific biochar market?

A. Asia Pacific biochar market is anticipated to grow at 18.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launch, partnership, and investment are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Airex Énergie Inc., American BioChar, and Biochar Now are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global biochar market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Production method matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Biochar market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Biochar Market Analysis, by Feedstock

5.1.Overview

5.2.Agricultural Waste

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2031

5.2.3.Market share analysis, by country, 2022-2031

5.3.Animal Manure

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2031

5.3.3.Market share analysis, by country, 2022-2031

5.4.Bamboo-based

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2031

5.4.3.Market share analysis, by country, 2022-2031

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2022-2031

5.5.3.Market share analysis, by country, 2022-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Biochar Market Analysis, by Production Method

6.1.Overview

6.2.Pyrolysis

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2031

6.2.3.Market share analysis, by country, 2022-2031

6.3.Gasification

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2031

6.3.3.Market share analysis, by country, 2022-2031

6.4.Others

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2022-2031

6.4.3.Market share analysis, by country, 2022-2031

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7. Biochar Market Analysis, by Application

7.1.Overview

7.2.Agriculture

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2031

7.2.3.Market share analysis, by country, 2022-2031

7.3.Livestock Feed

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2031

7.3.3.Market share analysis, by country, 2022-2031

7.4.Building Materials

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2022-2031

7.4.3.Market share analysis, by country, 2022-2031

7.5.Others

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region, 2022-2031

7.5.3.Market share analysis, by country, 2022-2031

7.6.Research Dive Exclusive Insights

7.6.1.Market attractiveness

7.6.2.Competition heatmap

8.Biochar Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Feedstock, 2022-2031

8.1.1.2.Market size analysis, by Production method, 2022-2031

8.1.1.3.Market size analysis, by Application, 2022-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Feedstock, 2022-2031

8.1.2.2.Market size analysis, by Production method, 2022-2031

8.1.2.3.Market size analysis, by Application, 2022-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Feedstock, 2022-2031

8.1.3.2.Market size analysis, by Production method, 2022-2031

8.1.3.3.Market size analysis, by Application, 2022-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Feedstock, 2022-2031

8.2.1.2.Market size analysis, by Production method, 2022-2031

8.2.1.3.Market size analysis, by Application, 2022-2031

8.2.2.Sweden8.2.2.1.Market size analysis, by Feedstock, 2022-2031

8.2.2.2.Market size analysis, by Production method, 2022-2031

8.2.2.3.Market size analysis, by Application, 2022-2031

8.2.3.Switzerland

8.2.3.1.Market size analysis, by Feedstock, 2022-2031

8.2.3.2.Market size analysis, by Production method, 2022-2031

8.2.3.3.Market size analysis, by Application, 2022-2031

8.2.4.Austria

8.2.4.1.Market size analysis, by Feedstock, 2022-2031

8.2.4.2.Market size analysis, by Production method, 2022-2031

8.2.4.3.Market size analysis, by Application, 2022-2031

8.2.5.Spain

8.2.5.1.Market size analysis, by Feedstock, 2022-2031

8.2.5.2.Market size analysis, by Production method, 2022-2031

8.2.5.3.Market size analysis, by Application, 2022-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Feedstock, 2022-2031

8.2.6.2.Market size analysis, by Production method, 2022-2031

8.2.6.3.Market size analysis, by Application, 2022-2031

8.2.7.Research Dive Exclusive Insights8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Feedstock, 2022-2031

8.3.1.2.Market size analysis, by Production method, 2022-2031

8.3.1.3.Market size analysis, by Application, 2022-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Feedstock, 2022-2031

8.3.2.2.Market size analysis, by Production method, 2022-2031

8.3.2.3.Market size analysis, by Application, 2022-2031

8.3.3.India

8.3.3.1.Market size analysis, by Feedstock, 2022-2031

8.3.3.2.Market size analysis, by Production method, 2022-2031

8.3.3.3.Market size analysis, by Application, 2022-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Feedstock, 2022-2031

8.3.4.2.Market size analysis, by Production method, 2022-2031

8.3.4.3.Market size analysis, by Application, 2022-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Feedstock, 2022-2031

8.3.5.2.Market size analysis, by Production method, 2022-2031

8.3.5.3.Market size analysis, by Application, 2022-2031

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Feedstock, 2022-2031

8.3.6.2.Market size analysis, by Production method, 2022-2031

8.3.6.3.Market size analysis, by Application, 2022-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Feedstock, 2022-2031

8.4.1.2.Market size analysis, by Production method, 2022-2031

8.4.1.3.Market size analysis, by Application, 2022-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Feedstock, 2022-2031

8.4.2.2.Market size analysis, by Production method, 2022-2031

8.4.2.3.Market size analysis, by Application, 2022-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Feedstock, 2022-2031

8.4.3.2.Market size analysis, by Production method, 2022-2031

8.4.3.3.Market size analysis, by Application, 2022-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Feedstock, 2022-2031

8.4.4.2.Market size analysis, by Production method, 2022-2031

8.4.4.3.Market size analysis, by Application, 2022-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Feedstock, 2022-2031

8.4.5.2.Market size analysis, by Production method, 2022-2031

8.4.5.3.Market size analysis, by Application, 2022-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis

10.Company Profiles

10.1.Agri-Tech Producers, LLC

10.1.1.Overview

10.1.2.Business segments

10.1.3.Feedstock portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.1.7.Research Dive Analyst View10.2. Airex Énergie Inc.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Feedstock portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.2.7.Research Dive Analyst View

10.3.American BioChar

10.3.1.Overview

10.3.2.Business segments

10.3.3.Feedstock portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.3.7.Research Dive Analyst View

10.4.ECOERA

10.4.1.Overview

10.4.2.Business segments

10.4.3.Feedstock portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.4.7.Research Dive Analyst View

10.5.Biochar Now

10.5.1.Overview

10.5.2.Business segments

10.5.3.Feedstock portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.5.7.Research Dive Analyst View

10.6.Bioforcetech Corp.

10.6.1.Overview

10.6.2.Business segments

10.6.3.Feedstock portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.6.7.Research Dive Analyst View

10.7.Chargrow USA LLC

10.7.1.Overview

10.7.2.Business segments

10.7.3.Feedstock portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.7.7.Research Dive Analyst View

10.8.Pacific Biochar Benefit Corporation

10.8.1.Overview

10.8.2.Business segments

10.8.3.Feedstock portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.8.7.Research Dive Analyst View

10.9.Phoenix Energy

10.9.1.Overview

10.9.2.Business segments

10.9.3.Feedstock portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.9.7.Research Dive Analyst View

10.10.ARSTA Eco PVT LTD.

10.10.1.Overview

10.10.2.Business segments

10.10.3.Feedstock portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

10.10.7.Research Dive Analyst View

Biochar is charcoal-like, black, lightweight residue formed by burning of biomass and organic material from agricultural and forestry waste. The burning process of biomass is done through direct thermal decomposition, in limited oxygen environment that prevents combustion of the biomass. Biochar is very rich in pyrogenic carbon which makes it suitable for acidic soils; biochar is added to acidic soils to increase their fertility. Studies have shown that this practice of adding biochar to the soil to increase its fertility goes way back to thousands of years to the Amazon basin where ancient local population called it ‘terra preta’, meaning, dark earth.

Forecast Analysis of the Biochar Market

In the recent years, there has been an increase in the demand for biochar due to its application in agriculture, horticulture, soil remediation sector, etc. This growing applicability of biochar is expected to be the primary growth driver of the biochar market in the forecast years, 2022-2031. Along with this, rising use of biochar for waste management is expected to push the biochar market further. Also, biochar has become popular in the recent years due to its ability to address climate change by sequestering 50% of the carbon from the feedstock. This growing popularity of biochar is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, risk of contamination and compaction associated with overuse of biochar may restrain the growth of the market in the forecast period.

Regionally, the biochar market in the Asia-Pacific region is expected to be the most dominant by 2031. The presence of major biochar producing countries like China and Australia is anticipated to become the primary growth driver of the market in this region. Additionally, growing use of biochar in countries like India, South Korea, Japan, etc. is expected to the push the market in this region further.

According to the report published by Research Dive, the global biochar market is expected to gather a revenue of $2,366.4 million by 2031 and grow at 18.4% CAGR in the 2022-2031 timeframe. Some prominent market players include Agri- tech Producers, LLC, Biochar Now, Pacific Biochar Benefit Corporation, Airex Énergie Inc., Bioforcetech Corp., Phoenix Energy, American BioChar, Chargrow USA LLC, ARSTA Eco PVT LTD., ECOERA, and many others.

Covid-19 Impact on the Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The biochar market, however, showed resilience during the pandemic. The sustainable model of biochar production helped the market sail through tough times. Also, several biochar companies received funding for biochar production during the pandemic period which helped the market sustain the devastating effects of the lockdowns.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the biochar market to flourish. For instance:

- In June 2020, EarthRenew, an electric services company, announced that it was signing a supply agreement to acquire biochar from BiocharNow, a leading biochar producing company in the US. This agreement will help EarthRenew to receive biochar from BiocharNow at a discounted rate and redistribute it to sellers in the US on a non-exclusive basis. This agreement will, thus, help in a better penetration of biochar in the Americas and expand the market in this region.

- In June 2022, Biochar Life, an impact venture of Warm Heart Worldwide, announced that it was partnering with Carbonfuture, a carbon removal tracing platform based in Germany. The partnership is aimed sourcing 1000 tons of CO2e from biochar projects in countries like Kenya and Thailand. The partnership is predicted to boost the market share of both the partners in a substantial manner in the coming period.

- In December 2022, EVOIA, a leading agriculture technology company in the US, announced the launch of AmpliFYR, a biochar-based seed and root treatment product. This product launch is anticipated to boost the company’s footprint in the biochar market and place the company in the poll position in the next few years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com