Barite Market Report

RA00038

Barite Market by Color (Grey, White & Off White, Brown, and Others), Deposit Type (Bedding, Cavity Filling, Residual, and Vein), Grade (Grade 3.9, Grade 4.0, Grade 4.1, Grade 4.2, Grade 4.3, and Grade above 4.3), End-use Industry (Oil & Drilling, Paints & Coatings, Pharmaceuticals, Adhesives, Rubber & Plastics, Textiles, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Barite Market Analysis

The global barite market accounted for $1,232.0 million in 2020 and is predicted to grow with a CAGR of 4.3%, by generating a revenue of $1,712.1 million by 2028.

Market Synopsis

Barite also known as barytes is commonly found in hydrothermal veins and veins in limestone. It is gaining significant popularity as it is soft and has high specific gravity. Owing to these properties, it is widely used as a weighting agent in drilling muds for petroleum wells. Most of the barite is produced via open pit mining techniques, in which the barite ore which is mined undergoes simple process which separates mineral from the ore.

However, limited resources & stringent regulations related to mining that has negative environmental impact are anticipated to restrain the barite market size in the upcoming years. In addition, growing transportation cost for barite is another factor anticipated to hamper the barite market demand.

The use of barite in automotive industry in different sound insulation parts which prevents the engine noise from reaching the interior of the automotive vehicle is anticipated to generate excellent growth opportunities in the market. For instance, in automotive sector, barite is used in silent pipe and waste water systems of automotive vehicle. For instance, barite is used for polyurethane foam carpet underlays and mats for sound insulation as barite filling improves the sound damping feature.

According to regional analysis, the North America barite market accounted for $489.1 million in 2020 and is predicted to grow with a CAGR of 3.8% in the projected timeframe.

Barite Overview

Barite is a vital mineral which is derived from barium sulphate. Barite has derived its name from the Greek word “barys” which means heavy. Barite has high specific gravity of 4.5 which is quite high for a nonmetallic mineral. Owing to this, barite has wide range of applications across manufacturing, industrial, and medical sectors and it is a principal ore of barium.

COVID-19 Impact on Barite Market

The global crisis caused by COVID-19 pandemic has led to drastic decline in the production of barite. For instance, Imformed, the industrial minerals forums & research, stated that in 2020, the production of barite was declined by sharp 15%. In addition, the oilfield market which accounts for more than 70% of the barite consumption was negatively impacted owing to travel restrictions and drastic reduction in the demand for transportation fuels. Also, the producers as well as traders of barite experienced up to 90% decline in sales of barite in 2020 compared to 2019. The major producers and exporters of barite namely China, Morocco, Laos, Mexico, U.S., Turkey, and others experienced lower production volume during 2020. In addition, more than 90% of the barite sold in the U.S. is used for drilling of oil & natural gas. However, owing to the COVID-19 crisis, the consumption of barite in the U.S. was significantly declined by 45% in 2020. These factors have greatly affected the barite market share during the pandemic times.

Various initiatives are implemented to bring the barite market demand back on track which will offer some help to the producers. For instance, in April 2021, CIMBAR Performance Minerals Inc., the leading producer and distributor of barite, acquired the drilling grade barite plant of Baker Hughes’, the leading oilfield services company, to boost the production of barite.

Growing Application of Barite across Paint & Coating Industry to Drive the Market Growth

Barite has wide range of applications across paint & coating industry where it is used in primer, sealers, and topcoat. Barite has excellent characteristics such as excellent whiteness & brightness, narrow particle size distribution, low oil-absorption, high purity, and chemical inertness. Also, due to low silica content, it has low abrasiveness, presence of large number of isodiametric particles, and excellent resistance to acids & alkalis. Owing to the above-mentioned properties, the use of barite in paints & coatings industry exhibits UV & scrub resistance, fast drying, viscosity & gloss control, homogenization, stabilization, and other properties. Thus, barite has various end-use applications in paints & coatings industry due to which it can be used for road marking, powder coating, marine sector, decorative applications, as well as in industrial & automotive sector. All these factors are anticipated to drive the barite market size during the forecast period.

To know more about global barite market drivers, get in touch with our analysts here.

Presence of Substitutes to Restrain the Barite Market Growth

The availability of substitutes such as iron ore, synthetic ilmenite, estate, and others to restrain the barite market growth. In addition, barite is largely produced via open-pit mining techniques. Mining activity is highly regulated in countries such as U.S., Canada, and European countries which is predicted to hinder the market growth during the forecast period.

Growing Applications of Barite in Plastics & Rubber Industry to Generate Excellent Growth Opportunities

Barite is widely used in plastics and rubber compounds for the manufacturing of pipes, toys, automobile components, and PVC products. This is because barite has excellent properties owing to good processing rheology and low oil absorption. In rubber industry, barite is used as a weighting filler in rubber for making “anti-sail” mud flaps for trucks. In addition, owing to high chemical resistance, barite increases the resistance of rubber material and reduces the cost of rubber per unit volume. Hence, the properties such as high density, purity, chemical inertness, durability, and resistance to acid & alkali make it extremely useful in plastics & rubber industry.

To know more about global barite market opportunities, get in touch with our analysts here.

Based on color, the market has been divided into Grey, white & off white, brown, and others. Among these, the Grey sub-segment accounted for the highest revenue share in 2020 and white & off white sub-segment is anticipated to show the fastest growth during the forecast period. Download PDF Sample ReportBarite Market

By Color

Source: Research Dive Analysis

The grey sub-segment is anticipated to have a dominant market share and generate a revenue of $919.5 million by 2028, growing from $647.2 million in 2020. Grey barite is a mineral form of barium sulphate which occurs naturally. Grey barite is widely used as an aggregate, filler extender, and as a weighting agent to drill mud. Owing to its high specific gravity, barite is used to prevent the explosive release of gas and oil during drilling. These factors are estimated to drive the growth of capture sub-segment during the analysis timeframe. Grey barite mineral comprises of 65.7% of barium oxide (BaO) and the remaining percentage of sulfur trioxide (SO3). Also, grey barite powder has various industrial applications. These factors are anticipated to drive the grey barite market demand during the forecast period.

The white & off white sub-segment is anticipated to show the fastest growth and shall generate a revenue of $407.0 million by 2028, growing from $281.2 million in 2020. The white & off white barite is a natural of barium, also known as heavy spar. White & off white barite is largely used in paints & pigment industry, plastics, coatings, and as a functional additive for batteries. For instance, in automotive paints & coatings industry, the white & off white barite is used in dipping primers owing to excellent corrosion resistance and adhesion. Also, it has good blister resistance and good flow characteristics.

Barite Market

By Deposit TypeBased on deposit type, the market has been divided into Bedding, cavity filling, residual, and vein. Among these, the Bedding sub-segment accounted for the highest market share in 2020 it is estimated to show the fastest growth during 2021-2028.

Source: Research Dive Analysis

The bedding sub-segment is anticipated to have a dominant market share and generate a revenue of $903.4 million by 2028, growing from $631.9 million in 2020. This is because bedded barite is most economic occurrence of barite which is believed to have been formed as an emanation from seafloor sediments. Bedded barite is usually medium to dark grey in color and has fine grained sugary texture. Also, bedded deposits of barite can be easily mined using large-scale open-pit mining techniques and it requires simple processing steps for extraction. Also, bedded barite deposits are extensive and have consistent grades that make them useful for various industrial and oil & gas drilling operations. These characteristics are anticipated to drive the bedding sub-segment market size in the upcoming years.

Barite Market

By gradeBased on grade, the market has been divided into grade 3.9, grade 4.0, grade 4.1, Grade 4.2, grade 4.3, and grade above 4.3. Among these, the Grade 4.2 sub-segment accounted for the highest market share in 2020 and it is estimated to show the fastest growth during 2021-2028.

Source: Research Dive Analysis

The grade 4.2 sub-segment is anticipated to have a dominant market share and generate a revenue of $521.0 million by 2028, growing from $356.8 million in 2020. Rapid growth in the exploration of shale oil & gas has led to increase in the demand for grade 4.2 of barite market. This is because, grade 4.2 has very low solubility, high specific gravity, physical & chemical inertness, and relative softness. The grade 4.2 of barite has a specific gravity of 4.2. The composition of grade 4.2 includes minimum 90% BaSO4 (barium sulfate), maximum 2% SiO2 (silicon dioxide), maximum 0.25% Fe2O3 (ferric oxide), and 1% moisture. Grade 4.2 barite has high quality, is transparent, and colorless. It has applications in agricultural pesticides where barite compounds such as barium nitrate, barium carbonate, barium oxide, barium chloride, barium hydroxide, and others are used for configuration of glaze in ceramics, to increase the refractive index of glass, in agricultural pesticides, and others.

Barite Market

By End Use IndustryBased on end-use industry, the market has been divided into Oil & Drilling, paints & coatings, pharmaceuticals, adhesives, rubber & plastics, textiles, and others. Among these, the Oil & Drilling sub-segment accounted for the highest market share in 2020 and pharmaceuticals sub-segment is projected to show the fastest growth during 2021-2028.

Source: Research Dive Analysis

The oil & drilling sub-segment is anticipated to have a dominant market share and generate a revenue of $1,103.7 million by 2028, growing from $795.3 million in 2020. In oil & drilling, barite is widely used as a weighting agent for oil & gas. This is because in drilling mud, the barite is used as a weighting agent that balances the weight of mud and weight of underground oil & gas. This balancing helps in preventing the blowout accidents. The use of barite increases the hydrostatic pressure of drilling mud which compensates for the high-pressure zones experienced during oil & gas drilling. Also, the softness of barite is an important characteristic that serves as a lubricant for the drilling tools and prevents the damage caused to these tools during the drilling process. In addition, barite prevents the entry of gas, oil, or saltwater into the high-pressure zones thereby preventing the oil & gas accidents.

The pharmaceuticals sub-segment is anticipated to be the fastest growing market and generate a revenue of $139.6 million by 2028, growing from $94.8 million in 2020. In pharmaceutical sector, barite is used for filling of plaster and dope. It is used in diagnostic medical tests which is effective for blocking the emission of harmful x-rays and gamma-rays. Barite is used in gastrointestinal tract which prevents the penetration of x-rays making the lining of gastrointestinal tract visible on x-ray. Hence, it facilitates the determination of normal and abnormal anatomy.

Barite Market

By RegionThe barite market is investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Barite in North America to be the Most Dominant

The North America barite market accounted $489.1 million in 2020 and is projected to grow with a CAGR of 3.8%. The U.S. was the sixth leading producer of barite in the world in 2019 and majority of the barite is used as a weighting agent for drilling of oil & natural gas wells. Also, the U.S. is one of the leading importers of barite and majority of the barite is imported from countries such as China, Morocco, India, Mexico, and others. Most of the barite production in the U.S. come from Nevada and a single mine in Georgia. Additionally, barite is used as a filler in industrial applications such as in paints, rubber, and plastics. For instance, it is used in the manufacturing of automotive brake & clutch pads, in underwater petroleum pipelines, and as a primer for metal protection & gloss. These factors are anticipated to drive the barite demand in the North America region.

The Market for Barite in Asia-Pacific to Show the Fastest Growth

The Asia-Pacific barite market accounted $284.6 million in 2020 and is projected to grow with a CAGR of 5.1%. China is one of the largest producers of barite in the world and second largest consumer after the U.S. In 2021, China’s barite production reached 2.8 million metric tons followed by India with 1.6 million metric tons. China, India, and Morocco are largest producers of barite that accounted for over 70% world’s production in 2019. Around 50% of barite production in China is used for oil & gas drilling operations, around 40% if used for industrial applications, and the remaining 10% is used for counterweights, construction, and other applications. In India, Andhra Pradesh is leading producer of barite which accounts for 98% of total production of barite in India. All these aspects are anticipated to drive the Asia-Pacific barite market share in the upcoming years.

Competitive Scenario in the Global Barite Market

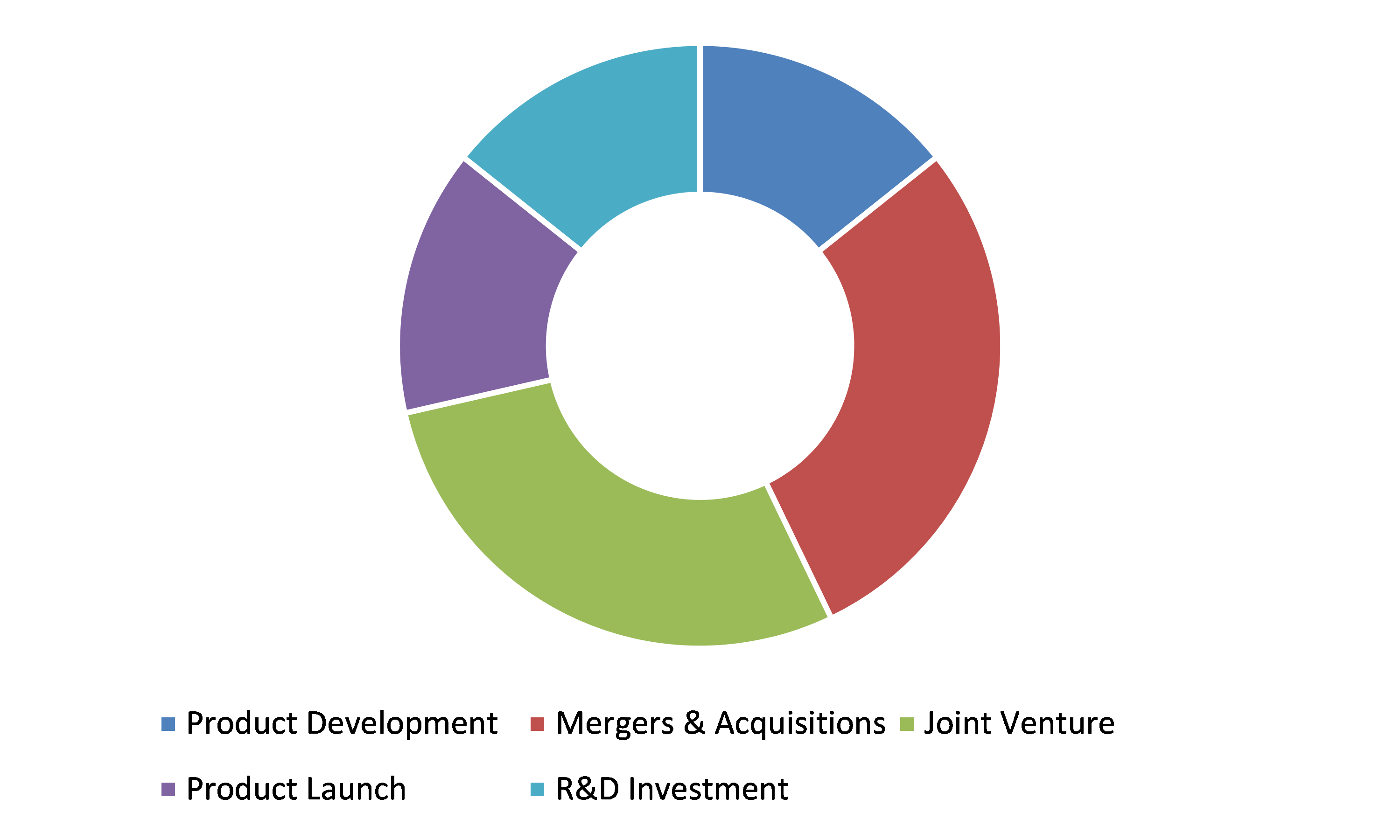

New Contract and new technology are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading Barite market players are Apmdc, Desku Group Inc., Ashapura Group, Halliburton Company, International Earth Products LLC, Excalibar Minerals LLC, Kaomin Industries, Barium & Chemicals Inc, Seaforth Mineral & Ore Co. Inc, and New Riverside Ochre Company, Inc.

Porter’s Five Forces Analysis for the Global Barite Market:

- Bargaining Power of Suppliers: There is limited number of suppliers of barite and product quality offered by various suppliers varies. In addition, emerging applications of barite increases the bargaining potential of the suppliers in the barite market.

Thus, the bargaining power of suppliers is high. - Bargaining Power of Buyers: The bargaining power of buyers is moderate as barite is the basic raw materials which is used across various oil & gas drilling operations as well as in industrial and medical sectors. Due to this, the bargaining power of buyers decreases to some extent.

Thus, buyer’s bargaining power will be moderate. - Threat of New Entrants: The threat of new entrants is moderate as the investment cost required for extraction of barite and setting up the manufacturing unit is high. In addition, brand loyalty is high.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: The availability of substitute such as iron ore and ilmenite increases the threat of substitute to some extent. However, barite is majorly used compared to other substitute owing to its excellent chemical & physical properties.

Thus, the threat of substitutes is moderate. - Competitive Rivalry in the Market: The companies operating in this market are focusing on acquiring new contracts to increase their consumer base.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Color |

|

| Segmentation by Deposit Type |

|

| Segmentation by Grade |

|

| Segmentation by End-use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global barite market?

A. The size of the global Barite market was over $1,232.0 million in 2020 and is projected to reach $1,712.1 million by 2028.

Q2. Which are the major companies in the barite market?

A. Apmdc, Desku Group Inc., and Ashapura group are some of the key players in the global barite market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific barite market?

A. Asia-Pacific barite market is anticipated to grow at 5.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. New contract and new technology are the key strategies opted by leading companies operating in the barite market.

Q6. Which companies are investing more on R&D practices?

A. Halliburton Company, International Earth Products LLC, and Excalibar Minerals LLC are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Color trends

2.3.Deposit Type trends

2.4.Grade trends

2.5.End Use Industry trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Barite Market, by Color

4.1.Grey

4.1.1.Key market trends, growth factors, and opportunities

4.1.2.Market size and forecast, by region, 2020-2028

4.1.3.Market share analysis, by country, 2020 & 2028

4.2.White & Off White

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country, 2020 & 2028

4.3.Brown

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country, 2020 & 2028

4.4.Others

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region, 2020-2028

4.4.3.Market share analysis, by country, 2020 & 2028

5.Barite Market, by Deposit Type

5.1.Bedding

5.1.1.Key market trends, growth factors, and opportunities

5.1.2.Market size and forecast, by region, 2020-2028

5.1.3.Market share analysis, by country, 2020 & 2028

5.2.Cavity Filling

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country, 2020 & 2028

5.3.Residual

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country, 2020 & 2028

5.4.Vein

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country, 2020 & 2028

6.Barite Market, by Grade

6.1.Grade 3.9

6.1.1.Key market trends, growth factors, and opportunities

6.1.2.Market size and forecast, by region, 2020-2028

6.1.3.Market share analysis, by country, 2020 & 2028

6.2.Grade 4.0

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2020-2028

6.2.3.Market share analysis, by country, 2020 & 2028

6.3.Grade 4.1

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2020-2028

6.3.3.Market share analysis, by country, 2020 & 2028

6.4.Grade 4.2

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2020-2028

6.4.3.Market share analysis, by country, 2020 & 2028

6.5.Grade 4.3

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region, 2020-2028

6.5.3.Market share analysis, by country, 2020 & 2028

6.6.Grade above 4.3

6.6.1.Key market trends, growth factors, and opportunities

6.6.2.Market size and forecast, by region, 2020-2028

6.6.3.Market share analysis, by country, 2020 & 2028

7.Barite Market, by End Use Industry

7.1.Oil & Drilling

7.1.1.Key market trends, growth factors, and opportunities

7.1.2.Market size and forecast, by region, 2020-2028

7.1.3.Market share analysis, by country, 2020 & 2028

7.2.Paints & Coatings

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2020-2028

7.2.3.Market share analysis, by country, 2020 & 2028

7.3.Pharmaceuticals

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2020-2028

7.3.3.Market share analysis, by country, 2020 & 2028

7.4.Adhesives

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region, 2020-2028

7.4.3.Market share analysis, by country, 2020 & 2028

7.5.Rubber & Plastics

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by region, 2020-2028

7.5.3.Market share analysis, by country, 2020 & 2028

7.6.Textiles

7.6.1.Key market trends, growth factors, and opportunities

7.6.2.Market size and forecast, by region, 2020-2028

7.6.3.Market share analysis, by country, 2020 & 2028

7.7.Others

7.7.1.Key market trends, growth factors, and opportunities

7.7.2.Market size and forecast, by region, 2020-2028

7.7.3.Market share analysis, by country, 2020 & 2028

8.Barite Market, by Region

8.1.North America

8.1.1.Key market trends, growth factors, and opportunities

8.1.2.Market size and forecast, by Color, 2020-2028

8.1.3.Market size and forecast, by Deposit Type, 2020-2028

8.1.4.Market size and forecast, by Grade, 2020-2028

8.1.5.Market size and forecast, by End Use Industry, 2020-2028

8.1.6.Market size and forecast, by country, 2020-2028

8.1.7.U.S.

8.1.7.1.Market size and forecast, by Color, 2020-2028

8.1.7.2.Market size and forecast, by Deposit Type, 2020-2028

8.1.7.3.Market size and forecast, by Grade, 2020-2028

8.1.7.4.Market size and forecast, by End Use Industry, 2020-2028

8.1.8.Canada

8.1.8.1.Market size and forecast, by Color, 2020-2028

8.1.8.2.Market size and forecast, by Deposit Type, 2020-2028

8.1.8.3.Market size and forecast, by Grade, 2020-2028

8.1.8.4.Market size and forecast, by End Use Industry, 2020-2028

8.1.9.Mexico

8.1.9.1.Market size and forecast, by Color, 2020-2028

8.1.9.2.Market size and forecast, by Deposit Type, 2020-2028

8.1.9.3.Market size and forecast, by Grade, 2020-2028

8.1.9.4.Market size and forecast, by End Use Industry, 2020-2028

8.2.Europe

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by Color, 2020-2028

8.2.3.Market size and forecast, by Deposit Type, 2020-2028

8.2.4.Market size and forecast, by Grade, 2020-2028

8.2.5.Market size and forecast, by End Use Industry, 2020-2028

8.2.6.Market size and forecast, by country, 2020-2028

8.2.7.Germany

8.2.7.1.Market size and forecast, by Color, 2020-2028

8.2.7.2.Market size and forecast, by Deposit Type, 2020-2028

8.2.7.3.Market size and forecast, by Grade, 2020-2028

8.2.7.4.Market size and forecast, by End Use Industry, 2020-2028

8.2.8.UK

8.2.8.1.Market size and forecast, by Color, 2020-2028

8.2.8.2.Market size and forecast, by Deposit Type, 2020-2028

8.2.8.3.Market size and forecast, by Grade, 2020-2028

8.2.8.4.Market size and forecast, by End Use Industry, 2020-2028

8.2.9.France

8.2.9.1.Market size and forecast, by Color, 2020-2028

8.2.9.2.Market size and forecast, by Deposit Type, 2020-2028

8.2.9.3.Market size and forecast, by Grade, 2020-2028

8.2.9.4.Market size and forecast, by End Use Industry, 2020-2028

8.2.10.Italy

8.2.10.1.Market size and forecast, by Color, 2020-2028

8.2.10.2.Market size and forecast, by Deposit Type, 2020-2028

8.2.10.3.Market size and forecast, by Grade, 2020-2028

8.2.10.4.Market size and forecast, by End Use Industry, 2020-2028

8.2.11.Spain

8.2.11.1.Market size and forecast, by Color, 2020-2028

8.2.11.2.Market size and forecast, by Deposit Type, 2020-2028

8.2.11.3.Market size and forecast, by Grade, 2020-2028

8.2.11.4.Market size and forecast, by End Use Industry, 2020-2028

8.2.12.Rest of Europe

8.2.12.1.Market size and forecast, by Color, 2020-2028

8.2.12.2.Market size and forecast, by Deposit Type, 2020-2028

8.2.12.3.Market size and forecast, by Grade, 2020-2028

8.2.12.4.Market size and forecast, by End Use Industry, 2020-2028

8.3.Asia Pacific

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by Color, 2020-2028

8.3.3.Market size and forecast, by Deposit Type, 2020-2028

8.3.4.Market size and forecast, by Grade, 2020-2028

8.3.5.Market size and forecast, by End Use Industry, 2020-2028

8.3.6.Market size and forecast, by country, 2020-2028

8.3.7.China

8.3.7.1.Market size and forecast, by Color, 2020-2028

8.3.7.2.Market size and forecast, by Deposit Type, 2020-2028

8.3.7.3.Market size and forecast, by Grade, 2020-2028

8.3.7.4.Market size and forecast, by End Use Industry, 2020-2028

8.3.8.Japan

8.3.8.1.Market size and forecast, by Color, 2020-2028

8.3.8.2.Market size and forecast, by Deposit Type, 2020-2028

8.3.8.3.Market size and forecast, by Grade, 2020-2028

8.3.8.4.Market size and forecast, by End Use Industry, 2020-2028

8.3.9.India

8.3.9.1.Market size and forecast, by Color, 2020-2028

8.3.9.2.Market size and forecast, by Deposit Type, 2020-2028

8.3.9.3.Market size and forecast, by Grade, 2020-2028

8.3.9.4.Market size and forecast, by End Use Industry, 2020-2028

8.3.10.South Korea

8.3.10.1.Market size and forecast, by Color, 2020-2028

8.3.10.2.Market size and forecast, by Deposit Type, 2020-2028

8.3.10.3.Market size and forecast, by Grade, 2020-2028

8.3.10.4.Market size and forecast, by End Use Industry, 2020-2028

8.3.11.Australia

8.3.11.1.Market size and forecast, by Color, 2020-2028

8.3.11.2.Market size and forecast, by Deposit Type, 2020-2028

8.3.11.3.Market size and forecast, by Grade, 2020-2028

8.3.11.4.Market size and forecast, by End Use Industry, 2020-2028

8.3.12.Rest of Asia Pacific

8.3.12.1.Market size and forecast, by Color, 2020-2028

8.3.12.2.Market size and forecast, by Deposit Type, 2020-2028

8.3.12.3.Market size and forecast, by Grade, 2020-2028

8.3.12.4.Market size and forecast, by End Use Industry, 2020-2028

8.4.LAMEA

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by Color, 2020-2028

8.4.3.Market size and forecast, by Deposit Type, 2020-2028

8.4.4.Market size and forecast, by Grade, 2020-2028

8.4.5.Market size and forecast, by End Use Industry, 2020-2028

8.4.6.Market size and forecast, by country, 2020-2028

8.4.7.Saudi Arabia

8.4.7.1.Market size and forecast, by Color, 2020-2028

8.4.7.2.Market size and forecast, by Deposit Type, 2020-2028

8.4.7.3.Market size and forecast, by Grade, 2020-2028

8.4.7.4.Market size and forecast, by End Use Industry, 2020-2028

8.4.8.United Arab Emirates

8.4.8.1.Market size and forecast, by Color, 2020-2028

8.4.8.2.Market size and forecast, by Deposit Type, 2020-2028

8.4.8.3.Market size and forecast, by Grade, 2020-2028

8.4.8.4.Market size and forecast, by End Use Industry, 2020-2028

8.4.9.Brazil

8.4.9.1.Market size and forecast, by Color, 2020-2028

8.4.9.2.Market size and forecast, by Deposit Type, 2020-2028

8.4.9.3.Market size and forecast, by Grade, 2020-2028

8.4.9.4.Market size and forecast, by End Use Industry, 2020-2028

8.4.10.South Africa

8.4.10.1.Market size and forecast, by Color, 2020-2028

8.4.10.2.Market size and forecast, by Deposit Type, 2020-2028

8.4.10.3.Market size and forecast, by Grade, 2020-2028

8.4.10.4.Market size and forecast, by End Use Industry, 2020-2028

8.4.11.Rest of LAMEA

8.4.11.1.Market size and forecast, by Color, 2020-2028

8.4.11.2.Market size and forecast, by Deposit Type, 2020-2028

8.4.11.3.Market size and forecast, by Grade, 2020-2028

8.4.11.4.Market size and forecast, by End Use Industry, 2020-2028

9.Company profiles

9.1.Apmdc

9.1.1.Company overview

9.1.2.Operating business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Key strategy moves and development

9.2.Desku Group Inc.

9.2.1.Company overview

9.2.2.Operating business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Key strategy moves and development

9.3.Ashapura Group

9.3.1.Company overview

9.3.2.Operating business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Key strategy moves and development

9.4.Halliburton Company

9.4.1.Company overview

9.4.2.Operating business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Key strategy moves and development

9.5.International Earth Products LLC

9.5.1.Company overview

9.5.2.Operating business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Key strategy moves and development

9.6.Excalibar Minerals LLC

9.6.1.Company overview

9.6.2.Operating business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Key strategy moves and development

9.7.Kaomin Industries

9.7.1.Company overview

9.7.2.Operating business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Key strategy moves and development

9.8.Barium & Chemicals Inc

9.8.1.Company overview

9.8.2.Operating business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Key strategy moves and development

9.9.Seaforth Mineral & Ore Co. Inc

9.9.1.Company overview

9.9.2.Operating business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Key strategy moves and development

9.10.New Riverside Ochre Company, Inc.

9.10.1.Company overview

9.10.2.Operating business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Key strategy moves and development

Barite is a naturally occurring barium-based mineral that has high specific gravity and chemical inertness and is found in a wide range of colors like yellow, blue, brown, gray, white, etc. Due to its excellent properties like high purity, low oil absorption, narrow particle size distribution, and whiteness, barite is highly used in drilling, medical, automotive, pain and coating industries, and many others. It is also used in other applications that include TV and computer monitors, rubber mud flaps, clutch pads, plastics, radiation shielding, paint and gold balls, etc.

Forecast Analysis

Increasing use of barite in the pain and coating industry in primers, sealers, and topcoat due to its excellent properties is the main factor expected to drive the growth of the global barite market during the forecast period. Moreover, since barite consists of large number of isodiametric particles and has great resistance to acids and alkalis, it is used in the pain and coating industry for fast drying, viscosity and gloss control, and stabilization. This is yet another factor estimated to boost the barite market growth by 2028. In addition, the increasing application of barite in manufacturing of toys, pipes, automobile components, and anti-sail mud flaps is anticipated to create ample growth opportunities for the barite market by 2028. However, the presence of substitutes like estate, iron ore, etc. is the major factor to impede the barite market growth.

Regionally, the barite market in the North America region is predicted to hold a dominant market share and grow at 3.8% CAGR in estimated timeframe due to the existence of leading barite importing countries in the region. Additionally, the extensive application of barite in multiple industries like plastics, rubber, paints, and automobile is also projected to uplift the market growth in the North America region.

According to the report published by Research Dive, the global barite market is expected to gather a revenue of $1,712.1 million and grow at 4.3% CAGR in the 2021–2028 timeframe. Some significant market players include Desku Group Inc., Kaomin Industries, Halliburton Company, Excalibar Minerals LLC, International Earth Products LLC, Apmdc, New Riverside Ochre Company, Inc, Barium & Chemicals Inc, Seaforth Mineral & Ore Co. Inc, Ashapura Group, and many others.

Covid-19 Impact on the Market

The onset of the Covid-19 pandemic has had a disastrous impact on the global barite market and led to its declined production and sales in most regions. The oilfield market that is accounted for over 70% of the barite consumption was adversely affected due to strict travel restrictions and reduced demand for transportation fuels. This is yet another factor to decline the demand for barite globally. However, various initiatives are implemented by leading companies to bring the market revenue back on track by strategic partnerships and acquisitions.

Key Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the barite market to flourish. For instance:

In April 2021, CIMBAR Performance Minerals Inc., a leading distributor and producer of barite, announced its acquisition of the drilling grade barite plant of Baker Hughes’ a renowned oilfield services organization, to boost the barite production. CIMBAR decided to add a new barite operation plant in Texas to supply Baker Hughes’ oil and gas customers in all land drilling region of the US.

In March 2022, Thunderstruck Resources Ltd., a Canadian mining exploration company, announced the conclusion of its partnership with Japan Oil, Gas, and Metals National Corporation. The partnership aimed to explore Thunderstruck’s Korokayiu base metal asset. Additionally, JOGMEC had surrendered 70% of its Korokayiu prospect that is now acquired by Thunderstruck with a fully owned exploration license.

In September 2021, Asante Gold Corporation, a gold exploration and development company, announced its acquisition of Mensin Bibiani Pty. Ltd., a leading metal exploration and mining company, to increase the production of barite and other metals and offer them for industrial applications in the western region of Ghana.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com