Hydraulic Cylinders Market Report

RA03796

Hydraulic Cylinders Market by Type (Double Acting and Single Acting), Design (Welded, Tie-rod, and Others), Application (Mobile and Industrial), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Hydraulic Cylinders Market Analysis

The global hydraulic cylinders market size was $11,568.7 million in 2020 and is predicted to grow with a CAGR of 5.0%, by generating a revenue of $16,977.3 million by 2028.

Market Synopsis

Hydraulic cylinders market is gaining huge popularity owing to increase in demand from construction sector. This is majorly owing to the use of hydraulic cylinders in various construction machinery and equipment such as backhoe loaders, earth moving equipment, lifts, cranes, steam rollers, wheel loaders, drilling rigs, and others. Rapid urbanization, industrialization, population growth, and rise in disposable income are the major growth drivers for the construction and hydraulic cylinders market growth.

However, hydraulic fluid leakages in hot areas that may catch fire is estimated to restrain the hydraulic cylinders market share during the forecast period. It is difficult to get rid of fluid leaks in the hydraulic system. If the hydraulic lines burst, it can lead to severe injuries and health issues such as intestinal bleeding, pneumonia, and others.

Technological advancements such as material advances, high level of corrosion resistance, and light weight are anticipated to drive the hydraulic cylinders market size in the coming years. For instance, the main metal part of hydraulic cylinders can operate with very little resistance, however some parts such as seals that were earlier made of leather now include rubber, fabric reinforced elastomers, plastics, and polyurethane. These materials can sustain high level of wear resistance due to which they are widely used in hydraulic cylinders.

According to regional analysis, the Asia-Pacific hydraulic cylinders market accounted for $4,438.9 million in 2020 and is predicted to grow with a CAGR of 5.6% in the projected timeframe.

Hydraulic Cylinders Market Overview

Hydraulic cylinders are part of hydraulic systems that convert hydraulic energy into mechanical movement. Hydraulic cylinders include incompressible liquid material under pressure that is used to hold, pull, lift, push, or move the equipment or goods. Some of the examples where hydraulic cylinders are used include excavators, construction machinery, agriculture equipment, and others. Hydraulic cylinders generate large amount of power, offers ease and accuracy of controlling the system with the help of levels and push buttons. Various hydraulic cylinders such as single acting cylinder, double acting cylinder, and electric hydraulic cylinder contain fewer moving parts due to which they are more durable and less prone to breakdown.

COVID Impact on Hydraulic Cylinders Market

Global crisis caused by COVID-19 pandemic has affected the functioning of various industries owing to nation-wide lockdown that led to economic downturn. Similarly, the hydraulic cylinders market faced negative impact owing to drastic decline in hydraulic cylinders demand & sales from construction, mining, material handling, and oil & gas sectors. For instance, as stated on May 11, 2021, in the Business Standard, the leading news platform, construction and mining equipment industry experienced 10-12% contradiction in its revenue in the year 2020. The postponement and cancellation of construction projects owing to lockdown imposed across various countries, ban on non-essential activities, non-availability of raw materials, shortage of labors, and economic losses have impacted the hydraulic cylinders market demand. This is because hydraulic cylinders are used in various construction and earth moving machineries such as drilling rigs, lifts, steam rollers, excavators, shovels, hauling, and others. The sale of construction equipment was declined by 20%-40% during pandemic which in turn affected the demand for hydraulic cylinders during the pandemic.

Various initiatives taken by the leading hydraulic cylinders manufacturers to protect the workers from COVID-19 is estimated to drive the market growth. For instance, on May 28, 2021, in the Business Standard, the daily edition newspaper, Wipro Enterprises P, top hydraulic cylinder manufacturer, stopped its production for 3 days to break the COVID-19 chain to enhance safety and wellbeing of its stakeholders. Wipro Enterprises P is leading hydraulic cylinder manufacturer in the world which delivers more than million cylinders to the original equipment manufacturers (OEM) for forestry, material & cargo handling machinery, earthmovers, farm & agriculture equipment, mining, truck tipping, and others.

High Demand from Construction and Material Handling Sector to Drive the Market Growth

The heavy-duty machineries and construction equipment used for various purposes during construction such as steam rollers, cranes, forklifts, wheel loaders, drilling rigs, telehandlers, and others use hydraulic cylinders to generate the necessary force for moving the heavy objects. In addition, growing construction activities across the world such as development of smart cities, mega projects, and growing government & private investments in the construction sector are estimated to drive the hydraulic cylinders market size in the upcoming years. For instance, as stated on November 17, 2020, in Invest India, the national investment promotion & facilitation agency, the Indian construction industry is estimated to reach $738.5 million by 2022 and it is anticipated to become third largest construction market in the world. The hydraulic systems including hydraulic cylinders have made their mark in construction industry which has made possible feats of both architecture and engineering which would not have been feasible otherwise. The construction industry is largely dependent on hydraulics for machines such as dozers, power shovels, graders, and excavators as they are reliable and more powerful.

To know more about global hydraulic cylinders market drivers, get in touch with our analysts here.

Hidden Danger of Oil Leakage in Hydraulic Cylinders to Restrain Market Growth

The slick surfaces create risk due to leaking of hydraulic fluid that creates risk for workers especially in high-risk environment such as heavy industries. Such hydraulic leaks can pose serious threat to the health due to inhalation, ingestion, or accidental injection. Accidental injection occurs when high-pressure hydraulic fluid leaks cause fluid to be rapidly injected into the skin. These factors are estimated to restrain the hydraulic cylinders market growth during the forecast period.

Rapid Technological Advancements in Hydraulic Cylinders to Generate Huge Opportunities

The advancements in hydraulic cylinders such as corrosion resistance due to the use of nitro steel rods compared to chrome-plated cylinder rods are estimated to drive huge growth opportunities in the market. For instance, the use of nitro steel rods offers wear & dent resistance and lubrication resistance. In addition, the chrome-plated rods of hydraulic cylinders are hard and thin that result in oil leaks and failure. In addition, the nitro steel rods operating in rugged environment mighty get nicked or scratched but as there is no plating or coating there is no risk of flaking or delamination. This helps in reducing the risk of hydraulic oil leaks and failure. Such nitro steel rods in hydraulic cylinders can be used across various applications such as industrial, oilfield, marine, construction equipment, and machineries.

To know more about global hydraulic cylinders market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into Double Acting and single acting. Among these, the Double Acting sub-segment accounted for highest market share in 2020 and it is estimated to show the fastest growth during the forecast period. Request Free Sample ReportHydraulic Cylinders Market

By Type

Source: Research Dive Analysis

The double acting sub-type is anticipated to have a dominant market share and generate a revenue of $10,686.7 million by 2028, growing from $7,075.3 million in 2020. Double acting cylinders move the load in both directions and they are used when machine requires more than one movement. In comparison with single acting cylinders, the double acting cylinders can extend and retract without the need of spring. Single acting cylinder has pressurized air into one port. However, in double acting cylinder, there is the presence of two ports where air can enter in and out. The ability to extend and retract within short period of time makes them more efficient and precise compared to single acting cylinders. Hence, these hydraulic cylinders offer controlled acceleration, excellent repetitive accuracy, precisely definable stroke measurements, and energy saving as the piston always returns to its starting point.

Hydraulic Cylinders Market

By DesignBased on design, the market has been divided into Welded, tie-rod, and others. Among these, the Welded hydraulic cylinders accounted for the highest revenue share in 2020 and it is estimated to show the fastest growth during the forecast period.

Source: Research Dive Analysis

The welded hydraulic cylinders sub-segment is anticipated to have a dominant market share and generate a revenue of $8,941.5 million by 2028, growing from $5,904.7 million in 2020. Welded hydraulic cylinders are more durable and can be custom-made for specific applications. This is majorly owing to superior seal packages that increase the life-expectancy of the cylinders. Due to the presence of superior seal packages, the welded hydraulic cylinders can be used across locations that involve contaminants and weathering. Also, welded cylinders are narrower compared to the tie-rod cylinders due to which they can work in the applications where space is a constraint.

Hydraulic Cylinders Market

By ApplicationBased on application, the market has been divided into Mobile and industrial. Among these, the Mobile sub-segment accounted for the highest market share in 2020 and it is estimated to show the fastest growth during 2021-2028.

Source: Research Dive Analysis

The mobile sub-segment is anticipated to have a dominant market share and generate a revenue of $10,646.1 million by 2028, growing from $7,091.2 million in 2020. Various mobile applications of hydraulic cylinders include agricultural machines, marine equipment, earth moving equipment, and construction vehicles. For instance, in agricultural machines, hydraulic cylinders are used in suspension, lifting, and load handling. Similarly, in mining & construction sector, hydraulic cylinders are used in drilling machines, excavators, and concrete sprayers. Similarly, in forestry and vehicle applications, hydraulic cylinders are used in lifts, steering, harvester heads, and booms.

Hydraulic Cylinders Market

By RegionThe hydraulic cylinders market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Hydraulic Cylinders in Asia-Pacific to be the Most Dominant and Fastest Growing

The Asia-Pacific hydraulic cylinders market accounted $4,438.9 million in 2020 and is projected to grow with a CAGR of 5.6%. The demand for hydraulic cylinders in Asia-Pacific region is driven by rapid construction activities in developing countries owing to rising population, construction of roads, smart cities, buildings, residential houses, and others. For instance, as stated in February 2021, in trade.gov, the International Trade Organization, China is the largest construction market. Also, China has launched “New Infrastructure” campaign to boost sustainable growth in construction sector and to offset the economic impact of COVID-19. This project will focus on development of 5G networks, data centers, inter-city transportation, inner-city rail systems, new energy vehicle charging stations, and others. The urbanization rate of China is highest in the world. In addition, as stated on January 28, 2020, in the South China Morning Post, Alibaba-owned English-language newspaper, China approved 26 infrastructure projects worth $142 billion in 2019. Hence, growing construction activities in the region that use hydraulic cylinders in various construction equipment is estimated to drive the Asia-Pacific hydraulic cylinders market share during the forecast period.

Competitive Scenario in the Global Hydraulic Cylinders Market

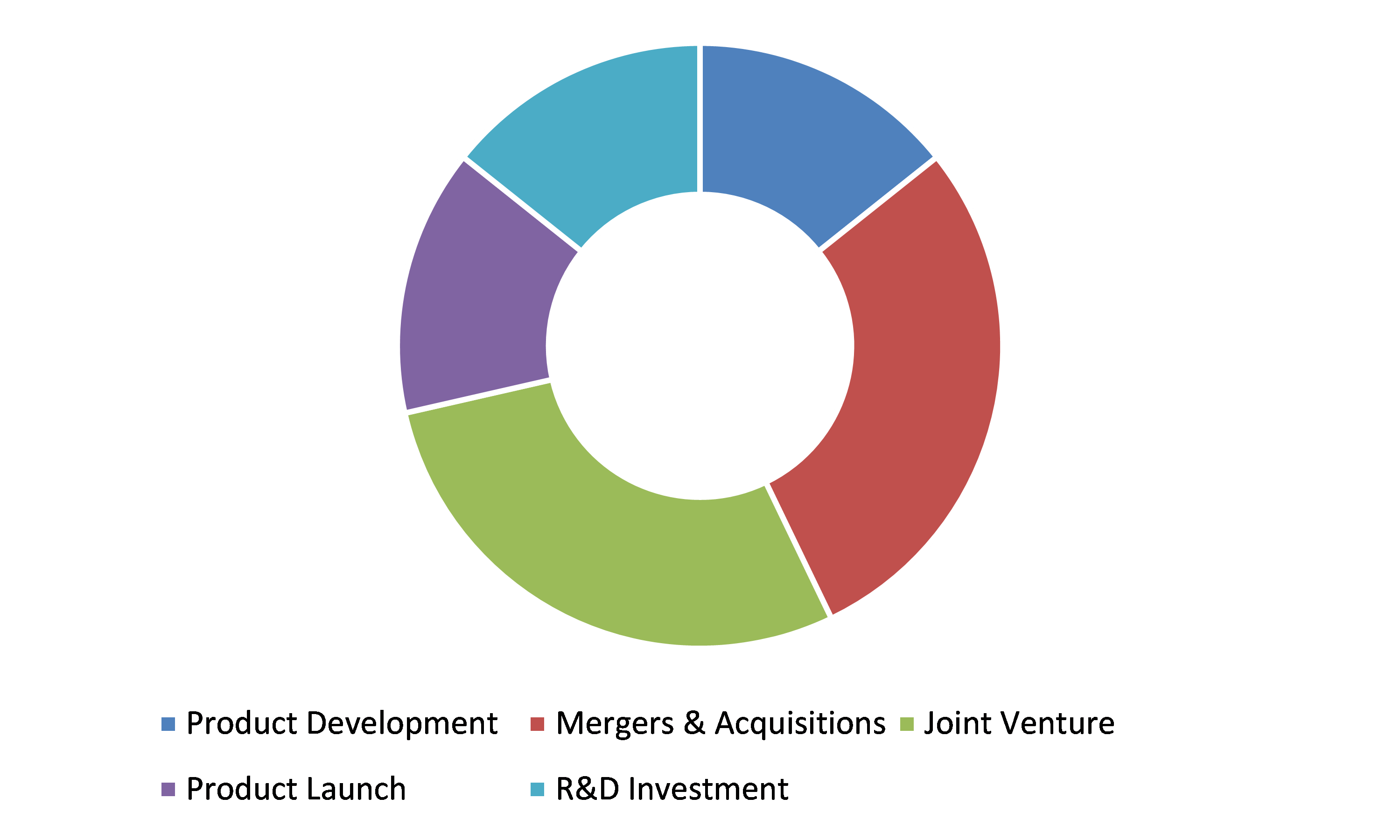

Partnership and Acquisition are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading hydraulic cylinders market players are Bosch Rexroth AG, Wipro Infrastructure Engineering, Parker Hannifin, Bailey International LLC, Caterpillar, Inc., Aggressive Hydraulics, Inc., Eaton, Enerpac, SMC Corporation, and KYB Americas Corporation.

Porter’s Five Forces Analysis for the Global Hydraulic Cylinders Market:

- Bargaining Power of Suppliers: Hydraulic cylinders is basic raw material that is used in manufacturing of various construction, mining, agricultural, industrial, and material handling equipment. Hence, suppliers have high bargaining power to sell hydraulic cylinders and to grab high profits.

Thus, the bargaining power of suppliers is high. - Bargaining Power of Buyers: There are large number of buyers in hydraulic cylinders industry as it has various applications across various equipment’s such as steam rollers, aircraft brakes, wheels, flight controls, hydraulic presses, and others. However, presence of large number of hydraulic cylinder manufacturers gives the buyer an option to select the right product and negotiate on the pricing.

Thus, buyer’s bargaining power will be moderate. - Threat of New Entrants: The new entrants entering in hydraulic cylinders industry have to invest significant capital amount as well as they need to incorporate techniques such as low pricing strategy and providing new value proposition to the customers.

Thus, the threat of the new entrants is low. - Threat of Substitutes: The presence of alternative products such as pneumatic, electrical, or mechanical cylinders may hamper the market growth. But this is negligible as hydraulic cylinders are more efficient and provide highest power for lifting, moving, pushing, or pulling the goods.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competition among players operating in hydraulic cylinders market is intense which may decrease the product price and overall profitability.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Design |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global hydraulic cylinders market?

A. The size of the global hydraulic cylinders market was over $11,568.7 million in 2020 and is projected to reach $16,977.3 million by 2028.

Q2. Which are the major companies in the hydraulic cylinders market?

A. Bosch Rexroth AG, Wipro Infrastructure Engineering, and Parker Hannifin are some of the key players in the global hydraulic cylinders market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific hydraulic cylinders market?

A. Asia Pacific hydraulic cylinders market is anticipated to grow at 5.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Partnership and acquisition are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Caterpillar, Inc., Eaton, and Enerpac are the companies investing more on R&D activities for developing new products and technologies.

Q7. What are different types of hydraulic cylinders?

A. Based on type, there are two types of hydraulic cylinders namely double acting and single acting. In terms of design, the hydraulic cylinders are classified into welded, tie-rod, telescopic, and mill type.

Q8. What do you use hydraulic cylinders for?

A. Hydraulic cylinders find applications across industries such as construction, agriculture & forestry, oil & gas, material handling, mining, aerospace & defense, compaction, and industrial equipment’s.

Q9. How do hydraulic cylinders work?

A. The working of hydraulic cylinders is based on Pascal’s principle in which the force is generated from the pressurized fluid. This pressure is equal to the force divided by the area on which it acts. Hence, the generated force is used to lift, pull, push, or move the objects.

Q10. How do I choose a hydraulic cylinder?

A. There are two types of hydraulic cylinders single acting and double acting cylinder. Based on requirement and complexity of tasks the user can choose the appropriate cylinder. For instance, single acting hydraulic cylinder is suitable for simple lifting jobs, light commercial & industrial applications, and when retraction is not required. Whereas, double acting hydraulic cylinder is suitable for repetitive applications such as jack and crib, when you need both pushing & pulling forces, when long hoses are necessary with controlled retraction time.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.Design trends

2.4.Application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Design landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Hydraulic Cylinders Market, by Type

4.1.Double Acting

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Single Acting

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

5.Hydraulic Cylinders Market, by Design

5.1.Welded

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Tie-rod

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Others

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

6.Hydraulic Cylinders Market, by Application

6.1.Mobile

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.Industrial

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

7.Hydraulic Cylinders Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Type, 2020-2028

7.1.2.Market size and forecast, by Design, 2020-2028

7.1.3.Market size and forecast, by Application, 2020-2028

7.1.4.Market size and forecast, by country, 2020-2028

7.1.5.Comparative market share analysis, 2020 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Type, 2020-2028

7.1.6.2.Market size and forecast, by Design, 2020-2028

7.1.6.3.Market size and forecast, by Application, 2020-2028

7.1.6.4.Comparative market share analysis, 2020 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Type, 2020-2028

7.1.7.2.Market size and forecast, by Design, 2020-2028

7.1.7.3.Market size and forecast, by Application, 2020-2028

7.1.7.4.Comparative market share analysis, 2020 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Type, 2020-2028

7.1.8.2.Market size and forecast, by Design, 2020-2028

7.1.8.3.Market size and forecast, by Application, 2020-2028

7.1.8.4.Comparative market share analysis, 2020 & 2028

7.2.Europe

7.2.1.Market size and forecast, by Type, 2020-2028

7.2.2.Market size and forecast, by Design, 2020-2028

7.2.3.Market size and forecast, by Application, 2020-2028

7.2.4.Market size and forecast, by country, 2020-2028

7.2.5.Comparative market share analysis, 2020 & 2028

7.2.6.Germany

7.2.6.1.Market size and forecast, by Type, 2020-2028

7.2.6.2.Market size and forecast, by Design, 2020-2028

7.2.6.3.Market size and forecast, by Application, 2020-2028

7.2.6.4.Comparative market share analysis, 2020 & 2028

7.2.7.UK

7.2.7.1.Market size and forecast, by Type, 2020-2028

7.2.7.2.Market size and forecast, by Design, 2020-2028

7.2.7.3.Market size and forecast, by Application, 2020-2028

7.2.7.4.Comparative market share analysis, 2020 & 2028

7.2.8.France

7.2.8.1.Market size and forecast, by Type, 2020-2028

7.2.8.2.Market size and forecast, by Design, 2020-2028

7.2.8.3.Market size and forecast, by Application, 2020-2028

7.2.8.4.Comparative market share analysis, 2020 & 2028

7.2.9.Spain

7.2.9.1.Market size and forecast, by Type, 2020-2028

7.2.9.2.Market size and forecast, by Design, 2020-2028

7.2.9.3.Market size and forecast, by Application, 2020-2028

7.2.9.4.Comparative market share analysis, 2020 & 2028

7.2.10.Italy

7.2.10.1.Market size and forecast, by Type, 2020-2028

7.2.10.2.Market size and forecast, by Design, 2020-2028

7.2.10.3.Market size and forecast, by Application, 2020-2028

7.2.10.4.Comparative market share analysis, 2020 & 2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Type, 2020-2028

7.2.11.2.Market size and forecast, by Design, 2020-2028

7.2.11.3.Market size and forecast, by Application, 2020-2028

7.2.11.4.Comparative market share analysis, 2020 & 2028

7.3.Asia Pacific

7.3.1.Market size and forecast, by Type, 2020-2028

7.3.2.Market size and forecast, by Design, 2020-2028

7.3.3.Market size and forecast, by Application, 2020-2028

7.3.4.Market size and forecast, by country, 2020-2028

7.3.5.Comparative market share analysis, 2020 & 2028

7.3.6.China

7.3.6.1.Market size and forecast, by Type, 2020-2028

7.3.6.2.Market size and forecast, by Design, 2020-2028

7.3.6.3.Market size and forecast, by Application, 2020-2028

7.3.6.4.Comparative market share analysis, 2020 & 2028

7.3.7.Japan

7.3.7.1.Market size and forecast, by Type, 2020-2028

7.3.7.2.Market size and forecast, by Design, 2020-2028

7.3.7.3.Market size and forecast, by Application, 2020-2028

7.3.7.4.Comparative market share analysis, 2020 & 2028

7.3.8.India

7.3.8.1.Market size and forecast, by Type, 2020-2028

7.3.8.2.Market size and forecast, by Design, 2020-2028

7.3.8.3.Market size and forecast, by Application, 2020-2028

7.3.8.4.Comparative market share analysis, 2020 & 2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Type, 2020-2028

7.3.9.2.Market size and forecast, by Design, 2020-2028

7.3.9.3.Market size and forecast, by Application, 2020-2028

7.3.9.4.Comparative market share analysis, 2020 & 2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Type, 2020-2028

7.3.10.2.Market size and forecast, by Design, 2020-2028

7.3.10.3.Market size and forecast, by Application, 2020-2028

7.3.10.4.Comparative market share analysis, 2020 & 2028

7.3.11.Rest of Asia Pacific

7.3.11.1.Market size and forecast, by Type, 2020-2028

7.3.11.2.Market size and forecast, by Design, 2020-2028

7.3.11.3.Market size and forecast, by Application, 2020-2028

7.3.11.4.Comparative market share analysis, 2020 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Type, 2020-2028

7.4.2.Market size and forecast, by Design, 2020-2028

7.4.3.Market size and forecast, by Application, 2020-2028

7.4.4.Market size and forecast, by country, 2020-2028

7.4.5.Comparative market share analysis, 2020 & 2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Type, 2020-2028

7.4.6.2.Market size and forecast, by Design, 2020-2028

7.4.6.3.Market size and forecast, by Application, 2020-2028

7.4.6.4.Comparative market share analysis, 2020 & 2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Type, 2020-2028

7.4.7.2.Market size and forecast, by Design, 2020-2028

7.4.7.3.Market size and forecast, by Application, 2020-2028

7.4.7.4.Comparative market share analysis, 2020 & 2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Type, 2020-2028

7.4.8.2.Market size and forecast, by Design, 2020-2028

7.4.8.3.Market size and forecast, by Application, 2020-2028

7.4.8.4.Comparative market share analysis, 2020 & 2028

8.Company profiles

8.1.Bosch Rexroth AG

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Wipro Infrastructure Engineering

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Parker Hannifin

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.Bailey International LLC

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5. Caterpillar, Inc.

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.Aggressive Hydraulics, Inc.

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Eaton

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.Enerpac

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.SMC Corporation

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.KYB Americas Corporation

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Hydraulic cylinders are used in heavy-duty operations in construction, mining, and manufacturing industries. They are mainly used for pushing or pulling heavy equipment from one place to another.

The application of technological advancements in hydraulic cylinders is expected to boost the hydraulic cylinders market in the upcoming years. Parts of the cylinder, such as seals were originally made of metal, they now include fabric reinforced elastomers, plastics, rubber, and polyurethane. These materials can survive high level of wear resistance due to which they are widely used in hydraulic cylinders.

Factors Enhancing the Growth of the Market

Hydraulic cylinders are used for various purposes in construction and manufacturing industries. Mainly they are used to operate heavy-duty machineries and construction equipment such as steam rollers, cranes, forklifts, wheel loaders, drilling rigs, telehandlers, and others. With the rapid urbanization in the developing countries, construction activities are on the rise which has increased the demand of hydraulic cylinders. These are the factors behind the growth of the market in the upcoming years. According to a report published by Research Dive, the global hydraulic cylinders market is anticipated to generate a significant revenue during the next few years.

Recent Trends of the Industry

According to a report published by Research Dive, the leading players of the global hydraulic cylinder market include KYB Americas Corporation, Bosch Rexroth AG, Caterpillar, Inc., Parker Hannifin, Bailey International LLC, Wipro Infrastructure Engineering, Eaton, Enerpac, Aggressive Hydraulics, Inc., and SMC Corporation among others.

These key players of the hydraulic cylinders market are investing a lot of efforts on the research and development of smart and unique strategies to sustain the growth of the market. These strategies include product launches, mergers and acquisitions, collaborations, partnerships, and refurbishing of existing technology. Some of the recent developments of the market are as follows:

-

In December 2020, Wipro Infrastructure Engineering’s Industrial Automation Business signed a definitive agreement to acquire PARI, India’s largest industrial automation company. The combined strength of Wipro and PARI is expected to expand its offering, broaden its global footprint, and strengthen its ability to furnace deeper customer relationships in India and overseas.

- In September 2019, EBSCO Capital, an investment service provider announced the acquisition of Bailey International, a global leader in the manufacturing and distribution of mobile hydraulic power solutions. Bailey offers a diverse group of mobile equipment OEMs, distributors and aftermarket customers - providing an extensive range of hydraulic and electro-hydraulic components under the brand names - Bailey™, Maxim™, Chief™, and SureGrip™.

- In June 2020, Caterpillar Inc., the world-leader in construction and mining equipment manufacturer acquired Marble Robot, Inc., a robot and autonomy technology solutions company based out of California. This acquisition is aimed to leverage the excellent expertise of the Marble Robot to bring scalable solutions to meet the changing requirements in the construction, quarry, industrial and waste industries.

COVID-19 Impact Analysis of the Global Hydraulic Cylinders Market

The COVID-19 pandemic has affected the global hydraulic cylinders market in a negative way. During the pandemic, the hydraulic cylinders market experienced a drastic decline in its demand because of the temporary restrictions and shutdowns of construction, mining, and every other end-use industry. As the lockdown was imposed across countries and the supply chain came to a sudden halt, the hydraulic cylinders market also witnessed a negative impact. However, the market is expected to revive soon after the lockdown and restrictions are lifted.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com