Vision Care Market Report

RA02171

Vision Care Market, by Product (Eye Glasses, Contact Lens, Intraocular Lens, Others), Distribution Channel (Retail Stores, E-Commerce, Clinics, Hospitals): Global Opportunity Analysis and Industry Forecast, 2020-2027

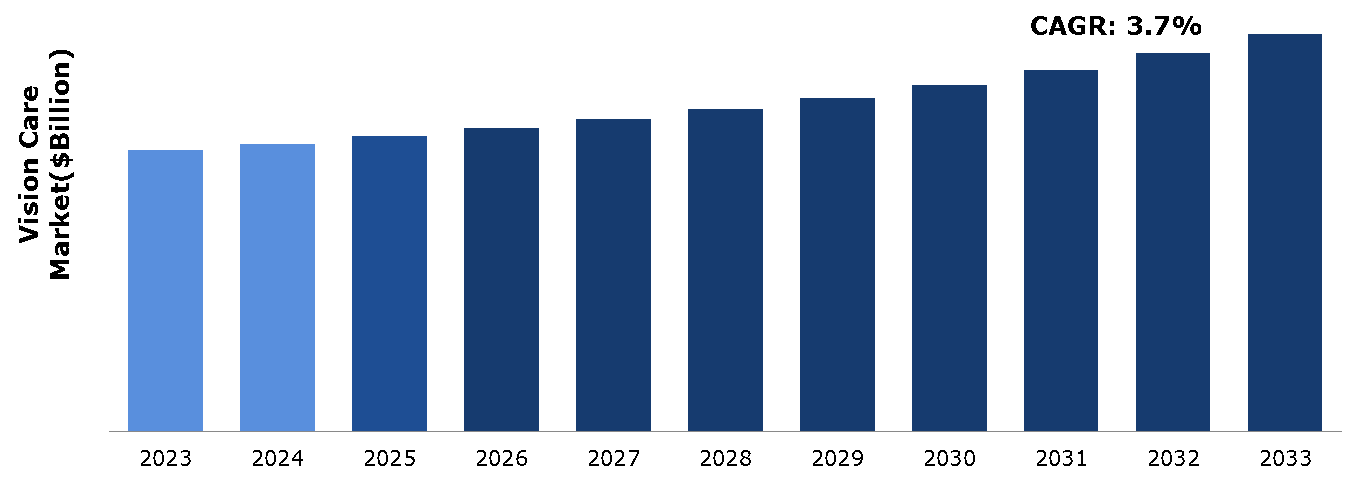

The vision care market was valued at $65.58 billion in 2023 and is estimated to reach $92.77 billion by 2033, exhibiting a CAGR of 3.7% from 2024 to 2033.

Market Definition and Overview

Vision care encompasses the prevention, diagnosis, and treatment of visual impairments and eye disorders to maintain or improve eye health and vision quality. It includes routine eye examinations, prescription of corrective lenses (glasses and contact lenses), and management of conditions like myopia, hyperopia, astigmatism, cataracts, glaucoma, and macular degeneration. Vision care also involves surgical interventions such as LASIK and cataract surgery, as well as the use of advanced diagnostic tools and imaging technology. Besides addressing vision problems, it focuses on education about eye health and lifestyle factors that affect vision, including proper lighting, screen time management, and eye protection. Comprehensive vision care aims to enhance overall quality of life by ensuring optimal visual function and comfort.

Key Takeaways

- The vision care market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major healthcare reimbursement industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In June 2023, Bausch + Lomb Corporation, a subsidiary of Bausch Health Companies, Inc., signed a definitive agreement with Novartis to acquire XIIDRA (lifitegrast ophthalmic solution) 5%. XIIDRA is a non-steroidal eye drop approved for treating dry eye disease (DED), specifically targeting inflammation linked to the condition.

- In December 2022, Vision Care Group partnered with ThinkCyte to advance cell therapy for retinal diseases. Vision Care Group provides expertise in developing cellular therapies, while ThinkCyte offers its AI-driven Ghost Cytometry technology for label-free cell characterization and sorting. This collaboration aims to improve manufacturing and pre-transplantation testing, enhancing the effectiveness of retinal cell-based treatments.

Market Dynamics

The vision care market is experiencing significant growth due to increasing consumer demand for fashionable eyewear. Eyewear has evolved beyond mere vision correction into a significant fashion accessory, with consumers prioritizing style and trends. This shift has created a niche market segment focused on stylish and trendy frames. Companies are capitalizing on this trend by offering diverse and innovative designs, blending functionality with fashion. Collaborations with fashion brands, advancements in materials, and customization options are further enhancing the appeal of eyewear. Therefore, the market is expanding to meet the dual demand for vision correction and fashionable eyewear, contributing to overall market growth.

The vision care market faces significant hurdles due to stringent regulatory approvals and quality standards, particularly for medical devices such as contact lenses and intraocular lenses. Compliance with these rigorous requirements poses a formidable challenge, particularly for smaller firms or newcomers, potentially hindering their ability to enter the market and innovate. The complex regulatory landscape necessitates substantial investments in R&D and compliance infrastructure, creating barriers to market entry despite the demand for advanced vision care solutions.

Technological advancements have revolutionized the vision care market, introducing innovative products like advanced contact lenses, intraocular lenses, laser eye surgery techniques, and sophisticated diagnostic devices. These technologies have greatly enhanced the precision and effectiveness of vision correction and treatment options, leading to improved outcomes for patients. By continually pushing the boundaries of what is possible in vision care, these advancements not only meet the evolving needs of consumers but also expand the market potential. As technology evolves further, opportunities abound for developing even more sophisticated solutions that offer enhanced vision correction capabilities and promote better overall eye health, driving continued growth and innovation in the vision care sector.

Ocular Diseases Analysis

Rising prevalence of ocular diseases highlights the increasing scope of the eye care market. As healthcare systems worldwide prioritize preventive care and technological advancements, the eye care industry is anticipated to witness significant revenue growth in the upcoming years, aiming to meet the increasing needs of affected populations and improve overall visual health outcomes globally.

The prevalence of ocular diseases such as cataracts, diabetic retinopathy, and glaucoma is steadily increasing, highlighting the critical importance of eye care globally. In the U.S., cataracts affect approximately 24.4 million people aged 40 and older, with a significant proportion among those aged 75 and above. In the UK, over 330,000 cataract surgeries are performed annually, addressing a condition that impairs the vision of many over the age of 65. Meanwhile, diabetic retinopathy affects nearly 899,000 Americans aged 40 and older, with implications for the eyesight of around 4.1 million adults.

Increasing occurrences of ocular diseases in China and India are boosting revenue growth in the region's eye care sector. Research indicates that among Chinese individuals aged 50 and older, cataract prevalence rates reach 27.45%, with 28.79% in rural areas and 26.66% in urban settings. Moreover, only 9.19% have cataract surgery covered by insurance. These factors are significant factors driving the growth of the eye care market across China and India.

Market Segmentation

The market is segmented into product type, application, end use, and region. On the basis of product type, the market is divided into contact lens, eye glasses, intraocular lens, and others. As per application, the market is classified into glaucoma, amblyopia, diabetic retinopathy, and dry eyes. On the basis of end use, the market is divided into hospitals, eye clinics, and ambulatory surgical centers (ASCs). Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North America vision care market is primarily driven by an aging population with increasing incidences of eye-related disorders like myopia and presbyopia. The rising awareness regarding eye health and advancements in eyewear technologies further boost the regional market expansion. In addition, the widespread adoption of digital devices contributes to rising cases of eye strain, boosting the demand for vision care products. Innovations in contact lenses and spectacles cater to evolving consumer preferences, sustaining market growth across the region.

- In November 2021, CooperVision launched MyDay daily disposable multifocal contact lenses at the American Academy of Optometry Meeting. These lenses cater to different levels of presbyopia and include the pioneering 3 ADD CooperVision Binocular Progressive System. Their introduction marks a significant advancement in vision care options available to consumers in the U.S.

- In August 2019, CooperVision received the U.S. FDA approval for its Paragon contact lens manufacturing facility in Phoenix, solidifying its compliance with regulatory standards for producing contact lenses in the U.S.

Competitive Landscape

The major players operating in the vision care market include Mojo Vision Inc., Alcon Inc., Bausch Health Companies Inc., HOYA CORP., Carl Zeiss AG, EssilorLuxottica, Ginko International Co. Ltd., Johnson and Johnson, Menicon Co. Ltd., NIDEK Co. Ltd., and others.

Recent Key Strategies and Developments

- In August 2022, Alcon revealed plans to acquire Aerie Pharmaceuticals, aiming to boost its ophthalmic pharmaceutical offerings. This acquisition is set to strengthen Alcon's position in the market for eye care treatments and innovations.

- In May 2022, Rodenstock expanded its market presence by acquiring Indo Optical, a prominent lens manufacturer based in Spain. This strategic move enhances Rodenstock's growth trajectory in crucial markets, strengthening its position in the optical industry.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Government websites

- Research Papers

- D&B Hoovers

- Industry Publications and Journals

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the vision care market segments, current trends, estimations, and dynamics of the vision care market analysis from 2023 to 2033 to identify the prevailing vision care market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vision care market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global vision care market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global vision care market trends, key players, market segments, application areas, and market growth strategies.

| Aspect | Particulars |

| Historical Market Estimations | 2021-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2024-2033 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Application |

|

| Segmentation by End Use |

|

| Key Companies Profiled |

|

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on vision care market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Vision Care Market Analysis, by Product Type

5.1. Overview

5.2. Contact Lens

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2024-2033

5.2.3. Market share analysis, by country, 2024-2033

5.3. Eye Glasses

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2024-2033

5.3.3. Market share analysis, by country, 2024-2033

5.4. Intraocular Lens

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2024-2033

5.4.3. Market share analysis, by country, 2024-2033

5.5. Others

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2024-2033

5.5.3. Market share analysis, by country, 2024-2033

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Vision Care Market Analysis, by Application

6.1. Overview

6.2. Glaucoma

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2024-2033

6.2.3. Market share analysis, by country, 2024-2033

6.3. Amblyopia

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2024-2033

6.3.3. Market share analysis, by country, 2024-2033

6.4. Diabetic Retinopathy

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2024-2033

6.4.3. Market share analysis, by country, 2024-2033

6.5. Dry Eyes

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2024-2033

6.5.3. Market share analysis, by country, 2024-2033

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Vision Care Market Analysis, by End Use

7.1. Overview

7.2. Hospitals

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2024-2033

7.2.3. Market share analysis, by country, 2024-2033

7.3. Eye Clinics

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2024-2033

7.3.3. Market share analysis, by country, 2024-2033

7.4. Ambulatory Surgical Centers (ASCs)

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2024-2033

7.4.3. Market share analysis, by country, 2024-2033

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Vision Care Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Product Type, 2024-2033

8.1.1.2. Market size analysis, by Application, 2024-2033

8.1.1.3. Market size analysis, by End Use, 2024-2033

8.1.2. Canada

8.1.2.1. Market size analysis, by Product Type, 2024-2033

8.1.2.2. Market size analysis, by Application, 2024-2033

8.1.2.3. Market size analysis, by End Use, 2024-2033

8.1.3. Mexico

8.1.3.1. Market size analysis, by Product Type, 2024-2033

8.1.3.2. Market size analysis, by Application, 2024-2033

8.1.3.3. Market size analysis, by End Use, 2024-2033

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Product Type, 2024-2033

8.2.1.2. Market size analysis, by Application, 2024-2033

8.2.1.3. Market size analysis, by End Use, 2024-2033

8.2.2. UK

8.2.2.1. Market size analysis, by Product Type, 2024-2033

8.2.2.2. Market size analysis, by Application, 2024-2033

8.2.2.3. Market size analysis, by End Use, 2024-2033

8.2.3. France

8.2.3.1. Market size analysis, by Product Type, 2024-2033

8.2.3.2. Market size analysis, by Application, 2024-2033

8.2.3.3. Market size analysis, by End Use, 2024-2033

8.2.4. Spain

8.2.4.1. Market size analysis, by Product Type, 2024-2033

8.2.4.2. Market size analysis, by Application, 2024-2033

8.2.4.3. Market size analysis, by End Use, 2024-2033

8.2.5. Italy

8.2.5.1. Market size analysis, by Product Type, 2024-2033

8.2.5.2. Market size analysis, by Application, 2024-2033

8.2.5.3. Market size analysis, by End Use, 2024-2033

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Product Type, 2024-2033

8.2.6.2. Market size analysis, by Application, 2024-2033

8.2.6.3. Market size analysis, by End Use, 2024-2033

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Product Type, 2024-2033

8.3.1.2. Market size analysis, by Application, 2024-2033

8.3.1.3. Market size analysis, by End Use, 2024-2033

8.3.2. Japan

8.3.2.1. Market size analysis, by Product Type, 2024-2033

8.3.2.2. Market size analysis, by Application, 2024-2033

8.3.2.3. Market size analysis, by End Use, 2024-2033

8.3.3. India

8.3.3.1. Market size analysis, by Product Type, 2024-2033

8.3.3.2. Market size analysis, by Application, 2024-2033

8.3.3.3. Market size analysis, by End Use, 2024-2033

8.3.4. Australia

8.3.4.1. Market size analysis, by Product Type, 2024-2033

8.3.4.2. Market size analysis, by Application, 2024-2033

8.3.4.3. Market size analysis, by End Use, 2024-2033

8.3.5. South Korea

8.3.5.1. Market size analysis, by Product Type, 2024-2033

8.3.5.2. Market size analysis, by Application, 2024-2033

8.3.5.3. Market size analysis, by End Use, 2024-2033

8.3.6. Rest of Asia Pacific

8.3.6.1. Market size analysis, by Product Type, 2024-2033

8.3.6.2. Market size analysis, by Application, 2024-2033

8.3.6.3. Market size analysis, by End Use, 2024-2033

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Product Type, 2024-2033

8.4.1.2. Market size analysis, by Application, 2024-2033

8.4.1.3. Market size analysis, by End Use, 2024-2033

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Product Type, 2024-2033

8.4.2.2. Market size analysis, by Application, 2024-2033

8.4.2.3. Market size analysis, by End Use, 2024-2033

8.4.3. UAE

8.4.3.1. Market size analysis, by Product Type, 2024-2033

8.4.3.2. Market size analysis, by Application, 2024-2033

8.4.3.3. Market size analysis, by End Use, 2024-2033

8.4.4. South Africa

8.4.4.1. Market size analysis, by Product Type, 2024-2033

8.4.4.2. Market size analysis, by Application, 2024-2033

8.4.4.3. Market size analysis, by End Use, 2024-2033

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Product Type, 2024-2033

8.4.5.2. Market size analysis, by Application, 2024-2033

8.4.5.3. Market size analysis, by End Use, 2024-2033

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2023

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2023

10. Company Profiles

10.1. Mojo Vision Inc.

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Alcon Inc.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Bausch Health Companies Inc.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. HOYA CORP.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Carl Zeiss AG

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. EssilorLuxottica

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Ginko International Co. Ltd.

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Johnson and Johnson

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Menicon Co. Ltd.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. NIDEK Co. Ltd.

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com