C-RAN Market Report

RA00172

C-RAN Market by Type (Virtualized/Cloud RAN and Centralization Technology), Component (Solutions and Services), Network Type (5G, 4G, and 3G), Deployment (Indoor and Outdoor), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global C-RAN Market Analysis

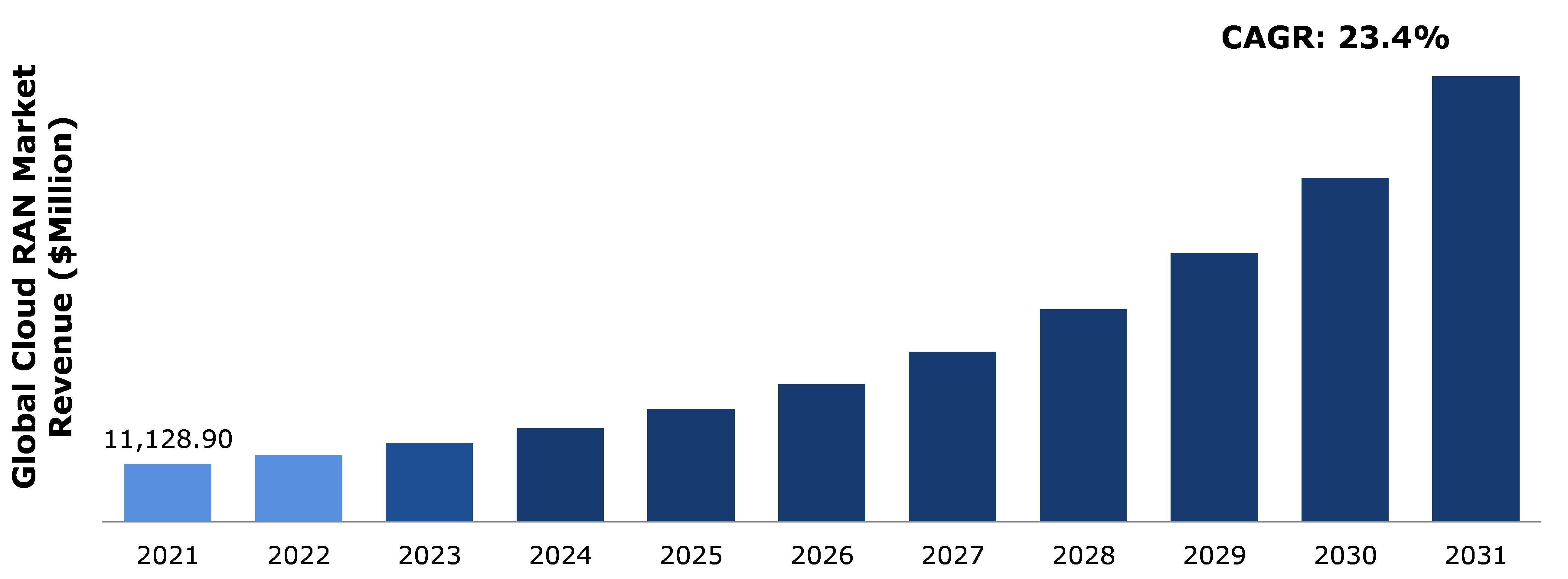

The Global C-RAN Market Size was $11,128.90 million in 2021and is predicted to grow with a CAGR of 23.4%, by generating revenue of $85,899.7 million by 2031.

Global C-RAN Market Synopsis

Cloud radio access network (C-RAN) represents a new wireless system paradigm that features centralized processing, collaborative radio, real-time cloud computing, and power-efficient infrastructure. It consists of two core entities i.e., centralized baseband units (BBUs) and distributed radio remote units (RRUs). The broadband based technology is used for the cloud-based IT platforms and to virtualize the different RAN technology architectures. The distributed radio access network is distributed over the particular region or geographical area, from which it communicates with the baseband units via ultra-fast and low-latency communication links. The C-RAN technology provides several benefits when compared to wireless system, such as increase in capacity and reduction in inter-channel interference, system throughput improvements, energy-efficient & green communication, and a reduction in capital and expenditure costs. These factors are anticipated to improve the global C-RAN market growth.

The stringent government laws regarding data security and requirements to follow standard security protocol. Furthermore, the co-location of many baseband units in baseband unit pools connected with remote radio head units required the link with high bandwidth capacity. The association of the baseband unit and the remote radio head unit must be done in such a way that the baseband units are efficiently utilized, which adds significant operation costs to the operator. These factors are anticipated to hamper the global C-RAN market share.

The telecommunications industry is undergoing a rapid transition to fifth generation cellular networks. The quick transition from user-centered to device-centered communication, in particular, has had a significant impact on service complexity and network requirements. Future networks will require constant throughput, minimal latency, and excellent reliability. They are also expected to offer an improved user experience, which is of utmost importance, as well as energy efficiency, spectrum reuse, network scalability, and robustness. To accomplish these difficult objectives, government, academic, and industrial entities are collaborating. Heterogeneous small cell networks, millimeter wave communication, massive multiple input multiple output, network function virtualization, and software-defined networks are just a few of the subjects and areas of study they are researching More interestingly, one of the finest candidates for fifth generation is a novel network design based on cloud computing and centralized processing. These factors are estimated to fuel the global C-RAN market opportunity over the forecasted period.

C-RAN Overview

The C-RAN is a radio access network (RAN) architecture based on centralized cloud computing that supports collaborative radio technology and real-time virtualization. It is an extension of the current wireless communication system that employs the most recent common public radio interface (CPRI) standard, coarse or dense wavelength division multiplexing technology, and millimeter wave (MM wave) transmission for long-distance signals. C-RANs are important for the development of wireless technology in the future, including 5G and the Internet of Things. C-RAN development will be crucial for the switch from LTE to 5G networks since it will make deployment and scalability easier. In addition, it offers an affordable, manageable alternative for accommodating more users.

COVID-19 Impact on Global C-RAN Market

The COVID-19 pandemic created several uncertainties, resulting in significant economic losses as various businesses around the world came to a halt. The COVID-19 pandemic had a significant impact on the global digital landscape. To stop the virus's spread, several measures have been put into place, including social isolation and lockdown, highlighting the need for a successful and inclusive digital economy, enabled by expanding access to dependable, adequate internet for socioeconomic well-being. The Fourth Industrial Revolution (4IR), which allows the use of integrated spectrum with conventional technologies, includes the fifth generation (5G) technology as a key element. The spread of COVID-19 has slowed the development of 5G infrastructure. The pandemic has caused factories to close their operations, which has hampered the production of equipment needed to develop 5G infrastructure. Because investments were made prior to the pandemic outbreak, 5G technology is expected to gain traction. In addition, the COVID-19 lockdown caused many to stay home, and working from home has become the new normal. With an increase in number of business operations moving online and a significant growth in the number of individuals working from home, indoor deployment of C-RAN architecture is expected to gain acceptance.

The Enormously Increasing Technical Innovation Of C-RAN Across the Globe Is Projected to Boost the Growth of The Global Cloud-Radio Access Network Market

The C-RAN is a 5G mobile architecture that emerged as a result of existing traffic patterns and technical advancements. The foundation of C-RAN is centralized processing, collaborative radio, and real-time cloud architecture, which entails dividing the base station (BS) RRHs and BBU pool to form a centralized pool. The centralized BBU has improved computation through virtualization and cloud computing technologies. By reducing the number of BS, the C-RAN design hopes to save network energy. In addition, the C-RAN makes use of cooperation and virtualization technology to enable dynamic resource allocation, improved spectrum efficiency, high bandwidth utilization, design flexibility, and operating efficiency. C-RAN provides some benefits over the convectional RAN, such as enhanced energy and spectral efficiency. The standard RAN uses more BBUs than the C-RAN, which results in a considerable increase in power usage. The RRHs can be naturally cooled by hanging on a pole or building walls, radio modules don't need a lot of sites-supporting equipment such as air conditioning. These factors are anticipated to boost the global C-RAN market growth.

To know more about global C-RAN market drivers, get in touch with our analysts here.

Stringent Government Policies Are Anticipated to Restrain the Growth of The Global C-RAN Industry

Strict government regulations and the necessity to conform to security standards are the factors limiting the C-RAN market's growth. Because cyber-attacks are on the rise, the C-RAN security issue has sparked alarm. Along with the typical security risks associated with conventional wireless networks, such as the main user emulation attack, C-RAN is also vulnerable to eavesdropping and jamming, media access control spoofing, IP spoofing and hijacking, transmission control protocol flooding assaults, and file transfer protocol attacks. These factors are anticipated to hinder the global C-RAN market opportunity.

The Significance Of C-RAN In 5G Networks Is Projected to Create Enormous Opportunities in The Global C-RAN Market

The introduction of 5G mobile communications has had a huge impact on society and industry. Compared to earlier cellular generations, 5G enables significantly greater peak data rates that are accessible practically anywhere and at any time. Despite the fact that mobile broadband services are currently widely accessible, 5G offers the next level of human connectedness and human-to-human interaction, including the widespread use of virtual or augmented reality, free perspective video, and telepresence. To improve 5G capabilities, there are three proposed primary service types: enhanced mobile broadband (eMBB), massive-machine type communications (mMTC), and ultra-reliable low latency communication (uRLLC). The enhanced mobile broadband uses 5G as a step up from 4G LTE mobile broadband service, providing quicker connections, higher throughput, and more capacity. As a result, cities, stadiums, and other high-traffic places will benefit. Ultra-reliable low-latency communication, on the contrary, is thought to be using the network for mission-critical applications and services that require continuous and reliable data transfer. To meet the requirements of dependable and low-latency wireless communication networks, short packet data transmission is adopted in this instance. Additionally, it is anticipated that massive machine type communications will be used to connect a variety of gadgets, particularly the numerous connected IoT gadgets. These factors are anticipated to boost global C-RAN market trends.

To know more about global C-RAN market opportunities, get in touch with our analysts here.

Global C-RAN Market, by Type

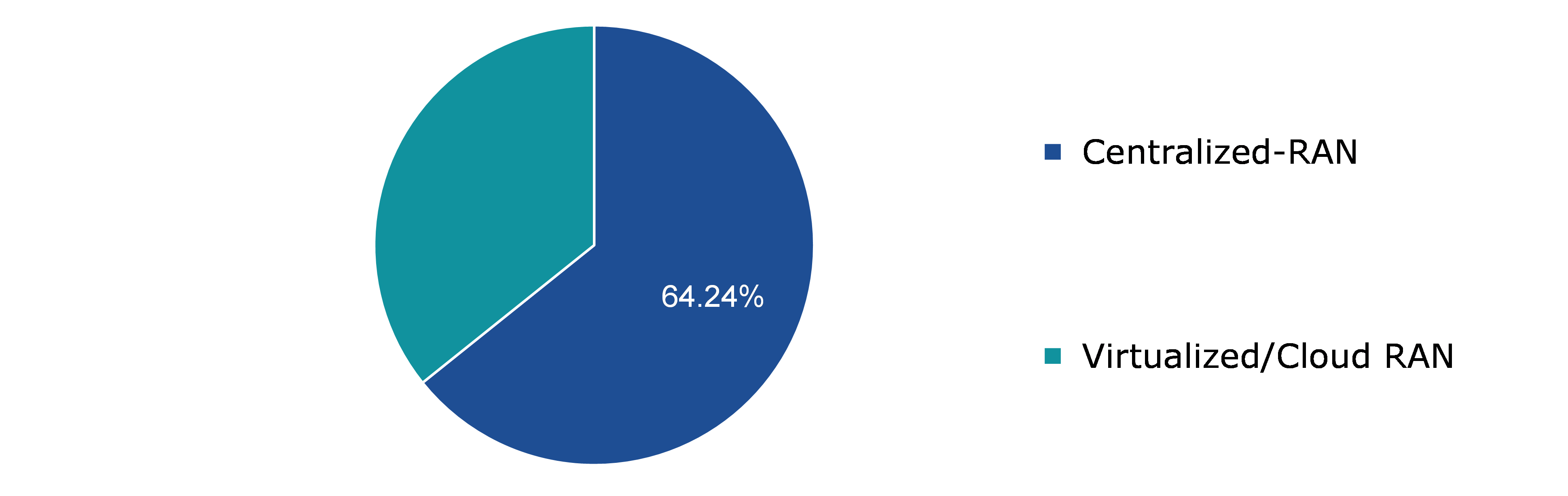

Based on type, the market has been divided into centralized RAN and virtualized/cloud RAN. Among these, centralized RAN sub-segment accounted for the highest market share in 2021, whereas the virtualized/cloud RAN sub-segment is estimated to show the fastest growth during the forecast period.

Global C-RAN Market Size, by Type, 2021

Source: Research Dive Analysis

The centralized RAN sub-type is anticipated to have a dominant market share. The centralized radio access network (C-RAN) is a next-generation RAN architecture in which baseband units (BBUs) are relocated from cell sites to a centralized location. This convenient location is frequently referred to as the baseband unit’s hotel. The baseband units are moved from the cell site to a centralized location, commonly referred to as a baseband units hotel, in the C-RAN architecture. This centralization of baseband units also enables network virtualization, in which a server can replace the BBU hotel. This has various advantages for network operators, including decreased space requirements at cell sites, lower costs for cooling solutions at cell sites, higher overall network performance, simpler test access, and speedier deployments.

The virtualized/cloud RAN sub-type is anticipated to show the fastest market growth. The virtualization of radio access networks is expected to ease carrier preparation for 5G by increasing bandwidth requirements. For instance, a 5G base station can theoretically increase a system's capacity and efficiency by utilizing a collection of baseband units. It facilitates the positioning of novel features that maximize the resource and enhance the end user experience by sharing signaling between cells.

Global C-RAN Market, by Component

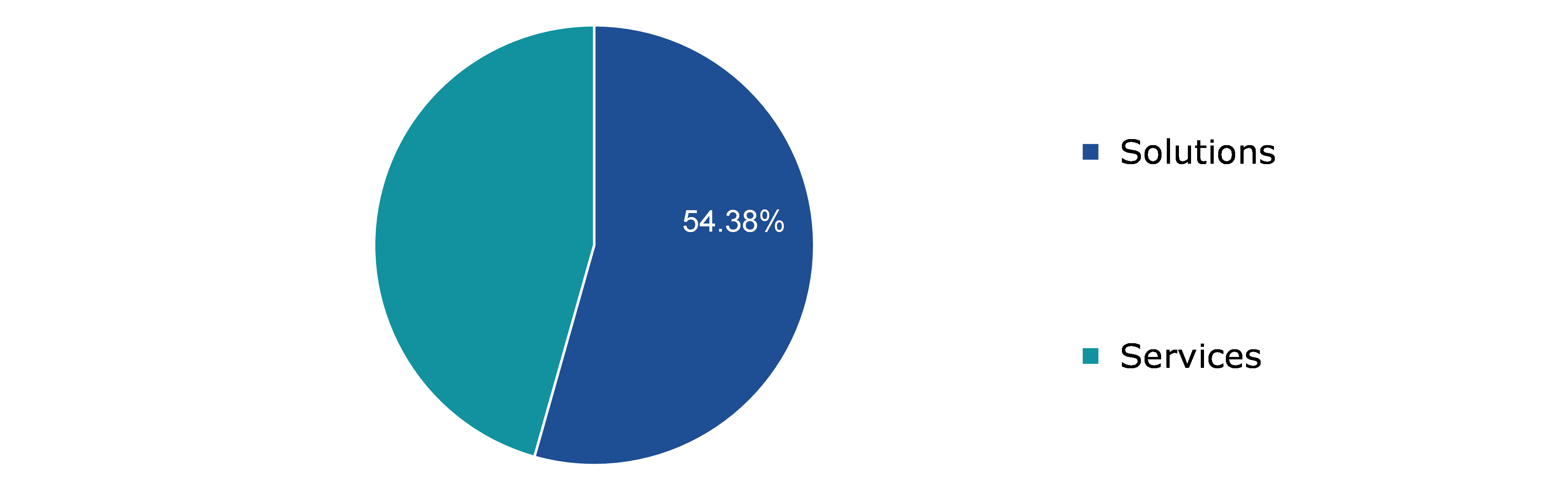

On the basis of component, the market has been divided into solutions and services. Among these, the solutions sub-segment accounted for the highest revenue share in 2021.

Global C-RAN Market Share, by Component, 2021

Source: Research Dive Analysis

The solutions sub-segment is anticipated to have a dominant market share. C-RAN solutions use data center network technology to offer low-cost, high-reliability, low-latency, and high-bandwidth connectivity between baseband unit pools. C-RAN requires fewer components, resulting in less energy consumption and lower maintenance and rental costs. Furthermore, it increases network security due to its centralization and optimizes network operators’ capital and operating expenditures. Furthermore, businesses have profited from increased capacity and coverage. It can be self-optimized, self-configured, and self-adaptable by utilizing a software-defined network or network function virtualization.

Global C-RAN Market, by Network Type

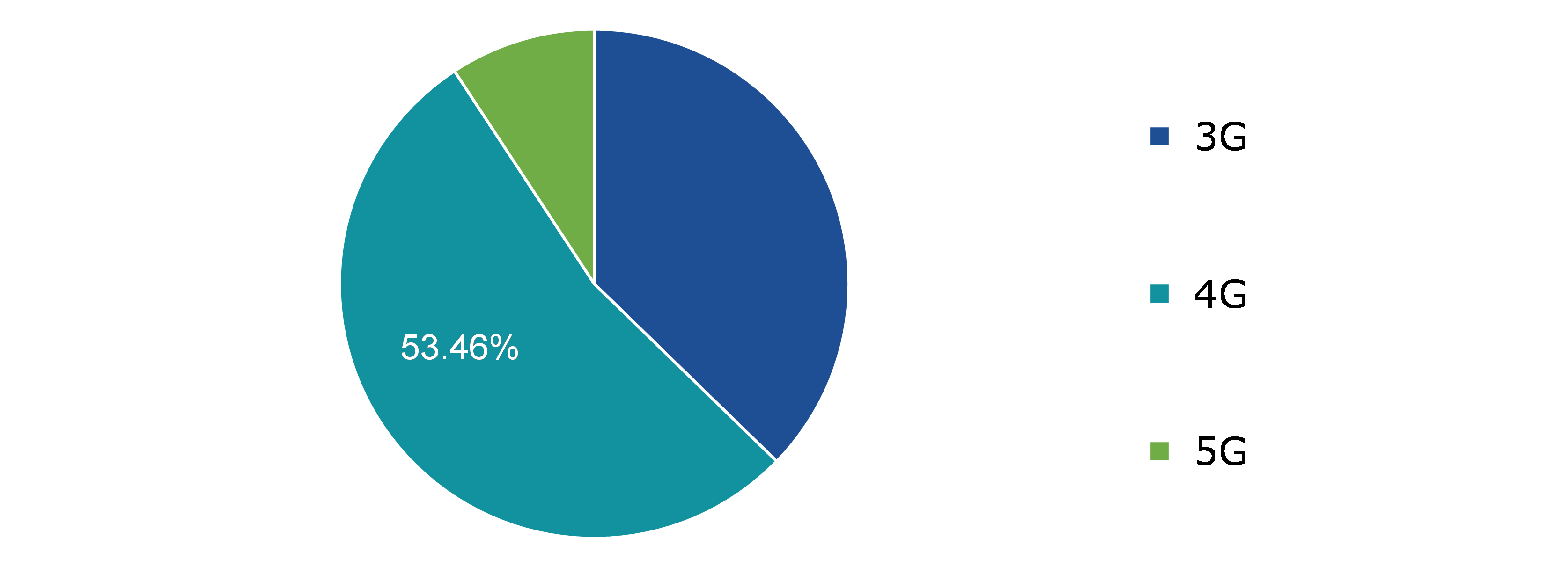

Based on network type, the market has been divided into 3G, 4G, and 5G. Among these, the 4G sub-segment accounted for the highest revenue share in 2021.

Global C-RAN Market Trends, by Network Type, 2021

Source: Research Dive Analysis

The 4G sub-segment is anticipated to have a dominant market share.4G is the most modern wireless technology that has replaced 3G systems. Receiving larger amounts of information, including photos, data, and video, with a faultless connection anytime, anywhere, is one of the key features of 4G networks. Multiple input multiple output (MIMO) antennas have been deployed to increase the potential for air interference between towers and user equipment (UE). C-RAN architectures based on LTE systems have a maximum distance of 20 km in fiber lines between RRUs and BBUs.

Global C-RAN Market, by Deployment

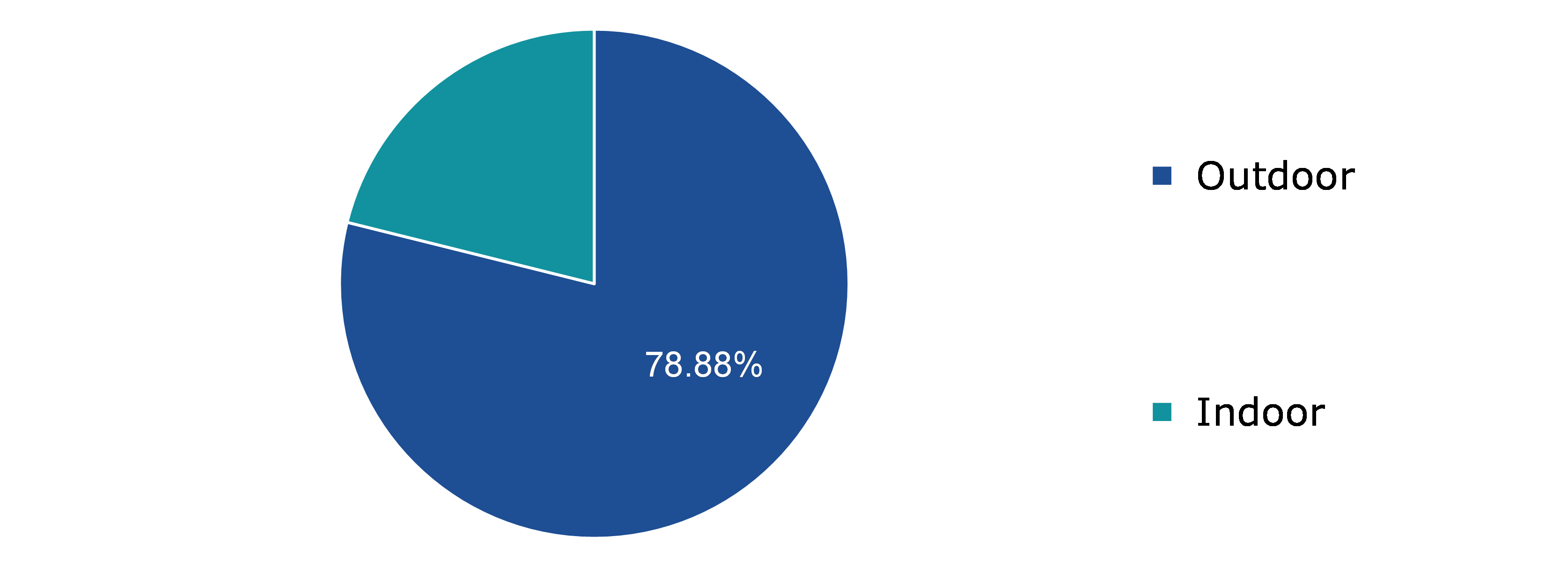

Based on deployment type, the market has been divided into outdoor and indoor. Among these, the outdoor sub-segment accounted for highest revenue share in 2021.

Global C-RAN Market Analysis, by Deployment, 2021

Source: Research Dive Analysis

The outdoor sub-segment is anticipated to have a dominant market share. The transition from 3G to LTE reduces the distance between base stations from 1.5 km to 500 m while increasing the number of base stations exponentially. Existing LTE networks are also being upgraded from coverage fillers to high-quality networks in their own right. In densely crowded areas such as shopping malls, indoor workplaces, and venues for sports and entertainment, more miniature base stations are needed. C-RAN development focuses on common public radio interface (CPRI) fronthaul devices that can be deployed outdoors without the need for additional site locations. Fully outdoor wavelength division multiplexing (WDM) devices have steadily gained importance as a CPRI fronthauling method. Currently, all completely outdoor WDM solutions in the industry are IP65-compliant, providing protection levels that meet all deployment requirements in a variety of hostile situations.

Global C-RAN Market, Regional Insights

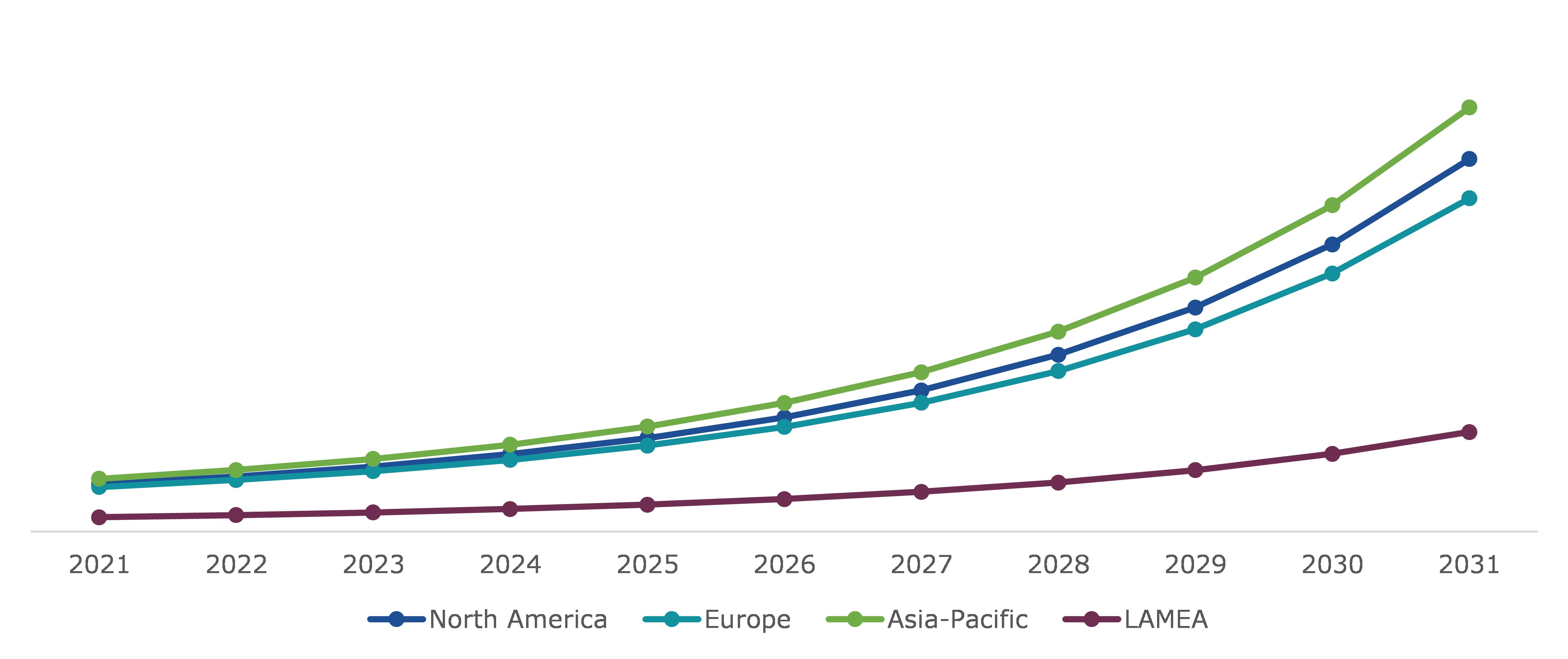

The C-RAN market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global C-RAN Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for C-RAN in North America to be the Most Dominant

The UU.S. is one of the early adopters of technology such as 5G. As a result, North America has gained a significant market share. The region's increased adoption of Internet of things and autonomous cars benefits in the rollout of 5G technologies. Network operators are investing heavily in and testing C-RAN architecture to commercialize 5G technologies. In the U.S. and Canada, major telecom companies have recently developed services for both wireless and fixed mobile networks. Furthermore, telecom operators' large investments in R&D for C-RAN technology adoption are expected to enhance the North American market's growth.

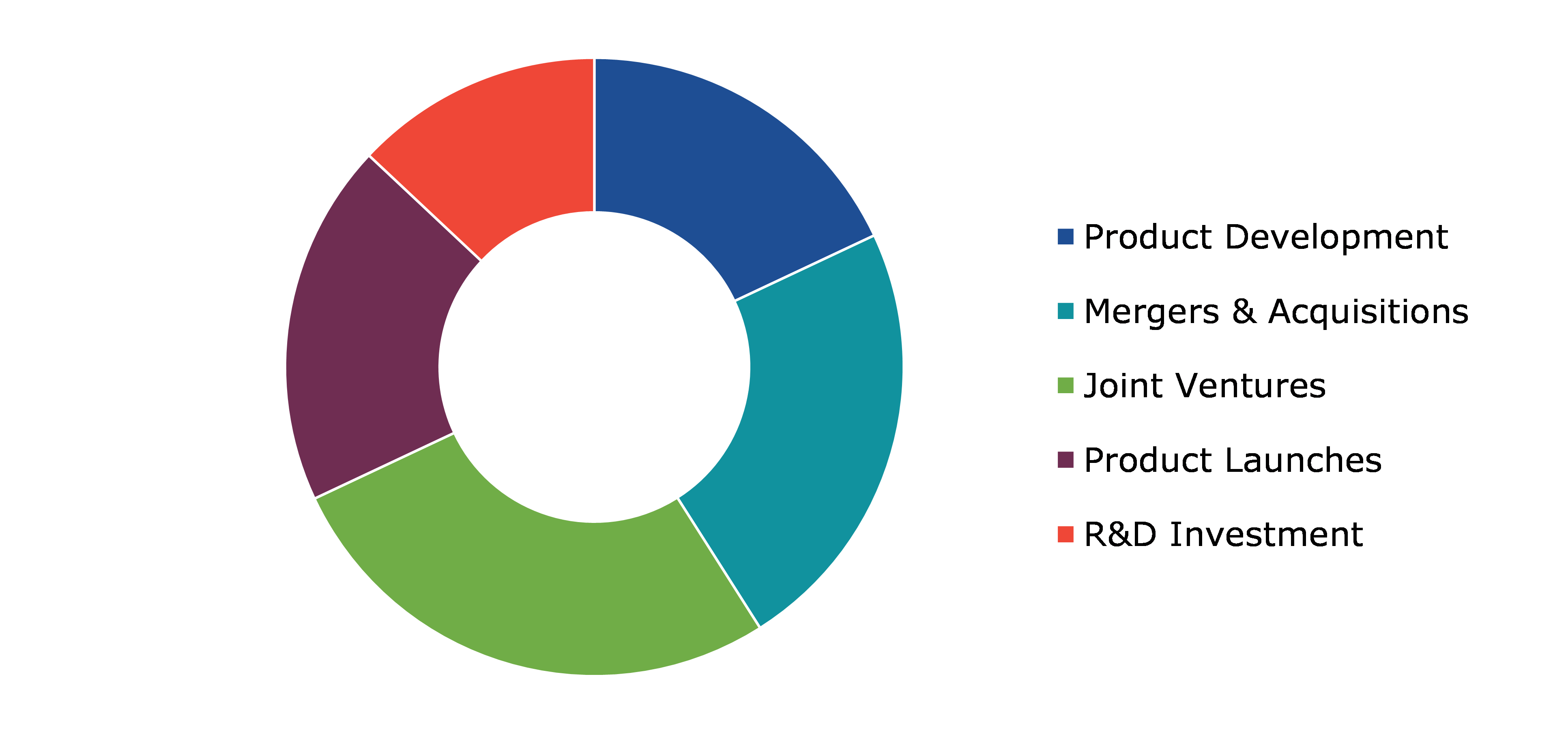

Competitive Scenario in the Global C-RAN Market

Investment and agreement are common strategies followed by major market players. For instance, in December 2022, BT, a telecommunications company based in the United Kingdom, collaborated with mobile operators EE and Three to test a cloud radio access network (C-RAN) 5G service in Leeds, England.

Source: Research Dive Analysis

Some of the leading C-RAN market players are FUJITSU, ZTE Corporation., Intel Corporation, Telefonaktiebolaget LM Ericsson, Cisco Systems, Inc., Huawei Technologies Co., Ltd., ASOCS Ltd., SAMSUNG, NEC Corporation, and Nokia.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Component |

|

| Segmentation by Network Type |

|

| Segmentation by Deployment |

|

| Key Companies Profiled |

|

Q1. What is the size of the global C-RAN market?

A. The size of the global C-RAN market was over $11,128.9 million in 2021 and is projected to reach $85,899.7 million by 2031.

Q2. Which are the major companies in the C-RAN market?

A. FUJITSU, ZTE Corporation, and Intel Corporation are some of the key players in the global C-RAN market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific C-RAN market?

A. Asia-Pacific C-RAN market is anticipated to grow at 23.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted for by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Cisco Systems, Inc., Huawei Technologies Co., Ltd., and ASOCS Ltd. are the companies investing more on R&D activities for developing new products and technologies

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Cloud RAN market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Cloud RAN market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Cloud RAN Market Analysis, by Type

5.1.Overview

5.2.Centralized-RAN

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.1.1.Market size analysis, by region, 2021-2031

5.2.1.2.Market share analysis, by country, 2021-2031

5.3.Virtualized/Cloud RAN

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.1.1.Market size analysis, by region, 2021-2031

5.3.1.2.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Cloud RAN Market Analysis, by Component

6.1.Solutions

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.1.1.Market size analysis, by region, 2021-2031

6.1.1.2.Market share analysis, by country, 2021-2031

6.2.Services

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.1.1.Market size analysis, by region, 2021-2031

6.2.1.2.Market share analysis, by country, 2021-2031

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Cloud RAN Market Analysis, by Network Type

7.1.3G

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.1.1.Market size analysis, by region, 2021-2031

7.1.1.2.Market share analysis, by country, 2021-2031

7.2.4G

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.1.1.Market size analysis, by region, 2021-2031

7.2.1.2.Market share analysis, by country, 2021-2031

7.3.5G

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.1.1.Market size analysis, by region, 2021-2031

7.3.1.2.Market share analysis, by country, 2021-2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Cloud RAN Market Analysis, by Deployment Type

8.1.Outdoor

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.1.1.Market size analysis, by region, 2021-2031

8.1.1.2.Market share analysis, by country, 2021-2031

8.2.Indoor

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.1.1.Market size analysis, by region, 2021-2031

8.2.1.2.Market share analysis, by country, 2021-2031

8.3.Research Dive Exclusive Insights

8.3.1.Market attractiveness

8.3.2.Competition heatmap

9.Cloud RAN Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Type, 2021-2031

9.1.1.2.Market size analysis, by Component, 2021-2031

9.1.1.3.Market size analysis, by Network Type, 2021-2031

9.1.1.4.Market size analysis, by Deployment Type, 2021-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Type, 2021-2031

9.1.2.2.Market size analysis, by Component, 2021-2031

9.1.2.3.Market size analysis, by Network Type, 2021-2031

9.1.2.4.Market size analysis, by Deployment Type, 2021-2031

9.1.3.Mexico

9.1.3.1.Market size analysis, by Type, 2021-2031

9.1.3.2.Market size analysis, by Component, 2021-2031

9.1.3.3.Market size analysis, by Network Type, 2021-2031

9.1.3.4.Market size analysis, by Deployment Type, 2021-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Type, 2021-2031

9.2.1.2.Market size analysis, by Component, 2021-2031

9.2.1.3.Market size analysis, by Network Type, 2021-2031

9.2.1.4.Market size analysis, by Deployment Type, 2021-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Type, 2021-2031

9.2.2.2.Market size analysis, by Component, 2021-2031

9.2.2.3.Market size analysis, by Network Type, 2021-2031

9.2.2.4.Market size analysis, by Deployment Type, 2021-2031

9.2.3.France

9.2.3.1.Market size analysis, by Type, 2021-2031

9.2.3.2.Market size analysis, by Component, 2021-2031

9.2.3.3.Market size analysis, by Network Type, 2021-2031

9.2.3.4.Market size analysis, by Deployment Type, 2021-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Type, 2021-2031

9.2.4.2.Market size analysis, by Component, 2021-2031

9.2.4.3.Market size analysis, by Network Type, 2021-2031

9.2.4.4.Market size analysis, by Deployment Type, 2021-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Type, 2021-2031

9.2.5.2.Market size analysis, by Component, 2021-2031

9.2.5.3.Market size analysis, by Network Type, 2021-2031

9.2.5.4.Market size analysis, by Deployment Type, 2021-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Type, 2021-2031

9.2.6.2.Market size analysis, by Component, 2021-2031

9.2.6.3.Market size analysis, by Network Type, 2021-2031

9.2.6.4.Market size analysis, by Deployment Type, 2021-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Type, 2021-2031

9.3.1.2.Market size analysis, by Component, 2021-2031

9.3.1.3.Market size analysis, by Network Type, 2021-2031

9.3.1.4.Market size analysis, by Deployment Type, 2021-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Type, 2021-2031

9.3.2.2.Market size analysis, by Component, 2021-2031

9.3.2.3.Market size analysis, by Network Type, 2021-2031

9.3.2.4.Market size analysis, by Deployment Type, 2021-2031

9.3.3.India

9.3.3.1.Market size analysis, by Type, 2021-2031

9.3.3.2.Market size analysis, by Component, 2021-2031

9.3.3.3.Market size analysis, by Network Type, 2021-2031

9.3.3.4.Market size analysis, by Deployment Type, 2021-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Type, 2021-2031

9.3.4.2.Market size analysis, by Component, 2021-2031

9.3.4.3.Market size analysis, by Network Type, 2021-2031

9.3.4.4.Market size analysis, by Deployment Type, 2021-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Type, 2021-2031

9.3.5.2.Market size analysis, by Component, 2021-2031

9.3.5.3.Market size analysis, by Network Type, 2021-2031

9.3.5.4.Market size analysis, by Deployment Type, 2021-2031

9.3.6.Rest of Asia Pacific

9.3.6.1.Market size analysis, by Type, 2021-2031

9.3.6.2.Market size analysis, by Component, 2021-2031

9.3.6.3.Market size analysis, by Network Type, 2021-2031

9.3.6.4.Market size analysis, by Deployment Type, 2021-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Type, 2021-2031

9.4.1.2.Market size analysis, by Component, 2021-2031

9.4.1.3.Market size analysis, by Network Type, 2021-2031

9.4.1.4.Market size analysis, by Deployment Type, 2021-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Type, 2021-2031

9.4.2.2.Market size analysis, by Component, 2021-2031

9.4.2.3.Market size analysis, by Network Type, 2021-2031

9.4.2.4.Market size analysis, by Deployment Type, 2021-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Type, 2021-2031

9.4.3.2.Market size analysis, by Component, 2021-2031

9.4.3.3.Market size analysis, by Network Type, 2021-2031

9.4.3.4.Market size analysis, by Deployment Type, 2021-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Type, 2021-2031

9.4.4.2.Market size analysis, by Component, 2021-2031

9.4.4.3.Market size analysis, by Network Type, 2021-2031

9.4.4.4.Market size analysis, by Deployment Type, 2021-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Type, 2021-2031

9.4.5.2.Market size analysis, by Component, 2021-2031

9.4.5.3.Market size analysis, by Network Type, 2021-2031

9.4.5.4.Market size analysis, by Deployment Type, 2021-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.FUJITSU

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.ZTE Corporation.

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Intel Corporation

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Telefonaktiebolaget LM Ericsson

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Cisco Systems, Inc.

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.Huawei Technologies Co., Ltd.

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.ASOCS Ltd.

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.SAMSUNG

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.NEC Corporation

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Nokia

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

12.Appendix

12.1.Parent & peer market analysis

12.2.Premium insights from industry experts

12.3.Related reports

In the modern world, there is an increasing need for Internet connectivity and faster data speeds. The rising reliance on the Internet for numerous activities has resulted in an increased need for faster and more dependable Internet connections. This is where the C-RAN solution comes in.

The C-RAN market has experienced rapid expansion in recent years. The C-RAN is a radio access network architecture based on centralized cloud computing that allows collaborative radio technologies and real-time virtualization. It is an expansion of the current wireless communication system that uses the most modern common public radio interface (CPRI) standard, millimeter wave (MM) wave transmission for long-distance signals, and coarse or dense wavelength division multiplexing technology. C-RANs are critical for the future growth of wireless technologies such as the Internet of Things and 5G. C-RAN development will be essential to the transition from LTE to 5G networks since it will simplify deployment and scalability. In addition, it provides a realistic, inexpensive option for accommodating more users. The C-RAN market is continuously evolving with new technologies and advancements. The rising usage of virtualization and cloud-native architectures in the telecommunications sector has driven the development of C-RAN.

Newest Insights in the C-RAN Market

As per a report by Research Dive, the global C-RAN market is expected to grow at a CAGR of 23.4% and generate revenue of $85,899.7 million by 2031. The primary factors including rapidly expanding C-RAN technology innovation, an upsurge in internet users, and a spike in network connectivity to deploy IoT are all contributing to the market growth. However, strict government regulations due to an increase in cyberattacks are expected to hinder the market expansion.

The C-RAN market in North America is expected to remain dominant in the upcoming years. The region's high revenue in 2021 was driven by the increased use of autonomous vehicles and the Internet of Things as a result of the deployment of 5G technologies. This has led to an increase in demand for centralized and virtualized radio access network (C-RAN) solutions.

How are Market Players Responding to the Rising Demand for C-RAN?

Market players are responding to the rising demand for C-RAN by investing in R&D to create more efficient and advanced solutions. They are also looking into collaborations and partnerships to use their knowledge and resources.

In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach. Some of the foremost players in the C-RAN market are Nokia, ZTE Corporation., Intel Corporation, Fujitsu, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Cisco Systems, Inc., ASOCS Ltd., NEC Corporation, Samsung, and others. These players are focused on implementing strategies such as mergers & acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global C-RAN market.

For instance:

- In March 2023, Virgin Media O2, a London-based British media and communications company, announced that the organization would conduct trials for Ericsson's radio access network product as a component of the broader network expansion and deployment arrangement.

- In March 2021, Nokia, a Finnish multinational corporation engaged in telecommunications, information technology, and consumer electronics, announced a collaboration with Google Cloud to create brand-new 5G radio technologies that are cloud-based. The two companies will work together to develop joint solutions that combine Nokia's Open RAN, Radio Access Network (RAN), Cloud RAN (vRAN), and edge cloud technologies with Google's edge computing infrastructure and application ecosystem. The partnership will result in the creation of solutions and use cases to address crucial 5G scenarios for businesses throughout the world.

- In October 2020, Ericsson, a Swedish global telecommunications and networking firm, launched Cloud Radio Access Network (RAN), a new solution that would allow communications service providers to give their networks more adaptability and diversity.

COVID-19 Impact on the Global C-RAN Market

The COVID-19 pandemic had a moderate impact on the global C-RAN market. During the pandemic, in order to stop the virus's spread, a number of precautions were implemented, including lockdown and social isolation. The COVID-19 pandemic hampered the development of 5G infrastructure. Factory closures brought on by the pandemic have made it more difficult to produce the equipment required to build the 5G infrastructure. However, many people choose to stay at home during the COVID-19 shutdown, and working from home has now become the new standard. With a surge in the number of company operations moving online and an enormous rise in the number of people working from home, C-RAN architecture is projected to gain traction in the post-pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com