Biological Wastewater Treatment Market Report

RA00163

Biological Wastewater Treatment Market by Process (Aerobic, Anaerobic, and Anoxic), Type (Municipal Waste and Industrial Waste), and Regional Outlook (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Biological Wastewater Treatment Market Analysis

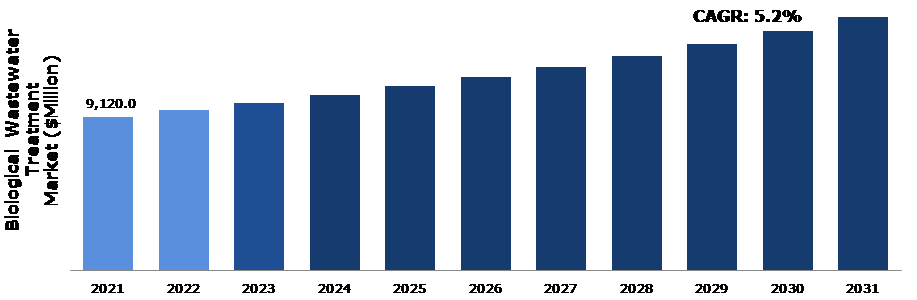

The Global Biological Wastewater Treatment Market Size was $9,120.0 million in 2021and is predicted to grow with a CAGR of 5.2%, by generating revenue of $15,067.7 million by 2031.

Global Biological Wastewater Treatment Market Synopsis

The market for biological wastewater treatment is growing as a result of a several factors, including the rapid urbanization and growth of the population, the regulations governing water treatment that are increasing demand for new water resources due to the rising importance of public health and water quality, and the rising incidence of waterborne diseases. Additionally, in the coming years, there will likely be considerable growth prospects for companies that manufacture water and wastewater treatment systems due to the increase in need for energy-efficient and sophisticated water treatment technology.

The growth of this market, however, is anticipated to be significantly constrained by the high costs of installation, upkeep, and operation. Furthermore, one of the most significant barriers to the expansion of the water and wastewater treatment business is the deterioration and corrosion of current water infrastructure. .

The high cost of waste water treatment is expected to stymie industry growth. The most significant market constraint is the high cost of sludge removal, operational expenditures, and other potential costs associated with water purification. Furthermore, biological waste water treatment provides a variety of methods to meet the needs, but it requires adequate space for storing gallons of water as well as the installation of the apparatus. The system's space and cost are expected to stymie market expansion over the projection period.

Municipal standards for water quality are becoming more important, particularly as the nation's water infrastructure is inspected more closely. Microbiological treatments will help WWTP operators comply with ever-stricter rules and avoid paying penalties and fees for water contamination. The EBS-Di solution from EnBiorganic Technologies provides excellent effluent treatment with results that are guaranteed to exceed National Pollutant Discharge Elimination System (NPDES) permit standards and other governmental guidelines.

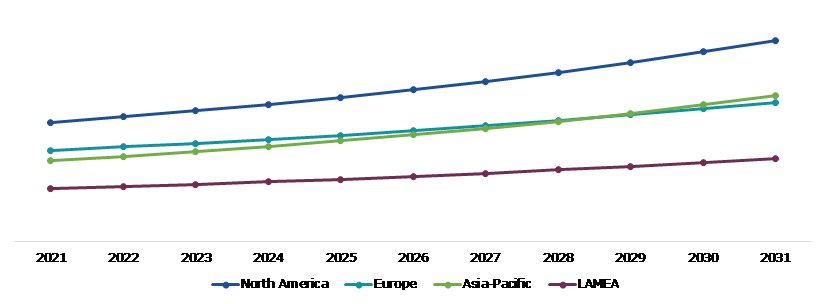

According to regional analysis, the Asia-Pacific biological wastewater treatment market size accounted for $2,138.6 million in 2021 and is predicted to grow with a CAGR of 5.2% in the projected timeframe. This is because, China has intensified its attention and efforts on reducing the high levels of environmental pollution in the nation.

Biological Wastewater Treatment Overview

The action of microorganisms in biological wastewater treatment is intended to degrade pollutants dissolved in effluents. These substances are used by microorganisms to survive and reproduce. Pollutants are converted into nutrients. With the help of several bacteria, yeasts, microorganisms, fungi, and algae, it considers biodegradation bleaching. Recent years have seen an increase in industrial effluent discharges as well as the number of contaminants present in effluent streams. As a result, wastewater treatment methods are being extensively experimented with and researched across the globe. Coupled with waste usage, wastewater treatment is always necessary. To increase their total energy efficiency and economy in such a situation, effluent treatment and handling technologies must unavoidably undergo renovations.

COVID-19 Impact on Global Biological Wastewater Treatment Market

The Covid-19 impact on biological wastewater treatment market epidemic has affected the world economy by stopping the activities of various sectors. The World Health Organization determined that washing hands with soap and water is a basic process for combating coronaviruses. However, research has shown that about 3 billion people do not have access to safe drinking water. As a result, people are particularly vulnerable to the potentially lethal infection. As a result, governments are focusing more on the provision of safe drinking water. This has increased the global need for wastewater treatment. As a result, demand for biological wastewater treatment is expected to increase throughout the forecast period. Additionally, the largest problem during the COVID-19 pandemic has surfaced in many regions of the world as the lack of access to clean water for maintaining a minimal level of cleanliness and the treatment of virus-contaminated wastewater to ensure a minimum level of public exposure. Decentralized wastewater management solutions can be very effective where there is no controlled centralized sewer connection, which is common in most developing nations (Matto and Singhal, 2020).

However, in September 2020, the Suez Group took a new initiative to produce biological wastewater treatment market growth. Suez Group introduced SARS-CoV-2 presence sensors that can identify the British variation among other SARS-CoV-2 infections in wastewater networks. Approximately 13 million people in Spain today use this system, which was created by the Suez Group, in about 100 local communities. In France, where there are 1.8 million people living in 100 local towns, the similar concept is used. The U.S., the U.K., and Latin America all use the same water treatment technology.

Increasing industrialization and Rising Volume of Wastewater to Fuel the Market Growth

The major drivers for the growth of the market for biological wastewater treatment are anticipated to be the increase in industrialization and government water conservation programs. To operate on a daily basis, many businesses need enormous amounts of water. Water shortages for the population may result from the use of fresh water. Industries can reuse water for operational purposes repeatedly with the aid of biological wastewater treatment. Due to the causes mentioned above, the industrialization rate is rising, which is fueling the market for biological wastewater treatment. The need for water also rises as the population grows. One of the projected driving forces for the market is the government's multiple initiatives for water purification as a result of the growing population.

To know more about global biological wastewater treatment market drivers, get in touch with our analysts here.

The market's expected expansion would be hampered by the high costs associated with properly disposing of tainted water

The market's growth is expected to be hampered by the high cost of waste water treatment. The main market barrier to entry is the high operational expenses, sludge transportation costs, and other potential expenditures associated with water filtration. Additionally, biological waste water treatment offers a number of options to address the issues, but it also needs space to set up the equipment and store the necessary water in gallons. The price and available area required for the setup are likely to limit market growth throughout the anticipated term.

Increasing Number of Government Activities Aimed at Increasing Consumer Awareness to Drive Excellent Opportunities

To raise awareness about using and drinking sanitary and safe water amid this chaos, various governments and non-profit organizations around the world are launching numerous programs. These programs are raising the need for water treatment services, which is driving up the growth of biological wastewater treatment throughout the projection period. Additionally increased industrialization and government water conservation policies. Many industries require massive amounts of water on a daily basis. The use of freshwater creates a water scarcity for the population. Industries can reuse water for operational processes with the help of biological wastewater treatment, which significantly contributes to the global biological wastewater treatment market growth.

To know more about global biological wastewater treatment market opportunities, get in touch with our analysts here.

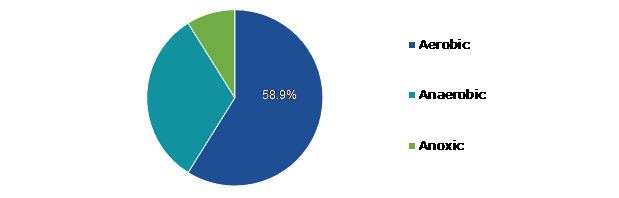

Global Biological Wastewater Treatment Market, by Process

Based on process, the market is divided into aerobic, anaerobic, and anoxic. Among these, the aerobic sub-segment accounted for the highest revenue share in 2021.

Global Biological Wastewater Treatment Market Size, by Process, 2021

Source: Research Dive Analysis

The aerobic sub-type accounted for a highest market share in 2021. The aerobic treatment is primarily implemented as secondary treatment process. The treatment is an efficient and fast method that removes about 98% of organic pollutants. The increase in requirement to oxygenate wastewater using mixers and aerators encourages the use of biological aerobic treatment. The benefits of biological aerobic treatment include reduced greenhouse gas emissions, pathogens, and nitrification of ammonia into nitrate. These advantages are increasing the aerobic segment. In compared to a standard wastewater system, biological aerobic treatment takes less property. The ability of the aerobic wastewater treatment procedure to manage massive amounts of wastewater has driven demand for this technique.

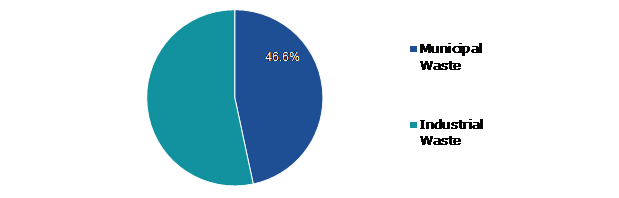

Global Biological Wastewater Treatment Market, by Type

Based on type, the market has been divided into municipal waste, industrial waste. Among these, the industrial waste sub-segment accounted for the highest market share in 2021 whereas the municipal waste sub-segment is estimated to show the fastest growth during the forecast period.

Global Biological Wastewater Treatment Market Share, by Type, 2021

Source: Research Dive Analysis

The industrial waste sub-segment accounted for a highest market share in 2021.The segment includes industries in the oil and gas, chemical, pulp and paper, pharmaceutical, and meat and poultry industries. Aerobic wastewater treatment is used to handle wastewater discharged from pulp and paper mills as well as food-related sectors like meat processing that contains carbon molecules. Government restrictions on the discharge of industrial wastewater are encouraging enterprises to employ biological wastewater treatment methods.

Global Biological Wastewater Treatment Market, Regional Insights

The biological wastewater treatment market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Biological Wastewater Treatment Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Biological Wastewater Treatment in North-America to be the Most Dominant

The North-American biological wastewater treatment market analysis accounted for a highest market share in 2021. The demand for biological wastewater treatment in North America is driven by rapid urbanization, the expanding need for sophisticated household water treatment, developments in membrane technology, accelerated environmental deterioration, the region's restricted water resource availability, and the rise in number of public sector entities investing in water infrastructure. According to the United Nations Educational, Scientific, and Cultural Organization (UNESCO), the majority of urban and industrial wastewater is generated in Europe (71%), whereas just 20% is treated in North America. In North America, an estimated 51% of municipal and industrial wastewater was treated.. In humid regions of high-income nations, wastewater treatment, usage, and disposal are governed by strict effluent discharge rules and public awareness of environmental quality (especially in North America).

Competitive Scenario in the Global Biological Wastewater Treatment Market

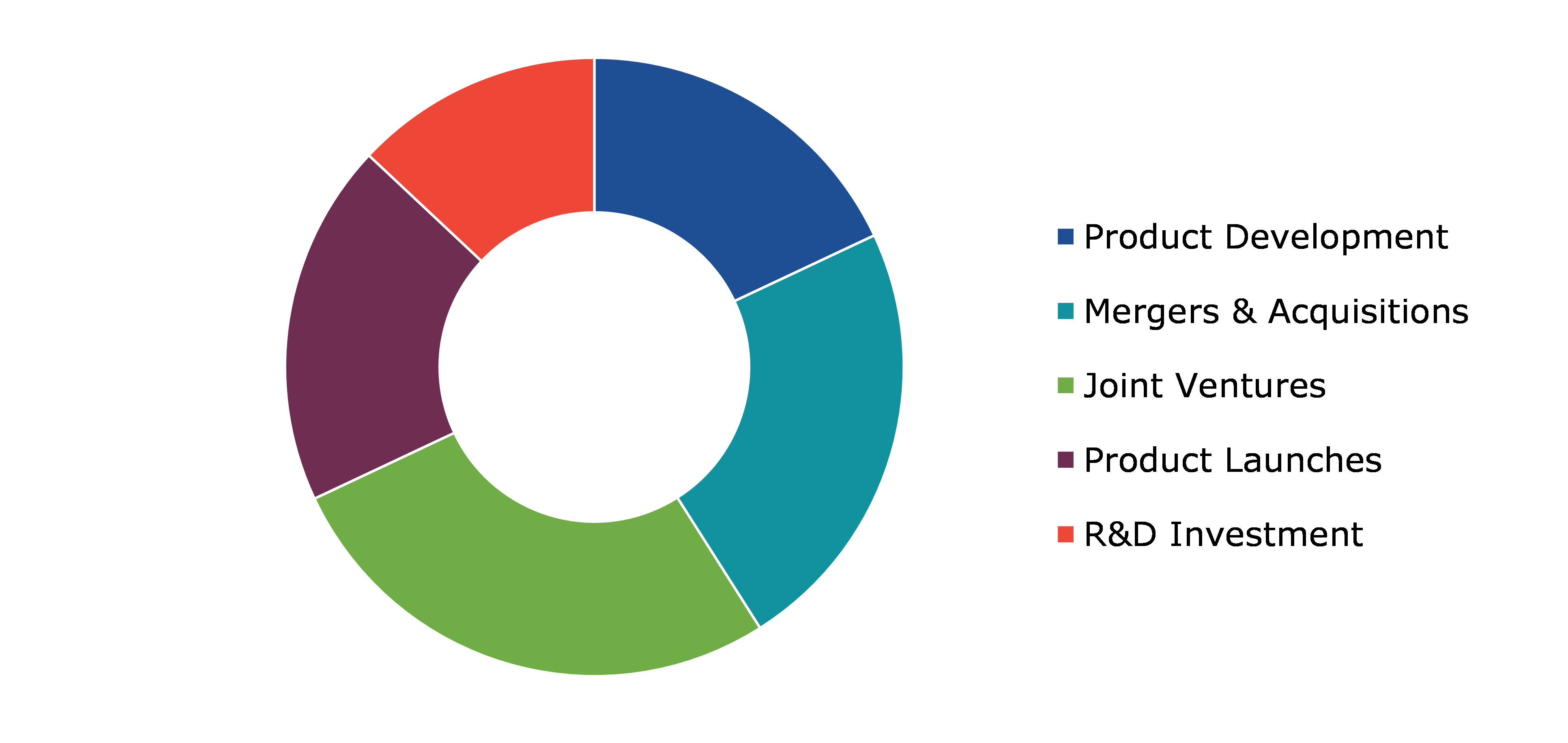

Investment and agreement are common strategies followed by major market players. For instance, in June 2022, ChartWater™ a division of Chart Industries, Inc. and Calgon Carbon Corporation, a wholly owned subsidiary of Kuraray Co., Ltd., formally announced an agreement to jointly offer drinking water systems using granular activated carbon, to under-resourced rural areas.

Source: Research Dive Analysis

Some of the leading biological wastewater treatment market players are 3M, Calgon Carbon Corporation, Aquatech International LLC, Evoqua Water Technologies LLC, Pentair plc, Veolia, Ecolab, Xylem and SUEZ & Dryden Aqua Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Process |

|

| Segmentation by Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global biological wastewater treatment market?

A. The size of the global biological wastewater treatment market share was over $9,120.0million in 2021 and is projected to reach $15,067.7millionby 2031.

Q2. Which are the major companies in the biological wastewater treatment market?

A. Xylem and SUEZ are some of the key players in the global biological wastewater treatment market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific biological wastewater treatment market?

A. Asia-Pacific biological wastewater treatment market share is anticipated to grow at 6.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development is the key strategies opted by the operating companies in this biological wastewater treatment market.

Q6. Which companies are investing more on R&D practices?

A. 3M is the company investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global biological wastewater treatment market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on biological wastewater treatment market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Biological Wastewater Treatment Market, by Process

5.1.Overview

5.1.1.Market size and forecast, by Process

5.2.Aerobic

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2021-2031

5.2.3.Market share analysis, by country 2021 & 2031

5.3.Anaerobic

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2021-2031

5.3.3.Market share analysis, by country 2021 & 2031

5.4.Anoxic

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2021-2031

5.4.3.Market share analysis, by country 2021 & 2031

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Biological Wastewater Treatment Market, by Type

6.1.Overview

6.1.1.Market size and forecast, by Product Type

6.2.Municipal Waste

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2021-2031

6.2.3.Market share analysis, by country 2021 & 2031

6.3.Industrial Waste

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2021-2031

6.3.3.Market share analysis, by country 2021 & 2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Biological Wastewater Treatment Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Process, 2021-2031

7.1.1.2.Market size analysis, by Type, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Process, 2021-2031

7.1.2.2.Market size analysis, by Type, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Process, 2021-2031

7.1.3.2.Market size analysis, by Type, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Process, 2021-2031

7.2.1.2.Market size analysis, by Type, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Process, 2021-2031

7.2.2.2.Market size analysis, by Type, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Process, 2021-2031

7.2.3.2.Market size analysis, by Type, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Process, 2021-2031

7.2.4.2.Market size analysis, by Type, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Process, 2021-2031

7.2.5.2.Market size analysis, by Type, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Process, 2021-2031

7.2.6.2.Market size analysis, by Type, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Process, 2021-2031

7.3.1.2.Market size analysis, by Type, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Process, 2021-2031

7.3.2.2.Market size analysis, by Type, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Process, 2021-2031

7.3.3.2.Market size analysis, by Type, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Process, 2021-2031

7.3.4.2.Market size analysis, by Type, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Process, 2021-2031

7.3.5.2.Market size analysis, by Type, 2021-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Process, 2021-2031

7.3.6.2.Market size analysis, by Type, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Process, 2021-2031

7.4.1.2.Market size analysis, by Type, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Process, 2021-2031

7.4.2.2.Market size analysis, by Type, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Process, 2021-2031

7.4.3.2.Market size analysis, by Type, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Process, 2021-2031

7.4.4.2.Market size analysis, by Type, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Process, 2021-2031

7.4.5.2.Market size analysis, by Type, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.3M

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Calgon Carbon Corporation

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Aquatech International LLC

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Evoqua Water Technologies LLC

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Pentair plc

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Veolia

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Ecolab

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Xylem

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.SUEZ

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Dryden Aqua Ltd.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

Wastewater treatment plays a crucial role in maintaining the health of our environment and ensuring the availability of clean water resources. Among the various wastewater treatment methods, biological wastewater treatment has emerged as a sustainable and efficient solution. By utilizing natural processes and microorganisms, this method effectively removes contaminants and transforms wastewater into a valuable resource. Biological wastewater treatment relies on the principle of harnessing the natural abilities of bacteria, fungi, and other microorganisms to break down complex organic compounds into simpler, harmless forms. The process typically occurs in a treatment plant where wastewater is subjected to different stages. The primary treatment involves the removal of large solids and debris, followed by the secondary treatment where biological processes take place. This can be achieved through various methods, including activated sludge, trickling filters, rotating biological contractors, and sequencing batch reactors.

Forecast Analysis of the Biological Wastewater Treatment Market

The rising volume of wastewater across the globe, water shortages due to the growing population, and tremendously increasing industrialization are the major factors expected to foster the growth of the biological wastewater treatment market throughout the forecast timeframe. Moreover, the increasing number of government activities to raise consumer awareness about using and drinking sanitary and safe water is expected to create huge growth opportunities for the market during the analysis period. Additionally, the increasing government water conservation programs to reuse water for operational processes across numerous industries are predicted to augment the growth of the biological wastewater treatment market in the coming period. However, the high costs of proper disposition of tainted water may impede the growth of the market over the estimated period.

According to the report published by Research Dive, the global biological wastewater treatment market is anticipated to garner $15,067.7 million in revenue and grow at a CAGR of 5.2% during the forecast timeframe from 2022 to 2031. The major players of the market include Dryden Aqua Ltd., 3M, SUEZ, Calgon Carbon Corporation, Xylem, Aquatech International LLC, Ecolab, Evoqua Water Technologies LLC, Veolia, Pentair Plc., and many more.

Key Developments of the Biological Wastewater Treatment Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global biological wastewater treatment market to grow exponentially. For instance:

- In September 2022, LANXESS, a German-based specialty chemicals company inaugurated its new biological wastewater treatment plant. The company renovated and made advancements in the existing plant to adhere to the stricter environmental legislation. This plant would not only process the wastewater from the company but also from two nearby companies along with the production of rubber chemicals, and glass fiber.

- In October 2022, Envirozyme, a world leader in the bioaugmentation industry announced its acquisition of Novozymes, a global biotechnology company. This acquisition would help Envirozyme to enhance its bio-augmented solutions for water resource recovery and expand its business to new markets worldwide.

- In March 2023, Aquatech, a renowned provider of water purification systems and wastewater treatment technology for industrial and infrastructure markets, announced its partnership with Fluid Technology Solutions, Inc., a global leader in water treatment technology. With this partnership, the companies aimed to deliver next-generation solutions for water reuse, advanced separation, and brine concentration.

Most Profitable Region

The North America region of the biological wastewater treatment market registered the highest revenue in 2021. This is mainly due to rapid urbanization, the growing environmental deterioration, and the developments in membrane technology in the region. Moreover, the increasing need for sophisticated household water treatment, the rising number of public sector entities, and the restricted water resource availability across the region are the factors expected to boost the regional growth of the market over the forecast period.

Covid-19 Impact on the Global Biological Wastewater Treatment Market

With the rise of the novel coronavirus, the biological wastewater treatment market has experienced a negative impact initially, likewise, various other industries. However, the increased emphasis given by the World Health Organization on using clean water for washing hands and other purposes and the increased government focus on the provision of providing safe drinking water have increased the need for wastewater treatment during the pandemic period. Furthermore, the lack of access to clean water for sustaining a minimal level of cleanliness and restricting significant public exposure has increased growth opportunities for the market throughout the crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com