Neonatal Ventilator Market Report

RA00033

Neonatal Ventilator Market, By Product (Invasive Ventilation, Non-Invasive Ventilation), By Technology (Volume Targeted Ventilator, Mechanical Ventilator, High Frequency Ventilator, Hybrid Ventilator), By Mode of Ventilation (Volume Mode, Pressure Mode, Combined Mode), By End-use (Clinics, Ambulatory Surgical Centers, Hospitals): Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Neonatal Ventilator Market Size 2026

Global market size of Neonatal Ventilator will reach $ 474.0 million by 2026, rising from $ 288.6 million in 2018, at a CAGR of 6.4%.

The neonatal ventilator provides support and care to a preterm or a newborn and critically unwell infant who are experiencing problems with the lungs or in the respiratory process like high breathing resistance and high respiratory rates. This process is also known as artificial respiration. The neonatal ventilator generates positive pressure in the lungs of an infant who is incapable and too weak to breathe on its own.

Rapid growth in the death of preterm neonates and rising demand for the neonatal ventilator across the globe are the key neonatal ventilator market insights.

Neonatal Ventilator Market Drivers:

Rapid growth in the technological advancements in healthcare infrastructure specifically in emerging economies along with increasing awareness about the treatments that are available for chronic respiratory diseases will lead to the swift adoption of the neonatal ventilators and will assist in the market growth. Growing disposable income, government support, rising awareness level, and growth in private funding for the prevention along with effective treatment of respiratory diseases are anticipated to drive the market. Rising necessity for emergency treatment for sustained illnesses and prolonged treatment associated with lung diseases in adults and children are further expected to be the neonatal ventilator market growth factors.

In spite of the wide range of advantages, the high cost of the ventilators is expected to hinder the adoption rate across the globe. The high-cost limitation is majorly observed in non-invasive ventilators, which are very effective when compared to the invasive ventilator. Additionally, lack of skilled practitioners, shortage of better healthcare infrastructure, and healthcare budgets in underdeveloped economies will hinder the smooth adoption of neonatal ventilators.

Neonatal Ventilator Market Segmentation, by Product

Invasive Ventilator segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

Invasive neonatal ventilator market share will reach over 6.2% in the year 2026. The invasive segment is expected to witness a slightly higher growth rate than non-invasive ventilator growing at a CAGR over the forecast period. This is majorly due to their wide usage in newborn baby intensive care units. Invasive systems such as mechanical ventilators are presently the mainstream interface that is being used in the majority of regions worldwide. The invasive segment is expected to continue its dominance over the forecast period and expected to grow at a CAGR of 6.2% from 2019 to 2026.

Neonatal Ventilator Market, by Technology

Mechanical Ventilator Technology segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

Mechanical ventilator segment held for the largest market share in the year 2018. This is majorly due to the advancements in the neonatal care which have resulted in a substantial decrease in the morbidity and mortality rates. Additionally, the high-frequency ventilator segment is expected to grow at a higher CAGR of 7.2% over the forecast period. These ventilators have gained the demand in recent years as they provide effective treatment to the neonates in various clinical situations. The high-frequency ventilator is known to be effective, safe, and less injury-prone to the users.

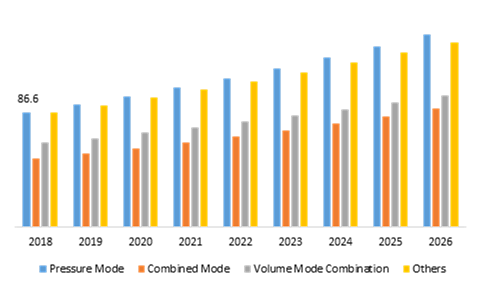

Neonatal Ventilator Market, by Mode of Ventilation

Pressure Mode segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The pressure mode ventilator market led the global market in the year 2018, by accounting for $86.6 million. It is the most preferred ventilation mode across the hospitals. Increase in the number of preterm births having respiration difficulties are adopting pressure mode ventilators, as they reduce the increasing chances, and this will lead to the growth of this segment in the near future. This mode of ventilation is largely used on the basis of resistance and compliance of the patient's lungs. Therefore, the rising prevalence of respiratory failure in the newborns is expected to be the key growth factor of the neonatal ventilator market in the near future.

The combined mode segment is expected to be lucrative in the near future. This segment will grow at a CAGR of 7.0% during the projected period. Additionally, respiratory distress syndrome is one of the fast-growing diseases among toddlers. Combined mode ventilation will assist to reduce the risk of lung injury and breathing problems in preterm births. However, recent developments in neonatal ventilator will observe the market growth over the forecast period.

Neonatal Ventilator Market, by End-Use

Hospitals segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

Hospitals end-use market segment held a dominant market share in 2018, as it has been a highly preferred area of application in both developed and developing nations. Besides the clinics segment is expected to account for the largest market share over the forecast period and is projected to grow at 7.4% CAGR.

Neonatal Ventilators Market, by Region:

Asia-Pacific region will have enormous opportunities for the market investors to grow over the coming years

North America region accounted for the largest market share in the year 2018. Whereas the Asia-Pacific market is expected to experience a swift growth over the forecast period, majorly due to the rapid growth in the product demand from China and India. This growth is majorly due to the increase in the expansions of hospitals and clinics. The rising birth rate in these countries is also one of the primary factors, driving the market growth.

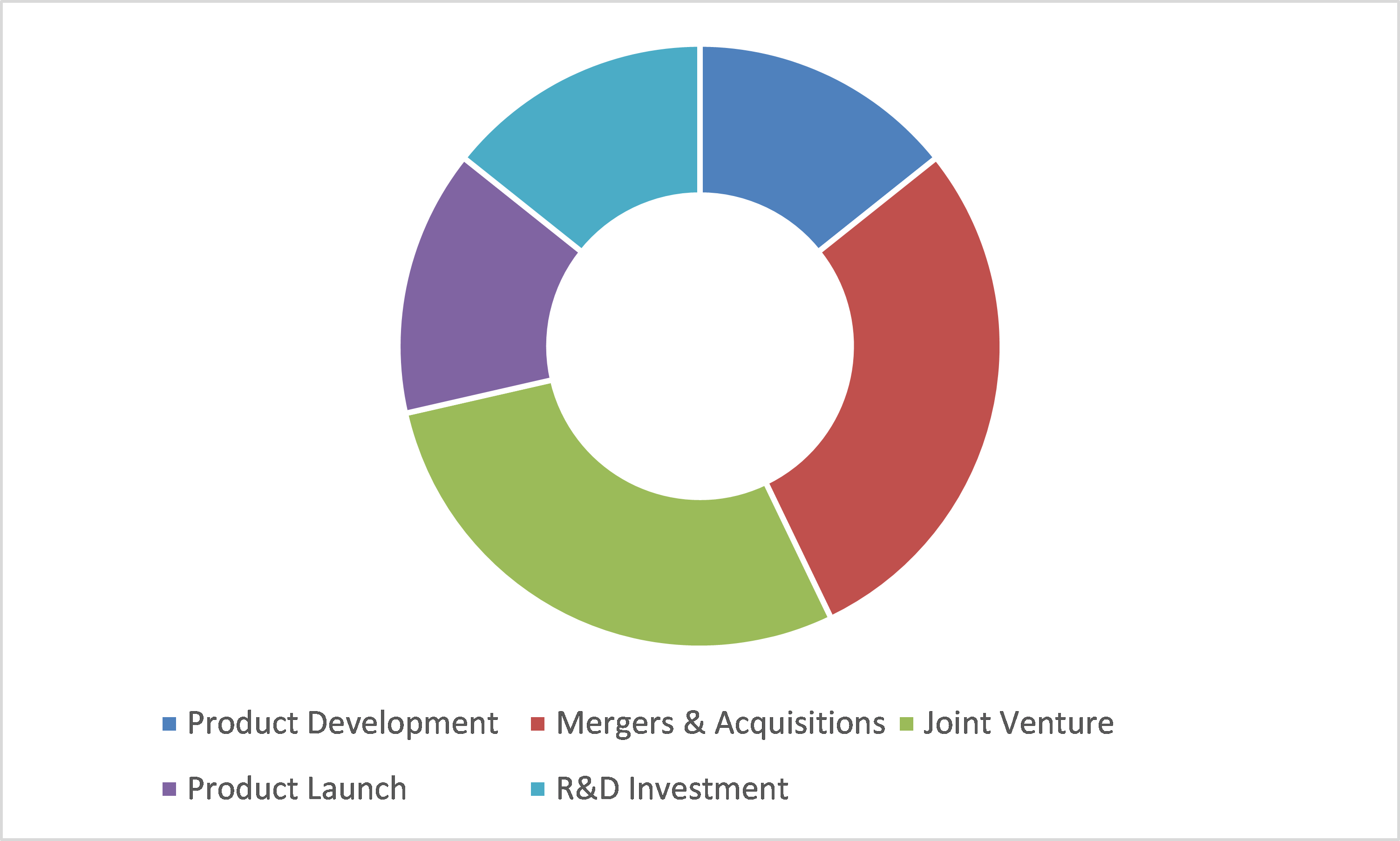

Key participants in Global Neonatal Ventilator Market:

Product development and joint ventures are the most common strategies followed by the market players

Source: Research Dive Analysis

The top players in the global neonatal ventilator market are Resmed, Medtronic Plc, Carefusion, Phillips Respironics, Smith Medical, Hamilton Medical, Breas Medical, Ge Healthcare, Drager Medical, and Maquet. These key players are majorly concentrating growth advancements in current technology, new product launches, mergers and acquisitions, and geographical expansion. These are some of the growth strategies adopted by these companies.

In December 2019, Hamilton Medical launched the hardware update for its Hamilton C6 ventilator, which has made the product more user-friendly as it is upgraded with the features such as additional mount tray. This upgrade provides additional advantages to the users, as it becomes easy to use, and advanced features which allow the users to personalize the patient's ventilation therapy.

Scope of the Research Report:

| Aspect | Particulars |

| Historical Market Estimations | 2016-2018 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Technology |

|

| Segmentation by Mode of Ventilation |

|

| Segmentation by End-use |

|

| Key Countries covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Q1. Which key growth drivers will define Ventilators Market market growth by 2026?

A. Growing number of deaths among pre-term babies due to respiratory disorder and other respiratory disorders are the major growth drivers in the market.

Q2. What is a neonatal ventilator?

A. A neonatal ventilator is a medical apparatus that provides support to preterm and critical ill infants suffering from respiratory disorder or have low-compliance lungs.

Q3. How many types of ventilators are there?

A. There are mainly six types of ventilators such as positive pressure ventilator, negative pressure ventilator, fluidic ventilator, home ventilators, transport ventilator, and microprocessor ventilator.

Q4. What is a normal PIP on ventilator?

A. Ventilator should have 18-25 cm H2O of peak inspiratory pressure.

Q5. How technological advancements in healthcare infrastructure will boost the Neonatal Ventilator market?

A. Recent advancements in healthcare infrastructure such as technological advancements in microprocessor controlled ventilation have reduced the complexity related with pre-term babies suffering from breathing problems.

Q6. Which Ventilator segment is expected to create immense opportunity in the Neonatal Ventilator market?

A. Invasive type of neonatal ventilator is anticipated to have immense opportunity in the upcoming period of time.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Product Type trends

2.3. Technology trends

2.4. Mode of Ventilation trends

2.5. End-use trends

3. Market overview

3.1. Market segmentation & definitions

3.2. key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.9. Strategic overview

4. Oxygen Cylinders and Concentrators Market, by Product Type

4.1. Invasive Ventilation

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Non-Invasive Ventilation

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

5. Oxygen Cylinders and Concentrators Market, by Technology

5.1. Mechanical Ventilator

5.1.1. Market size and forecast, by region, 2016-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. High Frequency Ventilator

5.2.1. Market size and forecast, by region, 2016-2026

5.2.2. Comparative market share analysis, 2018 & 2026

5.3. Volume Targeted Ventilator

5.3.1. Market size and forecast, by region, 2016-2026

5.3.2. Comparative market share analysis, 2018 & 2026

5.4. Hybrid Ventilator

5.4.1. Market size and forecast, by region, 2016-2026

5.4.2. Comparative market share analysis, 2018 & 2026

6. Oxygen Cylinders and Concentrators Market, by Mode of Ventilation

6.1. Pressure Mode Ventilation

6.1.1. Market size and forecast, by region, 2016-2026

6.1.2. Comparative market share analysis, 2018 & 2026

6.2. Combined Mode Ventilation

6.2.1. Market size and forecast, by region, 2016-2026

6.2.2. Comparative market share analysis, 2018 & 2026

6.3. Volume Mode Combination

6.3.1. Market size and forecast, by region, 2016-2026

6.3.2. Comparative market share analysis, 2018 & 2026

6.4. Others

6.4.1. Market size and forecast, by region, 2016-2026

6.4.2. Comparative market share analysis, 2018 & 2026

7. Oxygen Cylinders and Concentrators Market, by End-use

7.1. Hospitals

7.1.1. Market size and forecast, by region, 2016-2026

7.1.2. Comparative market share analysis, 2018 & 2026

7.2. Clinics

7.2.1. Market size and forecast, by region, 2016-2026

7.2.2. Comparative market share analysis, 2018 & 2026

7.3. Ambulatory Surgical Centers

7.3.1. Market size and forecast, by region, 2016-2026

7.3.2. Comparative market share analysis, 2018 & 2026

7.4. Others

7.4.1. Market size and forecast, by region, 2016-2026

7.4.2. Comparative market share analysis, 2018 & 2026

8. Oxygen Cylinders and Concentrators Market, by Region

8.1. North America

8.1.1. Market size and forecast, by product, 2016-2026

8.1.2. Market size and forecast, by technology, 2016-2026

8.1.3. Market size and forecast, by mode of ventilation, 2016-2026

8.1.4. Market size and forecast, by end-use, 2016-2026

8.1.5. Market size and forecast, by country, 2016-2026

8.1.6. Comparative market share analysis, 2018 & 2026

8.1.7. U.S.

8.1.7.1. Market size and forecast, by product, 2016-2026

8.1.7.2. Market size and forecast, by technology, 2016-2026

8.1.7.3. Market size and forecast, by mode of ventilation, 2016-2026

8.1.7.4. Market size and forecast, by end-use, 2016-2026

8.1.7.5. Comparative market share analysis, 2018 & 2026

8.1.8. Canada

8.1.8.1. Market size and forecast, by product, 2016-2026

8.1.8.2. Market size and forecast, by technology, 2016-2026

8.1.8.3. Market size and forecast, by mode of ventilation, 2016-2026

8.1.8.4. Market size and forecast, by end-use, 2016-2026

8.1.8.5. Comparative market share analysis, 2018 & 2026

8.1.9. Mexico

8.1.9.1. Market size and forecast, by product, 2016-2026

8.1.9.2. Market size and forecast, by technology, 2016-2026

8.1.9.3. Market size and forecast, by mode of ventilation, 2016-2026

8.1.9.4. Market size and forecast, by end-use, 2016-2026

8.1.9.5. Comparative market share analysis, 2018 & 2026

8.2. Europe

8.2.1. Market size and forecast, by product, 2016-2026

8.2.2. Market size and forecast, by technology, 2016-2026

8.2.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.4. Market size and forecast, by end-use, 2016-2026

8.2.5. Market size and forecast, by country, 2016-2026

8.2.6. Comparative market share analysis, 2018 & 2026

8.2.7. UK

8.2.7.1. Market size and forecast, by product, 2016-2026

8.2.7.2. Market size and forecast, by technology, 2016-2026

8.2.7.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.7.4. Market size and forecast, by end-use, 2016-2026

8.2.7.5. Comparative market share analysis, 2018 & 2026

8.2.8. Germany

8.2.8.1. Market size and forecast, by product, 2016-2026

8.2.8.2. Market size and forecast, by technology, 2016-2026

8.2.8.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.8.4. Market size and forecast, by end-use, 2016-2026

8.2.8.5. Comparative market share analysis, 2018 & 2026

8.2.9. France

8.2.9.1. Market size and forecast, by product, 2016-2026

8.2.9.2. Market size and forecast, by technology, 2016-2026

8.2.9.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.9.4. Market size and forecast, by end-use, 2016-2026

8.2.9.5. Comparative market share analysis, 2018 & 2026

8.2.10. Spain

8.2.10.1. Market size and forecast, by product, 2016-2026

8.2.10.2. Market size and forecast, by technology, 2016-2026

8.2.10.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.10.4. Market size and forecast, by end-use, 2016-2026

8.2.10.5. Comparative market share analysis, 2018 & 2026

8.2.11. Italy

8.2.11.1. Market size and forecast, by product, 2016-2026

8.2.11.2. Market size and forecast, by technology, 2016-2026

8.2.11.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.11.4. Market size and forecast, by end-use, 2016-2026

8.2.11.5. Comparative market share analysis, 2018 & 2026

8.2.12. Rest of Europe

8.2.12.1. Market size and forecast, by product, 2016-2026

8.2.12.2. Market size and forecast, by technology, 2016-2026

8.2.12.3. Market size and forecast, by mode of ventilation, 2016-2026

8.2.12.4. Market size and forecast, by end-use, 2016-2026

8.2.12.5. Comparative market share analysis, 2018 & 2026

8.3. Asia-Pacific

8.3.1. Market size and forecast, by product, 2016-2026

8.3.2. Market size and forecast, by technology, 2016-2026

8.3.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.4. Market size and forecast, by end-use, 2016-2026

8.3.5. Market size and forecast, by country, 2016-2026

8.3.6. Comparative market share analysis, 2018 & 2026

8.3.7. China

8.3.7.1. Market size and forecast, by product, 2016-2026

8.3.7.2. Market size and forecast, by technology, 2016-2026

8.3.7.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.7.4. Market size and forecast, by end-use, 2016-2026

8.3.7.5. Comparative market share analysis, 2018 & 2026

8.3.8. Japan

8.3.8.1. Market size and forecast, by product, 2016-2026

8.3.8.2. Market size and forecast, by technology, 2016-2026

8.3.8.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.8.4. Market size and forecast, by end-use, 2016-2026

8.3.8.5. Comparative market share analysis, 2018 & 2026

8.3.9. India

8.3.9.1. Market size and forecast, by product, 2016-2026

8.3.9.2. Market size and forecast, by technology, 2016-2026

8.3.9.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.9.4. Market size and forecast, by end-use, 2016-2026

8.3.9.5. Comparative market share analysis, 2018 & 2026

8.3.10. Australia

8.3.10.1. Market size and forecast, by product, 2016-2026

8.3.10.2. Market size and forecast, by technology, 2016-2026

8.3.10.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.10.4. Market size and forecast, by end-use, 2016-2026

8.3.10.5. Comparative market share analysis, 2018 & 2026

8.3.11. South Korea

8.3.11.1. Market size and forecast, by product, 2016-2026

8.3.11.2. Market size and forecast, by technology, 2016-2026

8.3.11.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.11.4. Market size and forecast, by end-use, 2016-2026

8.3.11.5. Comparative market share analysis, 2018 & 2026

8.3.12. Rest of Asia-Pacific

8.3.12.1. Market size and forecast, by product, 2016-2026

8.3.12.2. Market size and forecast, by technology, 2016-2026

8.3.12.3. Market size and forecast, by mode of ventilation, 2016-2026

8.3.12.4. Market size and forecast, by end-use, 2016-2026

8.3.12.5. Comparative market share analysis, 2018 & 2026

8.4. LAMEA

8.4.1. Market size and forecast, by product, 2016-2026

8.4.2. Market size and forecast, by technology, 2016-2026

8.4.3. Market size and forecast, by mode of ventilation, 2016-2026

8.4.4. Market size and forecast, by end-use, 2016-2026

8.4.5. Market size and forecast, by country, 2016-2026

8.4.6. Comparative market share analysis, 2018 & 2026

8.4.7. Brazil

8.4.8. Market size and forecast, by product, 2016-2026

8.4.9. Market size and forecast, by technology, 2016-2026

8.4.10. Market size and forecast, by mode of ventilation, 2016-2026

8.4.11. Market size and forecast, by end-use, 2016-2026

8.4.12. Comparative market share analysis, 2018 & 2026

8.4.13. Saudi Arabia

8.4.13.1. Market size and forecast, by product, 2016-2026

8.4.13.2. Market size and forecast, by technology, 2016-2026

8.4.13.3. Market size and forecast, by mode of ventilation, 2016-2026

8.4.13.4. Market size and forecast, by end-use, 2016-2026

8.4.13.5. Comparative market share analysis, 2018 & 2026

8.4.14. South Africa

8.4.14.1. Market size and forecast, by product, 2016-2026

8.4.14.2. Market size and forecast, by technology, 2016-2026

8.4.14.3. Market size and forecast, by mode of ventilation, 2016-2026

8.4.14.4. Market size and forecast, by end-use, 2016-2026

8.4.14.5. Comparative market share analysis, 2018 & 2026

8.4.15. Rest of LAMEA

8.4.15.1. Market size and forecast, by product, 2016-2026

8.4.15.2. Market size and forecast, by technology, 2016-2026

8.4.15.3. Market size and forecast, by mode of ventilation, 2016-2026

8.4.15.4. Market size and forecast, by end-use, 2016-2026

8.4.15.5. Comparative market share analysis, 2018 & 2026

9. Company profiles

9.1. Air Liquide

9.1.1. Business overview

9.1.2. Financial performance

9.1.3. Product portfolio

9.1.4. Recent strategic moves & developments

9.1.5. SWOT analysis

9.2. Becton Dickinson (CareFusion corporation)

9.2.1. Business overview

9.2.2. Financial performance

9.2.3. Product portfolio

9.2.4. Recent strategic moves & developments

9.2.5. SWOT analysis

9.3. Breas Medical

9.3.1. Business overview

9.3.2. Financial performance

9.3.3. Product portfolio

9.3.4. Recent strategic moves & developments

9.3.5. SWOT analysis

9.4. Smith’s Medical

9.4.1. Business overview

9.4.2. Financial performance

9.4.3. Product portfolio

9.4.4. Recent strategic moves & developments

9.4.5. SWOT analysis

9.5. Drägerwerk AG & Co. KGaA

9.5.1. Business overview

9.5.2. Financial performance

9.5.3. Product portfolio

9.5.4. Recent strategic moves & developments

9.5.5. SWOT analysis

9.6. Hamilton Medical

9.6.1. Business overview

9.6.2. Financial performance

9.6.3. Product portfolio

9.6.4. Recent strategic moves & developments

9.6.5. SWOT analysis

9.7. GE Healthcare

9.7.1. Business overview

9.7.2. Financial performance

9.7.3. Product portfolio

9.7.4. Recent strategic moves & developments

9.7.5. SWOT analysis

9.8. Koninklijke Philips N.V.

9.8.1. Business overview

9.8.2. Financial performance

9.8.3. Product portfolio

9.8.4. Recent strategic moves & developments

9.8.5. SWOT analysis

9.9. Maquet (Gentinge Group)

9.9.1. Business overview

9.9.2. Financial performance

9.9.3. Product portfolio

9.9.4. Recent strategic moves & developments

9.9.5. SWOT analysis

9.10. Medtronic plc

9.10.1. Business overview

9.10.2. Financial performance

9.10.3. Product portfolio

9.10.4. Recent strategic moves & developments

9.10.5. SWOT analysis

9.11. ResMed Inc

9.11.1. Business overview

9.11.2. Financial performance

9.11.3. Product portfolio

9.11.4. Recent strategic moves & developments

9.11.5. SWOT analysis

It's always painful for a parent to see their babies struggle and currently, the alarming rise in the number of deaths of preborn babies related to respiratory disorders is depressing. Respiratory problems have turned out to be a common problem in almost 7% of newborns, and are even more severe in mild prematurity. Newborns, who have been identified with non-compliance lungs, small tidal pressures, strong airway resistance, and elevated respiratory levels are also sustained at the assistance of the ventilator. Care and support are given to children who have difficulty breathing on their own with the assistance of neonatal ventilators. In these situations, the chances of survival always rely on sufficient and effective ventilation help for the unit.

Respiratory problems in newborns to drive the market

Artificial respiration is another name for this method, where babies are assisted to regulate elevated respiratory rates and high tolerance to breathing or lung disorders. The lungs of the newborn are filled with positive pressure in the lungs produced by the neonatal ventilator, so positive pressure protects vital babies when they are incompetent and too frail to breathe on their own. In such situations, intrusive ventilation is needed for the care of newborns with respiratory problems.

Growing chronic respiratory conditions in preterm infants were attributed to an increasing number of neonatal ventilators worldwide. Rapid growth in technological advances in healthcare infrastructure, especially in emerging economies, and increased awareness of the treatments available for chronic respiratory diseases would lead to the rapid adoption of neonatal ventilators and will contribute to market growth. The neonatal ventilator market growth drivers are also expected to increase the need for emergency treatment for chronic infections and extended diagnosis for lung diseases in adults and children.

The growing increase in demand has led to an increase in technological developments in the healthcare sector. The infrastructure focuses on developments as developing countries raise awareness of chronic respiratory diseases and their treatment. Growing disposable income, government support, increasing awareness and increasing private funding for prevention, along with effective treatment of respiratory diseases, are expected to drive the market.

The Asia-Pacific area will have tremendous potential for retail participants to expand in the coming years, despite. North America responsible for the largest market share in 2018. Whereas the Asia-Pacific market is expected to grow rapidly over the forecast period, mainly due to the rapid growth in demand for products from China and India. Such a rise is largely due to the increase in hospital and clinic expansions. The increasing birth rate in these countries is also one of the main factors driving the market growth.

Modes of Ventilation

The growing incidence of respiratory failure in newborns is projected to be a major growth factor in the neonatal ventilator industry in the near future. Neonatal ventilators may be seen in schools, clinics, and also emergency departments. Pressure Mode is projected to be the most profitable market by the end of 2026. Pressure-mode neonatal ventilator market is growing dramatically in the coming future and is expected to reach $145.4 million by 2026, with a CAGR of 6.7%. It's the most preferred mode of ventilation across hospitals. An increase in the number of preterm births with difficulty breathing Pressure Form Ventilators are taking place because they decrease the rising risks, and this will add to the development of this sector soon. This method of ventilation is generally used on the grounds of the patient's respiratory tolerance and conformity.

The combined mode category is predicted to be successful shortly. The global ventilation market for combined mode is projected to increase over the forecast period and is expected to reach $89.2 million by 2026, with a CAGR of 7.0%. Combined mode ventilation helps reduce the risk of breathing problems and lung infections in preterm births as respiratory distress syndrome is one of the fast-growing diseases in newborn babies. The reduction in the likelihood of pulmonary disease and breathing problems in preterm births can be managed by the integrated combined ventilation mode.

The global market size of the Neonatal Ventilator was over $288.6 million in 2018 and is expected to reach $474.0 million by 2026. Nevertheless, new developments in the neonatal ventilator will demonstrate the expansion of the demand over the forecast period. The hospital neonatal ventilator market is expected to remain dominant and expand at 6.2% of CAGR. This market is forecast to hit $322.2 million by 2026. Along with clinics, the pharmaceutical sector will undergo robust growth during the forecast period and is projected to reach $61.3 million by 2026.

Restrictive influences

Notwithstanding the broad variety of advantages, the high expense of ventilators is anticipated to inhibit the pace of acceptance around the globe. The high-cost constraint is mostly seen in non-invasive ventilators, which are very efficient as opposed to invasive ventilators. The lack of skilled doctors, the absence of better healthcare facilities and health resources in underdeveloped countries would impede the smooth introduction of neonatal ventilators. The expense effect is restricted to smaller facilitators and in particular to non-invasive ventilators. Whereas, the non-invasive ventilators are so much more efficient than intrusive ventilators as measured.

Major players in the global market for neonatal ventilators are introducing many strategies to improve their market presence. Some of these strategies are introducing new product development and mergers and acquisitions. Recent developments in the neonatal ventilator industry of Hamilton Medical include the announcement of the Hamilton C6 Ventilator model in December 2019. Improved hardware for its Hamilton C6 ventilator, allows the system to be more user-friendly as it is improved with enhancements such as an optional mounting tray. The update provides additional advantages for patients, as it becomes simple to use, with advanced features that allow users to configure the breathing therapy of the individual. With this approach, they are aiming to increase its market share.

In addition to Hamilton Medical, several other market players are involved in the ventilator business. Many of them include Medtronic Plc, Resmed, Carefusion, Smith Medical, Phillips Respironics, Hamilton Medical, Breas Medical, Drager Medical, Ge Healthcare, and Maquet. Such businesses focus mainly on modern technology improvements, the introduction of innovative products, mergers, and acquisitions, and international growth. All of these procedures indicate that the neonatal ventilator industry is on the brink of increasing height in the coming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com