Private Nursing Services Market Report

RA00095

Private Nursing Services Market by Service type (Retirement Communities, Group Care Homes, Nursing Care Facilities, and Home Health Care Providers), Gender (Female and Male), and Regional Outlook (North America, Europe, Asia-Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Private Nursing Services Market Analysis

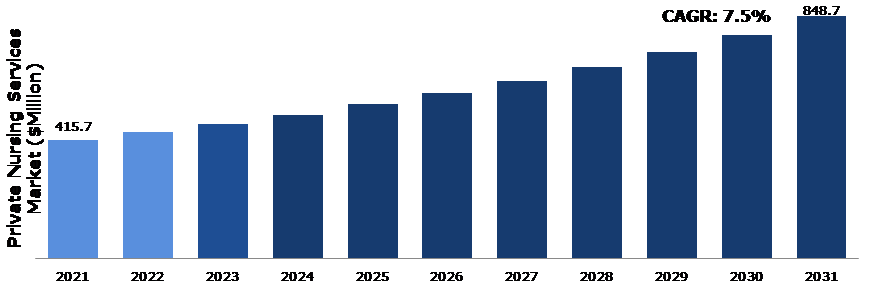

The Global Private Nursing Services Market Size was $415.70 million in 2021, and is predicted to grow with a CAGR of 7.5%, by generating revenue of $ 848.70 million by 2031.

Global Private Nursing Services Market Synopsis

There has been an increase in chronic disease cases over the last few years, and many illnesses require long-term care. Chronic illness management and treatment are becoming major concerns. Private nursing services are anticipated to be primarily driven by the ability of nursing professionals to provide patients with superior care and individualized attention. Changes in social life were a major factor in the growth of the market for private nursing services. The division of joint families into nuclear families has resulted in smaller family groupings, making it more challenging to care for the family member who is dependent. Private nursing services are anticipated to see an increase in demand as a result.

However, the two biggest barriers are the lack of services in rural regions and the availability of unskilled healthcare workers. Obtaining the appropriate care might be difficult for rural residents since they typically confront several barriers in the healthcare system. The expansion of this industry is constrained for a variety of reasons, including the costs associated with private nursing care and the commute required to access and utilize the services. The primary barriers to the expansion of the private nursing services industry are the scarcity of qualified professionals owing to a lack of education, appropriate skills, and working professionals with experience.

Government support and advantageous reimbursement policies are anticipated to open up new opportunities in this sector. Additionally, it is projected that the availability of extremely beneficial services as well as the increasing frequency and prevalence of chronic diseases among individuals worldwide would fuel this private nursing services market growth throughout the course of the anticipated timeframe.

According to regional analysis, the Asia-Pacific private nursing service market share is predicted to have the fastest growth in the forecast time period. This is because in China, healthcare authorities have started a new wave of healthcare changes that favor in-home nursing services. The nation's graded healthcare system has been improved by introducing electronic medical record capture of patients and allowing doctors to practice medicine more freely.

Private Nursing Services Overview

Private nursing services are provided by nurses who hold a Licensed Practical Nurse (LPN) or Registered Nurse (RN) license. Professionals offer these services to patients on an individual basis. These services are provided to patients in accordance with their needs, whether the setting is the patient's home, a medical facility like a hospital or nursing home, or somewhere else; they are provided to patients who have serious illnesses or injuries, or who require assistance in caring for the elderly or young children.

COVID-19 Impact on Global Private Nursing Services Market

Infectious disease COVID-19 was first discovered in Hubei province of Wuhan City. SARS-CoV-2, an extremely contagious virus that causes severe acute respiratory syndrome, spreads from person to person. Since the diseases initial outbreak in December 2019, it has spread to nearly 213 nations, prompting the World Health Organization to declare a public health emergency on March 11, 2020. In addition to the healthcare issue, the 2019 corona virus disease (COVID-19) has caused an economic disaster. The COVID-19 epidemic has put a strain on the healthcare system globally, and affluent nations are predicted to experience an economic downturn. The epidemic negatively affects the healthcare system, which saw a 50% to 70% decline in revenue from March. Small clinics, hospitals, and nursing homes have been compelled to close their doors. Additionally, regional curfews and social isolation have delayed elective surgical treatments. Furthermore, the expansion of the private nursing services sector may be significantly impacted by visa cancellations, which have halted medical tourism.

However, in February 2021, the Indian government took a new initiative for the health care industry: the PM Ayushman Bharat Health Infrastructure Mission (PM-ABHIM) Scheme, with an estimated outlay of Rs. 64,180 Cr (to be implemented until 2025-26), was announced in the budget for FY 2021–22. The scheme's goals are to focus on building the capacities of health systems and institutions across the continuum of care at all levels—primary, secondary, and tertiary—and on preparing health systems to respond effectively.

The Need for Private Nursing Services Is Anticipated to Increase Due to The Prevalence of Chronic Diseases and Socioeconomic Changes

There has been an increase in chronic disease cases over the last few years, and many illnesses require long-term care. Chronic illness management and treatment are becoming major concerns. Private nursing services are anticipated to be primarily driven by the ability of nursing professionals to provide patients with superior care and individualized attention. Changes in social life were a major factor in the growth of the market for private nursing services. The division of joint families into nuclear families has resulted in smaller family groupings, making it more challenging to care for the family member who is dependent. Private nursing services market size are anticipated to see an increase in demand as a result.

To know more about global private nursing services market drivers, get in touch with our analysts here.

A Lack of Skilled Workers and A Lack of Service in Rural Areas to Restrain the Market Growth

The two biggest barriers are the lack of services in rural regions and the availability of unskilled workers. Obtaining the appropriate care might be difficult for rural residents since they typically confront several barriers in the healthcare system. The expansion of this industry is constrained for a variety of reasons, including the costs associated with private nursing care and the commute required to access and utilize the services. The primary barriers to the expansion of the private nursing services industry are the scarcity of qualified professionals owing to a lack of education, appropriate skills, and working professionals with experience.

Rise in Demand for Therapeutic Equipment Used in Private Nursing Services Market

Rise in healthcare expenses have boosted patient choice for home-based therapies. Patients in home care settings employ nebulizers, ventilators, and continuous positive airway pressure (CPAP) equipment to treat, diagnose, and monitor a variety of respiratory disorders. These technologies, in conjunction with home care services, provide patients with cost-effective healthcare. The fast increase in the global geriatric population, increase in incidence of chronic illnesses (asthma), and the cost benefits of home care equipment and services (compared to hospital visits) are the primary drivers driving the expansion of the home healthcare market. The high private nursing services growth potential in emerging markets, healthcare decentralization, and the advancement of miniaturized equipment are just a few of the primary reasons that are anticipated to bring considerable growth prospects to respiratory home healthcare market participants.

To know more about global private nursing services market opportunities, get in touch with our analysts here.

Global Private Nursing Service Market, by Service Type

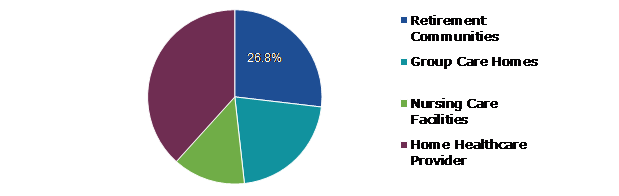

On the basis of service type, the market has been divided into retirement communities, group care homes, nursing care facilities, and home health care providers. Among these, the home health care providers sub-segment accounted for the highest market share in 2021 whereas the retirement communities' sub-segment is estimated to show the fastest growth during the forecast period.

Global Private Nursing Service Market Share, by Type, 2021

Source: Research Dive Analysis

The home healthcare providers sub-type is anticipated to have a dominant market share in 2021.The adoption of nuclear families has led to a decline in the number of individuals living at home, which has a negative impact on the ability to care for the elderly residents of the home. When individuals lived in joint families in the past, other family members in the home would take care of the elderly and retired because there were so many of them. The number of people in families has decreased as a result of this shift in societal trends and the rise of nuclear families. This has increased the need for healthcare experts, which has boosted the number of retirement homes in the service sector.

Global Private Nursing Service Market, by Gender

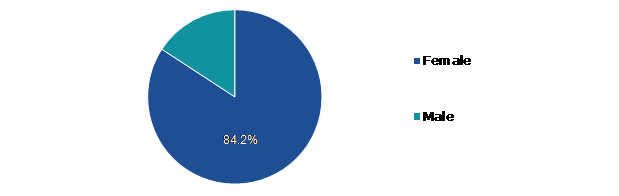

Based on gender, the market has been divided into female and male. Among these, the female sub-segment accounted for highest revenue share in 2021.

Global Private Nursing Service Market Size, by Gender, 2021

Source: Research Dive Analysis

The female sub-segment is anticipated to have a dominant market share in 2021.The female population dominates the market for nursing care. Even patients prefer female nurses over male nurses for their private nursing because they are more compassionate and sensitive than male nurses, who also treat the patients with less consideration. As long as women continue to dominate the nursing field, the market for private nursing services is expected to grow.

Global Private Nursing Service Market, Regional Insights

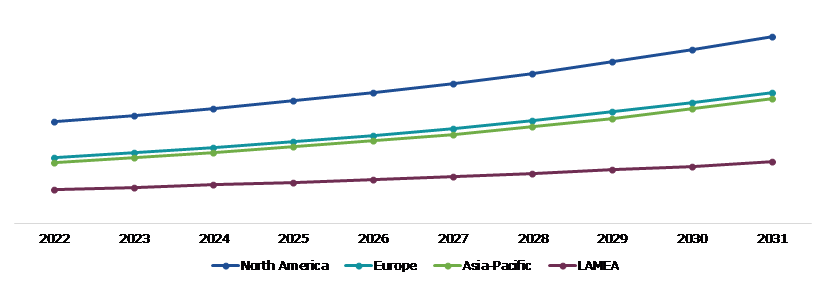

The private market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Private Nursing Service Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Private Nursing Service in North America to be the Most Dominant

The North American private nursing services market had a dominating market share in 2021. Some of the important variables include the region's huge senior population, advanced healthcare infrastructure, and relatively higher levels of disposable income. Its substantial market share is also being boosted by a growing number of government initiatives designed to reduce healthcare costs by boosting home treatment. For instance, the Hospital at Home program, which allowed patients to get care at home and cut the cost of care by approximately 30%, was implemented. The need for home healthcare goods and services is rising as a result of issues such as underdeveloped healthcare infrastructure, expensive in-hospital healthcare facilities, and chronic conditions that demand long-term care. Furthermore, companies are putting more of an emphasis on underdeveloped nations such as the U.S. and Canada. For instance, Apollo Homecare provides long-term plans for a number of categories, including mother and infant care, geriatric care, heart rehab, and neuro rehab. These programs offer individualized healthcare services and medical oversight.

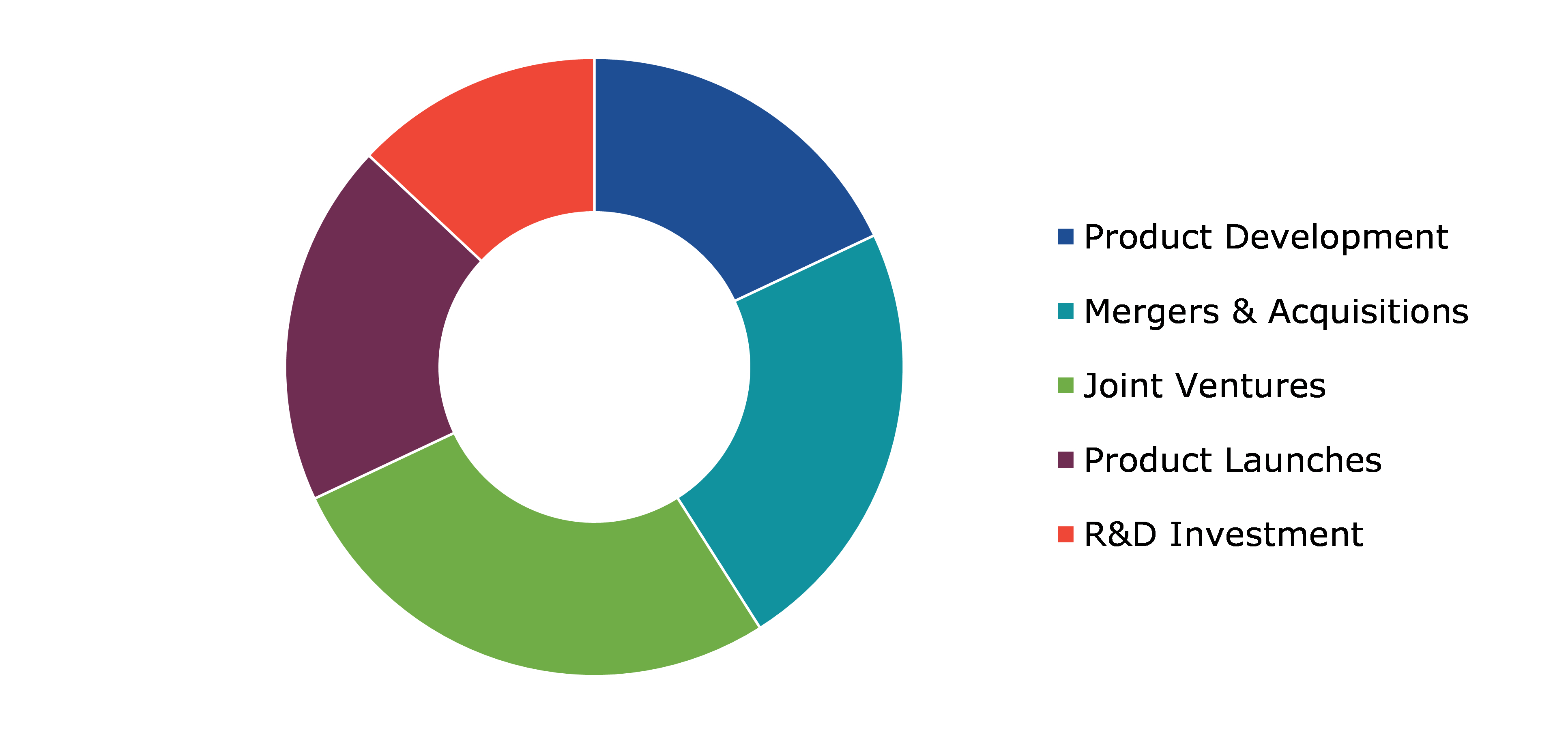

Competitive Scenario in the Global Private Nursing Service Market

Customer satisfaction and business expansion are common strategies followed by major market players. For instance, The Ensign Group, Inc., the parent company of the Ensign (TM) group of companies that provide post-acute healthcare services and make long-term healthcare investments, primarily in skilled nursing and senior living facilities, released operating results for the fourth quarter and fiscal year 2021 in February 2022.

Source: Research Dive Analysis

Some of the leading private nursing service market players are The Ensign Group, Inc., Kindred Healthcare, LLC, Genesis Healthcare, Brookdale Senior Living, Kaiser Permanente, CBI Health Group Inc., Trinity Health, Columbia Asia, Apollo Hospitals Enterprise Ltd., and Grand World Elder Care among others.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Service Type |

|

| Segmentation by Gender |

|

| Key Companies Profiled |

|

Q1. What is the size of the global private nursing service market?

A. The global private nursing services market size was $415.70 million in 2021, and is predicted to grow with a CAGR of 7.5%, by generating0 revenue of $ 848.70 million by 2031

Q2. Which are the major companies in the private nursing service market?

A. The Ensign Group, Inc., Kindred Healthcare, LLC, and Genesis Healthcare are some of the key players in the global Private nursing services.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific private nursing service market?

A. Asia-Pacific private nursing service market is anticipated to grow at 8.22% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Customer satisfaction and business expansion are the key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Private Nursing Service Market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Private Nursing Service Market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Private Nursing Service Market Analysis, by Service Type

5.1.Overview

5.2.Retirement Communities

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Group Care Homes

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Nursing Care Facilities

5.4.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Home Healthcare Provider

5.5.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness, 2021-2031

5.6.2.Competition heatmap, 2021-2031

6.Private Nursing Service Market Analysis, by Gender

6.1.Female

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Male

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness, 2021-2031

6.3.2.Competition heatmap, 2021-2031

7.Private Nursing Service Market Analysis, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Service Type, 2021-2031

7.1.1.2.Market size analysis, by Gender, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Service Type, 2021-2031

7.1.2.2.Market size analysis, by Gender, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Service Type, 2021-2031

7.1.3.2.Market size analysis, by Gender, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness, 2021-2030

7.1.4.2.Competition heatmap, 2021-2030

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Service Type, 2021-2031

7.2.1.2.Market size analysis, by Gender, 2021-2031

7.2.2.U.K.

7.2.2.1.Market size analysis, by Service Type, 2021-2031

7.2.2.2.Market size analysis, by Gender, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Service Type, 2021-2031

7.2.3.2.Market size analysis, by Gender, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Service Type, 2021-2031

7.2.4.2.Market size analysis, by Gender, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Service Type, 2021-2031

7.2.5.2.Market size analysis, by Gender, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Service Type, 2021-2031

7.2.6.2.Market size analysis, by Gender, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness, 2021-2030

7.2.7.2.Competition heatmap, 2021-2030

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Service Type, 2021-2031

7.3.1.2.Market size analysis, by Gender, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Service Type, 2021-2031

7.3.2.2.Market size analysis, by Gender, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Service Type, 2021-2031

7.3.3.2.Market size analysis, by Gender, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Service Type, 2021-2031

7.3.4.2.Market size analysis, by Gender, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Service Type, 2021-2031

7.3.5.2.Market size analysis, by Gender, 2021-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Service Type, 2021-2031

7.3.6.2.Market size analysis, by Gender, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness, 2021-2030

7.3.7.2.Competition heatmap, 2021-2030

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Service Type, 2021-2031

7.4.1.2.Market size analysis, by Gender, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Service Type, 2021-2031

7.4.2.2.Market size analysis, by Gender, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Service Type, 2021-2031

7.4.3.2.Market size analysis, by Gender, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Service Type, 2021-2031

7.4.4.2.Market size analysis, by Gender, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Service Type, 2021-2031

7.4.5.2.Market size analysis, by Gender, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness, 2021-2030

7.4.6.2.Competition heatmap, 2021-2030

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1. The Ensign Group, Inc.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Kindred Healthcare

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3. LLC

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Genesis Healthcare

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5. Brookdale Senior Living

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6. Kaiser Permanente

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.CBI Health Group Inc.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8. Trinity Health

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Columbia Asia

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Apollo Hospitals Enterprise Ltd.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

In today’s fast-paced environment, it can be difficult for office workers to care for their sick, disabled, and dying loved ones of all ages. Private nursing services are the best choice for a person's collaborative care, which includes the promotion of health while taking into account the patient's convenience. The nursing service is a pioneer in offering individualized and expert services to enable a quicker and better recovery while considering comfort.

Private nursing services are provided by nurses who hold the titles of registered nurses (RN) or licenced practical nurses (LPN). However, experts offer these services to treat patients on an individual basis. Additionally, these services are offered to patients considering their needs, whether they are receiving care at home or in a medical facility such as a hospital or nursing home. These services are provided to patients who have serious illnesses or who require assistance in caring for elderly or young children. The global private nursing services market is expanding at a rapid pace due to the rise in the number of nuclear households and the growth in the incidence of chronic diseases.

Newest Insights in the Private Nursing Services Market

The rise in the prevalence of chronic conditions, such as COPD and asthma, as well as the economic benefits of home care equipment and services (compared to hospital visits), have boosted the demand for private nursing services. As per a report by Research Dive, the global private nursing services market is expected to surpass a revenue of $848.70 million in the 2022–2031 timeframe. The North America private nursing services market is expected to experience dominant growth in the coming years. This is because the region has a massive demand for private nursing services owing to the growing number of government initiatives aimed at lowering healthcare expenses by increasing home treatment in the region.

How are Market Players Responding to the Rising Demand for Private Nursing Services?

Market players are hugely investing in innovative research and developments to cater for the increasing need for the therapeutic equipment used in private nursing services. Some of the foremost players in the private nursing services market are The Ensign Group, Inc., LLC, Genesis Healthcare, Kindred Healthcare, Kaiser Permanente, Brookdale Senior Living, CBI Health Group, Inc., Apollo Hospitals Enterprise Ltd., Trinity Health, Columbia Asia, Grand World Elder Care, and others. These players are focused on planning and implementing strategies such as mergers and acquisitions, collaborations, novel advances, and partnerships to attain a remarkable position in the global market. For instance:

- In November 2021, Woodlands Hospital, a renowned healthcare facility in Kolkata, announced home care services that will allow individuals to access a variety of healthcare services at home. Nursing care, health check-ups, and physiotherapy are among the services provided.

- In June 2022, Marwari Hospitals, an extensive medical facility in Guwahati, launched two new programmes for the general public's benefit. The schemes are called 'Home Care Service' and 'Home Sample Collection'.

- In September 2022, Athulya Senior Care, one of the largest and most specialized suppliers of home healthcare and assisted living services in India, announced the launch of a new assisted living facility on Hosa Road, close to the electronic city, in Bengaluru.

COVID-19 Impact on the Global Private Nursing Services Market

The abrupt rise of the coronavirus pandemic in 2020 has adversely impacted the global private nursing services market. The COVID-19 pandemic put a burden on the world's healthcare system, and it is expected that wealthy countries will experience a downturn. The pandemic made a significant impact on the healthcare system, resulting in a revenue loss of 50% to 70% since March. Smaller medical facilities like hospitals, clinics, and nursing homes have been forced to close. Additionally, social isolation and local curfews have caused a delay in elective surgical procedures. Furthermore, the private nursing services sector may be hampered by visa cancellations, which have slowed medical tourism. However, after the relaxation of the pandemic, the private nursing services market is expected to grow significantly in the post-pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com