Commercial Robots Market Report

RA08658

Commercial Robots Market by Type (Field Robots, Medical Robots, Autonomous Guided Robotics, Drones, and Others), Application (Medical & Healthcare, Defense & Security, Agriculture & Forestry, Marine, and Other), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast 2022–2031

Global Commercial Robots Market Analysis

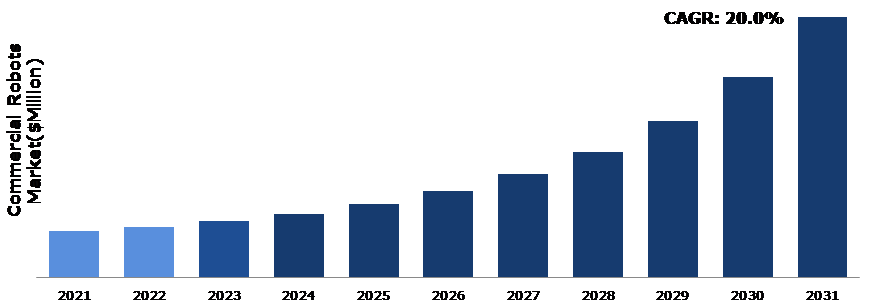

The Global Commercial Robots Market Size was $15,200.0 million in 2021 and is predicted to grow with a CAGR of 20.0%, by generating a revenue of $85,166.1 million by 2031.

Global Commercial Robots Market Synopsis

The medical and healthcare sectors are driving the increase in the uses of commercial and industrial robots. The lack of skilled workers promotes the usages of robot to drive the market growth. The development of the commercial robots in the e-commerce industry, especially at logistics hubs and warehouses, is projected to be influenced by an increase in consumers' tendency to make purchases online. The market is also expanding due to increased R&D spending as well as developments in IoT, AI and machine learning. Commercial robots, which are frequently used for surgical procedures, cleanliness, and the delivery of medicines, are now being used in the healthcare industry. These factors are predicted to drive the market growth. Additionally, ecommerce businesses are leveraging industrial and commercial robots to make their supply chain more efficient by deploying them in their distribution centers and warehouses. Use of commercial robots is also gaining traction owing to their capability of making deliveries faster. Also, the use of these robots in surveillance and communication is making them useful for areas like defense. Continued investment in R&D efforts and spending towards new product launches to capture emerging opportunities are expected to drive growth. However, the market is often restricted by high initial investment and deployment costs, which can be especially burdensome for small and medium-sized companies. These factors are anticipated to boost the commercial robots industry growth in the upcoming years.

However, the cost of purchasing market tools and utilizing the services offered by the leading players in the global market is high. Small and developing firms lack the funding required to purchase and utilize commercial robots across numerous departments and industry sectors. This will probably restrict the market for commercial robots from expanding as expected.

The increasing utilization of commercial robots all around the world and rising demand for robots are driving the growth of the commercial robots market. The companies are developing robots with advanced technologies and modern features due to the growing industrial sector. For instance, in November 2022 - Brain Corporation announced the release of a next-generation autonomous platform for commercial robots. The third-generation platform is an evolution of Brain Corp's BrainOS autonomous robotic operating system, which currently powers over 20,000 autonomous robots in public spaces and has been designed to underpin a future generation of intelligent robotic solutions for use across multiple commercial sectors.

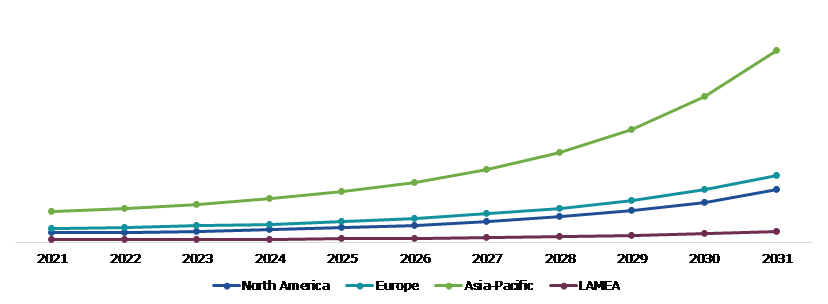

According to regional analysis, the Asia-Pacific commercial robots market accounted for a dominating market share in 2021 and it is anticipated to show the fastest growth by 2031. This is because of the widespread acceptance of the infrastructure necessary for the deployment of commercial robotic systems, the Asia-Pacific region is expected to dominate the market for commercial robots.

Commercial Robots Market Overview

Commercial robots are machines that can assist in replicating or substituting human actions in a variety of applications such as transporting materials within a factory, delivering retail products, medication, supplies, collecting and transmitting data, inspecting, recording videos, and monitoring ongoing projects, mapping activities, and more. Industrial robots are devices that can be operated and reprogrammed autonomously. They have three or more axes of multifunctional manipulator programmability.

COVID-19 Impact on Global Commercial Robots Market

The COVID-19 pandemic has brought several uncertainties leading to severe economic losses as various businesses across the world were on a standstill. This has ultimately lowered the demand for commercial robots due to disruptions in supply chain, closure of manufacturing plants, as well as economic slowdown across several countries. The COVID-19 pandemic affected most types of industrial and service robots, and it is predicted to have a short-term impact. COVID-19 has caused worldwide supply chain problems, resulting in shortages of some robot components and delayed deliveries. With many organizations suffering financial uncertainty, robot deployment may be delayed. With increased concern about the spread of COVID-19, there is a strong focus on ensuring that robots are safe and hygienic to use in a variety of settings. For instance, FANUC (Japan) announced that its ROBOT division's revenues for the fiscal year March 2020 were down 6.9% from the previous year. One of the causes for the reduction was the effect of COVID-19 at the end of the financial year.

Growing Investments and Fundings in Commercial Robots are Expected to Boost the Growth of the Global Market

The increasing number of technological investments and fundings is one of the important reasons driving the growth of the global commercial robots industry. According to the International Federation of Robotics' Global Robotics report, investments in new vehicle manufacturing capacities and industry modernization have fueled demand for robots. Additionally, the increased need for industrial robots is driving the worldwide robotic technology industry forward. BMW AG, for example, announced a contract with KUKA in 2020 to provide around 5,000 robots for new manufacturing lines and plants worldwide. According to KUKA, these industrial robots will be deployed internationally at BMW Group's international production facilities to produce current and future vehicle models. To know more about global commercial robots market drivers, get in touch with our analysts here.

High Cost of Commercial Robot Systems to Restrain the Market Growth

The initial capital investment necessary for programming, procurement, integration, and other accessories of robots is relatively substantial, making expansion of the service robots industry challenging. Furthermore, according to the Robotic Industries Association, the annual maintenance cost of these robots is between USD 2,50,000 and USD 10,000. This makes it difficult for organizations, especially small and medium-sized businesses, to invest in these robots since they find it hard to get substantial amounts of cash because of the low volume of production and lower return on investment (ROI). Additionally, numerous novel and cutting-edge commercial robotics models are anticipated to become available over the coming years. This is anticipated to increase the cost of the robots even further. Robot adoption in industries is anticipated to be hindered by this cost increase, particularly in India, Africa, and other emerging nations. Hence, a serious barrier to the expansion of the global commercial robotics industry is the high cost of robots.

Increasing Use of Commercial Robots in the Medical and Healthcare Industry to Drive Excellent Opportunities

Increased emphasis on the development of innovative medical treatment has also expanded the opportunity for commercial robot devices. The scope of robotic surgery and medical robotics has expanded with the inclusion of machine learning and artificial intelligence into the healthcare industry. The market's constant focus on research and development has driven it to create innovative, automated products for the healthcare industry. Because of the excellent success rate of robotic operations, companies are developing automated surgical solutions. These factors are predicted to create excellent opportunities for commercial robots.

To know more about global commercial robots market opportunities, get in touch with our analysts here.

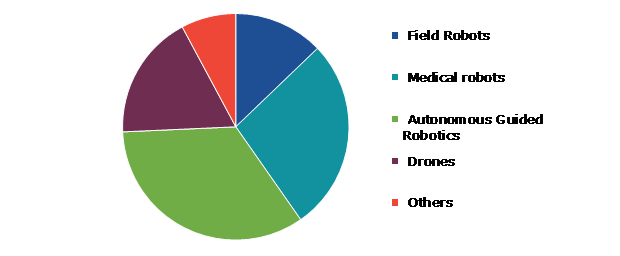

Global Commercial Robots Market, by Type

Based on type, the market has been divided into field robots, medical robots, autonomous guided robotics, drones, and others. Among these, the autonomous guided robotics sub-segment accounted for the highest market share in 2021, whereas the drone’s sub-segment is estimated to show the fastest growth during the forecast period.

Global Commercial Robots Market Share, by Type, 2021

Source: Research Dive Analysis

The autonomous guided robotics sub-type is accounted to have a dominant market share in 2021. Autonomous guided robots are widely used because of various advantages, including lower labor costs, less product damage, higher productivity, and the ability to support automated operations. These significant benefits are prompting transportation and logistics companies to install autonomous guided robots to improve the efficiency of their operations. For instance, in May 2021, Audi AG reported using automatic guided vehicle system (AGVs) in their manufacturing facilities to assist in planning the production process by letting them know which component is out of stock and must be available.

The drones sub-type is anticipated to show the fastest growth during the forecast period. Drones are gaining popularity and are being used in a wide range of settings, including the commercial sector. Additionally, numerous startups and tech powerhouses are assiduously investing in this technology to quickly increase their market share. Many governmental and private entities are collaborating and gearing in the market; for example, in August 2022, the Drone Federation of India signed an Agreement with the Indian Army Design Bureau to speed drone technology development and indigenization in the drone ecosystem.

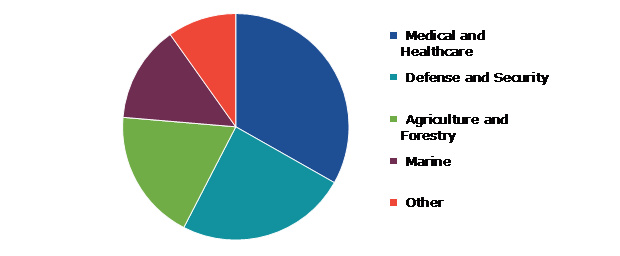

Global Commercial Drone Market, by Application

Based on application, the market has been divided into medical & healthcare, defense & security, agriculture & forestry, marine, and other. Among these, the medical & healthcare sub-segment accounted for highest revenue share in 2021.

Global Commercial Robots Market Size, by Application, 2021

Source: Research Dive Analysis

The medical & healthcare sub-segment accounted a dominant market share in 2021. The increased awareness of the advantages of medical robots in the healthcare industry has caused the industry to grow significantly. The IoT sector and investments in robots have been the main market development factor. The healthcare sector strongly favors technological innovation. Additionally, commercial robots are being created to help patients and medical staff due to the ageing population, which is on the rise and requires more care. Robotics in rehabilitation help in treating individuals. Medical assistance robots are also utilized to help with surgery and diagnosis by bringing necessary equipment or transporting tools and other medical supplies. Medical robots are becoming more popular because of the benefits of minimally invasive surgery. These factors are anticipated to boost the growth of medical & healthcare sub-segment during the analysis timeframe.

Global Commercial Robots Market, Regional Insights

The commercial robots market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Commercial Robots Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Commercial Robots in Asia-Pacific to be the Most Dominant

The Asia-Pacific commercial robots market accounted a dominating market share in 2021. The Asia-Pacific region holds a significant share of the market due to the region's rising labor expenses, which force enterprises to automate their manufacturing processes to maintain a competitive advantage. Due to low manufacturing costs, easy access to economic labor, moderate emissions, safety requirements, and government incentives for foreign direct investment (FDI), the industrial robotics market will experience rapid growth in Asia-Pacific countries.

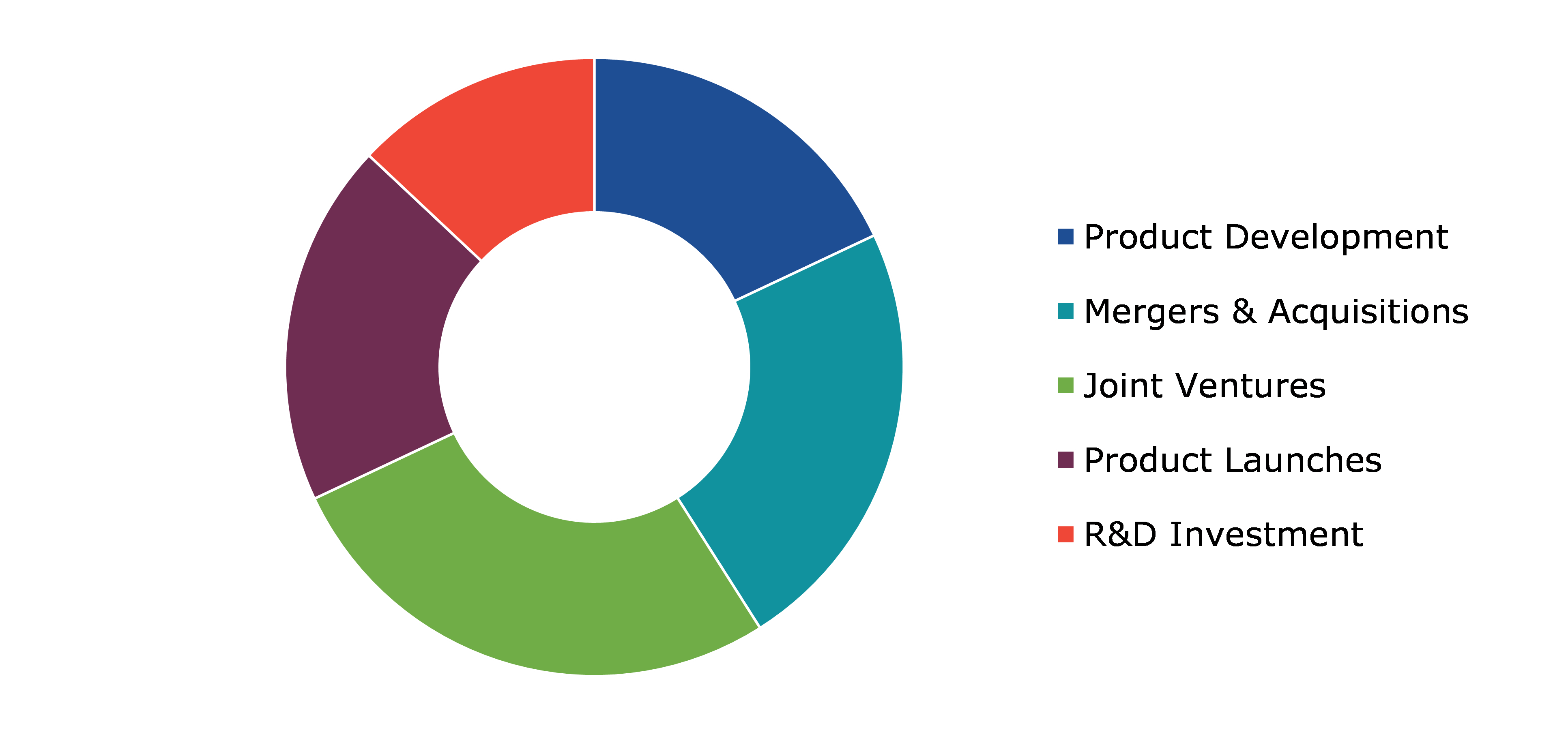

Competitive Scenario in the Global Commercial Robots Market

Investment and agreement are common strategies followed by major market players. For instance, in April 2021, Kuka AG announced the launch of the new operating system iiQKA.OS, which greatly simplifies robot use. This new operating system serves as the cornerstone of the entire ecosystem, offering a diverse set of programs, components, apps, devices, and services.

Source: Research Dive Analysis

Some of the leading commercial robots market players are Northrop Grumman Corp., Kuka AG, iRobot Corporation, Yaskawa Electric Corporation, Omron Adept Technologies Inc., Honda Motor Company Limited, 3D Robotics Inc., Alphabet Inc., Accuray Inc., and AeroVironment Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global commercial robots market?

A. The size of the global commercial robots market was over $15,200.0 million in 2021 and is projected to reach $85,166.1 million by 2031.

Q2. Which are the major companies in the commercial robots market?

A. Northrop Grumman Corp., Kuka AG, iRobot Corporation, Yaskawa Electric Corporation are some of the key players in the global commercial robots market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific commercial robots market?

A. Asia-Pacific commercial robots market is anticipated to grow at 21.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Northrop Grumman Corp., Kuka AG, iRobot Corporation, Yaskawa Electric Corporation are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global commercial robots market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on global commercial robots market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Commercial Robots Market Analysis, by Type

5.1.Overview

5.2.Field Robots

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2022-2031

5.2.3.Market share analysis, by country,2022-2031

5.3.Medical robots

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2022-2031

5.3.3.Market share analysis, by country,2022-2031

5.4.Autonomous Guided Robotics

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region,2022-2031

5.4.3.Market share analysis, by country,2022-2031

5.5.Drones

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region,2022-2031

5.5.3.Market share analysis, by country,2022-2031

5.6.Others

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region,2022-2031

5.6.3.Market share analysis, by country,2022-2031

5.7.Research Dive Exclusive Insights

5.7.1.Market attractiveness

5.7.2.Competition heatmap

6.Commercial Robots Market, by Application

6.1.Overview

6.2.Medical and Healthcare

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2022-2031

6.2.3.Market share analysis, by country,2022-2031

6.3.Defense and Security

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2022-2031

6.3.3.Market share analysis, by country,2022-2031

6.4.Agriculture and Forestry

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region,2022-2031

6.4.3.Market share analysis, by country,2022-2031

6.5.Marine

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region,2022-2031

6.5.3.Market share analysis, by country,2022-2031

6.6.Others

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region,2022-2031

6.6.3.Market share analysis, by country,2022-2031

6.7.Research Dive Exclusive Insights

6.7.1.Market attractiveness

6.7.2.Competition heatmap

7.Commercial Robots Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type,2022-2031

7.1.1.2.Market size analysis, by Application,2022-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type,2022-2031

7.1.2.2.Market size analysis, by Application,2022-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type,2022-2031

7.1.3.2.Market size analysis, by Application,2022-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type,2022-2031

7.2.1.2.Market size analysis, by Application,2022-2031

7.2.2.U.K.

7.2.2.1.Market size analysis, by Type,2022-2031

7.2.2.2.Market size analysis, by Application,2022-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type,2022-2031

7.2.3.2.Market size analysis, by Application,2022-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type,2022-2031

7.2.4.2.Market size analysis, by Application,2022-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type,2022-2031

7.2.5.2.Market size analysis, by Application,2022-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type,2022-2031

7.2.6.2.Market size analysis, by Application,2022-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type,2022-2031

7.3.1.2.Market size analysis, by Application,2022-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type,2022-2031

7.3.2.2.Market size analysis, by Application,2022-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type,2022-2031

7.3.3.2.Market size analysis, by Application,2022-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type,2022-2031

7.3.4.2.Market size analysis, by Application,2022-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type,2022-2031

7.3.5.2.Market size analysis, by Application,2022-2031

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type,2022-2031

7.3.6.2.Market size analysis, by Application,2022-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type,2022-2031

7.4.1.2.Market size analysis, by Application,2022-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type,2022-2031

7.4.2.2.Market size analysis, by Application,2022-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type,2022-2031

7.4.3.2.Market size analysis, by Application,2022-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type,2022-2031

7.4.4.2.Market size analysis, by Application,2022-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type,2022-2031

7.4.5.2.Market size analysis, by Application,2022-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2022

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2022

9.Company Profiles

9.1.Northrop Grumman Corp.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Kuka AG

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.iRobot Corporation

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Yaskawa Electric Corporation

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Omron Adept Technologies Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Honda Motor Company Limited

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.3D Robotics Inc.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Alphabet Inc.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Accuray Inc.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.AeroVironment Inc.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Commercial robots, sometimes referred to as cobots, are anthropomorphic machines built to aid humans in simplifying certain complex tasks and perform certain iterative procedures. Commercial robots find applications in different sectors including healthcare, agriculture, defense, manufacturing, logistics, and others. These robots are designed to collect, store, and process the data from their surroundings and, in turn, use these data points to learn and improve themselves to further ease the procedures for which they are used.

Forecast Analysis of the Commercial Robots Market

In recent years, there has been a steady increase in investments and funding in the development of commercial robots from various market players which is predicted to be the primary growth driver of the global commercial robots market during the forecast period. In addition, the rising expansion of the medical and healthcare sector is anticipated to drive the market forward. Along with this, advancements in new-age technologies such as IoT, AI and machine learning are projected to create numerous growth and investment opportunities for the market players during the forecast timeframe. However, the high cost of commercial robot systems is estimated to hamper the growth of the commercial robots market in the upcoming years.

Regionally, the commercial robots market in the Asia-Pacific region is expected to be the most dominant by 2031. The rising cost of manual labor and increasing foreign direct investments in the robotics sector are expected to be the leading factors driving the growth of the market in this region.

According to the report published by Research Dive, the commercial robots market is expected to generate a revenue of $85,166.1 million by 2031 and grow at 20.0% CAGR during the 2022 to 2031 timeframe. Some of the prominent market players include Northrop Grumman Corp., Omron Adept Technologies Inc., Alphabet Inc., Kuka AG, Honda Motor Company Limited, Accuray Inc., iRobot Corporation, 3D Robotics Inc., AeroVironment Inc., and Yaskawa Electric Corporation.

COVID-19 Impact on the Market

The outbreak of the COVID-19 pandemic had a massive negative effect on almost all industries and businesses across the world. The commercial robots market also witnessed a negative impact owing to the pandemic. The lockdowns and travel restrictions severely affected the supply of raw materials necessary for manufacturing commercial robots which caused a decline in the market growth. Furthermore, closure of manufacturing industries led to a fall in demand for commercial robots which hampered the growth rate of the market.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the commercial robots market to flourish. For instance:

- In May 2021, Ondas Holdings Inc., a leading wireless broadband technology provider, announced the acquisition of American Robotics, a commercial drone manufacturing firm. This acquisition will help Ondas Holdings to integrate their wireless broadband technological solutions with the drone systems and provide advanced robotic infrastructure to various industrial players.

- In March 2021, The Toro Company, a landscaping equipment manufacturing company, announced the acquisition of Left Hand Robotics, Inc., a robotic machinery manufacturer. This acquisition is predicted to increase the footprint of the acquiring company in the commercial robots market in the future.

- In February 2023, Rapid Robotics, a leading automation company, announced that it had signed a partnership agreement with Universal Robots, a Denmark-based commercial robot manufacturer. This partnership is aimed at developing commercial robots and supplying them to different manufacturing companies in the North America region. The collaboration is anticipated to help both the companies to pool their resources and cater to the demands of the manufacturing sector.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com