Alpaca Fiber Market Report

RA08656

Alpaca Fiber Market by Type (Huacaya Fiber and Suri Fiber), Application (Flooring, Textile, Industrial Felting, and Others), Grade (Ultra Fine, Superfine, Fine, Medium, and Intermediate), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2030

Global Alpaca Fiber Market Analysis

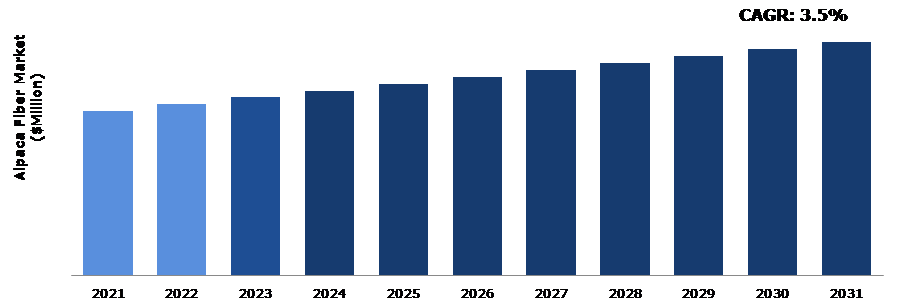

The Global Alpaca Fiber Market Size was $846.50 million in 2021 and is predicted to grow with a CAGR of 3.5%, by generating a revenue of $1,201.5 million by 2031.

Global Alpaca Fiber Market Synopsis

The natural fiber obtained from an alpaca is known as alpaca fleece that is in demand in the luxury clothing market, which can be sold for a premium price. This has made alpaca breeding a potentially profitable business for many farmers. Alpacas are easy to care for compared to other livestock, as they require minimal feed, shelter, and medical care. They are also well-suited to a range of climates, making them an attractive option for farmers in diverse regions.

However, some of the disadvantages of alpaca farming are that fiber production can be expensive, particularly if high-quality fiber is desired. Factors that influence production costs include feed, labor, veterinary care, and shearing costs. The quality of alpaca fiber can vary depending on factors such as the age of the alpaca, its diet, and the environment in which it is raised. Higher quality alpaca fiber is more valuable and can command a higher price.

The alpaca fiber market presents several opportunities for businesses and entrepreneurs who are looking to meet the growing demand for sustainable and luxury products while promoting ethical and sustainable practices. Consumers are increasingly interested in the social and ethical practices of the companies they buy from. Alpaca farming and fiber production can be done in a way that promotes social responsibility, such as fair labor practices and responsible land use.

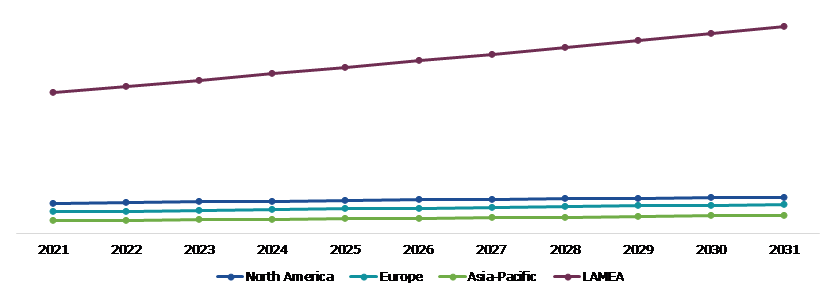

According to regional analysis, the LAMEA alpaca fiber market accounted for a dominant market share in 2021. This is because Peru is the largest producer and exporter of alpaca fiber.

Alpaca Fiber Overview

Alpaca fiber is a natural fiber that is derived from the fleece of the alpaca, a domesticated South American mammal related to llamas and camels. Alpaca fiber is highly prized for its softness, warmth, and durability, and is used to produce a range of luxury textiles and clothing items. The fiber comes in a variety of natural colors, including white, black, brown, and gray, and can also be dyed to create a wide range of vibrant colors. Alpaca fiber is considered to be a sustainable and eco-friendly alternative to synthetic fibers, as it is biodegradable and can be produced without the use of harmful chemicals or synthetic materials. Alpaca fiber is also hypoallergenic, making it a good choice for people with sensitive skin.

COVID-19 Impact on Global Alpaca Fiber Market

The COVID-19 pandemic has had a significant impact on the alpaca fiber market, as it has on many other industries. The pandemic disrupted the global supply chains, making it more difficult to source and transport alpaca fiber and products. Lockdowns and travel restrictions have also made it more difficult for farmers and manufacturers to access markets and customers. For instance, the pandemic has led to changes in consumer behavior, with many people shifting their purchasing habits towards online shopping and prioritizing comfort and sustainability in their purchases. This has created opportunities for businesses that can adapt to these changing trends but has also increased competition in the market.

Growing Applications of Alpaca Fiber in Textile Industry Sector to Drive the Market Growth

Rising income levels can lead to increased demand for luxury goods, including alpaca fiber products. As consumers become more affluent, they may be more willing to spend money on high-quality, sustainable, and ethically produced products. As the number of affluent consumers grows, so does the market for high-end luxury goods. This can create opportunities for businesses that cater to high-end markets, including those that specialize in alpaca fiber products. Rising income levels can also lead to increased investment in the alpaca fiber industry. Investors may be more willing to fund research and development, marketing, and other activities that can help to grow the market. Increased investment can also lead to innovation in the alpaca fiber industry. Businesses may invest in new technologies and processes that can help to improve the quality and efficiency of alpaca fiber production or develop new products that appeal to a broader range of consumers.

To know more about global alpaca fiber market drivers, get in touch with our analysts here.

Limited Production and Supply of Alpaca Fiber to Restrain the Market Growth

Alpaca fiber production is limited by the number of alpacas available, and it can take several years for new alpaca herds to become productive. This can limit the amount of alpaca fiber that can be produced, which can affect the availability and pricing of alpaca fiber products. In addition, one of the main challenges with processing alpaca fiber is its high moisture content. Alpaca fiber is naturally very soft and fine, which makes it prone to matting and felting if it becomes wet. As a result, processing alpaca fiber typically involves a more delicate and time-consuming process than processing other natural fibers.

Increasing Use of New Innovative Manufacturing Processes to Improve Quality of Alpaca Fiber to Drive Excellent Opportunities

Innovation, such as fleece assessment to recognize the genetic value of alpaca, can also help to improve the efficiency of alpaca fiber production and manufacturing processes. This can reduce costs and increase productivity, making alpaca fiber products more affordable and accessible to a wider range of consumers. Innovation in processing and manufacturing can lead to improvements in the quality of alpaca fiber products. This can help to differentiate alpaca fiber from other natural fibers and synthetic materials and make it more attractive to consumers. The product presents opportunities for the production of incredibly cozy and adaptable winter clothing. Additionally, the product's hypoallergenic qualities are likely to give it a competitive edge over its synthetic counterparts over the anticipated time frame. Demand is anticipated to increase as consumer awareness of the benefits of the product increases. Additionally, it is anticipated that easily accessible alpaca fiber fashion stores will make these products readily available, positively impacting the alpaca fiber market.

To know more about global alpaca fiber market opportunities, get in touch with our analysts here.

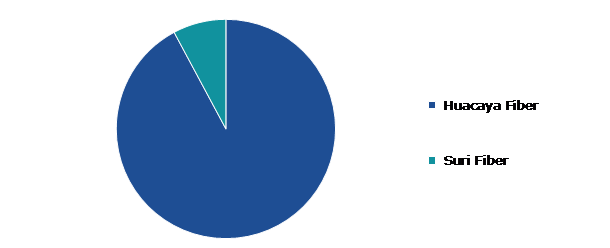

Global Alpaca Fiber Market, by Type

Based on type, the market has been divided into Huacaya fiber and Suri fiber. Among these, the Huacaya fiber sub-segment generated the maximum revenue in 2021.

Global Alpaca Fiber Market Share, by Type, 2021

Source: Research Dive Analysis

The Huacaya fiber sub-segment accounted for a dominant market share in 2021. Huacaya fiber has a crimped and fluffy appearance, with a denser and more compact structure than Suri fiber, which is the other main type of alpaca fiber. The market segment for Huacaya fiber is driven by consumer demand for high-quality, sustainable, and eco-friendly textiles. As the demand for natural fibers continues to grow, particularly in the sustainable fashion and home decor markets, the Huacaya fiber market is likely to continue to expand and evolve.

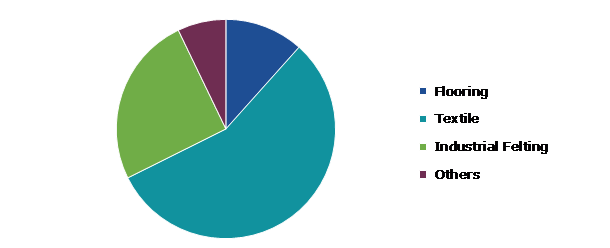

Global Alpaca Fiber Market, by Application

Based on application, the market has been divided into flooring, textile, industrial felting and other. Among these, the textile sub-segment accounted for a dominant market share in 2021.

Global Alpaca Fiber Market Size, by Application, 2021

Source: Research Dive Analysis

The textile sub-segment accounted for a dominant market share in 2021. The textile industry is one of the key segments of the alpaca fiber market, as alpaca fiber is used to produce a wide range of high-quality textiles. Alpaca fiber is prized for its softness, warmth, and durability, making it an ideal material for a range of textiles, including clothing, blankets, and home decor items. The main textile products made from alpaca fiber is yarn. Alpaca yarn is available in a range of weights and blends and is popular among knitters and weavers for its softness, drape, and warmth. Alpaca yarn can be used to create a wide range of textile products, including sweaters, scarves, hats, and shawls.

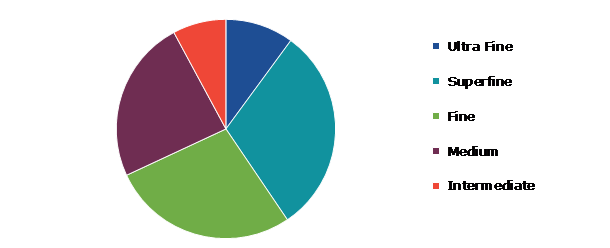

Global Alpaca Fiber Market, by Grade

Based on grade, the market has been divided into ultra fine, superfine, fine, medium, intermediate. Among these, the superfine sub-segment accounted for highest revenue share in 2021.

Global Alpaca Fiber Market Growth, by Grade, 2021

Source: Research Dive Analysis

The superfine sub-segment accounted for a dominant market share in 2021. The market segment for superfine grade alpaca fiber is typically focused on high-end luxury products, including fine knitwear, shawls, and scarves. Superfine grade alpaca fiber is also used in the production of high-end home textiles, such as blankets and throws. The demand for superfine grade alpaca fiber is driven by consumers who are looking for high-quality, sustainable, and eco-friendly products that are also soft and luxurious to touch. Superfine grade alpaca fiber is particularly popular among consumers who are interested in sustainable fashion and home decor, as it is a natural, renewable resource that is produced without the use of harmful chemicals or synthetic materials.

Global Alpaca Fiber Market, Regional Insights

The alpaca fiber market was investigated across LAMEA, Europe, Asia-Pacific, and LAMEA.

Global Alpaca fiber Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Alpaca fiber in LAMEA is the Most Dominant

LAMEA is one of the largest markets for alpaca fiber, and there are several factors driving its growth in this region. There has been a growing interest in sustainable and eco-friendly materials in LAMEA, which has led to an increased demand for natural fibers like those from alpacas. Consumers are becoming more conscious of the environmental impact of their purchases and are seeking out products that are made using sustainable and ethical practices. The fashion industry has been a significant driver of growth in the LAMEA alpaca fiber market. High-end fashion designers are incorporating alpaca fiber into their collections, and consumers are willing to pay a premium for high-quality, luxury garments made from this material. there has been a rise in alpaca farming and breeding in LAMEA, which has led to an increase in the availability of alpaca fiber. This has made it easier for businesses to source and produce alpaca fiber products, and has also helped to bring down the cost of production. The popularity of outdoor activities like hiking and camping has also contributed to the growth of the alpaca fiber market in LAMEA. Alpaca fiber is known for its excellent insulating properties, making it an ideal material for outdoor clothing and accessories. The combination of these factors is expected to continue driving growth in the LAMEA alpaca fiber market, creating new opportunities for businesses operating in this space.

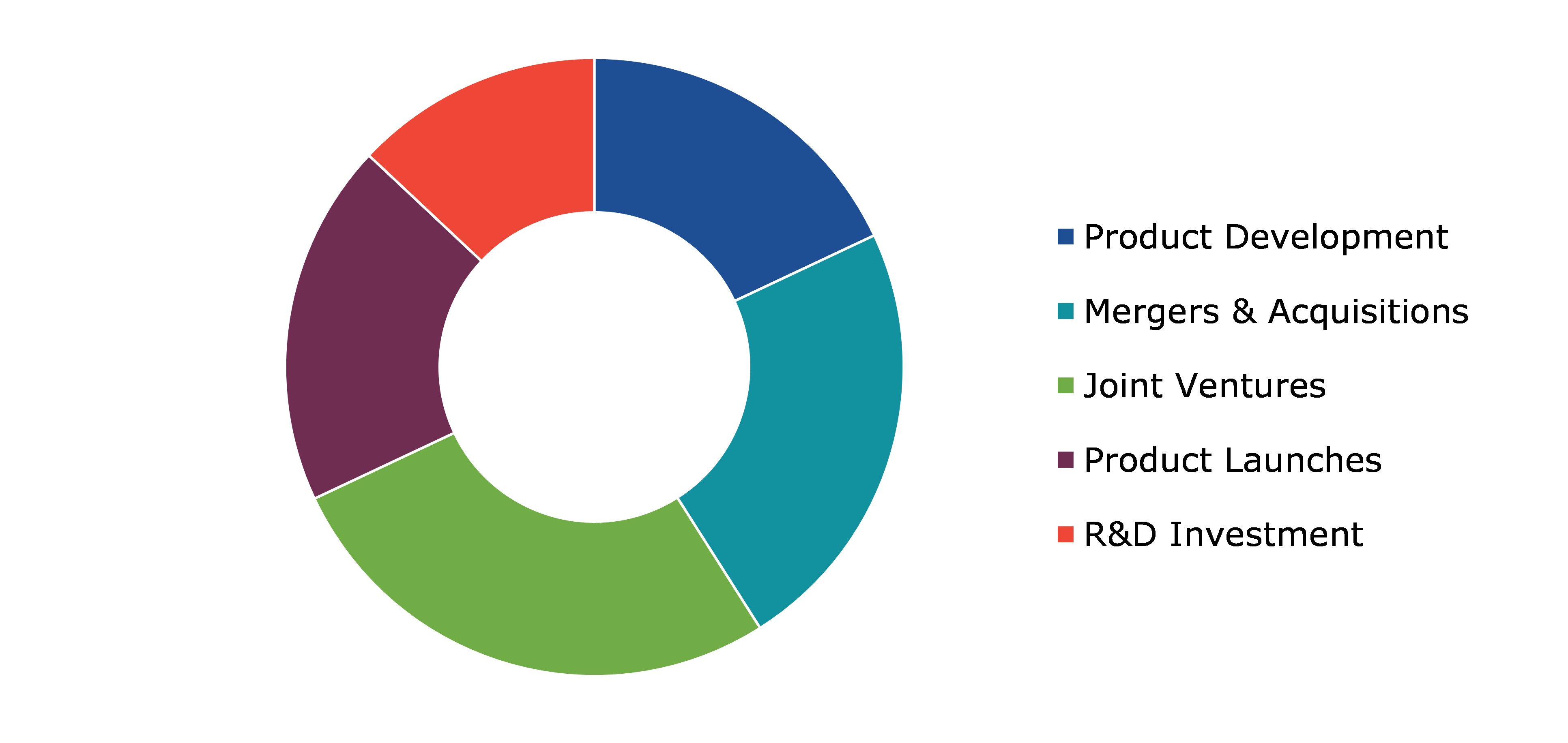

Competitive Scenario in the Global Alpaca Fiber Market

Investment and agreement are common strategies followed by major market players. For instance, in October 2021, China’s largest yarn exporter, Consinee Group, partnered with Alpaca yarn, company which is specializes in producing high-quality alpaca yarn products, for increasing their production and apparel clothing offered with alpaca fiber to the world.

Source: Research Dive Analysis

Some of the leading alpaca fiber market players are AHA Bolivia, The Alpaca Yarn Company, The Natural Fibre Company, Zeilinger Wool Co., Altifibers S.A., Alpaca Owners Association, Inc., Plymouth Yarn Company, Inc., Mary Maxim Inc., Berroco, Inc., and Stichting Agriterra.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application

|

|

| Segmentation by Grade |

|

| Key Companies Profiled |

|

Q1. What is the size of the global alpaca fiber market?

A. The size of the global alpaca fiber market was over $846.50 million in 2021 and is projected to reach $1,201.50 million by 2031.

Q2. Which are the major companies in the alpaca fiber market?

A. AHA Bolivia, The Alpaca Yarn Company, and The Natural Fibre Company are some of the key players in the global alpaca fiber market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The LAMEA region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific alpaca fiber market?

A. Asia-Pacific alpaca fiber market is anticipated to grow at 3.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Zeilinger Wool Co., Altifibers S.A., and Alpaca Owners Association are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global alpaca fiber market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on alpaca fiber market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Alpaca Fiber Market Analysis, by Type

5.1.Overview

5.2.Huacaya Fiber

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Suri Fiber

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Alpaca Fiber Market Analysis, by Application

6.1.Overview

6.2.Flooring

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Textile

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Industrial Felting

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Others

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021-2031

6.5.3.Market share analysis, by country, 2021-2031

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Alpaca Fiber Market Analysis, by Grade

7.1.Ultra Fine

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2.Superfine

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Fine

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2021-2031

7.3.3.Market share analysis, by country, 2021-2031

7.4.Medium

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2021-2031

7.4.3.Market share analysis, by country, 2021-2031

7.5.Intermediate

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region, 2021-2031

7.5.3.Market share analysis, by country, 2021-2031

7.6.Others

7.6.1.Definition, key trends, growth factors, and opportunities

7.6.2.Market size analysis, by region, 2021-2031

7.6.3.Market share analysis, by country, 2021-2031

7.7.Research Dive Exclusive Insights

7.7.1.Market attractiveness

7.7.2.Competition heatmap

8.Alpaca Fiber Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Type, 2021-2031

8.1.1.2.Market size analysis, by Application, 2021-2031

8.1.1.3.Market size analysis, by Grade, 2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Type, 2021-2031

8.1.2.2.Market size analysis, by Application, 2021-2031

8.1.2.3.Market size analysis, by Grade, 2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Type, 2021-2031

8.1.3.2.Market size analysis, by Application, 2021-2031

8.1.3.3.Market size analysis, by Grade, 2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Type, 2021-2031

8.2.1.2.Market size analysis, by Application, 2021-2031

8.2.1.3.Market size analysis, by Grade, 2021-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Type, 2021-2031

8.2.2.2.Market size analysis, by Application, 2021-2031

8.2.2.3.Market size analysis, by Grade, 2021-2031

8.2.3.Switzerland

8.2.3.1.Market size analysis, by Type, 2021-2031

8.2.3.2.Market size analysis, by Application, 2021-2031

8.2.3.3.Market size analysis, by Grade, 2021-2031

8.2.4.Rest of Europe

8.2.4.1.Market size analysis, by Type, 2021-2031

8.2.4.2.Market size analysis, by Application, 2021-2031

8.2.4.3.Market size analysis, by Grade, 2021-2031

8.2.5.Research Dive Exclusive Insights

8.2.5.1.Market attractiveness

8.2.5.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Type, 2021-2031

8.3.1.2.Market size analysis, by Application, 2021-2031

8.3.1.3.Market size analysis, by Grade, 2021-2031

8.3.2.Australia

8.3.2.1.Market size analysis, by Type, 2021-2031

8.3.2.2.Market size analysis, by Application, 2021-2031

8.3.2.3.Market size analysis, by Grade, 2021-2031

8.3.3.New Zealand

8.3.3.1.Market size analysis, by Type, 2021-2031

8.3.3.2.Market size analysis, by Application, 2021-2031

8.3.3.3.Market size analysis, by Grade, 2021-2031

8.3.4.Rest of Asia Pacific

8.3.4.1.Market size analysis, by Type, 2021-2031

8.3.4.2.Market size analysis, by Application, 2021-2031

8.3.4.3.Market size analysis, by Grade, 2021-2031

8.3.5.Research Dive Exclusive Insights

8.3.5.1.Market attractiveness

8.3.5.2.Competition heatmap

8.4.LAMEA

8.4.1.Peru

8.4.1.1.Market size analysis, by Type, 2021-2031

8.4.1.2.Market size analysis, by Application, 2021-2031

8.4.1.3.Market size analysis, by Grade, 2021-2031

8.4.2.Bolivia

8.4.2.1.Market size analysis, by Type, 2021-2031

8.4.2.2.Market size analysis, by Application, 2021-2031

8.4.2.3.Market size analysis, by Grade, 2021-2031

8.4.3.Chile

8.4.3.1.Market size analysis, by Type, 2021-2031

8.4.3.2.Market size analysis, by Application, 2021-2031

8.4.3.3.Market size analysis, by Grade, 2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Type, 2021-2031

8.4.4.2.Market size analysis, by Application, 2021-2031

8.4.4.3.Market size analysis, by Grade, 2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Type, 2021-2031

8.4.5.2.Market size analysis, by Application, 2021-2031

8.4.5.3.Market size analysis, by Grade, 2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.AHA Bolivia

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.The Alpaca Yarn Company

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.The Natural Fibre Company

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Zeilinger Wool Co.

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Altifibers S.A.

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Alpaca Owners Association, Inc.

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Plymouth Yarn Company, Inc.

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Mary Maxim Inc.

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Berroco, Inc.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Stichting Agriterra

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Alpaca fiber or fleece is a natural fiber collected from alpaca, a camel-like animal found in the Latin Americas. Alpaca fiber is more durable and stronger than natural wool and has a smoother texture than wool. Moreover, since the diameter of alpaca fiber is smaller than its counterpart, it has become the primary raw material for manufacturing of luxury clothing items. Additionally, alpaca fleece has certain unique advantages of temperature regulation and water resistance which has further increased its popularity in the textile industry in the last few years.

Forecast Analysis of Alpaca Fiber Market

Growing applications of alpaca fiber in the global textile manufacturing industry is predicted to be the primary growth driver of the global alpaca fiber market in the forecast period. Additionally, increasing usage of alpaca fiber in manufacturing of luxury clothing items is anticipated to push the market forward. Along with this, rapid adoption of innovative manufacturing processes to improve alpaca fiber quality is projected to offer numerous growth and investment opportunities to the market in the analysis timeframe. However, limited production and supply of alpaca fiber is estimated to create hurdles in the full-fledged growth of the alpaca fiber market in the coming period.

Regionally, the alpaca fiber market in the LAMEA region is expected to be the most dominant by 2031. Growing interest in sustainable and eco-friendly clothing materials has led to a rise in demand for natural fibers which is expected to be the leading factor behind the growth of the market in this region.

According to the report published by Research Dive, the alpaca fiber market is expected to gather a revenue of $1,201.5 million by 2031 and grow at 3.5% CAGR in the 2022-2031 timeframe. Some prominent market players include AHA Bolivia, Altifibers S.A., Mary Maxim Inc., The Alpaca Yarn Company, Alpaca Owners Association, Inc., Berroco, Inc., The Natural Fibre Company, Plymouth Yarn Company, Inc., Stichting Agriterra, Zeilinger Wool Co., and many others.

Covid-19 Impact on the Alpaca Fiber Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The alpaca fiber market, too, faced a negative impact of the pandemic. The disruptions in the global supply chains immensely affected the regular supply of raw materials which affected the production cycles of the majority of textile manufacturing companies. This brought down the growth rate of the market in the pandemic period.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the alpaca fiber market to flourish. For instance:

- In June 2021, Textile Exchange, a non-profit organization, announced the launch of the Responsible Alpaca Standard which aims to set certain criteria for sustainable collection of alpaca yarn. The standard is expected to streamline all operations related to alpaca yarn manufacturing and will push the market players to establish and manage their global supply chains responsibly.

- In October 2021, Consinee Group, a global luxury yarn producer, announced a partnership with South American alpaca industry. Through this partnership agreement, Consinee Group aims to expand their alpaca yarn production by 30% in five years. This collaboration is expected to offer all the partners huge growth opportunities in the next five years as they will be able to consolidate their lead in the luxury textile industry.

- In January 2022, Bast Fiber Technologies, a specialty natural fibers manufacturer, announced the acquisition of Lumberton Cellulose LLC (LC), a North Carolina-based natural fiber processing company. This acquisition is predicted to increase the footprint of Bast Fiber Technologies substantially in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com