Urinary Tract Infection Testing Market Report

RA08596

Urinary Tract Infection Testing Market by Infection Type (Urethritis, Cystitis, Pyelonephritis), Test Type (Urinalysis, Urine Cultures, Susceptibility Testing), End User (Hospitals, Diagnostic Laboratories, Research Institutes), and Test Kit (Home Test Kits Laboratory Test Kits), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Urinary Tract Infection Testing Market Analysis

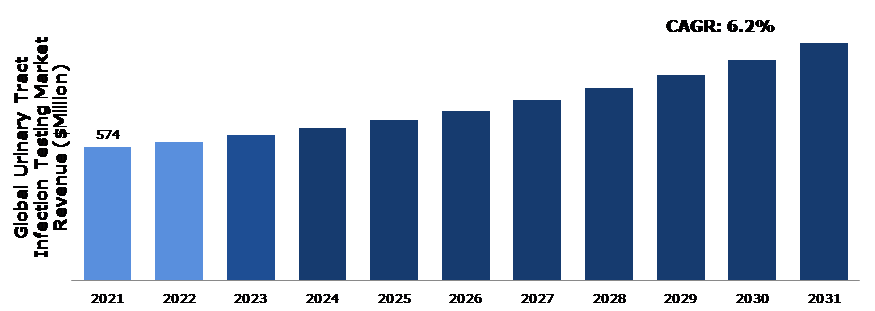

The Global Urinary Tract Infection Testing Market Size was $574 million in 2021 and is predicted to expand at a CAGR of 6.2%, generating revenue of $1,027.4 million by 2031.

Global Urinary Tract Infection Testing Market Synopsis

An infection of the urinary system, including the lower urinary tract or both the lower and upper urinary tracts, is known as a urinary tract infection (UTI). It occurs because microbes such as bacteria overcome the body’s defenses in the urinary tract and impact the bladder, kidneys, and the tubes that run between them. Women, immunocompromised people, older people, and patients using catheters and undergoing radiotherapy treatment are more prone to complicated UTIs. In addition, people with blockages and kidney function problems have higher chances of developing a critical UTI. Compared to men, women are more prone to UTIs. When it comes to adult women, disease incidence tends to rise with age.

The increase in geriatric population worldwide is anticipated to propel the urinary tract infection testing market growth during the forecast period. According to the World Health Organization (WHO), by the year 2030, 1 in 6 people across the world will be aged 60 years or over. UTIs occur more frequently in aging people, especially, in those who are in long-term care facilities. As the aging population increases worldwide, the burden of UTIs is anticipated to increase, thus, increasing the need for urinary tract infection testing.

False results from UTI testing, however, can hamper the urinary tract infection testing market demand. Rapid testing or dipstick tests can produce false-positive findings in one out of every five patients. The availability of at-home sample collection kits and self-testing kits for UTI testing is likely to offer ample growth opportunities to major market players. A home test kit, for instance, is offered in the UK by Healthy.io Ltd. Major players are anticipated to boost their investments in point-of-care testing for UTIs, which will be an important growth factor. Furthermore, researchers are developing cutting-edge medical diagnostic tools that will likely be commercialized in the coming years.

Urinary Tract Infection Testing Market Overview

A urinary tract infection (UTI) is an infection in the urinary system, including the bladder and urethra. If UTI is not diagnosed on time, it can cause kidney disease. UTI is caused by the bacteria that live in the genital, vagina, and anal areas. These bacteria can enter the urethra and the bladder and induce an infection. UTI can also be caused by gonorrhea, chlamydia, or other organisms.

COVID-19 Impact on Global Urinary Tract Infection Testing Market

The major symptoms in patients with COVID-19 are generally associated with the respiratory organ system. Some studies have also discovered the involvement of other organ systems, including the cardiovascular, gastrointestinal, central nervous, and lower urinary tract systems. The lower urinary tract symptoms can be severe, depending on the severity of the infection from COVID-19. Various studies have shown white blood cells and hematuria in the urine of a patient with COVID-19. UTIs caused by COVID-19 infection are more common in men than women and patients who are admitted to the hospital because of severe coronavirus infection. Pain in the male genitals is the most common symptom of UTIs caused by COVID-19.

Increase in Prevalence of Urinary Tract Infection Expected to Propel the Growth of the Global Urinary Tract Infection Testing Market

UTIs are one of the most frequently diagnosed infections impacting the human population across the world, with a lifetime occurrence of 50−60% in adult women. Several evaluations show that around 150 million people are diagnosed with UTI every year, which causes severe complications if left untreated. Except for a spike in young women aged between 14−24 years, the occurrence of UTIs grows with age. Moreover, the prevalence in women aged over 65 years of age is about 20%, compared with approximately 11% in the overall population.

UTIs can impact the quality of life of the patient and puts a clinical and financial burden on the patient. Due to this and other mentioned factors, the need for urinary tract infection testing is rising.

To know more about the global urinary tract infection testing market drivers, get in touch with our analysts here.

Wrong Results Associated with Urinary Tract Infection Testing Expected to Hinder the Market Growth

According to several studies, urinary tract infections wrongly show a negative result in a fifth of cases. Many times, patients can receive negative results for a urine test, but can still exhibit symptoms of UTIs. Exposing patients to poor test results lead to false positive or false negative results. Doctors usually act on these false results, which can cause undue evaluation and treatment. Such testing errors increase uncertainty and confusion among the patients.

Increase in R&D Activities on UTI Testing Kits Expected to Offer Lucrative Growth Opportunities to Key Players in the Global Urinary Tract Infection Testing Market

Companies are anticipated to increase their investments in point-of-care (POC) testing for UTIs, which is likely to offer ample growth opportunities. POC testing for UTIs can reduce the time required to get a precise diagnosis, offers doctors specific guidance on which antibiotics to prescribe for maximum therapeutic use, and ease the laboratory load of urine specimens and associated costs. Researchers are developing cutting-edge medical diagnostic tools that will likely be commercialized in the coming years. These are some of the major factors which are anticipated to provide major participants in the market with lucrative growth prospects during the forecast period.

To know more about the global urinary tract infection testing market opportunities, get in touch with our analysts here.

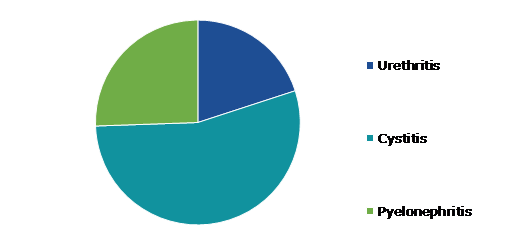

Global Urinary Tract Infection Testing Market, by Infection Type

On the basis of infection type, the market is divided into urethritis, cystitis, and pyelonephritis. Among these, the cystitis segment accounted for the highest market share in 2021 and is expected to remain dominant during the forecast period.

Global Urinary Tract Infection Testing Market Size, by Infection Type, 2021

Source: Research Dive Analysis

The cystitis segment had a dominant market share in 2021. Cystitis can be either complicated or uncomplicated. Acute cystitis is most commonly caused by a bacterial infection of the urinary bladder. Generally, women are more affected because the rectum is closer to the urethral meatus and due to the short urethral length in females. Most women will encounter cystitis at least once in their lifetimes. If cystitis is not treated on time, the infection can go back into the urinary system from the bladder and reach the kidneys. A kidney infection is critical and requires rapid medical attention as it can cause kidney failure.

The pyelonephritis segment is anticipated to grow at the fastest CAGR during the forecast period. Pyelonephritis is a urinary tract infection that advances to the upper urinary tract from the lower urinary tract. Acute pyelonephritis is a bacterial infection related to the kidney. Pyelonephritis can be fatal and frequently leads to scarring of the kidney. Tests that require the insertion of an instrument into the bladder also augment pyelonephritis chances. The two major signs of pyelonephritis are discomfort in the area just under the lower ribs in the back along with fever. Uncomplicated pyelonephritis symptoms start to improve after two to three days of treatment.

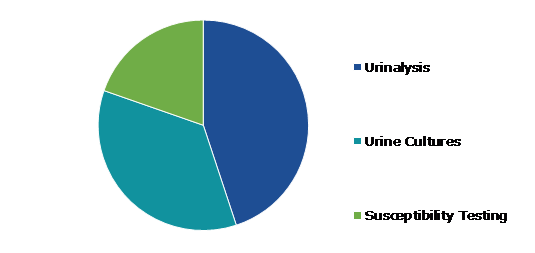

Global Urinary Tract Infection Testing Market, by Test Type

On the basis of test type, the market is classified into urinalysis, urine culture, and susceptibility testing. Among these, the urinalysis segment accounted for the highest revenue share in 2021.

Global Urinary Tract Infection Testing Market Share, by Test Type, 2021

Source: Research Dive Analysis

The urinalysis segment is anticipated to have a dominant market share during the forecast period. With the increasing geriatric population across the globe, the need for urinalysis is anticipated to boost during the forecast period. Aging people are more prone to urinary tract infections. Urinalysis is the most useful test for the diagnosis of UTIs. The precise interpretation of urinalysis is important for doctors to analyze and treat urinary tract-infected patients properly. There are numerous aspects to consider when assessing urinalysis for indicators of infection. The most common indicator is the presence of bacteria in the urine.

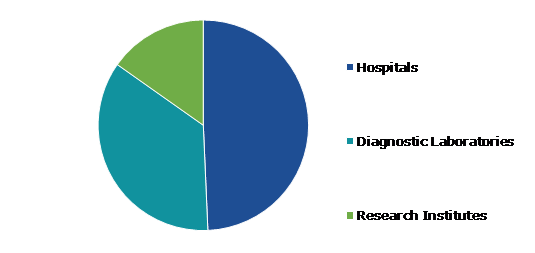

Global Urinary Tract Infection Testing Market, by End User

On the basis of end user, the market is divided into hospitals, diagnostic laboratories, and research institutes. Among these, the diagnostic laboratories segment is anticipated to grow at the fastest CAGR during the forecast period.

Global Urinary Tract Infection Testing Market Forecast, by End User, 2021

Source: Research Dive Analysis

The diagnostic laboratories segment is anticipated to have a dominant market share and the fastest CAGR during the forecast period. The number of UTI tests performed in diagnostic laboratories is anticipated to increase in the coming years. Diagnostic laboratories can be either public or private and are generally equipped with appropriate and costly instrumentation. However, there is a need for highly trained staff and qualified people to conduct the tests. Technological advances in data management are anticipated to further supplement the segment growth.

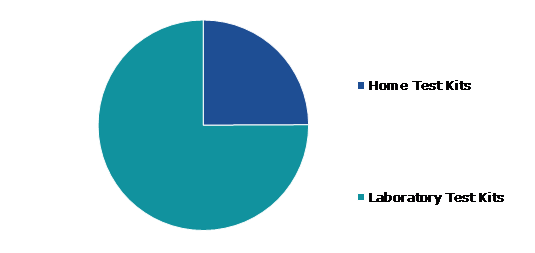

Global Urinary Tract Infection Testing Market, by Test Kit

On the basis of test kit, the market is classified into home test kit and laboratory test kit. Among these, the laboratory test kit segment accounted for the highest market share in 2021.

Global Urinary Tract Infection Testing Market Growth, by Test Kit, 2021

Source: Research Dive Analysis

The laboratory test kits segment is anticipated to have a dominant market share. The urinary tract infection laboratory test kit helps to keep track of nitrites, leukocytes, blood, pH, and other parameters in urine to diagnose UTIs. This test kit provides precise results on a smartphone within 30 seconds. Patients can re-check if they are infection-free or not easily using these UTI test kits.

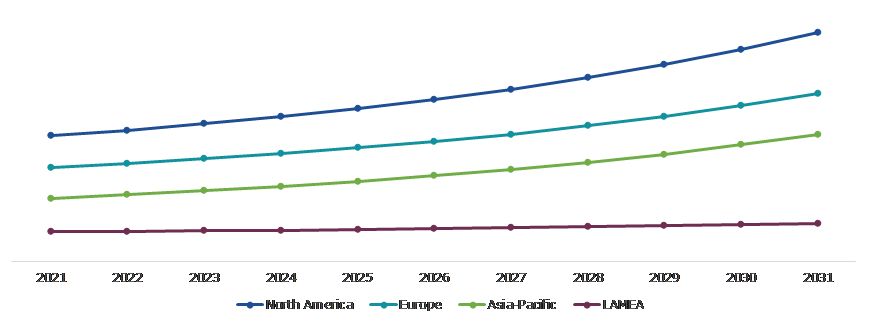

Urinary Tract Infection Testing Market, Regional Insights

The urinary tract infection testing market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Urinary Tract Infection Testing Market Size & Forecast, by Region, 2021-2031 ($Million)

Source: Research Dive Analysis

Market for Urinary Tract Infection Testing in Asia-Pacific to be the Most Dominant

UTIs are the most common infections in females in the United States (U.S.), accounting for around 6 million patient visits to doctors every year. The economic impact of UTIs is a significant factor impacting healthcare expenditures. Both inpatient and outpatient treatment contribute to overall expenses. Urinary tract infection most often occurs in hospitals owing to indwelling catheters. In Canada, around 50 percent of aging people who are in long-term care establishments have bacteria in their urine without symptoms of a urinary tract infection. Due to these factors, the demand for urinary tract infection testing is anticipated to propel in North America.

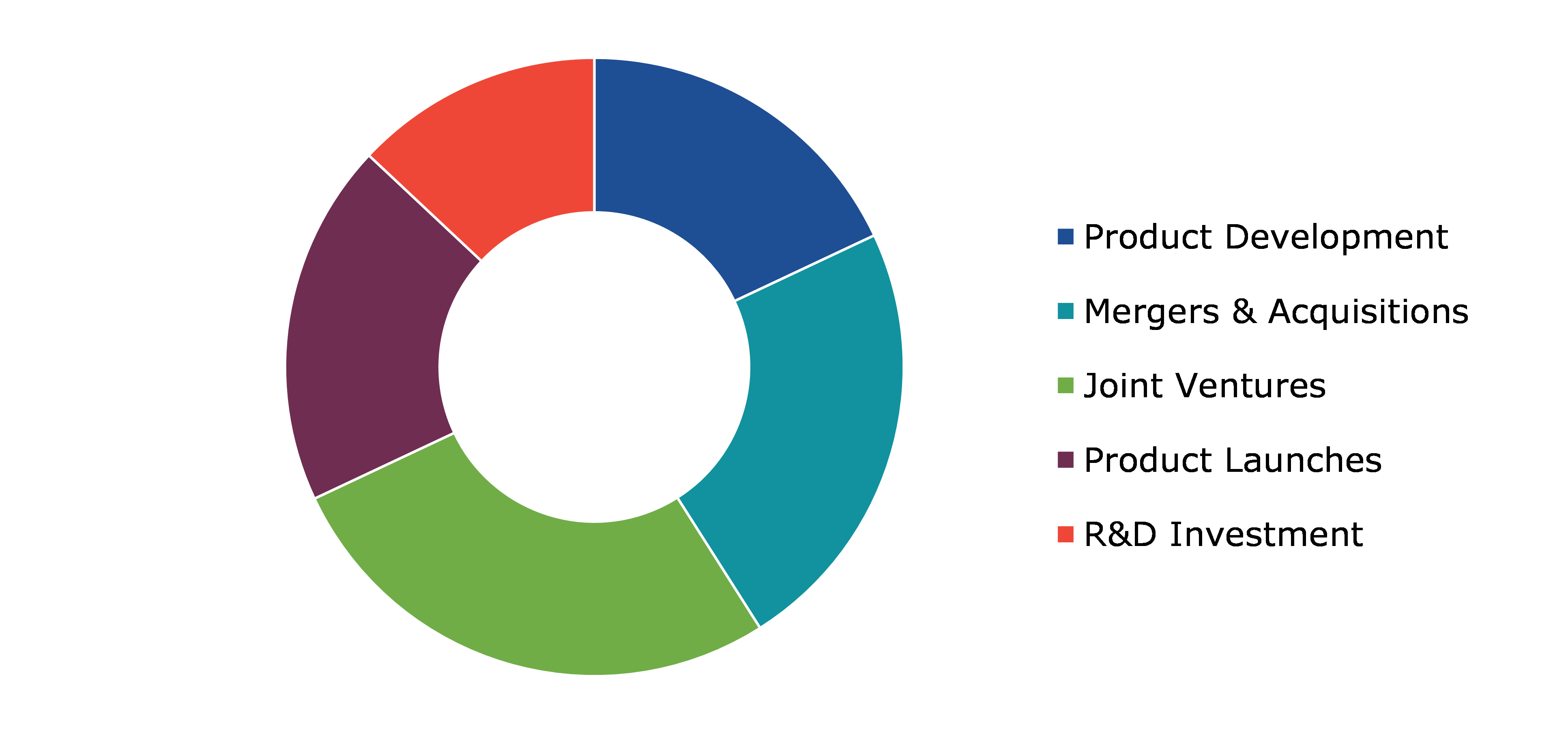

Competitive Scenario in the Global Urinary Tract Infection Testing Market

Investments, product launches, and agreements are common strategies followed by the major market players. For instance, in 2019, Scanwell Health launched a smartphone-powered home test for urinary tract infection testing.

Source: Research Dive Analysis

Some of the leading urinary tract infection testing market players are F. Hoffmann-La Roche Ltd, Stryker, Abbott, Siemens, Sysmex Corporation, Cardinal Health, Danaher, Quidel, Bio-Rad Laboratories, Inc., and ACON Labs.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Infection type |

|

| Segmentation by Test type |

|

| Segmentation by End User |

|

| Segmentation by Test kit |

|

| Key Companies Profiled |

|

Q1. What is the size of the global urinary tract infection testing market?

A. The size of the global urinary tract infection testing market was over $574 million in 2021 and is projected to reach $1,027.4 million by 2031.

Q2. Which are the major companies in the urinary tract infection testing market?

A. F. Hoffmann-La Roche Ltd., Abbott, and Siemens are some of the key players in the global urinary tract infection testing market.

Q3. Which region, among others, will possess great investment opportunities in the near future?

A. Europe possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the North America urinary tract infection testing market?

A. North America urinary tract infection testing market is anticipated to expand at a 6.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Mergers and acquisitions are the two key strategies opted by the operating companies in the market.

Q6. Which companies are investing more in R&D practices?

A. Quidel, Danaher, and ACON Labs are the companies investing more in R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global urinary tract infection testing market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of component providers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Urinary Tract Infection Testing market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5. Urinary Tract Infection Testing Market Analysis, by Infection Type

5.1.Overview

5.2.Urethritis

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Cystitis

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Pyelonephritis

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Urinary Tract Infection Testing Market Analysis, by Test Type

6.1.Urinalysis

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Urine Cultures

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Susceptibility Testing

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Urinary Tract Infection Testing Market Analysis, by End User

7.1.Hospitals

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Diagnostic Laboratories

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Research Institutes

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Urinary Tract Infection Testing Market Analysis, by Test Kit

8.1. Home Test Kits

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region

8.1.3.Market share analysis, by country

8.2.Laboratory Test Kits

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region

8.2.3.Market share analysis, by country

8.3.Research Dive Exclusive Insights

8.3.1.Market attractiveness

8.3.2.Competition heatmap

9.Urinary Tract Infection Testing Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Infection Type

9.1.1.2.Market size analysis, by Test Type

9.1.1.3.Market size analysis, by End User

9.1.1.4.Market size analysis, by Test Kit

9.1.2.Canada

9.1.2.1.Market size analysis, by Infection Type

9.1.2.2.Market size analysis, by Test Type

9.1.2.3.Market size analysis, by End User

9.1.2.4.Market size analysis, by Test Kit

9.1.3.Mexico

9.1.3.1.Market size analysis, by Infection Type

9.1.3.2.Market size analysis, by Test Type

9.1.3.3.Market size analysis, by End User

9.1.3.4.Market size analysis, by Test Kit

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Infection Type

9.2.1.2.Market size analysis, by Test Type

9.2.1.3.Market size analysis, by End User

9.2.1.4.Market size analysis, by Test Kit

9.2.2.UK

9.2.2.1.Market size analysis, by Infection Type

9.2.2.2.Market size analysis, by Test Type

9.2.2.3.Market size analysis, by End User

9.2.2.4.Market size analysis, by Test Kit

9.2.3.France

9.2.3.1.Market size analysis, by Infection Type

9.2.3.2.Market size analysis, by Test Type

9.2.3.3.Market size analysis, by End User

9.2.3.4.Market size analysis, by Test Kit

9.2.4.Spain

9.2.4.1.Market size analysis, by Infection Type

9.2.4.2.Market size analysis, by Test Type

9.2.4.3.Market size analysis, by End User

9.2.4.4.Market size analysis, by Test Kit

9.2.5.Italy

9.2.5.1.Market size analysis, by Infection Type

9.2.5.2.Market size analysis, by Test Type

9.2.5.3.Market size analysis, by End User

9.2.5.4.Market size analysis, by Test Kit

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Infection Type

9.2.6.2.Market size analysis, by Test Type

9.2.6.3.Market size analysis, by End User

9.2.6.4.Market size analysis, by Test Kit

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Infection Type

9.3.1.2.Market size analysis, by Test Type

9.3.1.3.Market size analysis, by End User

9.3.1.4.Market size analysis, by Test Kit

9.3.2.Japan

9.3.2.1.Market size analysis, by Infection Type

9.3.2.2.Market size analysis, by Test Type

9.3.2.3.Market size analysis, by End User

9.3.2.4.Market size analysis, by Test Kit

9.3.3.India

9.3.3.1.Market size analysis, by Infection Type

9.3.3.2.Market size analysis, by Test Type

9.3.3.3.Market size analysis, by End User

9.3.3.4.Market size analysis, by Test Kit

9.3.4.Australia

9.3.4.1.Market size analysis, by Infection Type

9.3.4.2.Market size analysis, by Test Type

9.3.4.3.Market size analysis, by End User

9.3.4.4.Market size analysis, by Test Kit

9.3.5.South Korea

9.3.5.1.Market size analysis, by Infection Type

9.3.5.2.Market size analysis, by Test Type

9.3.5.3.Market size analysis, by End User

9.3.5.4.Market size analysis, by Test Kit

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Infection Type

9.3.6.2.Market size analysis, by Test Type

9.3.6.3.Market size analysis, by End User

9.3.6.4.Market size analysis, by Test Kit

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Infection Type

9.4.1.2.Market size analysis, by Test Type

9.4.1.3.Market size analysis, by End User

9.4.1.4.Market size analysis, by Test Kit

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Infection Type

9.4.2.2.Market size analysis, by Test Type

9.4.2.3.Market size analysis, by End User

9.4.2.4.Market size analysis, by Test Kit

9.4.3.UAE

9.4.3.1.Market size analysis, by Infection Type

9.4.3.2.Market size analysis, by Test Type

9.4.3.3.Market size analysis, by End User

9.4.3.4.Market size analysis, by Test Kit

9.4.4.South Africa

9.4.4.1.Market size analysis, by Infection Type

9.4.4.2.Market size analysis, by Test Type

9.4.4.3.Market size analysis, by End User

9.4.4.4.Market size analysis, by Test Kit

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Infection Type

9.4.5.2.Market size analysis, by Test Type

9.4.5.3.Market size analysis, by End User

9.4.5.4.Market size analysis, by Test Kit

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.F. Hoffmann-La Roche Ltd

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Stryker

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Abbott

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Siemens

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Sysmex Corporation

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.Cardinal Health

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Danaher

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Quidel

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Bio-Rad Laboratories, Inc.

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.ACON Labs.

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

Urinary tract infection, in the simplest terms, is infection in the urinary system. The urinary system mainly comprises of kidneys, bladder, urethra, and ureters. There are several types of urinary tract infections, depending on the part or organ of the urinary system which is affected. Urinary tract infections generally start from the lower side, i.e., from the bladder and is treatable. However, serious complications can arise if the infection goes unchecked and spreads to the kidneys. Medical studies have found that the incidence of urinary tract infections is higher in women as compared to men.

Forecast Analysis of the Urinary Tract Infection Testing Market

In the recent years, there has been an increase in the prevalence of urinary tract infections across the globe. This growing prevalence is expected to be the primary growth driver of the urinary tract infection testing market in the 2022–2031 timeframe. Along with this, an overall increase in the R&D activities related to urinary tract infection testing kits is expected to push the urinary tract infection testing market further. Also, increase in usage of at-home sample collection kits and self-testing kits for urinary tract infection testing is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, wrong results associated with urinary tract infection testing, may restrain the growth of the market in the forecast period.

Regionally, the urinary tract infection testing market in the North America region is expected to be the most dominant by 2031. Increase in the incidence of urinary tract infections and growing healthcare expenditure are expected to become the two main growth drivers of the market in this region during the forecast period.

According to the report published by Research Dive, the global urinary tract infection testing market is expected to gather a revenue of $1,027.4 million by 2031 and grow at 6.2% CAGR in the 2022–2031 timeframe. Some prominent market players include F. Hoffmann-La Roche Ltd, Sysmex Corporation, Quidel, Stryker, Cardinal Health, Bio-Rad Laboratories, Inc, Abbott, Danaher, ACON Labs, Siemens, and many others.

Covid-19 Impact on the Urinary Tract Infection Testing Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The urinary tract infection testing market faced a moderate impact of the pandemic. An overall shutdown of manufacturing industries caused a decline in the production of urinary tract infection testing kits. However, a rise in urinary tract infections was noted during the pandemic and was considered by many medical experts as one of the effects of the virus. This increase in the incidence of urinary tract infections caused a growth in the demand for testing kits, which helped the market register some growth amidst the pandemic.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the urinary tract infection testing market to flourish. For instance:

-

In July 2020, Uqora, the urinary biotechnology company, announced that it was launching a series of urinary diagnostic products specifically designed to address urinary tract infection issues. This new product line is expected to help the company to increase its footprint in the market in the coming period.

- In August 2020, TestCard, a healthcare technology platform, announced that it was launching an at-home urinary tract infection testing kit in the UK. This noninvasive testing method is predicted to help patients to get an idea about the urinary tract infection issues they are facing and seek medical help accordingly. Also, the launch is predicted to boost the market share of the company in the near future.

- In September 2022, Pathnostics, a leading medical laboratory in California, announced that it was collaborating with DispatchHealth, an at-home medical care provider, in order to conduct research involving a study of 6,800 patients suspected of having urinary tract infections. This collaboration will help both the parties to pool their resources and expertise and conduct the study in a holistic manner.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com