Moist Wound Dressings Market Report

RA08592

Moist Wound Dressings Market by Product (Foam Dressings, Hydrocolloid Dressings, Film Dressings, Alginate Dressings, Hydrogel Dressings, and Other Dressings), Application (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Surgical and Traumatic Wounds, Burns, and Others), and End Use (Hospitals, Clinics, and Home Healthcare): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Moist Wound Dressings Market Analysis

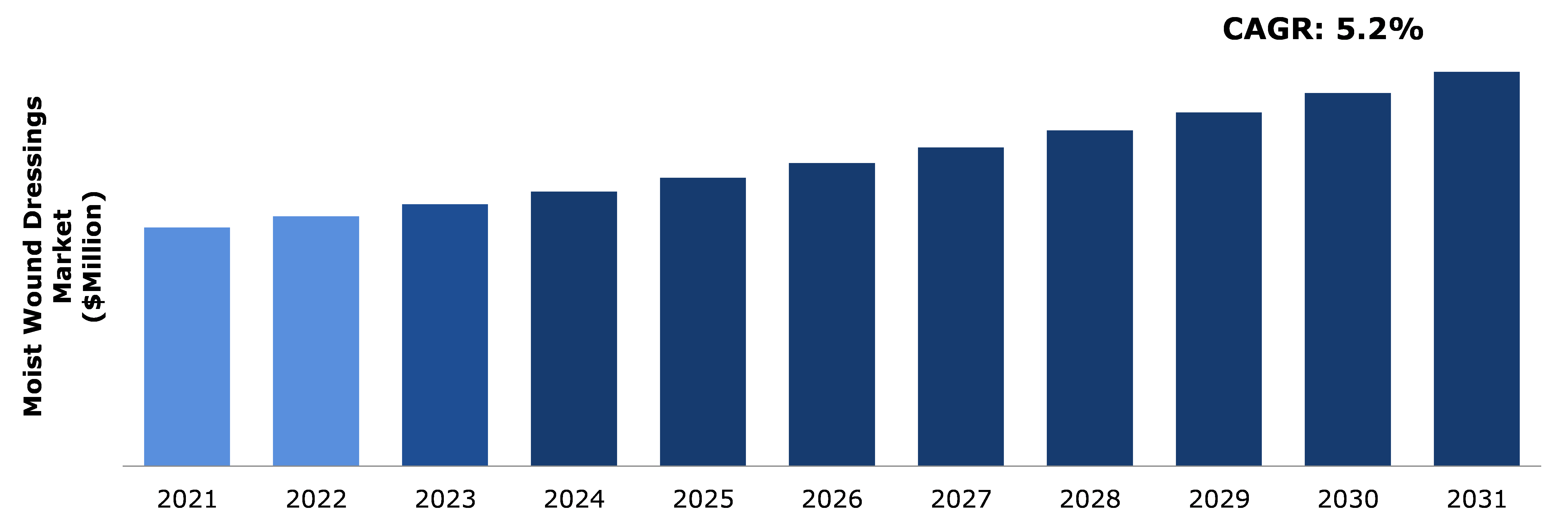

The global moist wound dressings market size was $4,120 million in 2021 and is predicted to expand at a CAGR of 5.2%, generating a revenue of $6,807.2 million by 2031.

Global Moist Wound Dressings Market Synopsis

Moist wound dressings are the most commonly used dressings in wound care. The rising popularity of moist wound dressings can be attributed to factors such as optimal moisture levels for cell growth and proliferation and expansion during wound healing phases. Moist wound dressings have advantages over standard dressings, such as proper exudate control, less pain and scarring, and faster wound healing.

A moist wound environment has several advantages that lead to faster and higher-quality healing. It promotes and facilitates keratinocyte migration over the wound surface, reduces pain and scarring, activates collagen synthesis, and supports the presence and function of nutrients, growth factors, and other soluble mediators in the wound microenvironment. Wound dressings can be used to create, maintain, and control a moist healing environment. Films, foams, hydrocolloids, hydrogels, and alginates are the various types of moist wound dressings. These factors are anticipated to boost the moist wound dressings market growth.

Some of the disadvantages of moist wound dressings include air exposure. Exposure to air reduces the surface temperature of the wound, causing peripheral vasoconstriction, which reduces blood flow (carrying oxygen and nutrients) to the wound and delays healing. This factor restrains the growth of the moist wound dressings industry.

Growing demographics and economies in developing countries like China, Japan, and India are expected to drive growth in the Asia-Pacific moist wound dressings market. Furthermore, new innovations in wound care products and technologies, increased technology adoption, and increased patient awareness about infections are expected to open up new opportunities for the global moist wound dressings market.

On the basis of region, the North America moist wound dressing market accounted for the highest market share for moist wound dressings because of highly trained professionals, an increase in chronic disease incidence, and increase in awareness of moist wound dressing market trends and technologies in the region.

Moist Wound Dressings Market Overview

A wound dressing is a technique or procedure that protects the wound from microbial infections, necrosis spread, and new contamination. Wound dressing improves wound healing by covering them with a moist wound healing bandage. Wounds are caused by damage to living tissue as a result of burns, accidents, cuts, scrapes, and chronic diseases such as diabetes.

Moist wound dressing creates a moist environment that aids in wound healing. This moist wound environment protects tissues from dehydration, alleviates pain, and promotes the breakdown of dead tissue.

COVID-19 Impact on Global Moist Wound Dressings Market

The COVID-19 pandemic had a significant impact on healthcare systems' ability to provide curative and preventive services, particularly to the most vulnerable populations. During the pandemic, wound treatment centers in Italy saw a significant decrease in the number of hospital admissions because only emergencies, such as severe infections or wound hemorrhagic complications, were permitted in the hospitals.

The COVID-19 pandemic impacted primary-care clinician consultations, hospitalizations, and diagnostic workups for moist wound care management. The pandemic's restrictions had no negative impact on wound-related QOL or home care. Many healthcare organizations and governments used telemedicine for wound care management, particularly in cases of severe wounds, because it reduced the risk of infection and contact between physicians and patients. However, telemedicine had a negligible impact on wound care management in Germany despite its obvious benefits in risk reduction.

Increase in Applications of Moist Wound Dressings in the Hospitals Sector to Drive the Market Growth

Moist wound dressings have vast application in healthcare for hospitalized patients. The increase in chronic wound conditions in developing countries is one of the factors that drive the moist wound market growth. According to the American Burn Association, about 450,000 patients are admitted each year in the U.S. as a result of burns, increasing their risk of infection. According to a survey conducted by the Centers for Disease Control and Prevention (CDC) in January 2020, surgical site infection (SSI) is one of the most expensive types of healthcare-associated illness (HAI) in the U.S. As a result, the market for moist wound dressings is rising at a quicker rate.

To know more about global moist wound dressings market drivers, get in touch with our analysts here.

High Cost of Wound Dressings to Restrain the Market Growth

The global wound dressings market is expected to be impacted by challenges such as product recalls, the availability of alternative products, and the high cost of wound dressing products during the forecast period. A growing number of product recalls are caused by product malfunction, component inconsistency, and packaging issues. However, the cost of care with advanced wound dressings is frequently high when compared to traditional wound dressings, which is anticipated to hamper the moist wound dressings market growth.

Technological Advancement and Initiatives to Improve Healthcare Systems to Drive Excellent Opportunities

Numerous advancements in wound dressing contribute significantly to the market's overall growth. Wound dressing advancements have resulted in a shift from basic dressings to advanced pharmaceutically active ingredient products and devices. Wound dressings have advanced to the point where, while actively encouraging wound healing, they now maintain a moist wound environment. Furthermore, new treatments such as radiation therapy, electrical stimulation, nanotechnology, and the use of silver and other hybrid bandages are being introduced to improve the overall industry. These advancements provide patients with great relief during any trauma recovery, thereby increasing demand and serving as high-impact rendering drivers for the overall market.

To know more about global moist wound dressings market opportunities, get in touch with our analysts here.

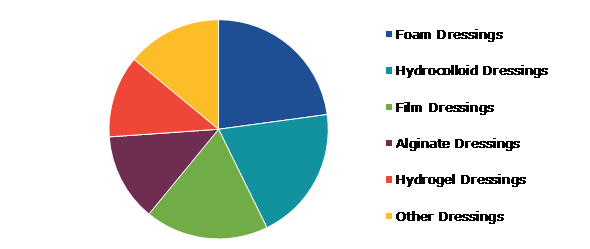

Global Moist Wound Dressings Market, By Product

On the basis of product, the moist wound dressings market outlook is divided into foam dressings, hydrocolloid dressings, film dressings, alginate dressings, hydrogel dressings, and other dressings. Among these, the foam dressings segment accounted for the highest market share in 2021, whereas the hydrogel dressings segment is estimated to show the fastest growth during the forecast period.

Global Moist Wound Dressings Market Growth, By Product, 2021

Source: Research Dive Analysis

The foam dressings segment accounted for a dominant moist wound dressings market share in 2021. Foam dressings are partially permeable polyurethane wound dressings. They are non-linting and non-adherent dressings that only enable water vapor to enter and prevent germs and other pollutants from entering. Foam dressings can be used to treat surgical wounds, skin grafts, mild burns, skin irritation, infected wounds, facial injuries, draining mucous membrane wounds, and leg ulcers.

The hydrogel dressings segment is anticipated to show the fastest growth during the forecast period. The hydrogel dressing can control wound infection and perform autolytic debridement of necrotic tissue by piggybacking on antibiotics or anti-inflammatory drugs during the inflammatory phase. Hydrogel dressings provide moisture and are suitable for wounds of any size, full or partial thickness. They can also be used in necrotic or infected wounds. Hydrogel dressings are made up of 90% water in a gel suspension.

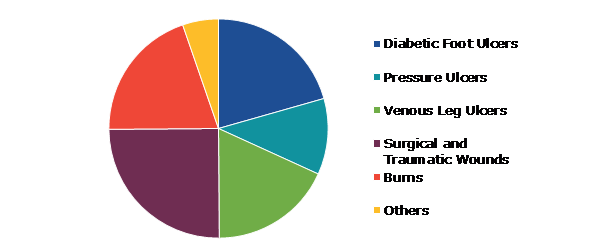

Global Moist Wound Dressings Market, by Application

On the basis of application, the market has been divided into diabetic foot ulcers, pressure ulcers, venous leg ulcers, surgical and traumatic wounds, burns, and others. Among these, the surgical and traumatic wounds segment accounted for the highest revenue share in 2021.

Global Moist Wound Dressings Market Outlook, by Application, 2021

Source: Research Dive Analysis

The surgical and traumatic wounds segment accounted for the highest moist wound dressings market share in 2021. A traumatic wound is an unexpected, unplanned injury that can range from minor to severe, such as a gunshot wound. Abrasions, lacerations, skin tears, bites, burns, and penetrating trauma wounds are examples of traumatic wounds. Surgical wounds are formed when a surgeon makes an incision or cut with a scalpel, a surgical instrument. A wide range of medical conditions surgery. The size of a wound is determined by the procedure and location on the body.

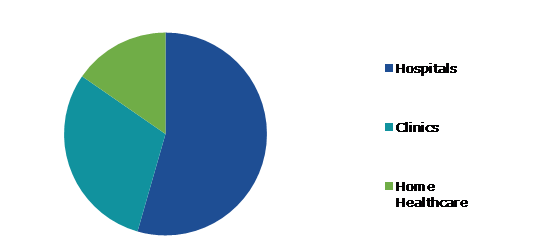

Global Moist Wound Dressings Market, by End Use

On the basis of end use, the market is divided into hospitals, clinics, and home healthcare. Among these, the hospitals segment accounted for the highest revenue share in 2021.

Global Moist Wound Dressings Market Forecast, by End Use, 2021

Source: Research Dive Analysis

The hospitals segment accounted for the highest market share in 2021. The hospitals segment is driven by the rise in prevalence of chronic diseases and wounds. Furthermore, the increase in prevalence of hospital-acquired illnesses is expected to boost the segment. The rise in use of technologically improved wound care products will drive this segment's growth during the forecast period.

Moist Wound Dressings Market, Regional Insights

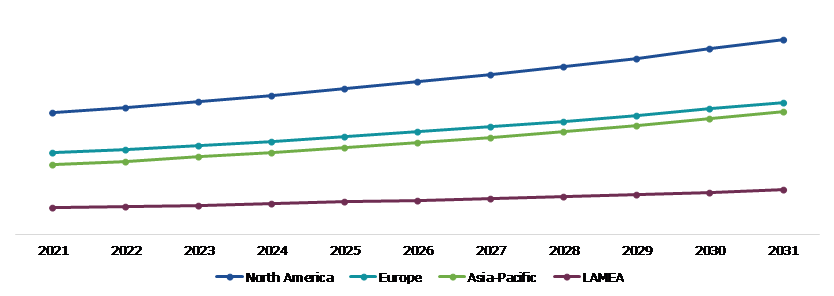

The moist wound dressings market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Moist Wound Dressings Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

Market for Moist Wound Dressings in North America to be Most Dominant

North America is expected to dominate the overall moist wound dressings market during the forecast period. The dominance is due to the rise in the prevalence of diabetes, burns, and surgeries, which has led to an increase in the cases of surgical site infection (SSI) in the U.S., necessitating effective management of these wounds. For example, according to a survey report published in January 2020 by the Centers for Disease Control and Prevention, SSI is the most expensive healthcare-associated infection (HAI) type in the U.S., accounting for an estimated annual cost of about $3.3 billion and affecting more than 1 million additional inpatient-days annually, which is expected to drive product demand in the near future.

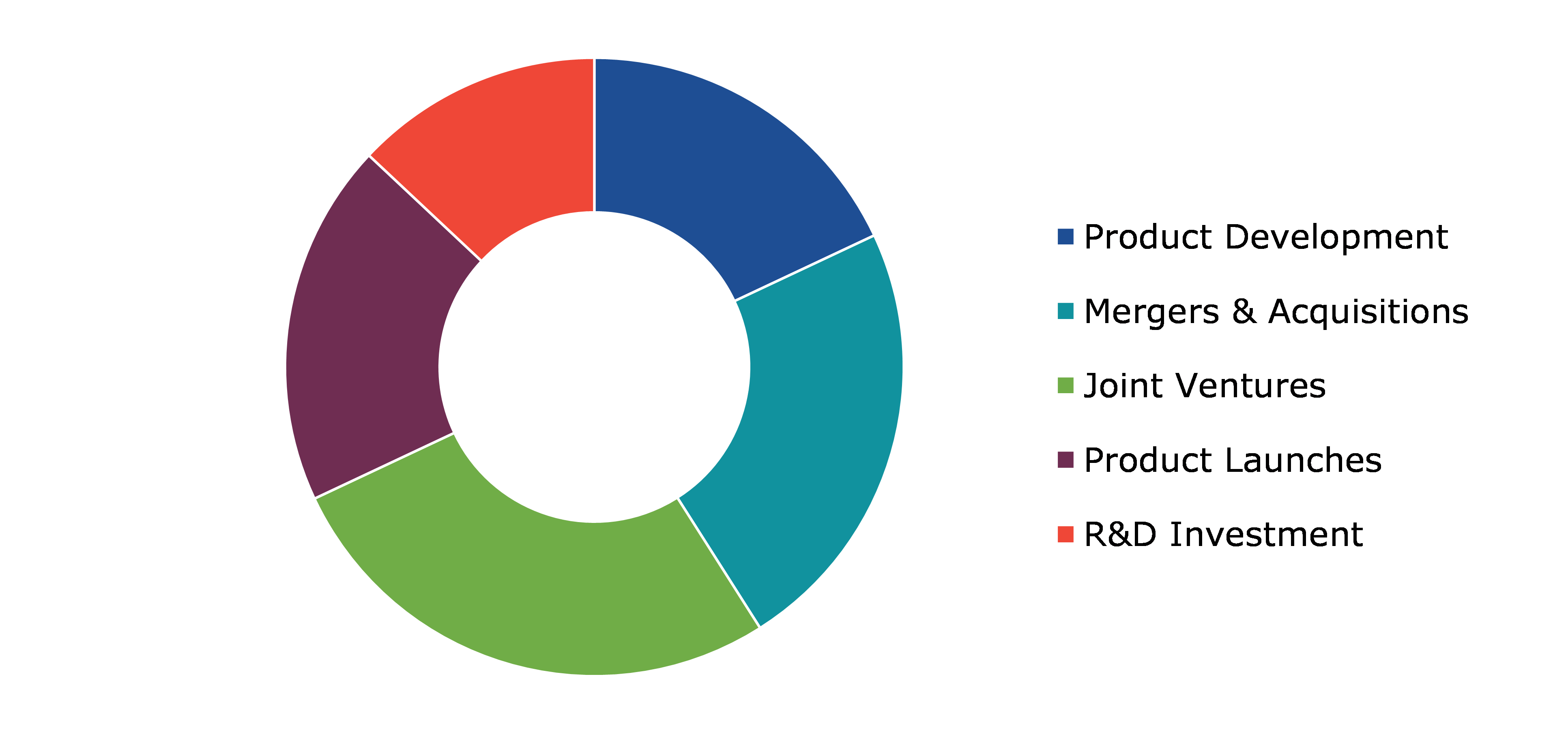

Competitive Scenario in the Global Moist Wound Dressings Market

Product launches and mergers & acquisitions are common strategies followed by major market players. For instance, in March 2020, Advanced Medical Solutions Group plc acquired Raleigh Adhesion Coatings Ltd., an independent wound care and bio-diagnostics coatings company. This acquisition expanded the company's product line and strengthened its market position.

Source: Research Dive Analysis

Some of the leading moist wound dressings market players are Coloplast A/S, 3M, Cardinal Health, Inc., Medline Industries, Inc., Smith & Nephew plc, B. Braun, Convatec Group plc, Systagenix Wound Management Ltd., Derma Sciences, and Hollister Incorporated.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Application |

|

| Segmentation by End Use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global moist wound dressings market?

A. The size of the global moist wound dressings market was over $4,120 million in 2021 and is projected to reach $6,807.2 million by 2031.

Q2. Which are the major companies in the moist wound dressings market?

A. Coloplast A/S, 3M Healthcare, and Cardinal Health, Inc. are some of the key players in the global moist wound dressings market.

Q3. Which region, among others, possesses great investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors and is set to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific moist wound dressings market?

A. Asia-Pacific moist wound dressings market is anticipated to expand at a 4.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launches and mergers & acquisition are the two key strategies opted by the companies operating in this market.

Q6. Which companies are investing more in R&D practices?

A. ConvaTec Group PLC, Systagenix Wound Management Ltd., and Derma Sciences, Inc. are the companies investing more in R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global moist wound dressings market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Application matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Moist Wound Dressings market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Moist Wound Dressings Market Analysis, by Product

5.1.Overview

5.2.Foam Dressings

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2031

5.2.3.Market share analysis, by country, 2022-2031

5.3.Hydrocolloid Dressings

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2031

5.3.3.Market share analysis, by country, 2022-2031

5.4.Film Dressings

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2031

5.4.3.Market share analysis, by country, 2022-2031

5.5.Alginate Dressings

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2022-2031

5.5.3.Market share analysis, by country, 2022-2031

5.6.Hydrogel Dressings

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region, 2022-2031

5.6.3.Market share analysis, by country, 2022-2031

5.7.Other Dressings

5.7.1.Definition, key trends, growth factors, and opportunities

5.7.2.Market size analysis, by region, 2022-2031

5.7.3.Market share analysis, by country, 2022-2031

5.8.Research Dive Exclusive Insights

5.8.1.Market attractiveness

5.8.2.Competition heatmap

6.Moist Wound Dressings Market Analysis, by Application

6.1.Overview

6.2.Diabetic Foot Ulcers

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2031

6.2.3.Market share analysis, by country, 2022-2031

6.3.Pressure Ulcers

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2031

6.3.3.Market share analysis, by country, 2022-2031

6.4.Venous Leg Ulcers

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2022-2031

6.4.3.Market share analysis, by country, 2022-2031

6.5.Surgical and Traumatic Wounds

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2022-2031

6.5.3.Market share analysis, by country, 2022-2031

6.6.Burns

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region, 2022-2031

6.6.3.Market share analysis, by country, 2022-2031

6.7.Others

6.7.1.Definition, key trends, growth factors, and opportunities

6.7.2.Market size analysis, by region, 2022-2031

6.7.3.Market share analysis, by country, 2022-2031

6.8.Research Dive Exclusive Insights

6.8.1.Market attractiveness

6.8.2.Competition heatmap

7. Moist Wound Dressings Market Analysis, by End-Use

7.1.Overview

7.2.Hospitals

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2031

7.2.3.Market share analysis, by country, 2022-2031

7.3.Clinics

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2031

7.3.3.Market share analysis, by country, 2022-2031

7.4.Home Healthcare

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2022-2031

7.4.3.Market share analysis, by country, 2022-2031

7.5.Research Dive Exclusive Insights

7.5.1.Market attractiveness

7.5.2.Competition heatmap

8.Moist Wound Dressings Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Product, 2022-2031

8.1.1.2.Market size analysis, by Application, 2022-2031

8.1.1.3.Market size analysis, by End use, 2022-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Product, 2022-2031

8.1.2.2.Market size analysis, by Application, 2022-2031

8.1.2.3.Market size analysis, by End use, 2022-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Product, 2022-2031

8.1.3.2.Market size analysis, by Application, 2022-2031

8.1.3.3.Market size analysis, by End use, 2022-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Product, 2022-2031

8.2.1.2.Market size analysis, by Application, 2022-2031

8.2.1.3.Market size analysis, by End use, 2022-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Product, 2022-2031

8.2.2.2.Market size analysis, by Application, 2022-2031

8.2.2.3.Market size analysis, by End use, 2022-2031

8.2.3.France

8.2.3.1.Market size analysis, by Product, 2022-2031

8.2.3.2.Market size analysis, by Application, 2022-2031

8.2.3.3.Market size analysis, by End use, 2022-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Product, 2022-2031

8.2.4.2.Market size analysis, by Application, 2022-2031

8.2.4.3.Market size analysis, by End use, 2022-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Product, 2022-2031

8.2.5.2.Market size analysis, by Application, 2022-2031

8.2.5.3.Market size analysis, by End use, 2022-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Product, 2022-2031

8.2.6.2.Market size analysis, by Application, 2022-2031

8.2.6.3.Market size analysis, by End use, 2022-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Product, 2022-2031

8.3.1.2.Market size analysis, by Application, 2022-2031

8.3.1.3.Market size analysis, by End use, 2022-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Product, 2022-2031

8.3.2.2.Market size analysis, by Application, 2022-2031

8.3.2.3.Market size analysis, by End use, 2022-2031

8.3.3.India

8.3.3.1.Market size analysis, by Product, 2022-2031

8.3.3.2.Market size analysis, by Application, 2022-2031

8.3.3.3.Market size analysis, by End use, 2022-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Product, 2022-2031

8.3.4.2.Market size analysis, by Application, 2022-2031

8.3.4.3.Market size analysis, by End use, 2022-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Product, 2022-2031

8.3.5.2.Market size analysis, by Application, 2022-2031

8.3.5.3.Market size analysis, by End use, 2022-2031

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Product, 2022-2031

8.3.6.2.Market size analysis, by Application, 2022-2031

8.3.6.3.Market size analysis, by End use, 2022-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Product, 2022-2031

8.4.1.2.Market size analysis, by Application, 2022-2031

8.4.1.3.Market size analysis, by End use, 2022-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Product, 2022-2031

8.4.2.2.Market size analysis, by Application, 2022-2031

8.4.2.3.Market size analysis, by End use, 2022-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Product, 2022-2031

8.4.3.2.Market size analysis, by Application, 2022-2031

8.4.3.3.Market size analysis, by End use, 2022-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Product, 2022-2031

8.4.4.2.Market size analysis, by Application, 2022-2031

8.4.4.3.Market size analysis, by End use, 2022-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Product, 2022-2031

8.4.5.2.Market size analysis, by Application, 2022-2031

8.4.5.3.Market size analysis, by End use, 2022-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2022

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2022

10.Company Profiles

10.1.Coloplast A/S

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.1.7.Research Dive Analyst View

10.2. 3M Healthcare

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.2.7.Research Dive Analyst View

10.3.Cardinal Health, Inc.

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.3.7.Research Dive Analyst View

10.4. Medline Industries, Inc.

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.4.7.Research Dive Analyst View

10.5.Smith & Nephew PLC

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.5.7.Research Dive Analyst View

10.6.B. Braun Melsungen AG

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.6.7.Research Dive Analyst View

10.7.ConvaTec Group PLC

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.7.7.Research Dive Analyst View

10.8.Systagenix Wound Management Ltd.

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.8.7.Research Dive Analyst View

10.9.Derma Sciences, Inc.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.9.7.Research Dive Analyst View

10.10.Hollister Incorporated

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

10.10.7.Research Dive Analyst View

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Moist wound dressings are some of the most used dressing methods in healthcare sector. Moist wounds heal faster as these wounds facilitate keratinocyte migration all over the wound. Moist wounds support the presence of nutrients and provide a conducive environment for the functioning of growth factors, nutrients, and other soluble mediators. Hence, moist wound dressings are used to create or keep intact the moist wound environment so as to activate collagen synthesis, reduce pain, and facilitate faster wound healing.

Forecast Analysis of the Moist Wound Dressings Market

Over the years, moist wound dressing has been increasingly adopted by doctors and medical practitioners. This increasing use of moist wound dressing in hospitals is expected to be the primary growth driver of the moist wound dressings market in the 2022-2031 timeframe. Along with this, technological advancements and innovations in the medical sector are predicted to boost the market in the analysis timeframe. Moreover, the advantages associated with moist wound dressings such as proper exudate control, less pain and scarring, etc. These advantages are expected to increase the demand for moist wound dressings, which is expected to offer numerous growth opportunities to the market in the forecast years. However, according to the market analysts, high cost of moist wound dressings might become a hurdle in the full-fledged growth of the moist wound dressings market in the forecast years.

Regionally, the moist wound dressings market in the North America region is expected to be the most dominant in the forecast period. The rise in the prevalence of diabetes, burns, and surgeries leading to an increase in the cases of surgical site infection (SSI) is predicted to be the main contributing factor to the growth of the market in this region.

As per a report by Research Dive, the global moist wound dressings market is expected to reach a revenue of $6,807.2 million in the 2022–2031 timeframe, thereby growing at a CAGR of 5.2% by 2031. Some prominent market players include Coloplast A/S, Smith & Nephew plc, Systagenix Wound Management Ltd., 3M, B. Braun, Derma Sciences, Cardinal Health, Inc., Convatec Group plc, Hollister Incorporated., Medline Industries, Inc., and many others.

Covid-19 Impact on the Moist Wound Dressings Market

The Covid-19 pandemic and the subsequent lockdowns have had a catastrophic impact on various businesses and markets worldwide. The moist wound dressings market, too, faced a similar fate. The pandemic saw a decrease in hospital admissions related to wound dressings as the number of Covid-19 emergency cases increased and were treated on a priority basis. Hence, the demand for moist wound dressings decreased during the pandemic period, thereby leading to a decline in the growth rate of the market.

Significant Market Developments

The key players of the market are adopting various business strategies such as partnerships, mergers & acquisitions, and launches to gain a leading position in the market, thus helping the moist wound dressings market to flourish. For instance:

- In June 2021, a press release from RMIT University announced that a group of scientists from RMIT University, Melbourne, had developed smart wound dressings with built-in healing sensors. The wound dressings were developed in such a way that they would glow if the wound was not healing as intended, thereby alerting the patient and the medical staff. This breakthrough is expected to propel the medical industry forward in the upcoming years.

- In February 2022, Argentum Medical, a medical device leader, announced that it was acquiring Anacapa Technologies, a pharmaceutical company based in California. Anacapa Technologies is considered to be a leader in antimicrobial wound care products and hence, this acquisition is predicted to help Argentum Medical to expand its footprint in the market.

- In September 2022, Evonik, a German speciality chemicals company, announced that it had signed an agreement to acquire Coopmed, a medical technology company. This acquisition by Evonik is aimed at bettering the distribution of biosynthetic cellulose wound dressing product epicite®. Thus, the acquisition is predicted to help the acquiring company, i.e., Evonik substantially in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com