Dentures Market Report

RA08541

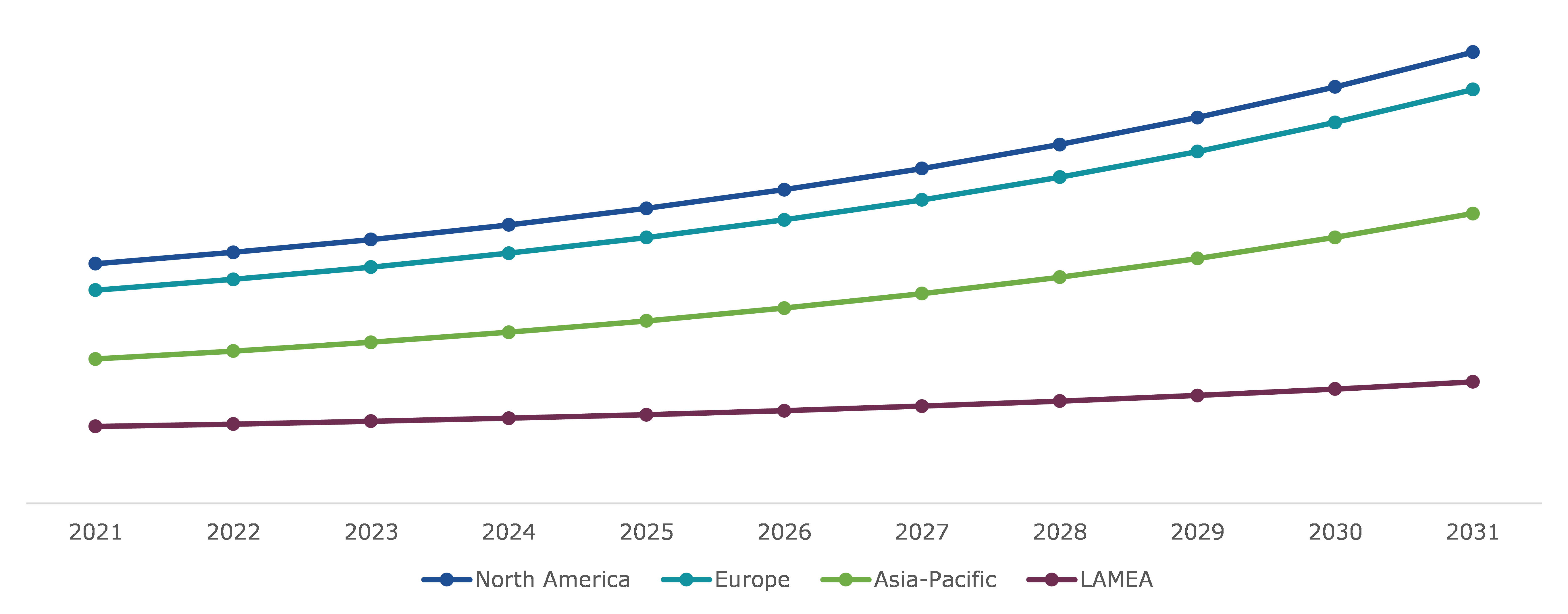

Dentures Market by Product Type (Complete and Partial), Product Implant (Fixed and Removable), End Users (Dental Hospitals & Clinics and Dental Laboratories & Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Dentures Market Analysis

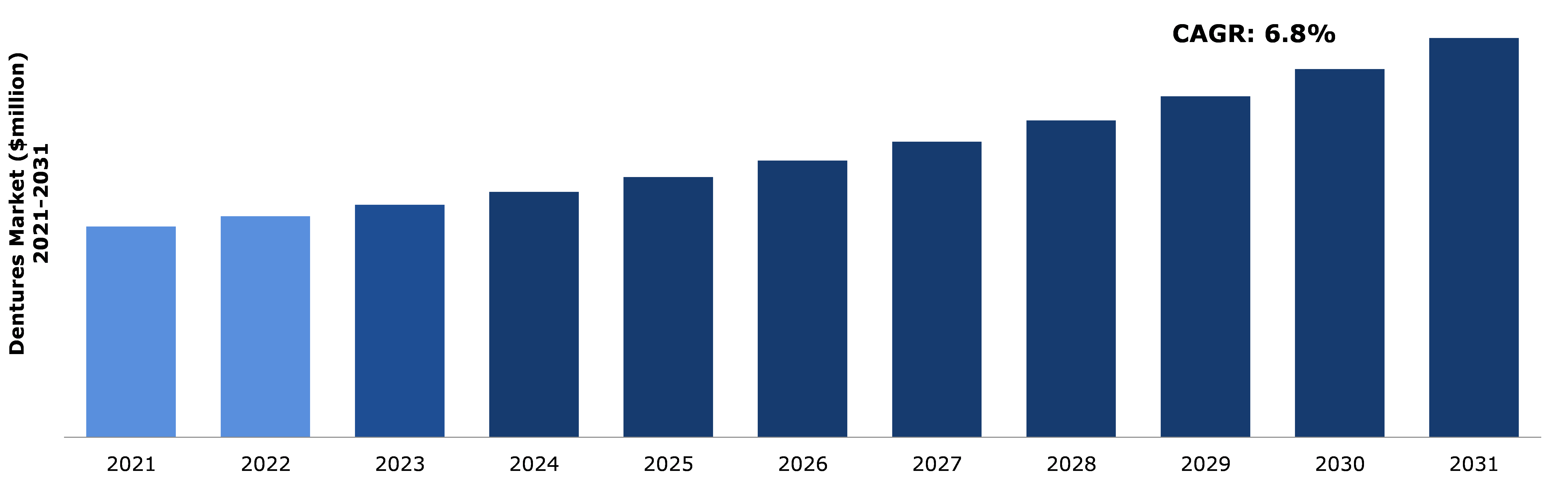

The Global Dentures Market size is expected to generate revenue of $ 3,212.1 million by 2031, growing from $ 1,696.2 million in 2021, at a CAGR of 6.8%.

Market Synopsis

The rise in the prevalence of tooth loss among people due to various causes such as poor oral health, accidents, and the prevalence of disorders such as edentulism is predicted to boost the global dentures market. Tooth loss is more common in adults over the age of 65 due to health risks associated with old age. The prevalence of edentulism is likewise increasing across the world, and it has become one of the primary health issues for the geriatric population. All these factors are anticipated to drive the dentures market revenue growth during the forecast period.

The high cost of treatment and dentures implant is likely to restrain the dentures market share growth. Dentures, either complete or partial, are expensive and it is difficult for people especially middle- or low-income people, to afford such high-priced dentures. This factor is anticipated to hamper market growth during the forecast period.

To fulfill the rise in the need for better healthcare facilities, several manufacturing companies are concentrating on expanding their denture product line and introducing new and improved denture goods. Such factors are expected to produce a number of growth opportunities for the major players operating in the dentures industry in the coming years.

According to the regional analysis of the market, the Asia-Pacific dentures market is anticipated to grow at the fastest CAGR during the forecast period. In the region, the growing geriatric population and prevalence of tooth decay among millennials is the main factor estimated to drive the growth of the dentures market during the forecast period. The growth of the regional market is subjected to the rapid increase in cases of dental problems in middle-aged people and the development and adoption of technologies such as computer-aided design (CAD) by dental healthcare companies to produce dentures in shorter periods.

Dentures Overview

Dentures, widely known as false teeth, are custom-made prosthetic replacements for missing or lost teeth, which can replace upper or lower teeth or both. Dentures are custom-made and can be made to fit any mouth configuration based on a person's clinical, aesthetic, and financial needs. Dentures are manufactured using a range of raw materials, including acrylic gum-colored bases, flexible polyamide microcrystalline, chrome-cobalt, and a hybrid material that combines two types of material. These false teeth are convincing in their aesthetic replication of human teeth, with the addition of realistic-looking substitute teeth, that it is impossible to identify a well-made denture from a set of original teeth.

COVID-19 Impact on the Global Dentures Market

The COVID-19 pandemic has negatively affected the expansion of the dentures market trends. Several patients purposefully postponed their routine medical and dentist visits due to the high rate of coronavirus transmission and the predominance of serious symptoms. To prevent the fatal infection from spreading, medical experts also rescheduled numerous dental procedures and limited outpatient visits. Several private dentistry clinics were shuttered due to the lockdown. These factors hampered the market share expansion for dentures during the pandemic.

Increase in Cases of Dental Issues to Surge the Market Growth

Currently, the prevalence of oral diseases continues to increase globally with growing urbanization and changes in living standards. As per the WHO Global Oral Health Status Report (2022), it is estimated that oral diseases affect close to around 3.5 billion people worldwide. Globally, around 2 billion people suffer from caries of permanent teeth and 514 million children suffer from caries of primary teeth. This is primarily due to inadequate exposure to fluoride (in the water supply and oral hygiene products such as toothpaste) and poor access to oral health care services in the community. Also, the penetration and marketing of food and beverages containing high sugar, and the rise in consumption of tobacco and alcohol are factors that contribute to an increase in oral health conditions and other non-communicable diseases (NCDs). Thus, the dentures market share growth is expected to be driven by a rapid increase in cases of oral health issues such as caries and tooth loss among millennials owing to unhealthy eating habits during the forecast period.

To know more about global dentures market drivers, get in touch with our analysts here.

High Cost of Dentures Implantation to Restrain the Market Growth

Dentures are artificial teeth and making them is an expensive process as the raw materials and techniques used in its manufacturing are expensive. Because of this, few patients, particularly in developing and underdeveloped countries, are unable to pay such high treatment costs. In addition, several insurance firms do not have reimbursement plans for expenses related to dental healthcare which further limits the patient to afford denture implants. These aspects are therefore anticipated to restrain the dentures market expansion during the forecast period. Apart from this, large out-of-pocket expenditures in low- and middle-income countries and the lack of unavailability of highly specialized dental equipment and skilled professionals in primary healthcare facilities negatively impact the growth of the dentures market.

Development of Dentures Product Portfolio by Major Companies to Fuel the Market Growth

Improvements to existing denture products and the introduction of new products are expected to drive dentures market share in the future. Major denture market players are focusing on developing and launching new products to meet the rise in demand for advanced treatment options for dental issues like tooth loss. Furthermore, major companies operating in the market are now using cutting-edge technologies such as computer-aided design (CAD) to design and manufacture dentures in record time. Such factors are expected to create several growth opportunities for the key players operating in the dentures market growth during the forecast period.

In addition, Dentsply Sirona announced the planned validation of Asiga and SprintRay 3D printers for Lucitone Digital Print Denture. Both of these announcements further enable the continued digital transformation in dental laboratories worldwide.

To know more about global dentures market opportunities, get in touch with our analysts here.

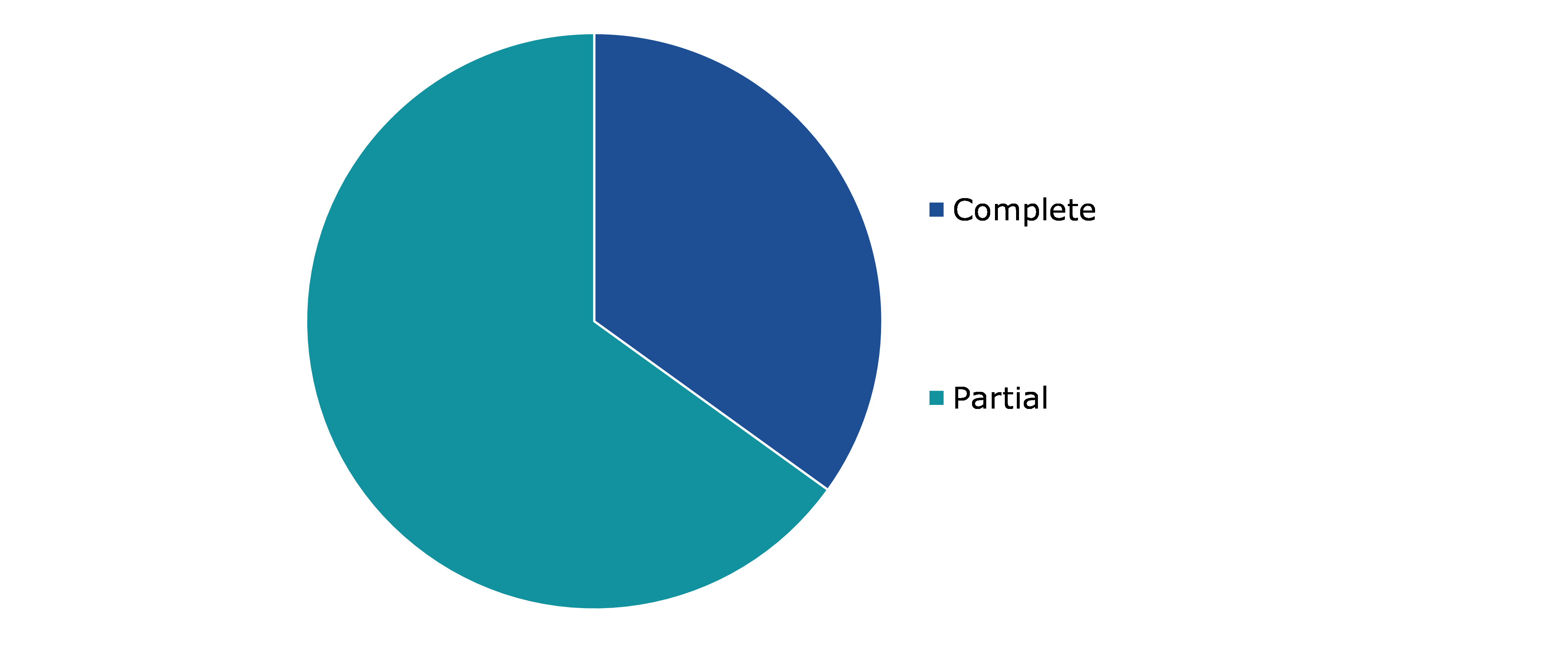

Global Dentures Market, by Product Type

Based on product type, the market is divided into complete and partial. The partial dentures sub-segment is projected to generate maximum revenue and is expected to register the fastest growth during the forecast period.

Global Dentures Market Growth, by Product Type, 2021

The partial dentures sub-segment is predicted to witness the fastest growth in the global market during the forecast period. Partial dentures are usually removable dentures that replace multiple teeth in the upper or lower jaw of the mouth. Partial dentures help in restoring face aesthetics by filling in the gaps in the mouth and offering a perfect smile. A partial denture keeps the underlying structures of the mouth - the gums, facial muscles, jawbone, and others active and engaged. The growth is majorly due to factors such as partial dentures being less expensive than full dentures and being used to replace a single or a few missing teeth. These dentures may be implanted in a one-day procedure, which makes it less time consuming.

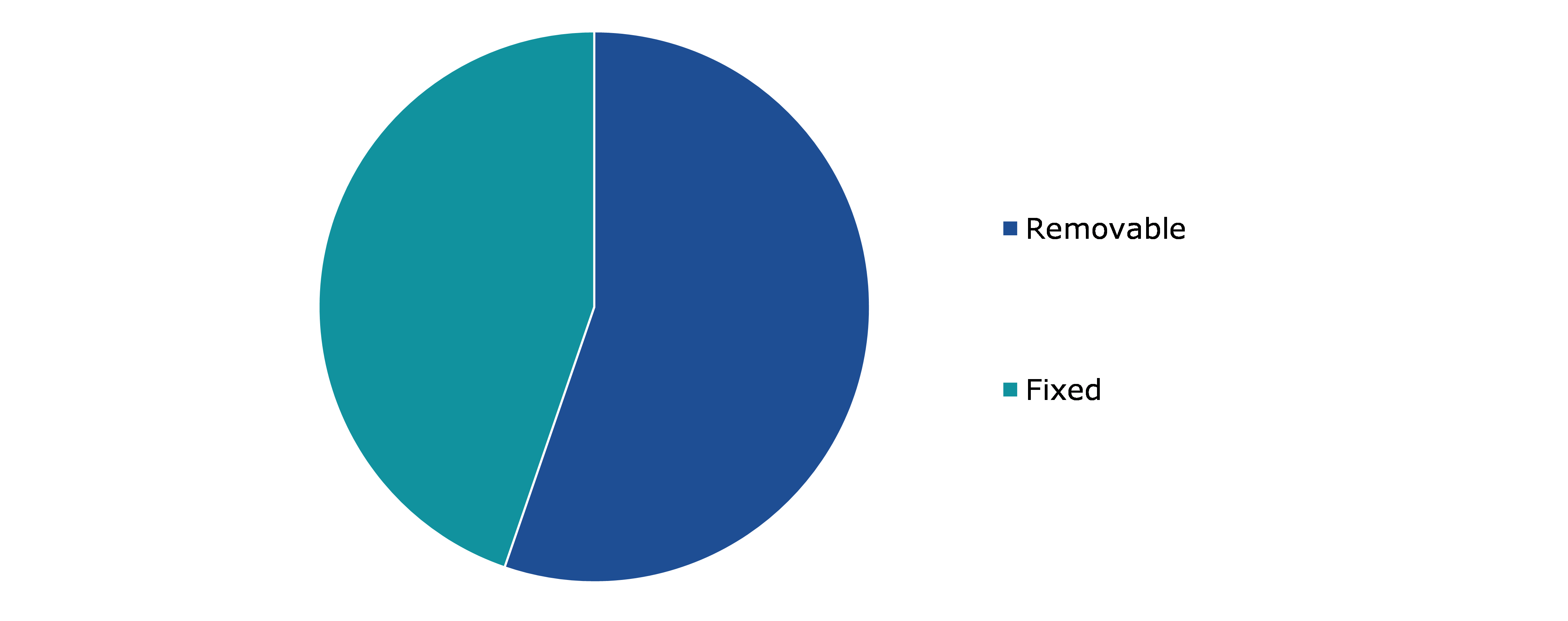

Global Dentures Market, by Product Implant

Based on product implant, the market is classified into fixed and removable. The removable sub-segment is projected to generate maximum revenue and is expected to have the fastest growth during the forecast time.

Global Dentures Market Value, by Product Implant, 2021

Removable dentures, also referred to as fake teeth, are artificial teeth that fit over the gums and remaining teeth to provide the impression that the patient still has a full set of teeth. They are typically made of materials like acrylic, nylon, or metal. Removable dentures are easily cleaned and stored because they are detachable. Also, these dentures are among the least expensive methods to replace missing teeth. Apart from replacing missing teeth set in a patient, the removable dentures also restore the mouth's functionality and helps in maintaining the shape of the face.

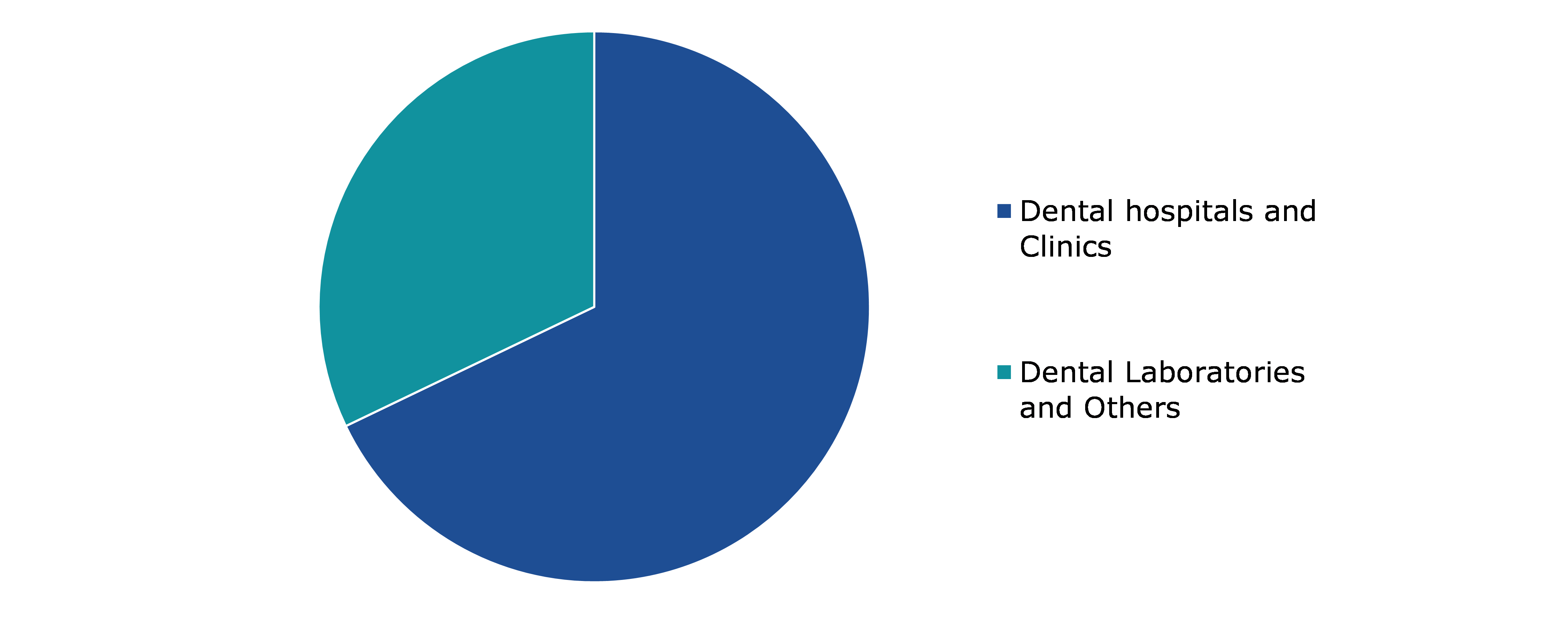

Global Dentures Market, by End User

Based on end user, the market is divided into dental hospitals & clinics and dental laboratories & others. The dental hospitals and clinics sub-segment is projected to generate fastest growth during the forecast time.

Global Dentures Market Forecast, by End User, 2021

The dental hospitals and clinics sub-segment is predicted to have a dominating market share in the global market during the forecast period. The sub-segment is expected to increase at an exponential rate in the future due to the increase in the incidence of dental disorders. Dental hospital visits have increased with the increase in the number of dental-related cases. Furthermore, the availability of experienced healthcare professionals in clinics to execute dental implants has boosted the sub-segment growth.

Global Dentures Market, Regional Insights:

The dentures market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Dentures Market Size & Forecast, by Region, 2021-2031 ($Million)

The Market for Dentures in Europe to be the Most Dominant

Oral disorders are becoming more common in Europe, owing to changes in eating habits and the adoption of an unhealthy lifestyle. A poor diet, smoking, and excessive alcohol consumption all have a negative impact on oral health. Furthermore, people tend to neglect their oral health as a result of their hectic lifestyles. As more people suffer from various dental disorders it is expected to contribute to an increase in the demand for dentures. Government initiatives to improve standard healthcare infrastructure and a greater emphasis on healthcare expenditure are assisting the countries in focusing on providing high-quality healthcare. Eastern European governments and dental organizations are working hard to promote the market's advanced dental treatments. In addition, the number of practicing dentists in Europe has increased significantly in recent years. Leading players such as Dentsply Sirona and Straumann, have large customer bases in European countries. The market is expected to grow significantly during the forecast period due to the presence of several market vendors that manufacture dental implants.

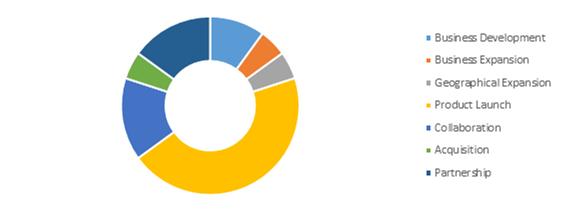

Competitive Scenario in the Global Dentures Market

Product launches and acquisitions are common strategies followed by the major market players. For instance, on December 23, 2022, Dr. B Dental Solutions, a global dental prosthetics manufacturer, announced the launch of their new care kit for denture wearers. The kit is consisting of 6 different products including new and improved ultrasonic cleaner, cleanadent paste, adhesadent denture adhesive, dental prosthetic, cleanadent denture and gum wipes, and mouth toothbrush, and liquid crystal soak disinfectant cleanser.

The companies involved in the dentures market are Kulzer GmbH, Modern Dental Group, Avadent Digital Dental Solutions, VITA Zahnfabrik, Protec Dental Laboratories, Amann Girrbach AG, Glidewell Dental, National Dentex Labs, Cosmos Dental Technology Co., Ltd, Appin Dental, and J. B. Dental Laboratories.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Product Implant |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the current market size and compound annual growth rate (CAGR) of the market during the forecast period (2021-2028)?

A. The global denture market was valued at $981.5 million in 2020, registering a CAGR of 6.5%.

Q2. What are the major factors driving the market growth?

A. Rising geriatric population and teeth loss issues associated with growing age are driving the dentures market size growth.

Q3. What is the dentures market size?

A. The global denture market was valued at $981.5 million in 2020, and is projected to reach $1,585.7 million by 2028, registering a CAGR of 6.5%.

Q4. What is the CAGR for dentures market?

A. The CAGR of dentures market is 6.5%.

Q5. What will be the growth rate of the Asia-Pacific dentures market?

A. Asia-Pacific dental equipment market is anticipated to grow at 7.4 % CAGR during the forecast period.

Q6. What are the strategies opted by the leading players in this market?

A. Product launches and mergers & acquisitions are the two key strategies opted by the operating companies in this market.

Q7. Which companies are investing more on R&D practices?

A. Dentsply Sirona and GC Corporation are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Dentures market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Dentures market

4.7.1.Pre-covid market scenario

4.8.Post-covid market scenario

5.Dentures Market, by Product Type

5.1.Overview

5.1.1.Market size and forecast, by Product Type

5.2.Complete

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2021 - 2031

5.2.3.Market share analysis, by country 2021 - 2031

5.3.Partial

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2021 - 2031

5.3.3.Market share analysis, by country 2021 – 2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Dentures Market, by Product Implant

6.1.Overview

6.1.1.Market size and forecast, by Product Implant

6.2.Fixed

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2021 - 2031

6.2.3.Market share analysis, by country 2021 - 2031

6.3.Removable

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2021 - 2031

6.3.3.Market share analysis, by country 2021 – 2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Dentures Market, by End Users

7.1.Overview

7.1.1.Market size and forecast, by End Users

7.2.Dental Hospitals & Clinics

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2021 - 2031

7.2.3.Market share analysis, by country 2021 - 2031

7.3.Dental Laboratories & Others

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2021 - 2031

7.3.3.Market share analysis, by country 2021 – 2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Dentures Market, by Region

8.1.Overview

8.1.1.Market size and forecast, by Region

8.2.North America

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by product type, 2021 - 2031

8.2.3.Market size and forecast, by product implant, 2021 - 2031

8.2.4.Market size and forecast, by end users, 2021 - 2031

8.2.5.Market size and forecast, by country, 2021 - 2031

8.2.6.U.S.

8.2.6.1.Market size and forecast, by product type, 2021 - 2031

8.2.6.2.Market size and forecast, by product implant, 2021 - 2031

8.2.6.3.Market size and forecast, by end users, 2021 - 2031

8.2.7.Canada

8.2.7.1.Market size and forecast, by product type, 2021 - 2031

8.2.7.2.Market size and forecast, by product implant, 2021 - 2031

8.2.7.3.Market size and forecast, by end users, 2021 - 2031

8.2.8.Mexico

8.2.8.1.Market size and forecast, by product type, 2021 - 2031

8.2.8.2.Market size and forecast, by product implant, 2021 - 2031

8.2.8.3.Market size and forecast, by end users, 2021 – 2031

8.3.Research Dive Exclusive Insights

8.3.1.Market attractiveness

8.3.2.Competition heatmap

8.4.Europe

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by product type, 2021 - 2031

8.4.3.Market size and forecast, by product implant, 2021 - 2031

8.4.4.Market size and forecast, by end users, 2021 - 2031

8.4.5.Market size and forecast, by country, 2021 - 2031

8.4.6.Germany

8.4.6.1.Market size and forecast, by product type, 2021 - 2031

8.4.6.2.Market size and forecast, by product implant, 2021 - 2031

8.4.6.3.Market size and forecast, by end users, 2021 - 2031

8.4.7.UK

8.4.7.1.Market size and forecast, by product type, 2021 - 2031

8.4.7.2.Market size and forecast, by product implant, 2021 - 2031

8.4.7.3.Market size and forecast, by end users, 2021 - 2031

8.4.8.France

8.4.8.1.Market size and forecast, by product type, 2021 - 2031

8.4.8.2.Market size and forecast, by product implant, 2021 - 2031

8.4.8.3.Market size and forecast, by end users, 2021 - 2031

8.4.9.Spain

8.4.9.1.Market size and forecast, by product type, 2021 - 2031

8.4.9.2.Market size and forecast, by product implant, 2021 - 2031

8.4.9.3.Market size and forecast, by end users, 2021 - 2031

8.4.10.Italy

8.4.10.1.Market size and forecast, by product type, 2021 - 2031

8.4.10.2.Market size and forecast, by product implant, 2021 - 2031

8.4.10.3.Market size and forecast, by end users, 2021 - 2031

8.4.11.Rest of Europe

8.4.11.1.Market size and forecast, by product type, 2021 - 2031

8.4.11.2.Market size and forecast, by product implant, 2021 - 2031

8.4.11.3.Market size and forecast, by end users, 2021 – 2031

8.5.Research Dive Exclusive Insights

8.5.1.Market attractiveness

8.5.2.Competition heatmap

8.6.Asia-Pacific

8.6.1.Key market trends, growth factors, and opportunities

8.6.2.Market size and forecast, by product type, 2021 - 2031

8.6.3.Market size and forecast, by product implant, 2021 - 2031

8.6.4.Market size and forecast, by end users, 2021 - 2031

8.6.5.Market size and forecast, by country, 2021 - 2031

8.6.6.China

8.6.6.1.Market size and forecast, by product type, 2021 - 2031

8.6.6.2.Market size and forecast, by product implant, 2021 - 2031

8.6.6.3.Market size and forecast, by end users, 2021 - 2031

8.6.7.Japan

8.6.7.1.Market size and forecast, by product type, 2021 - 2031

8.6.7.2.Market size and forecast, by product implant, 2021 - 2031

8.6.7.3.Market size and forecast, by end users, 2021 - 2031

8.6.8.India

8.6.8.1.Market size and forecast, by product type, 2021 - 2031

8.6.8.2.Market size and forecast, by product implant, 2021 - 2031

8.6.8.3.Market size and forecast, by product implant, 2021 - 2031

8.6.8.4.Market size and forecast, by end users, 2021 - 2031

8.6.9.South Korea

8.6.9.1.Market size and forecast, by product type, 2021 - 2031

8.6.9.2.Market size and forecast, by product implant, 2021 - 2031

8.6.9.3.Market size and forecast, by end users, 2021 - 2031

8.6.10.Australia

8.6.10.1.Market size and forecast, by product type, 2021 - 2031

8.6.10.2.Market size and forecast, by product implant, 2021 - 2031

8.6.10.3.Market size and forecast, by end users, 2021 - 2031

8.6.11.Rest of Asia-Pacific

8.6.11.1.Market size and forecast, by product type, 2021 - 2031

8.6.11.2.Market size and forecast, by product implant, 2021 - 2031

8.6.11.3.Market size and forecast, by end users, 2021 – 2031

8.7.Research Dive Exclusive Insights

8.7.1.Market attractiveness

8.7.2.Competition heatmap

8.8.LAMEA

8.8.1.Key market trends, growth factors, and opportunities

8.8.2.Market size and forecast, by product type, 2021 - 2031

8.8.3.Market size and forecast, by product implant, 2021 - 2031

8.8.4.Market size and forecast, by end users, 2021 - 2031

8.8.5.Market size and forecast, by country, 2021 - 2031

8.8.6.Latin America

8.8.6.1.Market size and forecast, by product type, 2021 - 2031

8.8.6.2.Market size and forecast, by product implant, 2021 - 2031

8.8.6.3.Market size and forecast, by end users, 2021 - 2031

8.8.7.Middle East

8.8.7.1.Market size and forecast, by product type, 2021 - 2031

8.8.7.2.Market size and forecast, by product implant, 2021 - 2031

8.8.7.3.Market size and forecast, by end users, 2021 - 2031

8.8.8.Africa

8.8.8.1.Market size and forecast, by product type, 2021 - 2031

8.8.8.2.Market size and forecast, by product implant, 2021 - 2031

8.8.8.3.Market size and forecast, by end users, 2021 – 2031

8.9.Research Dive Exclusive Insights

8.9.1.Market attractiveness

8.9.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company profiles

10.1.Kulzer GmbH

10.1.1.Company overview

10.1.2.Operating business segments

10.1.3.Product portfolio

10.1.4.Financial Performance

10.1.5.Recent strategic moves & developments

10.2.Modern Dental Group

10.2.1.Company overview

10.2.2.Operating business segments

10.2.3.Product portfolio

10.2.4.Financial Performance

10.2.5.Recent strategic moves & developments

10.3.Avadent Digital Dental Solutions

10.3.1.Company overview

10.3.2.Operating business segments

10.3.3.Product portfolio

10.3.4.Financial Performance

10.3.5.Recent strategic moves & developments

10.4.VITA Zahnfabrik

10.4.1.Company overview

10.4.2.Operating business segments

10.4.3.Product portfolio

10.4.4.Financial Performance

10.4.5.Recent strategic moves & developments

10.5.Protec Dental Laboratories

10.5.1.Company overview

10.5.2.Operating business segments

10.5.3.Product portfolio

10.5.4.Financial Performance

10.5.5.Recent strategic moves & developments

10.6.Amann Girrbach AG

10.6.1.Company overview

10.6.2.Operating business segments

10.6.3.Product portfolio

10.6.4.Financial Performance

10.6.5.Recent strategic moves & developments

10.7.Glidewell Dental

10.7.1.Company overview

10.7.2.Operating business segments

10.7.3.Product portfolio

10.7.4.Financial Performance

10.7.5.Recent strategic moves & developments

10.8.Cosmos Dental Technology Co., Ltd

10.8.1.Company overview

10.8.2.Operating business segments

10.8.3.Product portfolio

10.8.4.Financial Performance

10.8.5.Recent strategic moves & developments

10.9.Appin Dental

10.9.1.Company overview

10.9.2.Operating business segments

10.9.3.Product portfolio

10.9.4.Financial Performance

10.9.5.Recent strategic moves & developments

10.10.J. B. Dental Laboratories

10.10.1.Company overview

10.10.2.Operating business segments

10.10.3.Product portfolio

10.10.4.Financial Performance

10.10.5.Recent strategic moves & developments

In modern society, everyone needs healthy teeth. Having a healthy and appealing smile can have a tremendous impact on many parts of life, including social interactions, personal relationships, and professional prospects. However, when someone has damaged or unhealthy teeth, they may feel self-conscious about their appearance, which lowers their self-esteem and confidence. This is where the denture solution comes in.

The dentures market refers to the industry that manufactures, sales, and distributes dental prosthetic devices known as dentures. Dentures, also referred to as fake teeth, are prosthetic tooth replacements that are designed to fit a person's specific mouth and can be used to replace one or both upper and lower teeth. Dentures are manufactured to fit any mouth configuration according to a person's clinical, cosmetic, and budgetary demands. Dentures are made from a variety of raw materials, including acrylic gum-coloured bases, chrome-cobalt, flexible polyamide microcrystalline, and a hybrid material that includes two types of material. These realistic-looking alternative teeth are so effective in their visual replication of human teeth that distinguishing a well-made denture from a pair of original teeth is impossible.

Recent Trends in the Dentures Market

The dentures market is continuously evolving with new advancements and trends. One of the significant trends that have emerged in the dentures industry is the application of CAD/CAM (computer-aided design and manufacturing) systems. These methods enable the production of more precise and customized dentures, enhancing patient fit and comfort. Additionally, the use of implant-supported dentures as an alternative to conventional removable dentures has grown in popularity. Dental implants are implanted into the jawbone, and dentures are connected to the implants, giving them superior stability and reducing some of the frequent concerns related to traditional dentures, like discomfort and slippage.

Newest Insights in the Dentures Market

As per a report by Research Dive, the global dentures market is expected to grow at a CAGR of 6.8% and generate revenue of $3,212.1 million by 2031. The primary factors driving the growth of the market are an increase in the incidence of tooth loss among people due to a variety of factors such as poor dental health, accidents, prevalence of diseases such as edentulism, and a rise in dentures product portfolios by large corporations. However, large out-of-pocket expenses in nations with low or middle incomes and an absence of highly specialized dental equipment and trained experts in primary healthcare organizations are expected to hinder the market growth.

The dentures market in Europe is expected to remain dominant in the coming years. The region's high revenue in 2021 was driven by the availability of numerous dental implant manufacturers in the market, as well as the growing prevalence of various dental conditions. This has led to an increased need for excellent dental prosthesis, like dentures.

How are Market Players Responding to the Rising Demand for Dentures?

Market players are responding to the rising demand for dentures by investing in research and development to create more advanced and innovative denture solutions. They are also exploring unique materials and technologies to enhance the functioning, comfort, and appearance of dentures.

In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach. Some of the foremost players in the dentures market are Modern Dental Group, Kulzer GmbH, Avadent Digital Dental Solutions, Protec Dental Laboratories, VITA Zahnfabrik, Amann Girrbach AG, National Dentex Labs, Glidewell Dental, Cosmos Dental Technology Co., Ltd, J. B. Dental Laboratories, Appin Dental, and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market.

For instance:

- In May 2019, Kulzer, a pioneer in dental materials worldwide, and DENTCA, launched a web-based denture design platform, which will enable dental labs and doctors to create a denture online by utilizing digital Mondial and Mondial i teeth, print the denture by downloading the design files. As a result, dental offices, labs, and patients will all benefit from the time savings and accuracy improvements.

- In December 2022, Dr. B Dental Solutions, a world-wide producer of dental prosthesis, announced the availability of their denture care package. The kit is comprised of six different products, including Cleanadent Paste, Adhesadent Denture Adhesive, Dental Prosthetic and Mouth Toothbrush, Cleanadent Denture and Gum Wipes, Liquid Crystal Soak Disinfectant Cleanser, and New and Improved Ultrasonic Cleaner.

- In May 2023, SprintRay Inc., a world pioneer in digital dentistry and 3D printing technologies, announced that it had achieved US FDA (Food and Drug Administration) 510(k) clearance for High Impact Denture Base, the first denture material with ceramic infusion for 3D manufacture and repair of whole and partial removable dentures and baseplates.

COVID-19 Impact on the Global Dentures Market

The COVID-19 pandemic had an adverse impact on the global dentures market. During the pandemic, due to the rapidity of coronavirus transmission and the overwhelming number of significant symptoms, numerous individuals purposely delayed their regular medical and dental appointments. In addition, medical professionals delayed multiple dental treatments and restricted outpatient visits to stop the dangerous virus from spreading. As a result, the shutdown forced the closure of several private dentistry facilities. These factors significantly hindered the dentures market growth amidst the pandemic.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com