Payment Gateway Market Report

RA08495

Payment Gateway Market by Type (Hosted and Non Hosted), Enterprise Size (Small & Medium Enterprise (SME) and Large Enterprise), End-use (Travel & Hospitality, BFSI, Retail & E-Commerce, Media & Entertainment, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2030

Payment Gateway Market Analysis

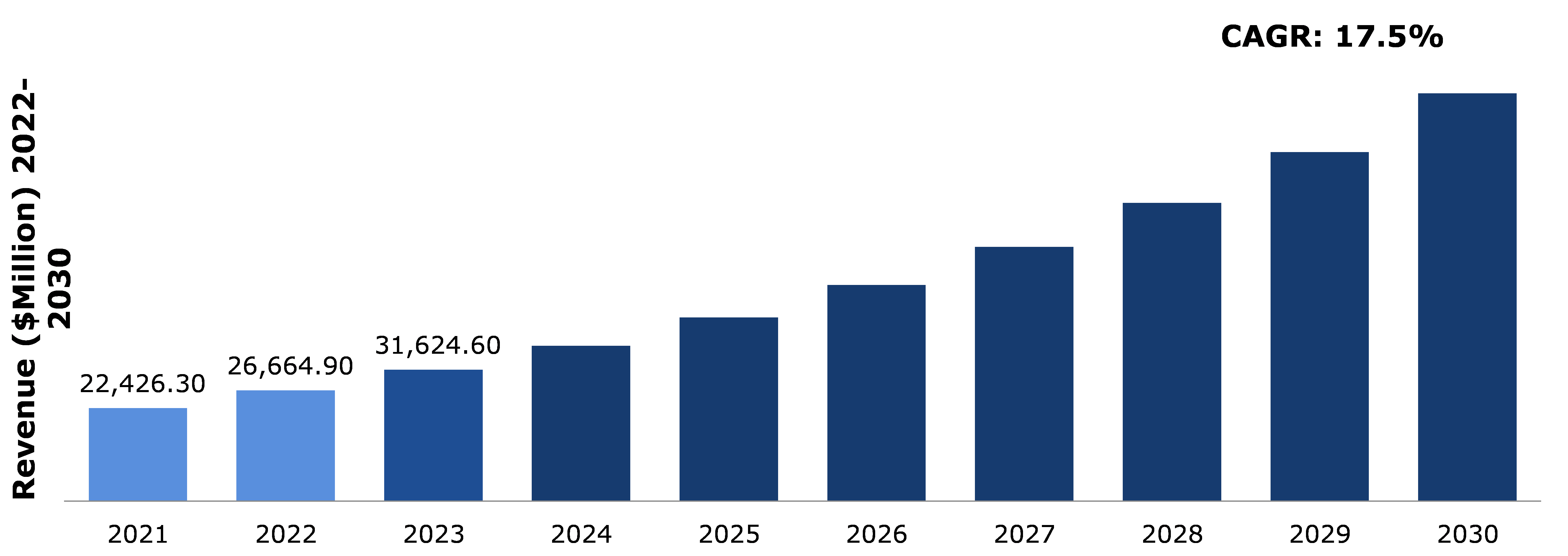

The global payment gateway market is estimated to be valued at $98,198.70 million by 2030, surging from $22,426.30 million in 2021, at a noteworthy CAGR of 17.7%.

Market Synopsis

Digital payments are becoming a more common mode of money transaction, and this mode is becoming more crucial. With technological improvements, the payment gateway platform is expected to suffer a further shift in its efficiency, resulting in the imposition of novel alterations. All of this might result in an umpteen of profits for the economy.

The main restraining factor of payment gateway market is rising cyber security issues. As more people are opting for online and digital payment methods, they require to post their account details on the payment portal. With this, many cyber criminals and naughty elements in the society can hack their accounts and misuse them. Such factors are responsible for impeding market growth in the next few years.

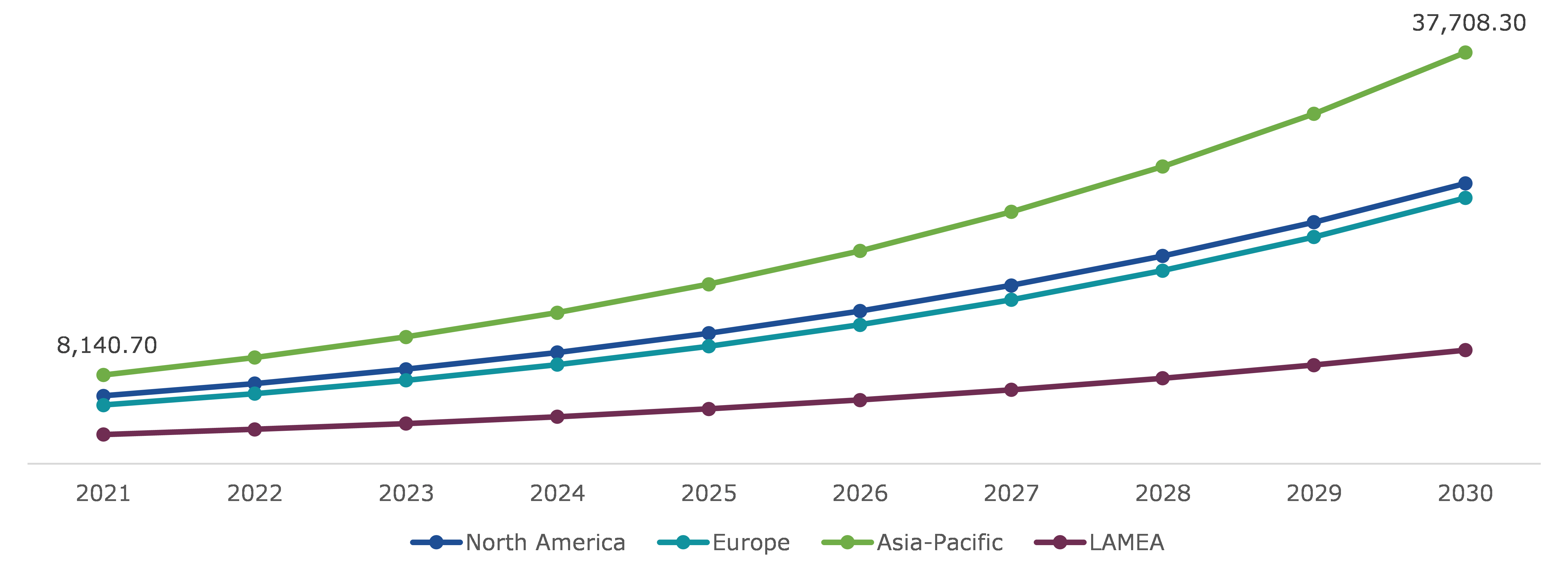

According to the regional analysis of the market, the Asia-Pacific market is expected to significantly grow during the review period.

Payment Gateway Overview

A payment gateway aids in the efficient execution of online transactions between buyers and sellers. It is an ecommerce solution that handles debit and credit card payments by moving sensitive data between payment gateways and front-end processors. As technology is advancing fast, the demand for quick and hassle free money transaction among people has increased. They now prefer to use digital transaction mode for payments. Payment gateways are constantly changing to match new consumer preferences and technological advancements.

Impact Analysis of COVID-19 on the Global Payment Gateway Market

COVID-19 has triggered a global public health disaster that has damaged every aspect of people's lives while also placing the global economy on precarious ground. The pandemic and its effects have expedited a number of current trends in consumer and corporate behavior, in the payments sector, as well as bringing new ones, such as supply chain restructuring and cross-border commerce. The payment gateway market greatly strengthened in the past years by ongoing movements toward e-commerce, digital payments (including contactless), quick payments, and cash displacement. Amazon, for example, saw 40 % year-over-year growth in the second quarter of 2020, fueled in part by a tripling of grocery sales. Furthermore, differences in purchasing behavior between geographies were greatly decreased, and many consumers, particularly the elderly, began to purchase online for the first time. As a result, electronic peer-to-peer and consumer-to-business payments have increased in popularity. Modern consumers' high expectations compel businesses to offer simpler, faster, and less expensive answers to everyday problems. Furthermore, as the need for cross-border payments grows, businesses must be able to process them swiftly and seamlessly for their customers, which helps to boost the demand for the payment gateway market worldwide.

Increased Ecommerce Sales, as well as Increased Internet Penetration, Projected to Drive the Market Growth

Rising e-commerce sales and improved internet speeds are expected to promote the growth of the payment gateway industry. Retail is shifting away from traditional business models due to modern payments, smartphone transactions, and the increased use of online credit card payments. Retailers are putting their efforts on developing innovative mobile payment solutions, risk management, and customer service, both online and offline. While certain aspects of this evolution will happen naturally, there will be plenty of opportunities for diverse parties to shape the outcome. The cashless revolution has significant implications for unbanked populations. For example, PayFuture Gateway Platform, a Singapore-based AI-based innovative, has launched a new high-performance payment gateway connector that provides online access to popular local payment options in a variety of emerging markets. With the fast rise of e-commerce around the world, both local and international online merchants may now use Pay Future to join these emerging areas and take advantage of hitherto untapped business prospects. Customers are being prioritized by market participants who have formed arrangements with credit/debit card companies such as MasterCard, Inc. and Visa, Inc. to simplify the payment process and lower processing rates. Furthermore, the rapidly increasing internet prevalence around the world, developments in mobile payment technology, and an increase in the use of smart phones & mobile wallets for a number of activities are some of the important drivers driving payment gateway market expansion.

To know more about global payment gateway market drivers, get in touch with our analysts here.

Lack of Internet Access in Emerging Countries to Restrain the Market Growth

Lack of internet access in developing countries due to lack of infrastructure and a poor regulatory environment act as a restraining factor. Regardless of the wide internet and mobile penetration across countries such as India, not everyone is able to get seamless and uninterrupted connectivity. Digital payments rely heavily on connection but securing and maintaining reliable internet access across developing countries remain major concerns.

Increasing Demand for Instant Mobile-based Payments and the Rising Use of Mobile Banking Channels to Provide Growth Opportunities

Payment gateway technological improvements have resulted in a broad and developing payment gateway market, as well as a significant growth in the use of BFSI. The sector is expected to rise due to rising demand for rapid mobile payments and increased use of mobile banking channels. Consumers anticipate a flawless user experience in mobile wallets as their tastes shift toward digital payment technology. As a result, the demand for secure and reliable payment gateways to handle the spike in digital payment volumes is rapidly increasing. Furthermore, given the quick speed of innovation in the digital economy, having a solid payment infrastructure is critical for digital commerce enterprises.

To know more about global payment gateway market opportunities, get in touch with our analysts here.

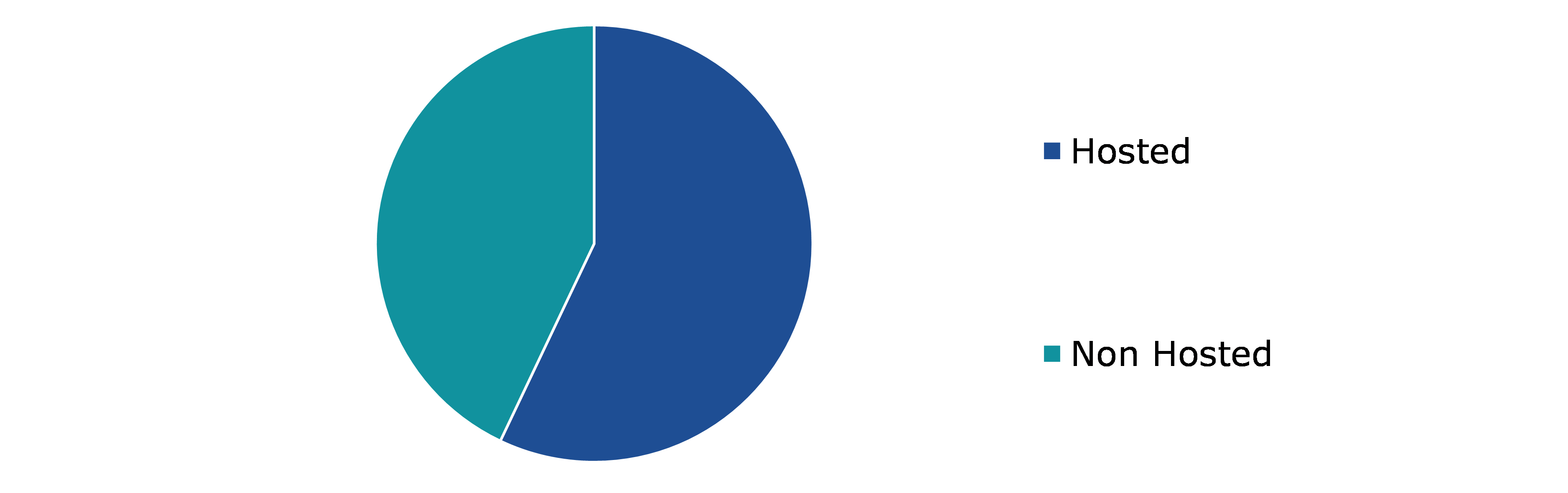

Global Payment Gateway Market, by Type

Based on type, the market has been divided into hosted and non hosted. Hosted sub-segment accounted for the highest revenue share in 2021, and non-hosted sub-segment is predicted to show the fastest growth during the forecast period.

Global Payment Gateway Market Share, by Type, 2021

Enterprise size: Research Dive Analysis

The hosted sub-segment is expected to have the largest market share during the forecast period. A third-party checkout system that directs clients to the payment service provider's (PSP) website is known as a hosted payment gateway. As utilities look for solutions to enable the continued usage of dependable online billing and payments, hosted payment gateways will remain a popular choice.

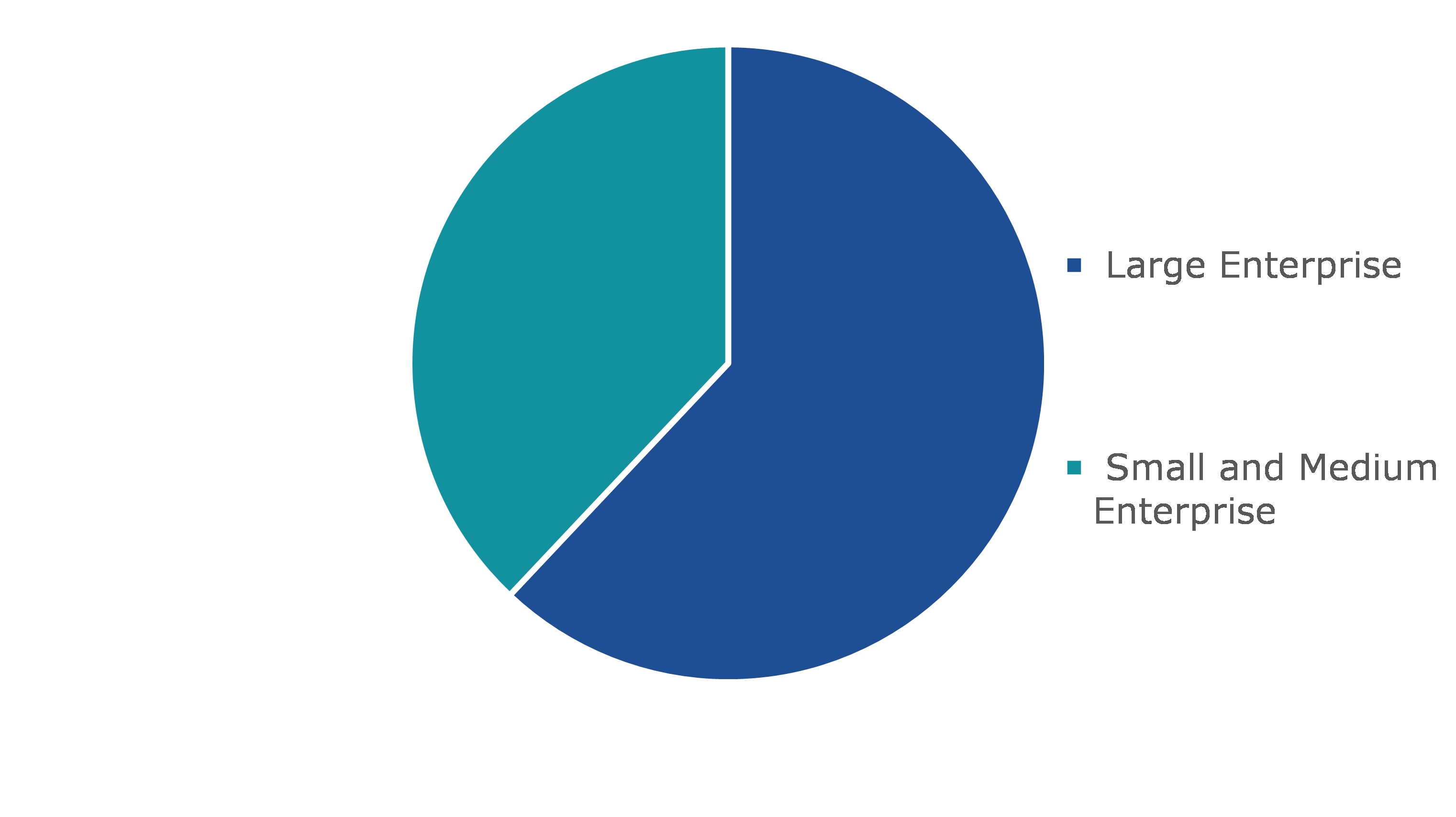

Global Payment Gateway Market, by Enterprise Size

Based on enterprise size, the analysis has been divided into small & medium enterprise (SME) and large enterprise. Out of these, large enterprise sub-segment is predicted to be the most dominant and small & medium enterprise (SME) sub-segment is anticipated to show the fastest growth during the forecast period.

Global Payment Gateway Market Share, by Enterprise Size, 2021

Enterprise size: Research Dive Analysis

The large enterprise sub-segment is expected to have a dominant market share during the forecast period. Due to the growing predisposition of the people towards online purchase, huge enterprises such as e-commerce businesses play a crucial role in the transaction. Payment gateway is a type of payment platform that accepts a variety of payment methods, manages the risks connected with those payments, processes them through appropriate channels, and provides tracking of information to both the financial institution and the business customer. The enterprise gateway payments platform enables financial institutions to simplify their payments infrastructure and execute a successful payments strategy on a single, integrated, and real-time platform. The increased adoption of digital transaction techniques and payment processing by large-scale firms to collect money from their customers is driving up demand for payment gateways in the large enterprise industry.

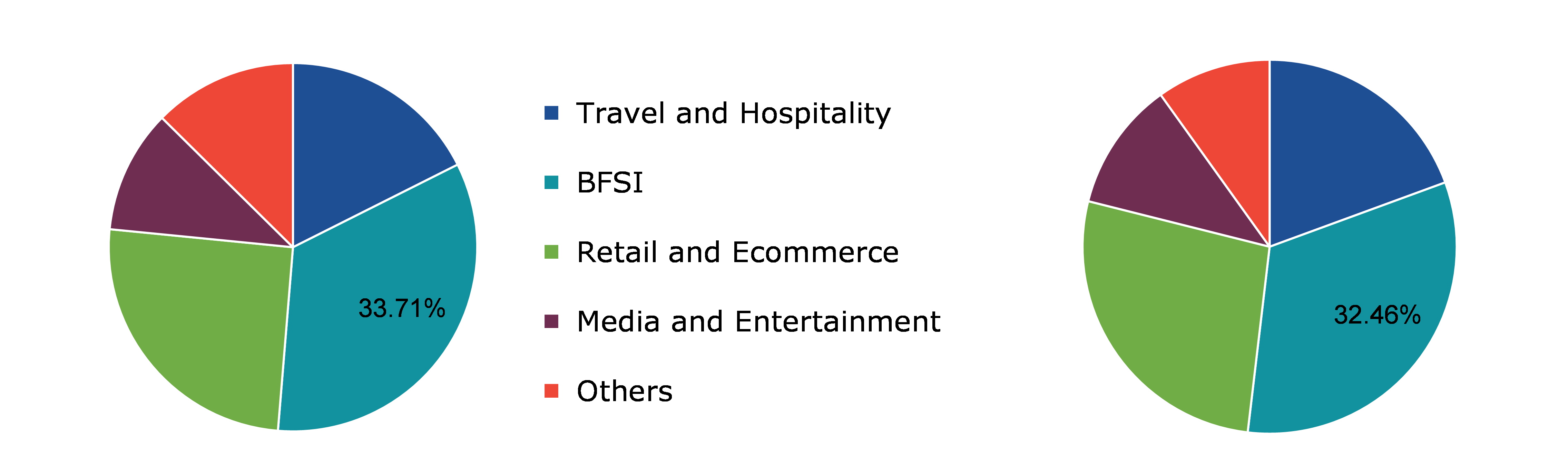

Global Payment Gateway Market, by End-use

Based on end-use, the analysis has been divided into travel & hospitality, BFSI, retail & ecommerce, media & entertainment, and others. Among these, BFSI sub-segment is predicted to be the most dominant sub-segment and travel & hospitality sub-segment is anticipated to have the fastest growth during the forecast period.

Global Payment Gateway Market Share, by End-use, 2021 & 2030

Enterprise size: Research Dive Analysis

The BFSI sub-segment is expected to have a dominating market share during the timeframe. The financial services industry (BFSI) is a leader in the adoption of new technology. It has spent the last few years focusing on strengthening its offerings and enhancing the client experience. Financial institutions have benefited from the development of payment gateways in a variety of ways. Financial organizations can offer differentiated payment services to potential clients through digital payment platforms. As a result, prominent financial institutions throughout the world have introduced mobile and online applications to conduct seamless financial transactions, which is one of the growth drivers.

Global Payment Gateway Market, Regional Insights:

The payment gateway market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Payment Gateway Market Size & Forecast, By Region, 2021-2030 ($ Million)

Enterprise size: Research Dive Analysis

The Market for Payment Gateway in Asia-Pacific to be the Most Dominant and the Most Lucrative

The payment gateway market in Asia-Pacific is expected to garner dominant share by 2030. This increase can be attributed to a number of government initiatives targeted at enhancing the online payment infrastructure of the Asia-Pacific region's diverse countries. The Reserve Bank of India (RBI), for example, has regulated a number of gateways to allow for effective digital payments in India. Furthermore, the Chinese government is focusing its efforts on improving internet connectivity in rural areas, resulting in enhanced market growth potential for online payment gateways in this region. The large population in this region, which adds to the volume of transactions, as well as the domestic and international enterprises investing in this region is the driving force behind market expansion in this region.

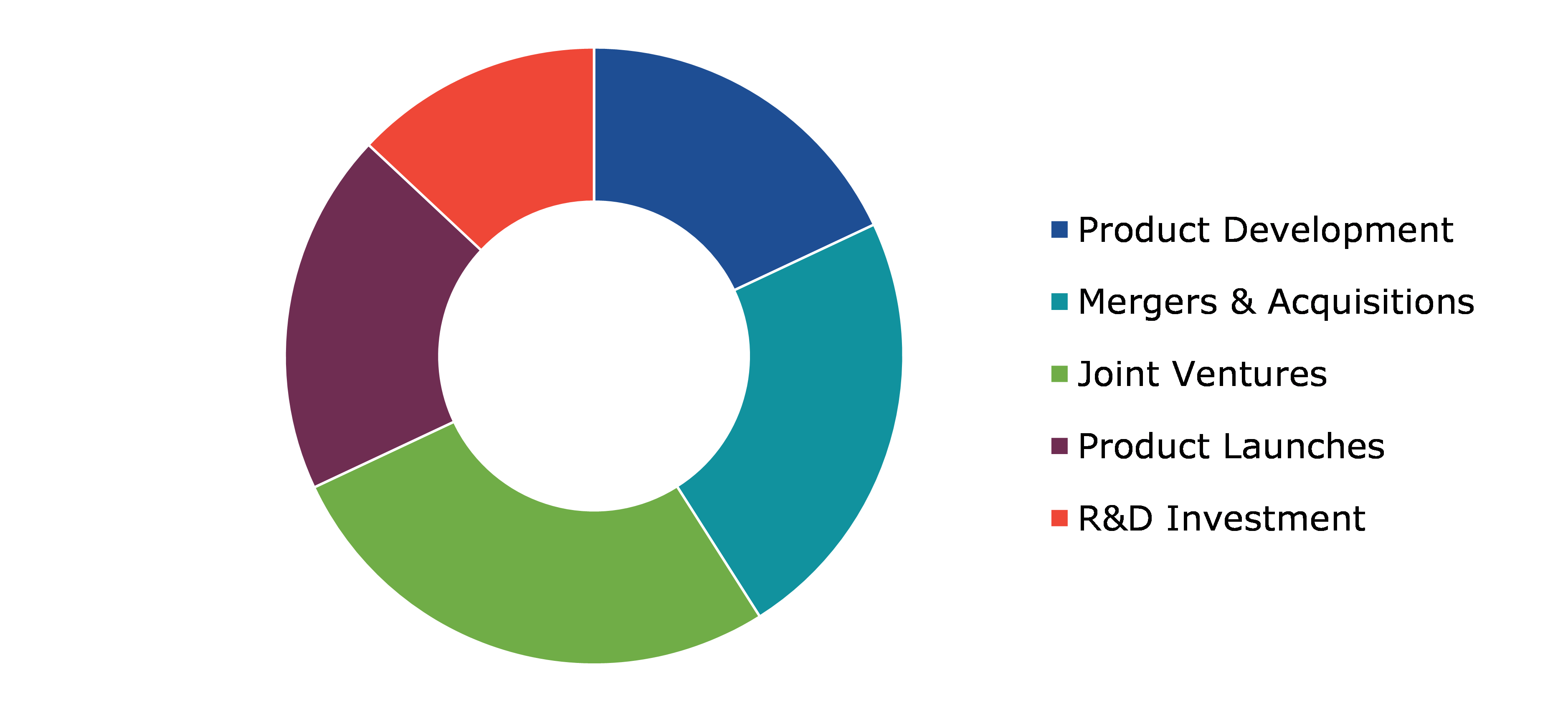

Competitive Scenario in the Global Payment Gateway Market

Product advancements, innovations, and business expansion are common strategies followed by major market players.

Enterprise size: Research Dive Analysis

Some of the leading payment gateway market players are PayPal Holdings, Inc., STRIPE, Visa Inc., Amazon.com Inc., FIS(Worldpay), Mastercard, PayU, BitPay, Inc., FISERV, INC.(BluePay), and JPMorgan Chase & Co.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2021-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Enterprise size |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global payment gateway market?

A. The global payment gateway market is estimated to be valued at $ 98,198.70 million by 2030, surging from $22,426.30 million in 2021, at a noteworthy CAGR of 17.7%.

Q2. Which are the major companies in the payment gateway market?

A. PAYPAL HOLDINGS INC., STRIPE, and Amazon.com Inc. are some of the major companies operating in the global payment gateway market.

Q3. Which region possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific payment gateway Market?

A. The growth rate of the Asia-Pacific payment gateway market is 18.4%.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovations, technological advancements, and business expansions are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. PAYPAL HOLDINGS INC., STRIPE, and Amazon.com Inc. are investing more on R&D practices.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global payment gateway market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Enterprise size matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on payment gateway market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Payment Gateway Market, by Type

5.1.Overview

5.1.1.Market size and forecast, by Type

5.2.Hosted

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2022-2030

5.2.3.Market share analysis, by country 2022 & 2030

5.3.Non-Hosted

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2022-2030

5.3.3.Market share analysis, by country 2022 & 2030

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Payment Gateway Market, by Enterprise size

6.1.Overview

6.1.1.Market size and forecast, by Enterprise size

6.2.Small & Medium Enterprise

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2022-2030

6.2.3.Market share analysis, by country 2022 & 2030

6.3.Large Enterprise

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2022-2030

6.3.3.Market share analysis, by country 2022 & 2030

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Payment Gateway Market, by End-use

7.1.Overview

7.1.1.Market size and forecast, by end-use

7.2.Travel & Hospitality

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2022-2030

7.2.3.Market share analysis, by country 2022 & 2030

7.3.BFSI

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2022-2030

7.3.3.Market share analysis, by country 2022 & 2030

7.4.Retail & E-Commerce

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region, 2022-2030

7.4.3.Market share analysis, by country 2022 & 2030

7.5.Media & Entertainment

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by region, 2022-2030

7.5.3.Market share analysis, by country 2022 & 2030

7.6.Others

7.6.1.Key market trends, growth factors, and opportunities

7.6.2.Market size and forecast, by region, 2022-2030

7.6.3.Market share analysis, by country 2022 & 2030

7.7.Research Dive Exclusive Insights

7.7.1.Market attractiveness

7.7.2.Competition heatmap

8.Payment gateway Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Type

8.1.1.2.Market size analysis, by Enterprise size

8.1.1.3.Market size analysis, by end-use

8.1.2.Canada

8.1.2.1.Market size analysis, by Type

8.1.2.2.Market size analysis, by Enterprise size

8.1.2.3.Market size analysis, by end-use

8.1.3.Mexico

8.1.3.1.Market size analysis, by Type

8.1.3.2.Market size analysis, by Enterprise size

8.1.3.3.Market size analysis, by end-use

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Type

8.2.1.2.Market size analysis, by Enterprise size

8.2.1.3.Market size analysis, by end-use

8.2.2.UK

8.2.2.1.Market size analysis, by Type

8.2.2.2.Market size analysis, by Enterprise size

8.2.2.3.Market size analysis, by end-use

8.2.3.France

8.2.3.1.Market size analysis, by Type

8.2.3.2.Market size analysis, by Enterprise size

8.2.3.3.Market size analysis, by end-use

8.2.4.Spain

8.2.4.1.Market size analysis, by Type

8.2.4.2.Market size analysis, by Enterprise size

8.2.4.3.Market size analysis, by end-use

8.2.5.Italy

8.2.5.1.Market size analysis, by Type

8.2.5.2.Market size analysis, by Enterprise size

8.2.5.3.Market size analysis, by end-use

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Type

8.2.6.2.Market size analysis, by Enterprise size

8.2.6.3.Market size analysis, by end-use

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Type

8.3.1.2.Market size analysis, by Enterprise size

8.3.1.3.Market size analysis, by end-use

8.3.2.Japan

8.3.2.1.Market size analysis, by Type

8.3.2.2.Market size analysis, by Enterprise size

8.3.2.3.Market size analysis, by end-use

8.3.3.India

8.3.3.1.Market size analysis, by Type

8.3.3.2.Market size analysis, by Enterprise size

8.3.3.3.Market size analysis, by end-use

8.3.4.Australia

8.3.4.1.Market size analysis, by Type

8.3.4.2.Market size analysis, by Enterprise size

8.3.4.3.Market size analysis, by end-use

8.3.5.South Korea

8.3.5.1.Market size analysis, by Type

8.3.5.2.Market size analysis, by Enterprise size

8.3.5.3.Market size analysis, by end-use

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Type

8.3.6.2.Market size analysis, by Enterprise size

8.3.6.3.Market size analysis, by end-use

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Type

8.4.1.2.Market size analysis, by Enterprise size

8.4.1.3.Market size analysis, by end-use

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Type

8.4.2.2.Market size analysis, by Enterprise size

8.4.2.3.Market size analysis, by end-use

8.4.3.UAE

8.4.3.1.Market size analysis, by Type

8.4.3.2.Market size analysis, by Enterprise size

8.4.3.3.Market size analysis, by end-use

8.4.4.South Africa

8.4.4.1.Market size analysis, by Type

8.4.4.2.Market size analysis, by Enterprise size

8.4.4.3.Market size analysis, by end-use

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Type

8.4.5.2.Market size analysis, by Enterprise size

8.4.5.3.Market size analysis, by end-use

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.PayPal Holdings, Inc.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.STRIPE

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Visa Inc.

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Amazon.com Inc

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.FIS(Worldpay)

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.MASTERCARD

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.BitPay, Inc

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.FISERV, INC.(BluePay)

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.JPMorgan Chase & Co.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.PayU

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

The terms and techniques of payments have evolved significantly in the last two decades. With the growing adoption of digitalization, the payment sector has taken many big turns to progress. Today, about 67% millennials and 56% GenXers prefer to shop online rather than from a store, as per the Big Commerce: The 19 Ecommerce Trend. People nowadays are demanding enhanced speed, improved convenience, greater value, and most essentially quicker checkout while performing online payments. All this has been thriving the growth of digital payment gateways remarkably.

The payment gateway, which enables businesses to accept payments online from anywhere via different channels and devices, has been undergoing several developments ever since the rising implementation of digitalization. An effective and smooth payment gateway is the key solution for uninterrupted and secure online transactions. According to a report by Research Dive, the global payment gateway market is expected to garner $98,198.70 million in the 2021–2030 timeframe, growing with a CAGR of 17.7%.

What Factors are Responsible for the Payment Gateway Market’s Growth?

The global payment gateway market is progressing at a bewildering rate. In 2020, after the outbreak of the COVID-19 pandemic, a sharp rise has been observed in the global penetration of smartphones as well as internet, offering of payment services even by non-banking organizations, consumers’ demand for one-touch payments, and many others.

A steep rise in the global ecommerce sales and enhanced internet speed are greatly fueling the growth of the payment gateway market. In the present times, retail businesses are switching from traditional business models to modern business techniques by integrating advancement payments options, encouraging smartphone transactions, and promoting the use of online credit cards for carrying out payments. All these factors are boosting the adoption of online payment methods, which is fueling the market growth at a significant rate.

In addition, today’s consumers expect a seamless user experience in mobile wallets as their preferences are shifting towards digital payment methods. Consequently, the need for safe and consistent payment gateways to cope with the spur in the adoption of digital payments is swiftly increasing.

Payment Gateway Market Trends and Developments

Several leading payment gateway market players such as PayPal Holdings, Inc., Visa Inc., STRIPE, Amazon.com Inc., Mastercard, FIS(Worldpay), PayU, FISERV, INC. (BluePay), BitPay, Inc., JPMorgan Chase & Co, and others, are undertaking various activities such as new product launches, mergers & acquisitions, partnerships, etc. to obtain a leading-edge in the global market. For instance,

- In October 2020, Paytm, an Indian multinational technology firm that focuses on offering digital payment system, e-commerce, and finance, launched the same-day settlement facility for fund transfers on its payment gateway service. This new facility will aid business partners conduct money transfers at any time in their bank account on the same day of receiving payment, without the need to wait for the next day.

- In June 2021, Xpate, a company focused on enhancing the global payments using a design-centric method to serve mounting business needs, stated that the company is attempting to streamline the management of card payments by launching a new payment gateway and operational support project called, xpate Links.

- In June 2021, StoreHippo, a foremost e-commerce platform, joined hands with Paytm, the leading digital financial services platform in India, for its payment gateway business. The payment gateway by Paytm will facilitate businesses on StoreHippo with easy payment methods and help the e-commerce players to explore further into the untapped markets in India. With this collaboration, StoreHippo will be able to provide its client's a stress-free, flexible, and safe payment gateway all over India.

COVID-19 Impact on the Payment Gateway Market

The payment gateway market has been significantly elevated with the outbreak of the COVID-19 pandemic in 2020. Growing shift toward e-commerce, quick payments, digital payments (including contactless payments), and cash displacement has boosted the growth of the global market in the pandemic period. For instance, Amazon, a leading e-commerce platform, observed around 40% year-over-year growth in the 2nd quarter of 2020, owing to the sudden boom in the grocery sales. Moreover, integration of advanced technologies in payment gateways are likely to deliver more advanced and reliable payment platforms and solutions, which might bring in several growth opportunities for the growth of the global market in the upcoming years.

Regional Analysis

The Asia-Pacific region is expected to have the largest share in the payment gateway market, and hence, dominate the market during the forecast period. The tremendous growth of the region can be attributed to the increasing number of government initiatives targeted at enhancing the online payment infrastructure in various countries of the region. For instance, the Reserve Bank of India (RBI), has regulated a number of gateways to allow for effective digital payments in the country. Moreover, the large population in countries like China and India adds to the volume of transactions, as well as the international and domestic enterprises investing in this region, which is driving the market growth.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com