Point Of Sale Software Market Report

RA08423

Point of Sale Software Market by Application Type (Fixed and Mobile), Deployment (On-premise and Cloud), Enterprise Size (Small & Medium Enterprises and Large Enterprises), End User (Restaurants, Retail, Hospitality, Healthcare, Media & Entertainment, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022- 2031

Global Point of Sale Software Market Analysis

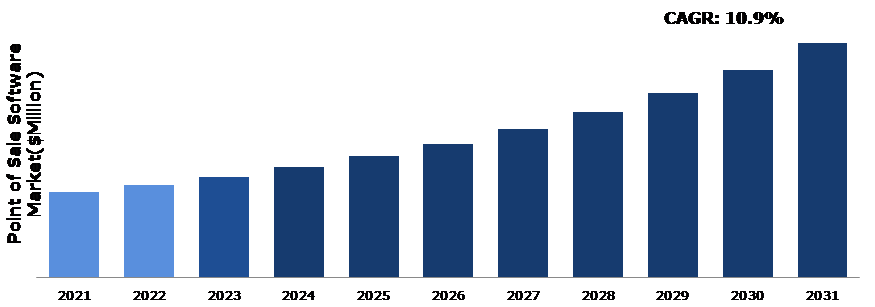

The Global Point of Sale Software Market Growth was $4936.4 million in 2021 and is predicted to grow with a CAGR of 10.9%, by generating revenue of $ 13645.2 million by 2031.

Point of Sale Software Market Synopsis

Point of sale software solutions have made in-roads in several sectors owing to their ability to offer custom and advanced analytical functions. These terminals or systems, supported by significant software capabilities, assist company operators in streamlining day-to-day operations while allowing them to focus on their primary business tasks. Increased demand for customized point of sale software or check-out systems across a wide range of corporate applications will drive the development of sophisticated software solutions that will serve as the basis of these systems. The development of software that supports a diverse range of industries while providing analytical capabilities to monitor data captured through regular company activities is expected to drive market growth during the forecast period.

Costly POS systems are possible while need to make a sizable initial investment when purchasing or renting hardware, this is not typically the case with software. The significant upfront investment is required when purchasing or renting hardware, this is not often the case with software. Additional fees are incurred for repairs and routine maintenance. In addition, some services may charge up to 3% for each transaction, which may be excessive, particularly for a small business.

The latest retail technology solutions are allowing merchants to offer customers with unparalleled convenience and more engaging experiences. Therefore, all types of point of sale software systems—desktop, mobile, tablet, and thin client—will need to incorporate fresh strategies for facilitating touch-free, frictionless transactions. Online orders must seamlessly interact with in-store pickups using point of sale software systems, smart businesses will provide.

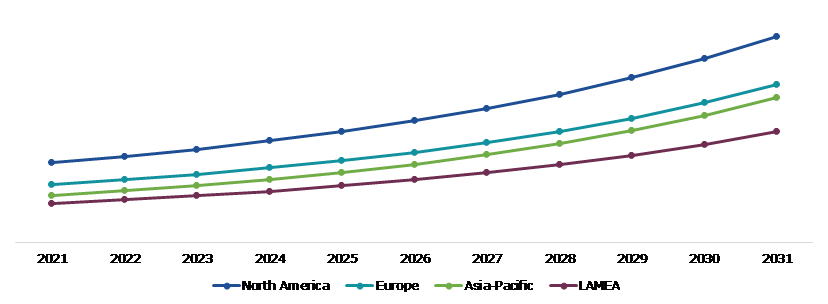

According to regional analysis, the Asia-Pacific point of sale market is anticipated to experience significant growth, owing to rise in demand for POS terminals from small & medium enterprises (SMEs). The rapid expansion of end-user industries, an increase in client base, and low ownership costs are some others factors projected to drive the regional market growth.

Point Of Sale Software Overview

A point of sale software represents the platform where consumer makes a payment for items or services at a shop. Every time a customer makes a purchase, they are performing a point of sale transaction. The latest point of sale software extends beyond credit card processing to allow shops and restaurants to include mobile POS features and contactless payment alternatives, and e-commerce connection capabilities.

COVID-19 Impact on Global Point of Sale Software Market

The COVID-19 impact of point of sale software market has positively impact globally. Fear of contracting the COVID-19 disease along with strict social distancing rules implemented by developed and developing countries to prevent the virus transmission has led to the implementation of lockdown worldwide. The POS market share increased due to increase in worries about handling cash transactions owing to COVID-19. Both businesses and consumers are opting for cashless payment solutions to limit the spread of virus and infections. Furthermore, the coronavirus pandemic has had a beneficial impact on the global point of sale software market trends, R&D, and operations in 2020. Several leading players in the market are developing cloud-and AI-based PoS systems and software to remain competitive. In January 2020, Hewlett – Packard Development Company, L.P. launched two cloud services, HP Catalog Engage and HP Console Engage, for small & medium businesses across the hospitality and retail industries. These two cloud-based services were designed into its systems for local retail stores, restaurants, travel, lodging, and other small businesses.

Increase in the Preference of Cashless Transactions Among Consumers is Anticipated to Drive the Market Growth

Some of the key benefits of being cashless are safety, increase in stored money in accounts, greater money management, and flexibility. Consumers can now use their bank cards or mobile phones to make numerous types of digital payments, avoiding the use of cash. Users can save their card details in digital payment apps or mobile wallets to indicate cashless payments. Additionally the point of sale software market growth is expected to increase gradually due to the availability of QuickBooks point of sale software, which allows users to follow sales, customers, and inventory effectively and quickly.

Security Concerns Related to Point of Sale Software Might Restrict the Market Growth

Point of sale software market growth is projected to be hampered due to security concerns. POS software is vulnerable to device faults, skimming, phishing, and software & network issues. Hackers can swiftly penetrate the infrastructure and get crucial documents such as business account data and customer credit card information due to unsecure networks. Even if the network is well-protected, devices must be secured as well. Therefore, choosing products with built-in security safeguards is critical when adopting POS systems. As more complicated technologies are installed and enterprise systems become linked, threats such as data theft and cyberattacks are expected to increase significantly. All these security concerns are anticipated to hinder the market growth during the forecast period.

Increase in Usage of Point of Sale Software among Small Businesses is Expected to Create Growth Opportunities

Small businesses are using point of sale systems to take advantage of features they provide. Effective POS systems assist business owners to spend less time on business/store management by giving relevant reports to help speed up decision-making in a timely manner. Streamlined POS systems also help to improve store profitability through appropriate inventory management. Solutions offer targeted and customized marketing efforts by using client data obtained during sales transactions. As small firms struggle to manage capital expenditures, reports generated from point of sale developers can provide a bird's-eye view of operations, allowing them to assess the productivity of various departments. Furthermore, web-based point of sale software is expected to be frequently used by small & medium businesses due to improved accessibility and affordability. Small businesses are anticipated to benefit from these features of point-of-sale software. All these factors are predicted to create several growth opportunities for the key players operating in the market during the forecast period.

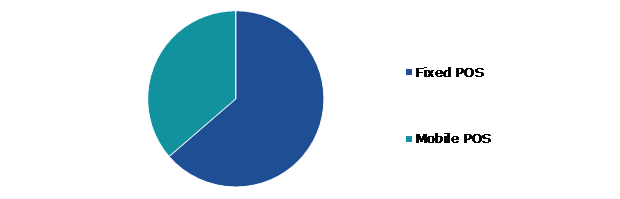

Global Point Of Sale Software Market, by Application

On the basis of application type, the point of sale software market has been classified into fixed POS and mobile POS. The mobile POS sub-segment of the global point of sales software market is projected to witness the fastest growth and the fixed POS sub-segment accounted for the highest revenue share by 2021.

Global Point of Sale Software Market Share, by Application, 2021

Source: Research Dive Analysis

The fixed POS sub-segment accounted for a dominant market share in 2021. The surge can be attributed to most restaurants and retail shops' current preference for a fixed POS system over a mobile POS system, as fixed POS solutions offer more functionality and capabilities. Businesses are more likely to use a fixed POS system due to its various perks such as powerful management solutions with company functionality, staff time clocks, inventory management, a cash drawer, loyalty programs, and gift card administration.

The mobile POS sub-segment is anticipated to witness the fastest growth by 2031. MPOS has a lot of potential and provides numerous opportunities; it can deploy current payment infrastructure, tailor services, improve business efficiency, increase consumer interaction, and provide a safe transaction environment. It extends card payments to new merchant areas, such as home delivery merchants, on-the-go merchants, and direct sellers, deploying the current payment infrastructure.

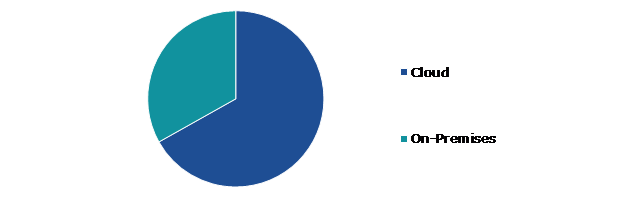

Global Point of Sale Software Market, by Deployment

On the basis of deployment, the market has been divided into cloud and on-premise sub-segments. The cloud sub-segment is projected to generate the maximum revenue and witness the fastest growth during the forecast period.

The cloud sub-segment is anticipated to hold the maximum revenue and witness the fastest market growth during the forecast period. This growth is credited to the high demand due to low-cost deployment on the cloud, which enables the adaptation of a changing business landscape. The cloud-based deployment is ideal for small- and medium-sized businesses that require timely software upgrades to support expanded business requirements. The cloud deployment offers remote access, affordable subscription-based pricing, endpoint security, sales management, and an all-in-one solution for inventory management. All these factors are expected to boost the demand for cloud-based deployment among price-conscious end-users.

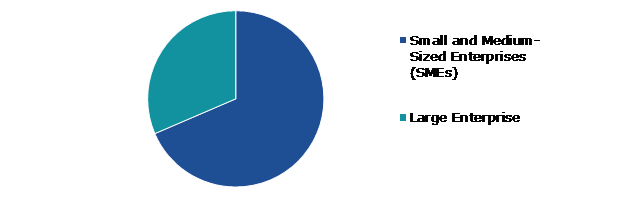

Global Point of Sale Software Market Forecast, by Enterprise Size

The enterprise size segment is further classified into small & medium enterprises and large enterprises. The small & medium enterprises sub-segment is predicted to hold a dominant market share in the global market during the forecast period.

The large enterprises sub-segment is anticipated to witness the fastest growth by 2031. The segment growth is credited to the high demand for customized POS software across large-scale retail stores, restaurants, and entertainment segments that need a system to manage their cash flows and business operations. As large enterprises have to streamline multiple outlets’ business and daily sales data, the solution is customized based on business type as well as function, and the solution is highly priced compared to readily available software. The customized software for a large enterprise helps manage an array of business operations while improving customer engagement. Rise in demand for advanced features, such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting, is expected to boost product adoption across various industries.

The small & medium enterprises sub-segment accounted for a dominant market share in 2021. The growth is credited to the quick adoption of cloud-deployed mobile POS software solutions by SMEs due to their affordability & scalability and the need to improve. Furthermore, many small & medium-sized businesses expanding to different cities or states prefer POS software based on recommendations and by similar business owners, while ensuring optimal budget allocation for the solution. Therefore, the SMEs’ revenue contribution to the market growth has been vital in helping the POS software vendors increase their market share by capturing local end users. The market players target local small- and medium-sized businesses across the hospitality, retail, entertainment, and other industries.

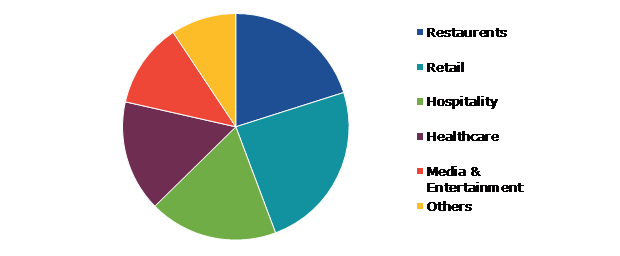

Global Point Of Sale Software Market, by End User

The end user sub-segment is further categorized into restaurants, retail, hospitality, healthcare, media & entertainment, and others. The retail sub-segment is anticipated to hold a dominant market share in the global market during the forecast timeframe. The restaurants sub-segment is anticipated to witness the fastest growth in the global market during the forecast period.

Global Point of Sale Software Market Trends, by End User, 2021

Source: Research Dive Analysis

The retail sub-segment as accounted for the dominant market share in 2021. The vast retail sector includes clothing, accessories, groceries, packaged products, electronics, and others that require POS software as per the nature of the business function. The retail industry gradually shifted from brick-and-mortar stores to multi-channel (social media) and e-commerce retailing. This shift in business channels augmented the need for additional features in POS software to manage both online and in-store sales. Businesses that installed POS software supporting both sales channels were able to manage operations and profit, while other businesses suffered during the COVID-19 pandemic. Retailers are widely adopting POS solutions as mobile and web-based platforms provide omnichannel experiences to retailing consumers and drive the growth of the POS software market.

Global Point Of Sale Software Market, Regional Insights

The point of sale software market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Point Of Sale Software Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Point of Sale Software in North America to be Most Dominant

The North America point of sale software market analysis accounted for a dominating market share in 2021. The region has a presence of prominent POS software vendors as well as a high demand for advanced integrated point of sale software. The healthcare industry in the U.S. is expected to witness the fastest growth rate owing to the need for improving facilities in hospitals related to payment, insurance, and management of patients. According to the American Hospital Association (AHA) annual survey for the fiscal year 2018, there were 6,148 hospitals, including the U.S. community, and nonfederal long-term care hospitals, which indicates the requirement for cost-effective and robust point of sale software market share integrated with all insurance payment processing, patient financial services software, reporting, and accounting, to provide complete payment processing. Moreover, higher adoption of cashless payment and rapid growth of the retail, restaurant, hospitality, healthcare, and other industries in North America is anticipated to boost product demand during the forecast period.

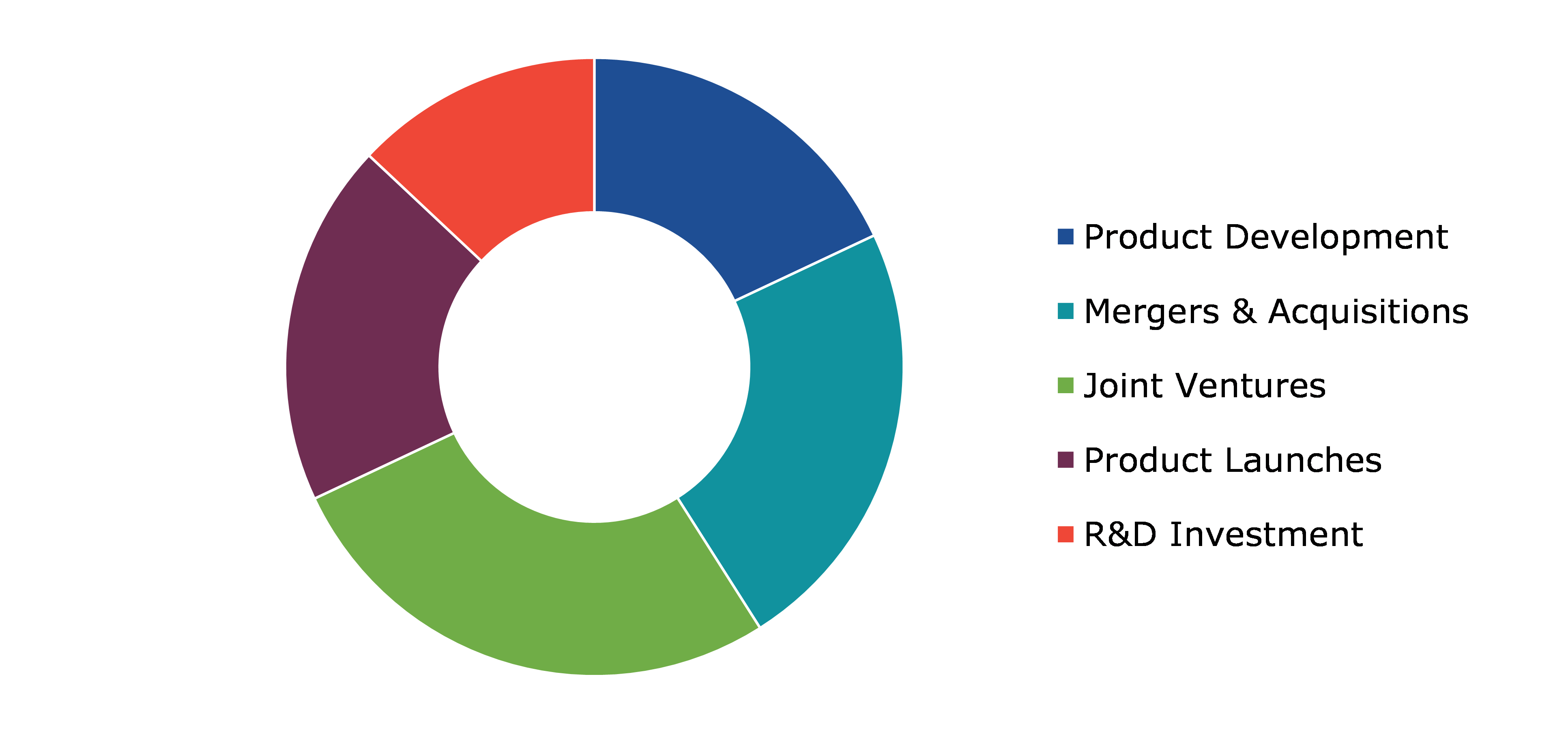

Competitive Scenario in the Global Point of Sale Software Market

Product launches and mergers & acquisitions are common strategies followed by major market players. For instance, in November 2019, Ingenico partnered with FinTech Pundi X to enable crypto transactions around the world. Pundi X completed the integration of its XPOS software with the Point-Of-Sale (POS) APOS A8 devices of Ingenico.

Source: Research Dive Analysis

Some of the leading points of sale software market players are NCR Corporation, Revel Systems, Oracle, Agilysys Inc., Clover Network Inc., Diebold Nixdorf Incorporated, Epicor Software Corporation, Ingenico Group, Intuit Inc., and SAP SE.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Application Type |

|

| Segmentation by Deployment |

|

| Segmentation by Organization Size |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global point of sale software market?

A. The size of the global point of sale software market size was over $ 4936.4 million in 2021 and is projected to reach $ 13645.2 million by 2031.

Q2. Which are the major companies in the point of sale software market?

A. NCR Corporation, Revel Systems, Oracle, Agilysys Inc., Clover Network Inc., Diebold Nixdorf Incorporated, Epicor Software Corporation, Ingenico Group, Intuit Inc., and SAP SE.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific point of sale software market?

A. Asia-Pacific point of sale software market share is anticipated to grow at 12.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. NCR Corporation, Revel Systems, Oracle, and Agilysys Inc. are investing more on R&D practices.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Point of Sale Software market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of service powders

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Point of Sale Software market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Point Of Sale Software Market Analysis, by Application

5.1.Overview

5.2.Fixed POS

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Mobile POS

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2031

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness, 2021-2031

5.4.2.Competition heatmap, 2021-2031

6.Point Of Sale Software Market Analysis, by Deployment Mode

6.1.Cloud

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.On-premise

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness, 2021-2031

6.3.2.Competition heatmap, 2021-2031

7.Point Of Sale Software Market Analysis, by Enterprise Size

7.1.Small & medium enterprises

7.1.1.Definition, key trends, growth factors, and opportunities, 2021-2031

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2. Large enterprises

7.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness, 2021-2031

7.3.2.Competition heatmap, 2021-2031

8.Point Of Sale Software Market Analysis, by End User

8.1.Restaurants

8.1.1.Definition, key trends, growth factors, and opportunities, 2021-2031

8.1.2.Market size analysis, by region, 2021-2031

8.1.3.Market share analysis, by country, 2021-2031

8.2. Retail

8.2.1.Definition, key trends, growth factors, and opportunities, 2021-2031

8.2.2.Market size analysis, by region, 2021-2031

8.2.3.Market share analysis, by country, 2021-2031

8.3.Hospitality

8.3.1.Definition, key trends, growth factors, and opportunities, 2021-2031

8.3.2.Market size analysis, by region, 2021-2031

8.3.3.Market share analysis, by country, 2021-2031

8.4.Healthcare

8.4.1.Definition, key trends, growth factors, and opportunities, 2021-2031

8.4.2.Market size analysis, by region, 2021-2031

8.4.3.Market share analysis, by country, 2021-2031

8.5.Media & Entertainment

8.5.1.Definition, key trends, growth factors, and opportunities, 2021-2031

8.5.2.Market size analysis, by region, 2021-2031

8.5.3.Market share analysis, by country, 2021-2031

8.6.Others

8.6.1.Definition, key trends, growth factors, and opportunities, 2021-2031

8.6.2.Market size analysis, by region, 2021-2031

8.6.3.Market share analysis, by country, 2021-2031

8.7.Research Dive Exclusive Insights

8.7.1.Market attractiveness, 2021-2031

8.7.2.Competition heatmap, 2021-2031

9.Point Of Sale Software Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Application, 2021-2031

9.1.1.2.Market size analysis, by Deployment Mode, 2021-2031

9.1.1.3.Market size analysis, by Enterprise Size, 2021-2031

9.1.1.4.Market size analysis, by End User, 2021-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Application, 2021-2031

9.1.2.2.Market size analysis, by Deployment Mode, 2021-2031

9.1.2.3.Market size analysis, by Enterprise Size, 2021-2031

9.1.2.4.Market size analysis, by End User, 2021-2031

9.1.3. Mexico

9.1.3.1.Market size analysis, by Application, 2021-2031

9.1.3.2.Market size analysis, by Deployment Mode, 2021-2031

9.1.3.3.Market size analysis, by Enterprise Size, 2021-2031

9.1.3.4.Market size analysis, by End User, 2021-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness, 2021-2031

9.1.4.2.Competition heatmap, 2021-2031

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Application, 2021-2031

9.2.1.2.Market size analysis, by Deployment Mode, 2021-2031

9.2.1.3.Market size analysis, by Enterprise Size, 2021-2031

9.2.1.4.Market size analysis, by End User, 2021-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Application, 2021-2031

9.2.2.2.Market size analysis, by Deployment Mode, 2021-2031

9.2.2.3.Market size analysis, by Enterprise Size, 2021-2031

9.2.2.4.Market size analysis, by End User, 2021-2031

9.2.3.France

9.2.3.1.Market size analysis, by Application, 2021-2031

9.2.3.2.Market size analysis, by Deployment Mode, 2021-2031

9.2.3.3.Market size analysis, by Enterprise Size, 2021-2031

9.2.3.4.Market size analysis, by End User, 2021-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Application, 2021-2031

9.2.4.2.Market size analysis, by Deployment Mode, 2021-2031

9.2.4.3.Market size analysis, by Enterprise Size, 2021-2031

9.2.4.4.Market size analysis, by End User, 2021-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Application, 2021-2031

9.2.5.2.Market size analysis, by Deployment Mode, 2021-2031

9.2.5.3.Market size analysis, by Enterprise Size, 2021-2031

9.2.5.4.Market size analysis, by End User, 2021-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Application, 2021-2031

9.2.6.2.Market size analysis, by Deployment Mode, 2021-2031

9.2.6.3.Market size analysis, by Enterprise Size, 2021-2031

9.2.6.4.Market size analysis, by End User, 2021-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness, 2021-2031

9.2.7.2.Competition heatmap, 2021-2031

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Application, 2021-2031

9.3.1.2.Market size analysis, by Deployment Mode, 2021-2031

9.3.1.3.Market size analysis, by Enterprise Size, 2021-2031

9.3.1.4.Market size analysis, by End User, 2021-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Application, 2021-2031

9.3.2.2.Market size analysis, by Deployment Mode, 2021-2031

9.3.2.3.Market size analysis, by Organization Size, 2021-2031

9.3.2.4.Market size analysis, by End User, 2021-2031

9.3.3.India

9.3.3.1.Market size analysis, by Application, 2021-2031

9.3.3.2.Market size analysis, by Deployment Mode, 2021-2031

9.3.3.3.Market size analysis, by Organization Size, 2021-2031

9.3.3.4.Market size analysis, by End User, 2021-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Application, 2021-2031

9.3.4.2.Market size analysis, by Deployment Mode, 2021-2031

9.3.4.3.Market size analysis, by Organization Size, 2021-2031

9.3.4.4.Market size analysis, by End User, 2021-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Application, 2021-2031

9.3.5.2.Market size analysis, by Deployment Mode, 2021-2031

9.3.5.3.Market size analysis, by Organization Size, 2021-2031

9.3.5.4.Market size analysis, by End User, 2021-2031

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Application, 2021-2031

9.3.6.2.Market size analysis, by Deployment Mode, 2021-2031

9.3.6.3.Market size analysis, by Organization Size, 2021-2031

9.3.6.4.Market size analysis, by End User, 2021-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness, 2021-2031

9.3.7.2.Competition heatmap, 2021-2031

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Application, 2021-2031

9.4.1.2.Market size analysis, by Deployment Mode, 2021-2031

9.4.1.3.Market size analysis, by Organization Size, 2021-2031

9.4.1.4.Market size analysis, by End User, 2021-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Application, 2021-2031

9.4.2.2.Market size analysis, by Deployment Mode, 2021-2031

9.4.2.3.Market size analysis, by Organization Size, 2021-2031

9.4.2.4.Market size analysis, by End User, 2021-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Application, 2021-2031

9.4.3.2.Market size analysis, by Deployment Mode, 2021-2031

9.4.3.3.Market size analysis, by Organization Size, 2021-2031

9.4.3.4.Market size analysis, by End User, 2021-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Application, 2021-2031

9.4.4.2.Market size analysis, by Deployment Mode, 2021-2031

9.4.4.3.Market size analysis, by Organization Size, 2021-2031

9.4.4.4.Market size analysis, by End User, 2021-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Application, 2021-2031

9.4.5.2.Market size analysis, by Deployment Mode, 2021-2031

9.4.5.3.Market size analysis, by Organization Size, 2021-2031

9.4.5.4.Market size analysis, by End User, 2021-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness, 2021-2031

9.4.6.2.Competition heatmap, 2021-2031

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1. NCR Corporation

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Revel Systems

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Oracle

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4. Agilysys Inc.

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Clover Network Inc.

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6. Diebold Nixdorf Incorporated

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Epicor Software Corporation

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Ingenico Group

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Intuit Inc.

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.SAP SE

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

Point of sale software basically offers platform to accept customers’ online payments, process the transactions, keep a track of the sales, and update inventory levels accordingly. Point of sale software also allow employers to keep a track of employees and their activities and also monitor marketing campaigns undertaken by the organization. There are primarily two Point of Sale (POS) software types: On-premise POS software and Cloud-based POS software. On-premise POS system refers to a physical POS machine with in-built software that is similar to a touchscreen monitor. Cloud-based POS software, on the other hand, is web-based software that is installed in remotely placed servers and data centers.

Forecast Analysis of the Point of Sale Software Market

In the recent years, there has been an increase in the demand for point of sale software from various corporate applications. This surge in demand is expected to be the primary growth driver of the point of sale software market in the forecast period, 2022-2031. Along with this, an increasing preference among customers globally for cashless transactions is expected to push the point of sale software market further. Also, growing adoption of point of sale software among small businesses is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, security concerns related to point of sale software may restrain the growth of the market in the forecast period.

Regionally, the point of sale software market in the North America region is expected to be the most dominant by 2031. Presence of numerous point of sale software vendors and increasing demand for advanced integrated point of sale software are expected to become the two main growth drivers of the market in this region during the forecast period.

According to the report published by Research Dive, the global point of sale software market is expected to gather a revenue of $13645.2 million by 2031 and grow at 10.9% CAGR in the 2022–2031 timeframe. Some prominent market players include NCR Corporation, Agilysys Inc., Epicor Software Corporation, Revel Systems, Clover Network Inc., SAP SE, Oracle, Ingenico Group, Diebold Nixdorf Incorporated, Intuit Inc., and many others.

Covid-19 Impact on the Point of Sale Software Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The point of sale software market, however, has been an exception. The lockdowns and social distancing norms put in place by various governments across the globe led to an increase in cashless transactions which increased the demand for point of sale software. Also, increasing investments by companies in research and development to introduce advanced POS systems helped in the growth of the market in the pandemic period.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the point of sale software market to flourish. For instance:

- In September 2021, SpotOn, a leading point of sale software developer for retail stores and restaurants, announced the acquisition of Appetize, a digital commerce platform. This acquisition is expected to increase the footprint of the acquiring company substantially in the coming next few years.

- In June 2022, Openbravo, a cloud-based software provider in Spain, announced that it was launching a new point of sale software for quick service restaurants. This point of sale (POS) software, the company has claimed, will help restaurants to manage their operations efficiently and increase their sales. This product launch is predicted to help the company to capture a sizeable chunk of the market share.

- In September 2022, the PNC Financial Services Group, a leading financial services institution in the US, announced that it was acquiring Linga, a leading global point of sale software developer. This acquisition is predicted to boost the market share of PNC Financial Services Group in the nearby future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com