COVID-19 Diagnostics Market Report

RA08414

COVID-19 Diagnostics Market by Product & Service (Instruments, Reagents & Kits, and Services), Sample Type (Nasopharyngeal Swabs, Oropharyngeal Swabs, Nasal Swabs, Blood, and Others), Test Type (Molecular, Antigen-based, Antibody-based, and Others), Mode (Point-of-care and Non Point-of-care), End User (Laboratories, Hospitals, Diagnostic Centers & Clinics, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

COVID-19 Diagnostics Market Analysis

The COVID-19 diagnostics market is predicted to generate $65,750.1 million in 2021-2028 timeframe, growing from $49,000.9 million in 2020 at a healthy CAGR of 3.5%.

Market Synopsis

Increasing cases of corona virus infection in all age people, especially in people suffering from diabetes and heart diseases is expected to drive the market of COVID-19 diagnostic market, globally.

However, lack of awareness among some sector of the population about the COVID-10 diagnosis is expected to hinder the market of COVID-19 diagnostic market.

According to the regional analysis of the market, the Asia-Pacific COVID-19diagnostic market is anticipated to grow at a CAGR of 4.60% by generating a revenue of $17,949.80 million during the review period.

COVID-19 Diagnostics Market Overview

COVID-19 diagnostics involve rapid diagnosis of the coronavirus infection in the patient. The diagnosis involves use of various different kits to conduct tests and receive rapid and accurate reports on the basis of which the healthcare providers can ensure proper treatment. Presently, the most widely used diagnostic test for detection of COVID-19 is RT PCR or reverse transcriptase PCR, which is recognized as the gold standard for the diagnosis of various infectious diseases. In addition, multiplex RT-PCR is the most preferred test for COVID-19 diagnostics in many countries across the globe.

Impact Analysis of COVID-19 on the COVID-19 Diagnostics Market

Though the novel coronavirus pandemic has had a devastating effect on several industries, but the healthcare and biotechnology sector of the market has been found to experience significant growth during this period. As this pandemic has entered its worse phase with more people being adversely affected from the viral infection, severe complications related to breathing are observed in the patients. Considering the pace with which the virus is spreading, the market for COVID-19 diagnostics has shown an incredible growth. Due to complete lockdown and stringent regulations laid by the government on travelling, it is mandatory to get a COVI-19 negative report while travel. Also, the employers at the workplaces have instructed their employees to get COVID-19 negative report regularly within a span of 15 to 20 days. These rules have accelerated the growth of the market in these unprecedented time.

Increasing cases of Corona Virus Infection to Surge the Market Growth

Increasing prevalence of coronavirus infection among the world population is expected to sure the market revenue of COVID-19 diagnostic market in the coming years. For instance, according to the report by worldometer, on June 13, 2021, Brazil recorded 17,454,861 COVID-19 cases out of which 488,404 cases were fatal in the region. To contain the transmission of the infection and provide early treatment facility, patients are opting for various different types of diagnosis tests like rt PCR, antibody tests, and others. This has further impeded the market growth. Also, government’s initiative for mass testing of people in the region is anticipated to increase the market share of COVID-19 diagnostic market in the predicted time span.

To know more about COVID-19 diagnostic market drivers, get in touch with our analysts here.

Lack of Awareness among People in Rural Areas to Restrain the Market Growth

In rural areas of the country, patients refrain from getting themselves diagnosed for COVID-19 in the fear of being isolated and ill-treated by their community. Due to this, the market for COVID-19 diagnostics is expected to face some hindrance. Also, decrease in the number of coronavirus cases will decrease the market growth in the stipulated time span. Apart from this, lack of knowledge about the importance of diagnosis for proper treatment of COVID infection is further likely to affect the market growth.

Government Initiatives and Increasing Investments for Research and Development Activities to Fuel the Market

Increased government funding and company investments in research and development activities in the diagnostic therapies and tools are expected to raise the market share of COVID-19 diagnostic market. The COVID-19 pandemic has given many opportunities to the biotech and biopharma companies to invest in R&D related to innovating various new COVID-19 diagnostic tools. For instance, according to a news published in The Economic Times, in March 2020, a molecular diagnostic company Mylab in Pune, India, become the first Indian company to receive the validation for its Covid-19 diagnostic test kits popularly known as the reverse transcription polymerase chain reaction (RT-PCR) tests.

To know more about global COVID-19 diagnostic market opportunities, get in touch with our analysts here.

COVID-19 Diagnostics Market

By Product And ServiceBased on product & Services, the COVID-19 diagnostic market is segmented into instruments, reagents & kits, and Services. Services sub-segment is projected to generate the maximum revenue and reagents kits is predicted to show the fastest growth.

Source: Research Dive Analysis

The services sub-segment is predicted to have a dominating market share in the global market and is expected to register a revenue of $ 31,671.40 million during the forecast period. This growth is attributed to the fact that due to increasing coronavirus cases, the service providers are pacing up their testing capabilities by investing a huge sum in research and development of new products and diagnostic kits.

Reagent & kits sub-segment is anticipated to have the fastest market growth and it is predicted that the sub-segment shall generate a revenue of $23,435.90 million by 2028 from $17,036.30 million in 2020. This is because the manufacturing companies are developing and launching new products and kits that are more sensitive to the presence of infection and can deliver the results in very less time.

COVID-19 Diagnostics Market

By SampleOn the basis of sample type, the market has been sub-segmented into nasopharyngeal swabs, oropharyngeal swabs, nasal swabs, blood and others. Among the mentioned sub-segments, the blood sub-segment is predicted to show the fastest growth, whereas the nasopharyngeal swabs sub-segment is projected to garner a dominant market share.

Source: Research Dive Analysis

The blood sub-segment of the COVID-19 diagnostic market is projected to have the fastest growth and it is projected to surpass $15,409.10 million by 2028, with an increase from $10,580.50 million in 2020. This growth is because the blood sample provides a wider window for detecting asymptomatic symptoms of corona viral infection in the patient.

The nasopharyngeal swabs sub-segment is anticipated to have a dominating market share in the global market and register a revenue of $26,485.50 million during the analysis timeframe because most of the molecular tests like rtPCR require nasopharyngeal swabs for viral infection detection.

COVID-19 Diagnostics Market

By TestBased on test type, the market has been divided into molecular, antigen-based, antibody-based, and others. Out of these, the antibody (serology) test sub-segment is predicted to have the fastest growth and molecular test sub-segment is anticipated to garner the maximum revenue share in the global market.

Source: Research Dive Analysis

The antibody (serology) testing of the market is predicted to have a rapid growth and it is expected to surpass $15,125.10 million by 2028, with an increase from $10,699.40 million in 2020 owing to its high capability to detect the presence of viral load in the sample accurately.

Molecular (PCR) testing is predicted to have a dominating market share in the global market and is expected to register a revenue of $38,025.50 million during the analysis timeframe owing to its high accuracy rate and it can detect even a slightest of viral presence in the blood.

COVID-19 Diagnostics Market

By ModeBased on mode, the market has been divided into point-of-care and non point-of-care. Out of these, the non point-of-care sub-segment is predicted to have the fastest growth and point-of-care sub-segment is anticipated to garner the maximum revenue share in the global market.

Source: Research Dive Analysis

The non point-of-care sub-segment of the market is predicted to have a rapid growth and it is expected to surpass $27,223.90 million by 2028, with an increase from $19,564.50 million in 2020 owing to high demand for conducting tests in a high facility laboratory by a highly skilled laboratory person.

Point-of-care is predicted to have a dominating market share in the global market and is expected to register a revenue of $38,507.70 million during the analysis timeframe because many manufacturing companies are developing test kits that provides accurate results in very less time. Also, its operation does not require any major skill and hence, a normal person can also operate it easily.

COVID-19 Diagnostics Market

By End-userBased on end-user, the analysis has been divided into Laboratories, hospitals, diagnostic centers & clinics and others. Out of these, the diagnostic centers and clinics sub-segment is predicted to have the fastest growth and Laboratories sub-segment is anticipated to garner the maximum revenue share in the global market.

Source: Research Dive Analysis

The diagnostic centers and clinics of the market are predicted to have a rapid growth and surpass $16,047.30 million by 2028, with an increase from $11,145.00 million in 2020. This is due to the fact that hospitals are considered to be high infected zones, and to contain the infection, people prefer to visit a much safer place like clinics and diagnostic centers.

Laboratories are predicted to have a dominating market share in the global market and is expected to register a revenue of $25,747.20 million during the analysis timeframe because large number of laboratories are being established owing o increasing number of COVID-19 cases.

COVID-19 Diagnostics Market

By RegionThe COVID-19 diagnostic market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for COVID-19 Diagnostics in North America to be the Most Dominant

The North America COVID 19 diagnostics market accounted $16,366.30 million in 2020 and is projected to register a revenue of $21,237.30 million by 2028. This growth is due to increasing demand for corona virus diagnostic kits owing to increasing cases of corona virus infected patients. Also, presence of key market players in the region and their efforts in controlling the transmission is likely to drive the regional market.

The Market for COVID-19 Diagnostic in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific COVID-19 diagnostic market is anticipated to grow at a CAGR of 4.60% by registering a revenue of $17,949.80 million by 2028. This is due to factors such as rising prevalence corona virus patients in countries like India and China and growing demand for diagnostic kits to conduct mass testing of the population. Also, constantly improving healthcare infrastructure and facilities will further add on to the market growth.

Competitive Scenario in the Global COVID-19 Diagnostic Market

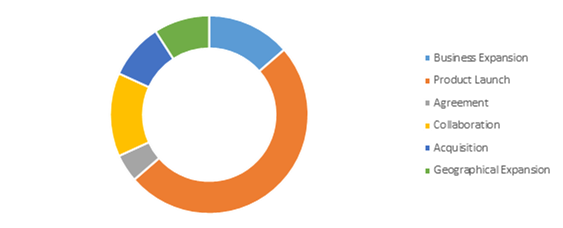

Product launch is a common strategy followed by major market players.

Source: Research Dive Analysis

The key players operating in the COVID-19 diagnostic market include Hologic Inc., Veredus Laboratories, ADT Biotech Sdn Bhd, Mylab Discovery Solutions Pvt. Ltd., Neuberg Diagnostics, Luminex Corporation, Quidel Corporation, and Quest Diagnostics.

Porter’s Five Forces Analysis for the Global COVID-19 Diagnostic Market:

- Bargaining Power of Suppliers: The suppliers in the COVID-19 market are high in number. Several companies are working on product innovation and development and thus will charge more for their new products. Thus, there is less threat from the suppliers.

Thus, the bargaining power suppliers is moderate. - Bargaining Power of Buyers: Buyers are high in number and have huge bargaining power; they demand best services at low prices comparative to the other suppliers in the market. This increases the pressure on the biotechnology and diagnostic kits manufacturing companies to offer the best service in a cost-effective way. Thus, buyers can freely choose the convenient service that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: New companies entering the COVID-19 market are adopting advanced technologies for innovations such as developing the best product in the minimum time frame. However, new players have to face tough competition from the already established market players as they already have built a trust with their buyers.

Thus, the threat of the new entrants is high. - Threat of Substitutes: Currently, as the COVID-19 cases are increasing, the buyers are focusing more on the available diagnostic kits rather than exploring new substitutes.

Thus, the threat of substitutes is moderate. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players. These companies are launching their COVID-19 diagnostics products in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2029-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product & Services |

|

| Segmentation by Sample Type |

|

| Segmentation by Test Type |

|

| Segmentation by Mode |

|

| Segmentation by End-Users |

|

| Key Companies Profiled |

|

Q1. What is the size of the COVID-19 diagnostic market?

A. The COVID-19 diagnostics market is predicted to generate $65,750.1 million in 2021-2028 timeframe, growing from $49,000.9 million in 2020 at a healthy CAGR of 3.5%.

Q2. Which are the major companies in the COVID-19 diagnostic market?

A. Quest Diagnostics, and Luminex Corporation are some of the prominent companies in the COVID-19 diagnostic market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific plasma fractionation market?

A. The share of Asia-Pacific market is anticipated to grow at a CAGR of 4.6%.

Q5. Which companies are investing more on R&D practices?

A. Quest Diagnostics and Veredus Laboratories are investing more on R&D activities for developing new products and technologies.

CHAPTER 1:INTRODUCTION

1.1.Research methodology

1.1.1.Desk research

1.1.2.Real-time insights and validation

1.1.3.Forecast model

1.1.4.Assumptions & forecast parameters

1.1.4.1.Assumptions

1.1.4.2.Forecast parameters

CHAPTER 2:EXECUTIVE SUMMARY

2.1.360° summary

2.2.Product & Service trends

2.3.Sample type trends

2.4.Test Type

2.5.Mode

2.6.End User

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.2.2.1.Top winning strategies, by year

3.2.2.2.Top winning strategies, by development

3.2.2.3.Top winning strategies, by company

3.2.3.Top player positioning

3.3.Porter's five forces analysis

3.4.Market dynamics

3.5.Drivers

3.5.1.Increasing corona virus cases

3.6.Restraints

3.6.1.Lack of awareness regarding diagnostic procedures

3.7.Opportunities

3.7.1.Technological advancements in the diagnostic methods to propel the market growth

3.8.Technology landscape

3.9.Regulatory landscape

3.10.Market value chain analysis

3.11.Strategic overview

CHAPTER 4:IMPACT OF COVID19 ON COVID-19 DIAGNOSTIC MARKET

4.1.Introduction

4.2.COVID-19 health assessment

4.3.Impact of COVID-19 on the global economy

4.4.Impact of COVID-19 on global COVID-19 diagnostic market

4.4.1.Technological impact

4.4.2.Investment scenario

4.5.COVID-19 diagnostic aircraft market size and forecast, by region, 2026-2033

CHAPTER 5:GLOBAL COVID-19 DIAGNOSTIC MARKET, BY PRODUCTS & SERVICES

5.1.Overview

5.1.1.Market size and forecast, by products & services

5.2.Instruments

5.2.1.Key market trends, growth factors and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market share analysis, by country

5.3.Reagents and kits

5.3.1.Key market trends, growth factors and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market share analysis, by country

5.4.Services

5.4.1.Key market trends, growth factors and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market share analysis, by country

CHAPTER 6:GLOBAL COVID-19 DIAGNOSTIC MARKET, BY SAMPLE TYPE

6.1.Overview

•Nasopharyngeal (NP) Swabs

•Oropharyngeal (OP) Swabs

•Nasal Swabs

•Blood

•Others

6.1.1.Market size and forecast, by sample type

6.2.Nasopharyngeal Swabs

6.2.1.Key market trends, growth factors and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market share analysis, by country

6.3.Oropharyngeal swab

6.3.1.Key market trends, growth factors and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market share analysis, by country

6.4.Nasal swab

6.4.1.Key market trends, growth factors and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market share analysis, by country

6.5.Blood

6.5.1.Key market trends, growth factors and opportunities

6.5.2.Market size and forecast, by region

6.5.3.Market share analysis, by country

6.6.Others

6.6.1.Key market trends, growth factors and opportunities

6.6.2.Market size and forecast, by region

6.6.3.Market share analysis, by country

CHAPTER 7:GLOBAL COVID-19 DIAGNOSTIC MARKET BY TEST TYPE

7.1.Overview

7.1.1.Market size and forecast, by range

7.2.Molecular (PCR) Testing

7.2.1.Key market trends, growth factors and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market share analysis, by country

7.3.Antigen-based testing

7.3.1.Key market trends, growth factors and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market share analysis, by country

7.4.Antibody-based testing

7.4.1.Key market trends, growth factors and opportunities

7.4.2.Market size and forecast, by region

7.4.3.Market share analysis, by country

7.5.Others

7.5.1.Key market trends, growth factors and opportunities

7.5.2.Market size and forecast, by region

7.5.3.Market share analysis, by country

CHAPTER 8:GLOBAL COVID-19 DIAGNOSTIC MARKET, BY MODE

8.1.Overview

8.1.1.Market size and forecast, by mode

8.2.Poin-of-Care

8.2.1.Key market trends, growth factors and opportunities

8.2.2.Market size and forecast, by region

8.2.3.Market share analysis, by country

8.3.Non point-of-care

8.3.1.Key market trends, growth factors and opportunities

8.3.2.Market size and forecast, by region

8.3.3.Market share analysis, by country

CHAPTER 9:COVID-19 DIAGNOSTIC MARKET, BY END USER

9.1.Overview

9.1.1.Market size and forecast, by end user

9.2.Laboratories

9.2.1.Key market trends, growth factors and opportunities

9.2.2.Market size and forecast, by region

9.2.3.Market share analysis, by country

9.3.Hospitals

9.3.1.Key market trends, growth factors and opportunities

9.3.2.Market size and forecast, by region

9.3.3.Market share analysis, by country

9.4.Diagnostic centers & clinics

9.4.1.Key market trends, growth factors and opportunities

9.4.2.Market size and forecast, by region

9.4.3.Market share analysis, by country

9.5.Others

9.5.1.Key market trends, growth factors and opportunities

9.5.2.Market size and forecast, by region

9.5.3.Market share analysis, by country

CHAPTER 10:COVID-19 DIAGNOSTIC MARKET, BY REGION

10.1.Overview

10.1.1.Market size and forecast, by region

10.2.North America

10.2.1.Key market trends, growth factors, and opportunities

10.2.2.Market size and forecast, by product & service

10.2.3.Market size and forecast, by sample type

10.2.4.Market size and forecast, by test type

10.2.5.Market size and forecast, by mode

10.2.6.Market size and forecast, by end-user

10.2.7.Market size and forecast, by country

10.2.8.U.S.

10.2.8.1.Market size and forecast, by product & service

10.2.8.2.Market size and forecast, by sample type

10.2.8.3.Market size and forecast, by test type

10.2.8.4.Market size and forecast, by mode

10.2.8.5.Market size and forecast, by end user

10.2.9.Canada

10.2.9.1.Market size and forecast, by product & service

10.2.9.2.Market size and forecast, by sample type

10.2.9.3.Market size and forecast, by test type

10.2.9.4.Market size and forecast, by mode

10.2.9.5.Market size and forecast, by end user

10.2.10.Mexico

10.2.10.1.Market size and forecast, by product & service

10.2.10.2.Market size and forecast, by sample type

10.2.10.3.Market size and forecast, by test type

10.2.10.4.Market size and forecast, by mode

10.2.10.5.Market size and forecast, by end user

10.3.Europe

10.3.1.Key market trends, growth factors, and opportunities

10.3.2.Market size and forecast, by product & service

10.3.3.Market size and forecast, by sample type

10.3.4.Market size and forecast, by test type

10.3.5.Market size and forecast, by mode

10.3.6.Market size and forecast, by end user

10.3.7.Market size and forecast, by country

10.3.8.Germany

10.3.8.1.Market size and forecast, by product & service

10.3.8.2.Market size and forecast, by sample type

10.3.8.3.Market size and forecast, by test type

10.3.8.4.Market size and forecast, by mode

10.3.8.5.Market size and forecast, by end user

10.3.9.UK

10.3.9.1.Market size and forecast, by product & service

10.3.9.2.Market size and forecast, by sample type

10.3.9.3.Market size and forecast, by test type

10.3.9.4.Market size and forecast, by mode

10.3.9.5.Market size and forecast, by end user

10.3.10.France

10.3.10.1.Market size and forecast, by product & service

10.3.10.2.Market size and forecast, by sample type

10.3.10.3.Market size and forecast, by test type

10.3.10.4.Market size and forecast, by mode

10.3.10.5.Market size and forecast, by end user

10.3.11.Italy

10.3.11.1.Market size and forecast, by product & service

10.3.11.2.Market size and forecast, by sample type

10.3.11.3.Market size and forecast, by test type

10.3.11.4.Market size and forecast, by mode

10.3.11.5.Market size and forecast, by end user

10.3.12.Spain

10.3.12.1.Market size and forecast, by product & service

10.3.12.2.Market size and forecast, by sample type

10.3.12.3.Market size and forecast, by test type

10.3.12.4.Market size and forecast, by mode

10.3.12.5.Market size and forecast, by end user

10.3.13.Rest of Europe

10.3.13.1.Market size and forecast, by product & service

10.3.13.2.Market size and forecast, by sample type

10.3.13.3.Market size and forecast, by test type

10.3.13.4.Market size and forecast, by mode

10.3.13.5.Market size and forecast, by end user

10.4.Asia-Pacific

10.4.1.Key market trends, growth factors, and opportunities

10.4.2.Market size and forecast, by product & service

10.4.3.Market size and forecast, by sample type

10.4.4.Market size and forecast, by test type

10.4.5.Market size and forecast, by mode

10.4.6.Market size and forecast, by maximum end user

10.4.7.Market size and forecast, by country

10.4.8.China

10.4.8.1.Market size and forecast, by product & service

10.4.8.2.Market size and forecast, by sample type

10.4.8.3.Market size and forecast, by test type

10.4.8.4.Market size and forecast, by mode

10.4.8.5.Market size and forecast, by end user

10.4.9.Japan

10.4.9.1.Market size and forecast, by product & service

10.4.9.2.Market size and forecast, by sample type

10.4.9.3.Market size and forecast, by test type

10.4.9.4.Market size and forecast, by mode

10.4.9.5.Market size and forecast, by end user

10.4.10.Australia

10.4.10.1.Market size and forecast, by product & service

10.4.10.2.Market size and forecast, by sample type

10.4.10.3.Market size and forecast, by test type

10.4.10.4.Market size and forecast, by mode

10.4.10.5.Market size and forecast, by end user

10.4.11.South Korea

10.4.11.1.Market size and forecast, by product & service

10.4.11.2.Market size and forecast, by sample type

10.4.11.3.Market size and forecast, by test type

10.4.11.4.Market size and forecast, by mode

10.4.11.5.Market size and forecast, by end user

10.4.12.India

10.4.12.1.Market size and forecast, by product & service

10.4.12.2.Market size and forecast, by sample type

10.4.12.3.Market size and forecast, by test type

10.4.12.4.Market size and forecast, by mode

10.4.12.5.Market size and forecast, by end user

10.4.13.Rest of Asia-Pacific

10.4.13.1.Market size and forecast, by product & services

10.4.13.2.Market size and forecast, by sample type

10.4.13.3.Market size and forecast, by test type

10.4.13.4.Market size and forecast, by mode

10.4.13.5.Market size and forecast, by end user

10.5.LAMEA

10.5.1.Key market trends, growth factors, and opportunities

10.5.2.Market size and forecast, by product & service

10.5.3.Market size and forecast, by sample type

10.5.4.Market size and forecast, by test type

10.5.5.Market size and forecast, by mode

10.5.6.Market size and forecast, by end user

10.5.7.Market size and forecast, by country

10.5.8.Latin America

10.5.8.1.Market size and forecast, by product & service

10.5.8.2.Market size and forecast, by sample type

10.5.8.3.Market size and forecast, by test type

10.5.8.4.Market size and forecast, by mode

10.5.8.5.Market size and forecast, by end user

10.5.9.Middle East

10.5.9.1.Market size and forecast, by product & service

10.5.9.2.Market size and forecast, by sample type

10.5.9.3.Market size and forecast, by test type

10.5.9.4.Market size and forecast, by mode

10.5.9.5.Market size and forecast, by end user

10.5.10.Africa

10.5.10.1.Market size and forecast, by product & service

10.5.10.2.Market size and forecast, by sample type

10.5.10.3.Market size and forecast, by test type

10.5.10.4.Market size and forecast, by mode

10.5.10.5.Market size and forecast, by end user

CHAPTER 11:COMPANY PROFILES

11.1.Quidel Corporation

11.1.1.Company overview

11.1.2.Company snapshot

11.1.3.Operating business segments

11.1.4.Product portfolio

11.1.5.Business performance

11.1.6.Key strategic moves and developments

11.2.HOLOGIC INC.

11.2.1.Company overview

11.2.2.Company snapshot

11.2.3.Business performance

11.2.4.Key strategic moves and developments

11.3.Veredus Laboratories

11.3.1.Company overview

11.3.2.Company snapshot

11.3.3.Product portfolio

11.3.4.Key strategic moves and developments

11.4.Quest Diagnostics

11.4.1.Company overview

11.4.2.Company snapshot

11.4.3.Operating business segments

11.4.4.Product portfolio

11.4.5.Business performance

11.4.6.Key strategic moves and developments

11.5.ADT BIOTECH

11.5.1.Company overview

11.5.2.Company snapshot

11.5.3.Product portfolio

11.5.4.Key strategic moves and developments

11.6.Mylab Discovery Solutions Pvt. Ltd.

11.6.1.Company overview

11.6.2.Company snapshot

11.6.3.Product portfolio

11.6.4.Key strategic moves and developments

11.7.Luminex Corporation

11.7.1.Company overview

11.7.2.Company snapshot

11.7.3.Product portfolio

11.7.4.Business performance

11.7.5.Key strategic moves and development

11.8.NEUBERG DIAGNOSTICS

11.8.1.Company overview

11.8.2.Product portfolio

11.8.3.Key strategic moves and developments

11.9.Laboratory Corporation of America Holdings

11.9.1.Company overview

11.9.2.Company snapshot

11.9.3.Operating business Segments

11.9.4.Product portfolio

11.9.5.Business performance

11.9.6.Key strategic moves and developments

11.10.Abbott Laboratories

11.10.1.Company overview

11.10.2.Company snapshot

11.10.3.Operating business segments

11.10.4.Product portfolio

11.10.5.Business performance

11.10.6.Key strategic moves and developments

The world went into a pandemic state due to the outbreak of the novel coronavirus or COVID-19. The COVID-19 virus belongs to the coronavirus family and it is the newly discovered infectious disease in 2019. According to the World Health Organization (WHO), dry cough, tiredness, and fever are the common symptoms of COVID-19 infection. Other symptoms of the disease include sore throat, shortness of breath, pains and aches, runny nose, nausea, and diarrhea in few cases. This infection may spread from person to person via discharge from nose or saliva droplets, when an infected person sneezes or coughs.

The number of coronavirus cases have surged dramatically across the globe which have rapidly increased the demand for COVID-19 diagnosis. The COVID-19 diagnostics involve fast diagnosis of corona viral infection in the patient. This diagnosis involves the use of several different kits to conduct tests and receive quick & accurate results or reports on the basis of which the healthcare professionals can ensure proper treatment. Reverse transcriptase PCR or RTPCR is presently the most widely used diagnostic test for COVID-19 detection.

COVID-19 Impact Analysis

The outbreak of COVID-19 across the globe has progressively impacted the global COVID-19 diagnostics market, owing to increasing number of people being affected from the deadly virus. In addition, severe complications related to breathing are observed in coronavirus affected patients. Considering the speed with which the virus is spreading, the global market for COVID-19 diagnostics is showing an exponential growth. Further, it is mandatory to get a COVID-19 negative report during travel due to stringent regulations imposed by various governments on travelling, which is boosting the market growth.

Key Developments in the Industry

The companies operating in the global industry are adopting various growth strategies and business tactics such as partnerships, investments, collaborations, product approvals & launches, and many more to obtain a leading position in the global industry, which is predicted to drive the growth of the global COVID-19 diagnostics market in upcoming years.

For instance, in March 2020, SignalChem, a worldwide leader in cell signaling, announced the launch of coronavirus ELISA kits for diagnostic research and detection of the coronavirus infection. The ELISA kit a sandwich enzyme-linked immunosorbent assay for detection and quantification of SARS-CoV-2 spike protein (RBD) in infected patients.

In May 2020, Bio-Rad Laboratories Inc., a leading life science research and clinical diagnostic products company, announced to have received the US Food and Drug Administration (FDA) EUA (Emergency Use Authorization) approval for its ‘Droplet Digital PCR (ssPCR) SARS-CoV-2’ test kit. The SARS-CoV-2 test runs on Bio-Rad’s QXDx and QX200 ddPCR systems.

In May 2021, Cipla, an Indian multinational pharmaceutical company, entered into a partnership with Ubio Technologies Biotechnology Systems, the leading manufacturers of diagnostic devices, to launch a polymerase chain reaction COVID-19 test kit namely, 'ViraGen' in India. It is the third COVID-19 testing kit by the pharma Cipla that already has partnerships for antigen test kits and antibody detection kit.

Forecast Analysis of Global COVID-19 Diagnostics Market

The global COVID-19 diagnostics market is projected to witness a striking growth during the forecast period, owing to the increased investments and funding by governments and companies across the globe for R&D in the diagnostic therapies and tools. Conversely, the lack of awareness among people in rural areas about getting diagnosed for COVID-19 is expected to hamper the market growth in the projected timeframe.

The growing prevalence of coronavirus infection among the population across the globe abd the increasing initiatives by governments across various nations for mass testing of people are the significant factors estimated to propel the growth of the global market in the coming future. According to a latest report published by Research Dive, the global COVID-19 diagnostics market is expected to garner $65,750.1 million during the forecast period (2021-2028). Regionally, the North America region is estimated to dominate in the global industry, mainly due to the rising demand for COVID-19 diagnostic kits owing to growing cases of coronavirus affected patients. The key players functioning in the global market include Hologic Inc., ADT Biotech Sdn Bhd, Veredus Laboratories, Mylab Discovery Solutions Pvt. Ltd., Luminex Corporation, Neuberg Diagnostics, Quest Diagnostics, and Quidel Corporation.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com