Navigation Lighting Market Report

RA08346

Navigation Lighting Market by Type (Low Light Intensity, Medium Light Intensity, and High Light Intensity), End-user (Marine and Aerospace), and Regional Outlook (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2030

Global Navigation Lighting Market Analysis

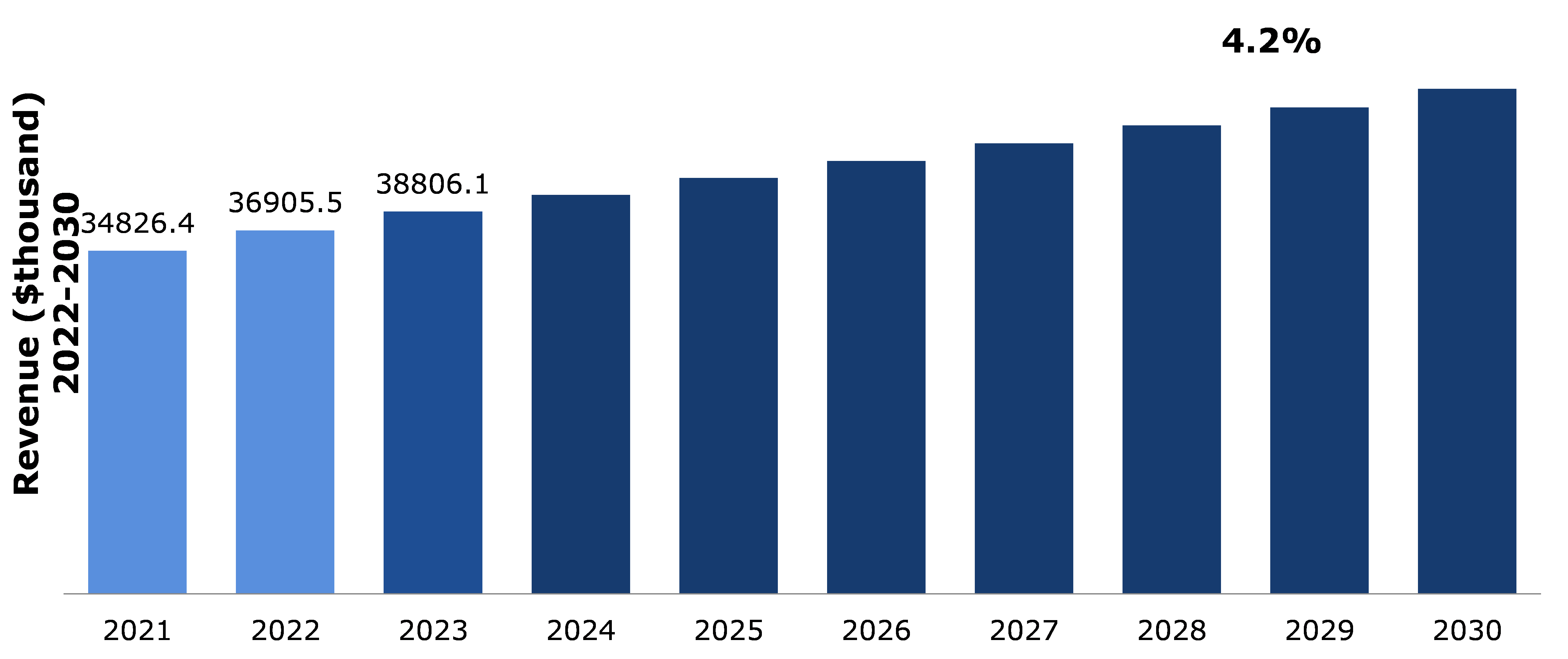

The global navigation lightning market size was $34,826.4 thousand in 2021 and is predicted to grow with a CAGR of 4.2%, by generating a revenue of $51,277.1thousand by 2030.

Source: Research Dive Analysis

Market Synopsis

The navigation lighting is mainly used for marine or aerospace transportation, to avoid collision at night. The primary function of any navigation lighting system is to prevent vehicles’ accident. All types of vehicles whether they are small or big require lights as part of their navigation system. Navigation lights are white or colored illuminating devices which are fitted on aircraft and shipping vessels for navigation purpose. They give visual signaling as well as awareness of craft & vessel position, condition, and direction, which is especially crucial during nighttime vehicle operation. It also helps to know size, position, and direction of vehicles.

However, installation & manufacturing of navigation lights is very expensive which is going to restrain navigation lighting market growth. Also, navigation lighting requires proper maintenance and extra care. Since navigation lightings are located at the exterior of the vehicles, they are vulnerable to the impacts of seawater, precipitation, and atmospheric moisture. This factor is likely to hamper global navigation lighting market.

The global navigation lighting market growth is expected to boost in the forecast time period due to rising demand of people for faster, safer, and convenient mode of transportation. The navigation lightings are illuminating devices on water vessel and aircraft for providing visual signal & position between two vehicles, which is important during night time. For instance, according to article published on Financial Express, on May 11, 2021, the cruise industry has witnessed the growth of 35% year on year, which is anticipated to increase navigation lighting market share.

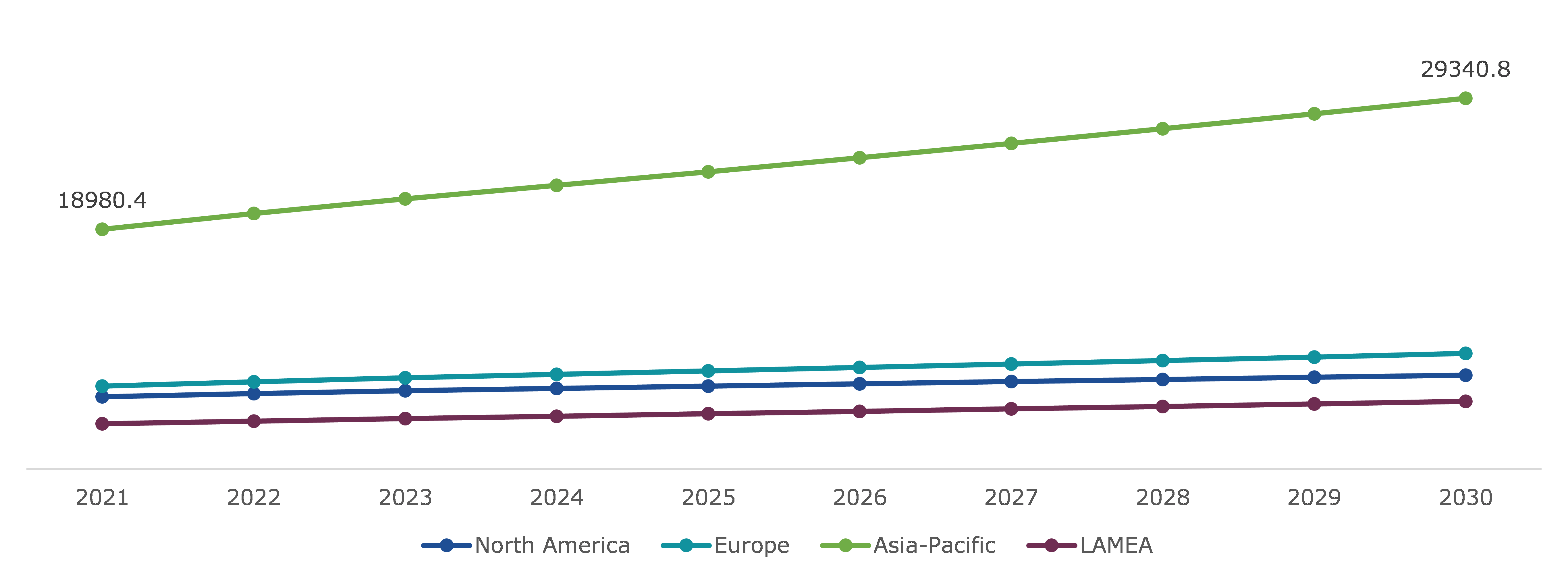

According to regional analysis, the Asia-Pacific global navigation lighting market accounted is projected to significantly grow in the projected timeframe.

Global Navigation Lighting Overview

Navigation lights are a critical safety feature on boats and aircraft. These lights aid all vessels navigating between sunset and sunrise, as well as in low-visibility conditions like rainfall or fog. Navigation lights are mostly known as position or running lights that are used to navigate the parking of a ship or landing of an aircraft. It is divided into side light, mast-head light, towing light, stern light, and other categories. The mast-head light is a white light that is used to alert people to one's position and location. A side light is used to indicate a sailing direction, similar to a turn signal. It must be placed with a red light on the left side and a green light on the opposite side. A towing light, such as a yellow light, is also used to signal a towing issue.

Covid-19 Impact on Global Navigation Lighting Market

The global crises and commercial uncertainties caused by the Covid-19 outbreak have had a substantial impact on the operations of many enterprises, resulting in revenue losses. The global navigation lighting market has been harmed by lockdown restrictions imposed by several governments, as well as travel restrictions imposed by other countries. Also, shutdown of seaports & airports, closed borders, and ban on import-exports further hampered the supply of raw materials, which impacted the market drastically. In addition, the sudden drop in the demand for passenger aircraft & cruise ship due to covid-19 pandemic and social distancing norms hampered the growth of global navigation lighting market.

To cope with declining business growth in covid-19 pandemic, the UN General Assembly adopted international cooperation to solve issues faced as a result of the COVID-19 epidemic to sustain global supply chains. Also, the governments of numerous countries started focusing on vaccinating against covid-19, bilateral or multilateral trade agreements, and lifting travel restrictions along with implementing new health guidelines for safe travel.

Increasing Demand for Air Travel to Drive the Global Navigation Lighting Market

Factors like increase in demand for travel after the ease of Covid-19 travel restrictions and rise in passengers demand for air travel as they can reach their destination early are expected to drive the market growth. The aviation industry is expanding at a high rate. According to India Brand Equity Foundation (IBEF), in 2021, India became third largest aviation market in the world. The aviation sector has benefited from an increase in the number of middle-income households, strong competition among low-cost carriers, infrastructure expansion at major airports, and supportive governmental environment. Also, the initiatives taken by government such as UDAN scheme to connect small and medium cities with metro cities through airline services, Kirishi UDAN 2.0 and NIRMAN scheme to expand the airport handling capacity are going to boost aviation industry which is leading to productions of more aircrafts to meet the demand. The equitable rise in air-passenger traffic and aircraft is driving the global navigation lighting market.

‘To know more about global navigation lighting market drivers, get in touch with our analysts here.

High Cost of Navigation Lighting Market is Expected to Hamper Global Navigation Lighting Market

Navigation lights are made using variety of technology such as light emitting diodes (LED), high intensity discharge (HID), halogens, flashes, and halogen lighting. These navigation lights are used to provide white or color lighting to avoid collision at night or in low visibility. These lights are equipped with lenses and control panels to protect navigation lighting from rain, snow, dust damage, and atmospheric moisture. The cost involved in manufacturing & installing these lights is high which is going to be the biggest restraint for the navigation lighting market. Despite the significant investment costs, the light has a high risk of being broken, necessitating the replacement or modification of the light after a certain amount of time.

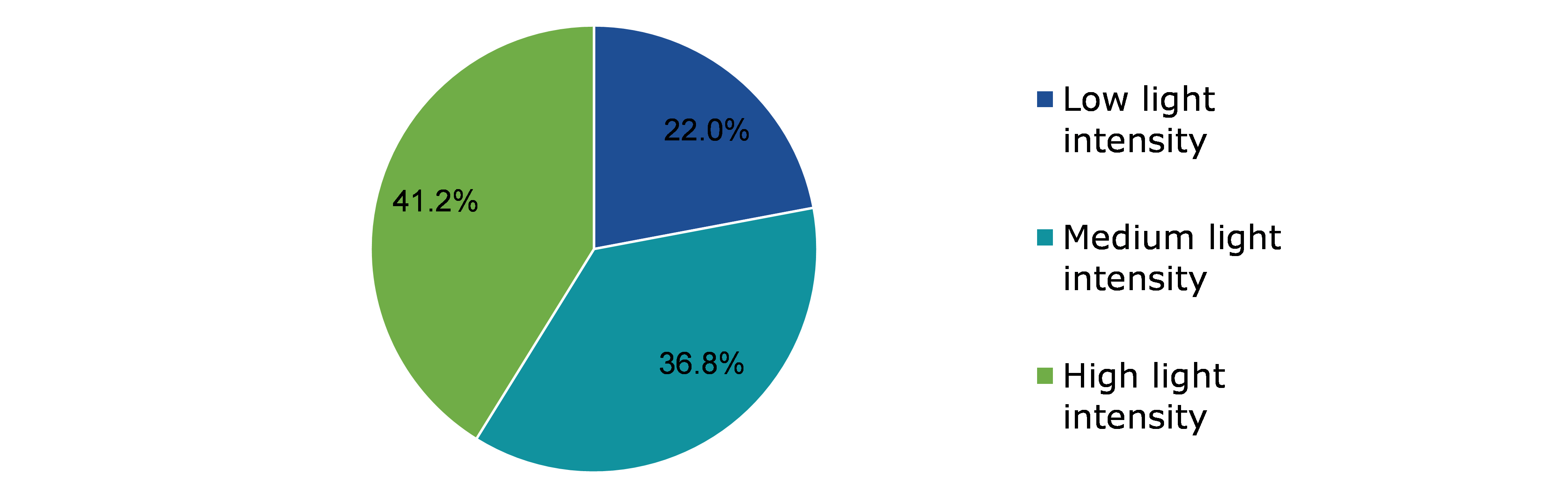

Global Navigation Lighting Market, by Type

Based on type, the market has been classified into low light intensity, medium light intensity, and high light intensity. Among these, the medium light intensity is estimated to show the fastest growth during forecast period.

Global Navigation Lighting Market, by Type, 2021

Source: Research Dive Analysis

The medium light intensity sub-type is anticipated to be the fastest growing market share during the timeframe. Medium light intensity light consists of a series of flashers and steady-burning light bars that provide visual information about the position, height perception, and references to aid in the visual component of an instrument approach. Medium light intensity lights are suitable for aircraft, watercraft, and spacecraft. The medium light intensity lights require low maintenance because these lights are made using LEDs having a life expectancy of around 50,000 hours. When compared to traditional light sources, LEDs have a two-fold increase in luminous efficiency, a two- to three-fold reduction in CO2 emissions, and a ten-fold increase in life lifetime. It is for this reason that these are being considered as a possible future light source.

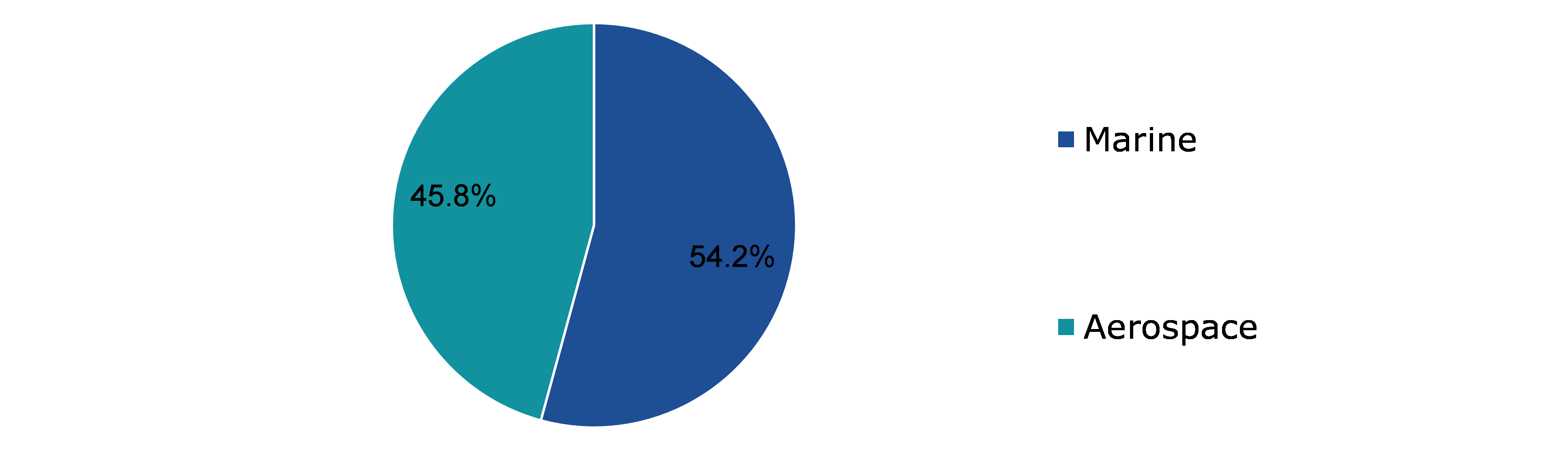

Global Navigation Lighting Market, by End-user

Based on end-user the market has been divided into marine and aerospace. Among these, the marine sub-segment accounted for the highest navigation lighting market share in 2021.

Global Navigation Lighting Market, by End-user, 2021

Source: Research Dive Analysis

The marine sub-segment is anticipated to have a dominant navigation lighting market size during the review period. Navigation lights are colored or white illumination devices which are used by water vessels and spacecraft for avoiding any chance of accident. They also provide information regarding the position, size, and direction of vehicles. These navigation lights also indicate position of watercraft and aircraft to person, such as aircraft traffic controller, marine yard engineer, and dockyard manager.

Navigation lights are also known as marine lights or running lights. The transportation of goods and services by watercraft is cheaper compared to aircraft. Around 80%of import-exports of global economy happen through water ways. In order to respond more flexibly to changing market conditions, carriers, shippers, ports, and inland transport operators will rethink their business and operating models. For example, the covid-19 pandemic changed people’s perspective towards e-commerce, which is going to accelerate demand for shipping container for transportation, improving the navigation lighting market growth.

Global Navigation Lighting Market Regional Insights

The global navigation lighting market was investigated across North America, Europe, Asia-Pacific, and LAMEA

Source: Research Dive Analysis

The Market for Global Navigation Lighting Market in Asia-Pacific to be Most Dominant and Fastest Growing

The Asia-Pacific global navigation lighting market is predicted to garner dominant market share in the timeframe. The Asia-Pacific region market is playing an important role in the global economy, and it will continue to do so in the next fifteen years. The region will account for 45% to 50 % of global GDP by 2030. As a result of continuous urbanization, changing population’s trends, and growing middle classes, the demographic and social profile of Asia-Pacific will change during the next decade and a half. The region's key driving element in the forecast period is expected to be rapid infrastructure development and government attempts to expand airports & seaports. The development of infrastructure such as marine docks and airports will require installation of navigation lighting which is going to propel the global market growth of navigation lighting market. For example, the Indian government is focusing on operationalizing of 23 domestic waterways route for cost effective and environmentally friendly mode of transportation, which is going to increase the demand for navigation lighting market.

Moreover, in February 2021, the International Aviation Transport Association (IATA), released a mobile phone application for airline passengers that uses navigation lights to direct them to their respective aircrafts and seats. This is because, in order to adhere to social distancing conventions, airports have restricted the number of employees that accompany passengers to their seats. Apple iOS and Android users will be able to download the IATA app. During the epidemic, navigation lights assist passengers in having a stress-free journey, which may drive demand for navigation lights in the region market over the forecast period.

Competitive Scenario in the Global Navigation Lighting Market

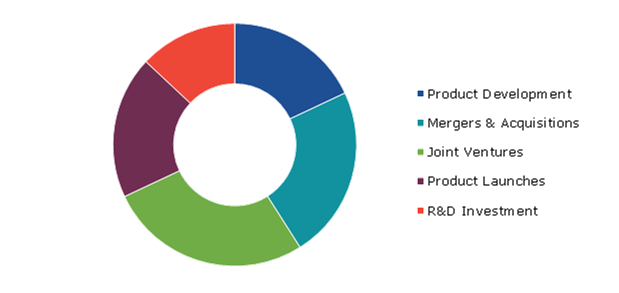

Product launches and mergers & acquisitions are common strategies followed by major market players

Source: Research Dive Analysis

Some of the major key players in the navigation lighting market are Glamox AS, Aveo Engineering Group, S.R.O., Hella Marine, Perko Inc., Lutron Electronics Co., Inc, Canepa & Campi, Den Haan Rotterdam, FAMOR S.A., and TRANBERG. Companies are investing in new product developments and collaborations to capture a dominant market share in the global navigation lighting market in the estimated period.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2021-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global navigation lighting market?

A. The size of the global navigation lighting market was over $34,826.4 thousand in 2021 and is projected to reach $51,277.1 thousand by 2030.

Q2. Which are the major companies in the navigation lighting market?

A. Glamox AS, Hella Marine, Aveo Engineering Group, and S.R.O. are some of the key players in the global navigation lighting market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific navigation lighting market?

A. Asia-Pacific navigation lighting market is anticipated to grow at 4.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Investment and business expansion are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Glamox AS is the company investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on navigation lighting market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on navigation lighting market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Navigation Lighting Market Analysis, by Type

5.1.Overview

5.2.Low Light Intensity

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3. Medium Light Intensity

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4. High Light Intensity

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Navigation Lighting Market Analysis, by End-user

6.1. Marine

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2. Aerospace

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Navigation Lighting Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type

7.1.1.2.Market size analysis, by End-user

7.1.2.Canada

7.1.3.Market size analysis, by Type

7.1.4.Market size analysis, by End-user

7.1.5.Mexico

7.1.5.1.Market size analysis, by Type

7.1.5.2.Market size analysis, by End-user

7.1.6.Research Dive Exclusive Insights

7.1.6.1.Market attractiveness

7.1.6.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type

7.2.1.2.Market size analysis, by End-user

7.2.2.UK

7.2.2.1.Market size analysis, by Type

7.2.2.2.Market size analysis, by End-user

7.2.3.France

7.2.3.1.Market size analysis, by Type

7.2.3.2.Market size analysis, by End-user

7.2.4.Spain

7.2.4.1.Market size analysis, by Type

7.2.4.2.Market size analysis, by End-user

7.2.5.Italy

7.2.5.1.Market size analysis, by Type

7.2.5.2.Market size analysis, by End-user

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type

7.2.6.2.Market size analysis, by End-user

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type

7.3.1.2.Market size analysis, by End-user

7.3.2.Japan

7.3.2.1.Market size analysis, by Type

7.3.2.2.Market size analysis, by End-use

7.3.3.India

7.3.3.1.Market size analysis, by Type

7.3.3.2.Market size analysis, by End-user

7.3.4.Australia

7.3.4.1.Market size analysis, by Type

7.3.4.2.Market size analysis, by End-user

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type

7.3.5.2.Market size analysis, by End-user

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type

7.3.6.2.Market size analysis, by End-user

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type

7.4.1.2.Market size analysis, by End-user

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type

7.4.2.2.Market size analysis, by End-user

7.4.3.UAE

7.4.3.1.Market size analysis, by Type

7.4.3.2.Market size analysis, by End-user

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type

7.4.4.2.Market size analysis, by End-user

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type

7.4.5.2.Market size analysis, by End-user

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1. Glamox AS

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2. Aveo Engineering Group

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.S.R.O

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4. Hella Marine

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5. Perko, Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Lutron Electronics Co., Inc

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Canepa & Campi

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Den Haan Rotterdam

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.FAMOR S.A.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.TRANBERG

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

Navigation lighting is a source of illumination for travelling aircrafts, sea vessels, or spacecrafts and help in providing information about the location and status of the aircraft or sea vessel. This information is crucial for other crafts that are travelling through the same area so that these crafts can reorient their journey accordingly. Hence, navigation lighting is also called as running or position lighting. The vital nature of the navigation lighting can be understood from the fact that prominent international conventions have mandated the use of navigation lighting for both, aircrafts and sea vessels.

Forecast Analysis

Over the years, there has been a dramatic increase in the demand for air travel all across the globe. This increase in demand, in turn, is predicted to boost the demand for navigation lighting and consequently result in the growth of the navigation lighting market in the forecast timeframe. Along with this, growth in demand for faster, safer, and convenient modes of transport is predicted to boost the market further. Moreover, various government schemes introduced in different countries to boost air travel is anticipated to offer numerous growth opportunities to the market in the coming years. However, the high cost of navigation lighting is expected to become the major hurdle in the growth of the navigation lighting market in the forecast years.

Regionally, the navigation lighting market in the Asia-Pacific region is expected to grow at the fastest rate by 2030. Rapid development in the infrastructure in various countries of this region in the form of development of numerous airports and seaports has led to an increase in demand for navigation lighting, which is predicted to help in the growth of this market in this region.

As per the report published by Research Dive, the global navigation lighting market is expected to gather a revenue of $51,277.1 thousand in the 2021–2030 timeframe and grow at 4.2% CAGR by 2030. Some prominent market players include Glamox AS, Lutron Electronics Co., Inc, Den Haan Rotterdam, Aveo Engineering Group, Canepa & Campi, FAMOR S.A., Hella Marine, TRANBERG, Perko Inc., S.R.O, and many others.

Covid-19 Impact on the Navigation Lighting Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The global navigation lighting market, too, has faced a similar fate. The travel restrictions and lockdowns that were put in place to curb the spread of the virus had disastrous impact on the air travel and shipping industry. Naturally, the spill-over effect of this impact was felt by the navigation lighting market also, as the demand for navigation lightings dropped drastically during the pandemic years.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the navigation lighting market to flourish. For instance:

- In July 2020, Oceanic Systems, a UK-based marine equipment manufacturer, announced the launch of its NMEA2000® Navigation Light Controller which is designed to monitor and control 8, 16, or 24 LED navigation lightings. This product launch by Oceanic Systems perfectly addresses the current demands of the navigation industry, and hence will help the company to increase its presence in the market in the near future.

- In April 2021, SPX Corporation, a highly-engineered infrastructure equipment provider, announced the acquisition of Sealite, a leading manufacturer of marine navigation products. Along with this, SPX Corportation has also acquired Sealite’s affiliated entities, viz., Avlite Systems and Star2M. These acquisitions are expected to help SPX Corporation to consolidate its position significantly in the navigation lighting industry.

- In May 2022, Advanced Navigation, a navigation and AI robotics company, announced the acquisition of Vai Photonics, a navigation technology developer. With this acquisition, Advanced Navigation would be much better placed in order to cater to the demands of its customers and thereby increase its footprint in the market in the long run.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com