Sodium Chlorite Market Report

RA08333

Sodium Chlorite Market, By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent and Others), By End Use Industry (Water Treatment, Paper, Textile, Medical and Others), Regional Outlook (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2019–2027

Sodium chlorite market accounted for $201,250.0 thousand in 2019 and is predicted to generate a revenue of $282,911.4 thousand by 2027 with a CAGR of 4.4% in the estimated period. In terms of revenue, Asia-Pacific region market accounted for $74,141.6 thousand in 2019 and is predicted to grow with a CAGR of 4.8% in the forecast period. The Asia-Pacific region market had a market share of 37% in 2019.

Market Analysis

Sodium chlorite is made by the reaction of sodium hypochlorite with chlorine dioxide from the reaction of a chlorate. Sodium chlorite’s chemical formula is NaClO2. It is mostly used as a bleaching agent and oxidizing agent in processes such as stripping of paper, pulp and textiles.

COIVD-19 Analysis on Sodium Chlorite Market

The coronavirus pandemic has created a positive impact on the global sodium chlorite market. The sodium chlorite market is predicted to grow enormously at the time of pandemic and the growth shall majorly be due to increasing use of sodium chlorite in healthcare institutions for the treatment of patients with the COVID-19 disease. Sodium chlorite solution is given to these patients for gargling and there are many more uses. In addition, sodium chlorite is used to disinfect certain surfaces. Due to the abovementioned reasons, the demand for sodium chlorite is predicted to grow and have a positive impact on the global sodium chlorite market at the time of the pandemic.

Increasing use of sodium chlorite in end use industries across the globe is predicted to be the major driving factor for the global sodium chlorite market

Sodium chlorite is used for various purpose such as bleaching and disinfection and has uses in food and beverages, oil and gas, other industrial sectors. These end user industries use sodium chlorite in multiple ways to make the proper use of final product or preserving the product. For instance, in food and beverage sodium chloride is used to disinfect containers used to manufacture and produce food products. Moreover, in healthcare institutions, a large amount of sodium chlorite solution is for disinfecting purposes and in the treatment of various illnesses, such as HIV, arthritis, and common cold. Due to multiple benefits of sodium chlorite, it is been used by numerous end use industries to a large extent which is predicted to be the major driving factor for the global sodium nitrate market in the estimated period.

Stringent environmental rules and regulation for the use of sodium chlorite is predicted to be the biggest restraint for the sodium chlorite market

Safety can only be considered in relative terms. Sodium chlorite impacts the environment adversely. Various environment rules and regulations for the use of sodium chlorite is predicted to hinder the market in the estimated period. Sodium chlorite in the soil can affect soil structure, and soil density which can reduce permeability, moisture retention, and fertility. In addition, if it gets mixed with water it affects the aquatic wildlife adversely. Due to adverse effects on the environment, most organizations do not prefer sodium chlorite, which is predicted to be the biggest restraint for the market in the estimated period. For instance, Motherson Group collaborated with UBQ to bring carbon-negative thermoplastics into auto parts. UBQ materials are mixed with styrene, chlorine-based resins, olefin, and other additives to produce final products.

Treating wastewater across the globe is predicted to create more growth opportunities for the global sodium chlorite market in the estimated period.

Most of the countries across the globe are focusing on conserving fresh water. Various government bodies are focusing more on treating wastewater to supply water to the population across respective regions. Treating wastewater is an important function as the demand for drinking water has been increasing at a faster rate. Increasing demand for drinking water and urgency of treating wastewater across the globe is predicted to create more growth opportunities in the estimated period. For instance, in May 2019, India built a largest sewage treatment plant at Okhla. The plant will be able to treat 124 million gallons of wastewater per day and will come up at a cost of Rs 1,161 crore in three years.

Sodium Chlorite Market, By Application

Disinfectant application sub-segment is predicted to be the most lucrative

Source: Research Dive Analysis

Disinfectant application sub-segment is predicted to have the maximum market share in terms of revenue and volume in the forecast period. Disinfectant application sub-segment accounted for $120,936.2 thousand in 2019 and is predicted to grow with a CAGR of 4.5% in the estimated period. For reducing the spread of the hospital-acquired infection it is very crucial to keep the areas sanitized, and sodium chloride is used as a disinfectant for these purposes. Increasing hospital-acquired infections (HAI) is predicted to boost the sub-segment market in the estimated period.

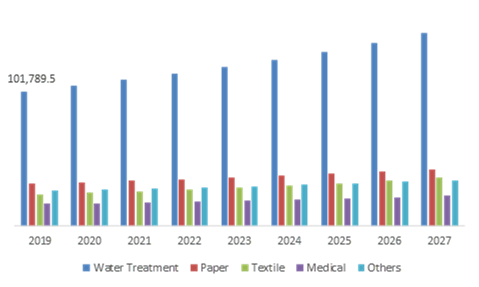

Sodium Chlorite Market, End Use Industry:

Water treatment end use sub segment is predicted to hold maximum market share

Source: Research Dive Analysis

Water treatment sub-segment is predicted to hold the highest revenue share in the market in the projected timeframe. Water treatment sub-segment accounted $101,789.5 thousand in 2019 and is predicted to grow with a CAGR of 4.7% in the projected timeframe. Due to increasing demand of water with rise in population, government bodies are focusing on treating wastewater which is predicted to boost the water treatment sub-segment in the estimated period.

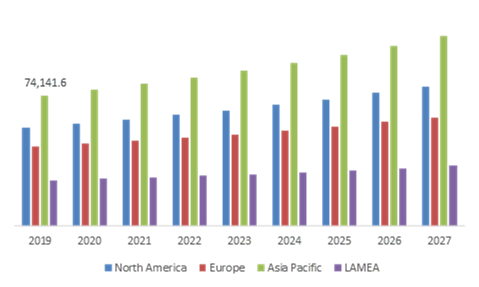

Sodium Chlorite Market, By Region:

Asia-Pacific region market is predicted to create more growth opportunities for the global market in the forecast period

Source: Research Dive Analysis

Asia-Pacific region market is predicted to have highest market share in terms of revenue in the estimated period. Asia-Pacific region market accounted $74,141.6 thousand in 2019 and is predicted to grow with a CAGR of 4.8% in the estimated period. Presence of large number of producers of sodium chlorite and decreasing groundwater increasing the demand for cleaning the wastewater is predicted to be the major driving factor for the region market in the estimated period. China is the largest manufacturer and exporter of sodium chlorite across the globe. In addition, increasing textile and clothing manufacturing across the region is predicted to drive the market in the estimated period.

Key Participants in the Sodium Chlorite Market:

Source: Research Dive Analysis

Some of the significant sodium chlorite market players include OSAKA SODA, Carlit Holdings Co., Ltd., Shandong Gaomi Gaoyuan Chemical Industry Co.,Ltd., Otsuka Chemical Co.,Ltd, Dongying Shengya Chemical Co., Ltd., Yancheng Huaou Industry Group Co., Ltd, Fengchen Group Co.,Ltd, ERCO Worldwide, Ercros SA, and Occidental petroleum corporation among others. For instance, in Feb 2019, Osaka Soda to acquire 31.3 pct stake in NITTO KAKO, it will acquire 1.2 million shares (31.3 percent stake) of NITTO KAKO CO LTD from Mitsubishi Chemical Corp, with undisclosed price.

Porter’s Five Forces Analysis for Sodium Chlorite Market:

- Bargaining Power of Suppliers: Limited number of suppliers are present in the market.

The bargaining power of suppliers is Moderate.

- Bargaining Power of Consumers: In this market, the concentration of buyers is Medium.

The bargaining power of consumers is Moderate.

- Threat of New Entrants: Huge initial investments are essential to start a new manufacturing unit of sodium chlorite whereas stringent rules and regulation restricts from entering the new entrants into the market.

The threat of new entrants is Low.

- Threat of Substitutes: This market has less number of substitute and availability of these product is also very less due to which switching costs for clients is low.

The threat of substitutes is Low.

- Competitive Rivalry in the Market: The sodium chlorite market has numerous small, medium and large, scale players.

The competitive rivalry in the industry is Moderate.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Application |

|

| Segmentation by End Use |

|

| Key Countries Covered | U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Russia, Rest of Europe, China, Japan, India, Australia, South Korea, Rest of Asia-Pacific, Latin America, Middle East, Africa |

| Key Companies Profiled |

|

Q1. What is the size of sodium chlorite Market?

A. The global Sodium Chlorite Market size in terms of revenue was over $201,250.0 thousand in 2019, and is predicted to grow with a CAGR of 4.4% over the forecast period.

Q2. Which are the leading companies in the sodium chlorite Market?

A. OSAKA SODA and ERCO Worldwide are some of the key players in the global sodium chlorite market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Asia-Pacific possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of North America?

A. North America Sodium Chlorite Market is projected to grow at 4.8% CAGR during the forecast period.

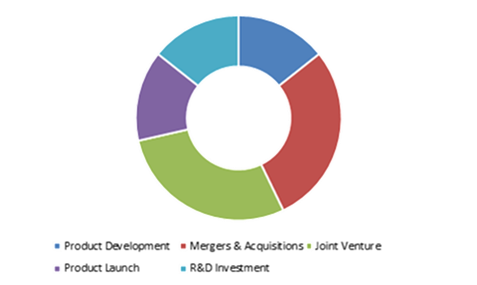

Q5. What are the strategies opted by the leading players in this market?

A. Product development is the key strategies opted by the operating companies in this sodium chlorite market.

Q6. Which companies are investing more on R&D practices?

A. OSAKA SODA is the company investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Application trends

2.3. End use industry trends

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By Application

3.8.2. By End use

3.8.3. By region

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Sodium Chlorite Market , by Application

4.1. Disinfectant

4.1.1. Market size and forecast, by region, 2019-2027

4.1.2. Comparative market share analysis, 2019-2027

4.2. Antimicrobial Agent

4.2.1. Market size and forecast, by region, 2019-2027

4.2.2. Comparative market share analysis, 2019-2027

4.3. Bleaching Agent

4.3.1. Market size and forecast, by region, 2019-2027

4.3.2. Comparative market share analysis, 2019-2027

4.4. Others

4.4.1. Market size and forecast, by region, 2019-2027

4.4.2. Comparative market share analysis, 2019-2027

5. Sodium Chlorite Market , by End Use Industry

5.1. Water Treatment

5.1.1. Market size and forecast, by region, 2019-2027

5.1.2. Comparative market share analysis, 2019-2027

5.2. Paper

5.2.1. Market size and forecast, by region, 2019-2027

5.2.2. Comparative market share analysis, 2019-2027

5.3. Textile

5.3.1. Market size and forecast, by region, 2019-2027

5.3.2. Comparative market share analysis, 2019-2027

5.4. Medical

5.4.1. Market size and forecast, by region, 2019-2027

5.4.2. Comparative market share analysis, 2019-2027

5.5. Others

5.5.1. Market size and forecast, by region, 2019-2027

5.5.2. Comparative market share analysis, 2019-2027

6. Disaster Recovery as Sodium Chlorite Market , by Region

6.1. North Region

6.1.1. Market size and forecast, by Application, 2019-2027

6.1.2. Market size and forecast, by End Use, 2019-2027

6.1.3. Market size and forecast, by country, 2019-2027

6.1.4. Comparative market share analysis, 2019-2027

6.1.5. U.S

6.1.6. Market size and forecast, by Application, 2019-2027

6.1.7. Market size and forecast, by End Use, 2019-2027

6.1.8. Market size and forecast, by vertical, 2019-2027

6.1.9. Canada

6.1.10. Market size and forecast, by Application, 2019-2027

6.1.11. Market size and forecast, by End Use, 2019-2027

6.2. Europe

6.2.1. Market size and forecast, by Application, 2019-2027

6.2.2. Market size and forecast, by End Use, 2019-2027

6.2.3. Market size and forecast, by country, 2019-2027

6.2.4. Comparative market share analysis, 2019-2027

6.2.5. UK

6.2.5.1. Market size and forecast, by Application, 2019-2027

6.2.5.2. Market size and forecast, by End Use, 2019-2027

6.2.5.3. Comparative market share analysis, 2019-2027

6.2.6. Germany

6.2.6.1. Market size and forecast, by Application, 2019-2027

6.2.6.2. Market size and forecast, by End Use, 2019-2027

6.2.6.3. Comparative market share analysis, 2019-2027

6.2.7. France

6.2.7.1. Market size and forecast, by Application, 2019-2027

6.2.7.2. Market size and forecast, by End Use, 2019-2027

6.2.7.3. Comparative market share analysis, 2019-2027

6.2.8. Italy

6.2.8.1. Market size and forecast, by Application, 2019-2027

6.2.8.2. Market size and forecast, by End Use, 2019-2027

6.2.8.3. Comparative market share analysis, 2019-2027

6.2.9. Rest of Europe

6.2.9.1. Market size and forecast, by Application, 2019-2027

6.2.9.2. Market size and forecast, by End Use, 2019-2027

6.2.9.3. Comparative market share analysis, 2019-2027

6.3. Asia-Pacific

6.3.1. Market size and forecast, by Application, 2019-2027

6.3.2. Market size and forecast, by End Use, 2019-2027

6.3.3. Comparative market share analysis, 2019-2027

6.3.4. Market size and forecast, by country, 2019-2027

6.3.5. China

6.3.5.1. Market size and forecast, by Application, 2019-2027

6.3.5.2. Market size and forecast, by End Use, 2019-2027

6.3.5.3. Comparative market share analysis, 2019-2027

6.3.6. India

6.3.6.1. Market size and forecast, by Application, 2019-2027

6.3.6.2. Market size and forecast, by End Use, 2019-2027

6.3.6.3. Comparative market share analysis, 2019-2027

6.3.7. Japan

6.3.7.1. Market size and forecast, by Application, 2019-2027

6.3.7.2. Market size and forecast, by End Use, 2019-2027

6.3.7.3. Comparative market share analysis, 2019-2027

6.3.8. South Korea

6.3.8.1. Market size and forecast, by Application, 2019-2027

6.3.8.2. Market size and forecast, by End Use, 2019-2027

6.3.8.3. Comparative market share analysis, 2019-2027

6.3.9. Australia

6.3.9.1. Market size and forecast, by Application, 2019-2027

6.3.9.2. Market size and forecast, by End Use, 2019-2027

6.3.9.3. Comparative market share analysis, 2019-2027

6.3.10. Rest of Asia Pacific

6.3.10.1. Market size and forecast, by Application, 2019-2027

6.3.10.2. Market size and forecast, by End Use, 2019-2027

6.3.10.3. Comparative market share analysis, 2019-2027

6.4. LAMEA

6.4.1.1. Market size and forecast, by Application, 2019-2027

6.4.1.2. Market size and forecast, by End Use, 2019-2027

6.4.1.3. Market size and forecast, by country, 2019-2027

6.4.1.4. Comparative market share analysis, 2019-2027

6.4.2. Latin America

6.4.2.1. Market size and forecast, by Application, 2019-2027

6.4.2.2. Market size and forecast, by End Use, 2019-2027

6.4.2.3. Comparative market share analysis, 2019-2027

6.4.3. Middle East

6.4.3.1. Market size and forecast, by Application, 2019-2027

6.4.3.2. Market size and forecast, by End Use, 2019-2027

6.4.3.3. Comparative market share analysis, 2019-2027

6.4.4. Africa

6.4.4.1. Market size and forecast, by Application, 2019-2027

6.4.4.2. Market size and forecast, by End Use, 2019-2027

6.4.4.3. Comparative market share analysis, 2019-2027

7. Company profiles

7.1. OSAKA SODA

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Product portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Carlit Holdings Co., Ltd.,

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Product portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. Shandong Gaomi Gaoyuan Chemical Industry Co.,Ltd.

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Product portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. Otsuka Chemical Co.,Ltd,

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Product portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. Dongying Shengya Chemical Co., Ltd.,

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Product portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Yancheng Huaou Industry Group Co., Ltd

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Product portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. Fengchen Group Co.,Ltd

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Product portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. ERCO Worldwide

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Product portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

7.9. Ercros SA,

7.9.1. Business overview

7.9.2. Financial performance

7.9.3. Product portfolio

7.9.4. Recent strategic moves & developments

7.9.5. SWOT analysis

7.10. Occidental petroleum corporation

7.10.1. Business overview

7.10.2. Financial performance

7.10.3. Product portfolio

7.10.4. Recent strategic moves & developments

7.10.5. SWOT analysis

Sodium chlorite is also known as sodium salt textone, chlorous acid, and miracle mineral solution. It is an amalgamation of oxygen (O2), sodium (Na), and chlorine (Cl).

There are different claims regarding the usage of this chemical as a health supplement. According to the U.S. Food and Drug Administration (FDA), however, it has hazardous, potentially life menacing chemical properties that should be totally avoided.

Sodium chlorite is known to be used for various consumers and industrial applications.

Some of the consumer applications of sodium chlorite are:

- water treatment

- surface cleanser for food preparation areas

- antimicrobial treatment for seafood

A great amount of sodium chlorite is used in different end-use industries. For example,

- sterilizing agent in water treatment plants

- bleaching and shedding of pulp, paper, and textiles

Growth Opportunity of the Industry

Sodium chlorite is used for bleaching, disinfection and many more by various end user such as food and beverage, oil and gas, other industrial sectors. These industries use sodium chlorite in multiple ways to make the proper use of final product or preserving the product. For instance, in the food and beverage industry, sodium chloride is used to disinfect the containers that has been used to manufacture and produce various type of food products.

In healthcare industry, a large amount of sodium chlorite solution is used as a disinfectant and used for treatment of various illnesses, such as HIV, arthritis and common cold.

This extensive usage of sodium chlorite is going to drive the growth of the global sodium chlorite market during the forecast period.

Market Trends and Recent Developments

According to a report published by Research Dive, the global sodium chlorite market include Carlit Holdings Co., Ltd., Shandong Gaomi Gaoyuan Chemical Industry Co.,Ltd., OSAKA SODA, Otsuka Chemical Co.,Ltd, Yancheng Huaou Industry Group Co., Ltd, ERCO Worldwide, Fengchen Group Co.,Ltd, Dongying Shengya Chemical Co., Ltd., Occidental Petroleum Corporation, and Ercros SA among others.

These significant players of the industry are working towards development of unique strategies such as product launches, mergers and acquisitions, upgradation of existing technology, and collaborations and partnerships to sustain the growth of the market in coming years.

Some of the recent developments of the market are mentioned below:

- In March 2020, as per an announcement by Occidental Petroleum Corporation, to add three new Icahn designated directors to Occidental’s Board, the company has entered into an agreement with Carl C. Icahn and its conglomerate, the “Icahn Group”.

- Coupa Software, a leading player in business spend management (BSM), has announced in March this years that Canada-based specialty chemical company, ERCO Worldwide, selected Coupa. This selection has been done in order to renovate its business by mechanizing its internal spend processes and empowering smoother invoice activities across the base of its supplier, as per a latest report.

- Another leading players of the market, Visterra, Inc. and Otsuka Pharmaceutical Co., Ltd. made an announcement about a definitive merger agreement. Pursuant to this agreement, Otsuka is going to acquire Visterra for in an all-cash transaction, approximately of $430 million, according to a recent release.

Impact of COVID-19 on the Industry

The emergence of coronavirus pandemic has brought the global economy to a halt. Among all the industries that are experiencing a drastic downfall, there are a few industries that survived the wrath of the natural catastrophe. The global sodium chlorite market has experienced a positive growth during this period. The increased use of sodium chlorite by the hospitals and medicals for the treatment of the Covid-19 patients is going to boost the market growth in the upcoming years. In addition, the sodium chlorite is used to disinfect the surface of the medical. Due to the above mentioned reason, the demand for sodium chlorite is predicted to grow and witness a positive growth during the time of pandemic.

The sodium chlorite market is going to experience a sustainable growth in coming years as the key players are focusing on developing new products, merger and acquisitions, and many other strategic steps.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com