EV Charging Infrastructure Market Report

RA00083

EV Charging Infrastructure Market, by Type (AC Charging Station, DC Charging Station), by Charging Level [Level 1 (120V), Level 2 (240 V), Level 3 (300-600 V)], by Application (Private, Public) Regional Analysis (North America, Europe, Asia-Pacific, LAMEA) Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Global EV Charging Infrastructure Market Analysis 2026:

The global EV charging infrastructure market forecast will be $18,589.0 million by 2026, increasing from $1,700 million in 2018 at a healthy CAGR of 34.9%. Asia-Pacific EV charging infrastructure market is anticipated to grow at a healthy CAGR of 34.5% by registering a revenue of $5,762.6 million by 2026. This is mainly because of increasing popularity for zero emission vehicles and latest technological innovations in the EVs.

An electric vehicle charging infrastructure (EV charging networks) is the recharging point that is used to connect electric vehicles and recharge them. The EV charging infrastructure provides multiple applications such as workplace, parking, fleet and others. Moreover, some EV charging infrastructures have advanced features such as cellular capability, network connectivity and smart metering. This infrastructure is also called as electric vehicle supply equipment (EVSE) which provides AC EV charger, and DC quick charger.

EV Charging Infrastructure Market Synopsis

Technological advancements and the increasing investments in EV charging stations by major market players are the key factors anticipated to drive the EV charging infrastructure market growth.

However, higher installation and infrastructure costs may restrain the growth of the global industry in the estimated timeframe.

According to the regional analysis, the Asia-Pacific market for EV charging infrastructure is anticipated to grow at a CAGR of 34.5%, by generating a revenue of $5,762.6 million during the forecast period.

Key evolutions in EVs and Public perception for the reduction of carbon footprint are one of the driving factors EV charging infrastructure market.

The compelling evolutions in EVs along with supportive government policies are anticipated to boost the growth of market. For instance, Government of India has approved 2,636 EV charging infrastructures in 62 cities across 24 states and UTs. Consumers' attitudes on carbon footprint reduction is one of the major factors for the growth of EV charging infrastructure market. Furthermore, the rapid progress of novel technology coupled with electric vehicle market players investing heavily in EV charging stations infrastructure is anticipated to drive the growth of global market.

Stringent requirement for installation and higher cost of infrastructure is predicted to restrain the growth of global EV charging infrastructure industry.

On the other hand, the higher cost of fast-charging infrastructure is anticipated to decline the growth of the global market. Also, stringent requirement for installation and complex charging infrastructure will restrain the growth of this market.

The solar power-based charging station solutions are projected to create enormous opportunities for the global market

Solar powered electric car (EV) charging infrastructure are mainly integrated with solar panels over charging infrastructure of electric vehicles. This infrastructure converts DC (direct current) to AC (alternating current), for both home and electric vehicle usage. Moreover, factors such as the capacity and range of EV’s battery are important to charge EV with solar energy. In addition, solar powered electric car charging infrastructure can be rapidly installed because it doesn’t need to get any building permit. These EV charging infrastructure market trends are expected to create huge opportunities for the growth of the global market.

EV Charging Infrastructure Market Segmentation, by Type

AC Charging System segment will generate a revenue of $7,900.3 Mn by 2026

Source: Research Dive Analysis

AC Charging System for EV Charging Infrastructure market size is anticipated to grow at a healthy rate, and is forecasted to account for $7,900.3 million by 2026, rising from $674.9 million in 2018. The key advantage of AC charging system is that it provides low-cost AC charging station feeding power directly from the electric grid to the electrical vehicles. These chargers have ability to maintain communication with control system of the vehicle and provide safe and controlled charging to the vehicle. Moreover, ongoing technology developments coupled with rising deployment of residential and public establishments is expected to drive the growth of the global market.

EV charging Infrastructure market share of DC charging system is anticipated to grow at a CAGR of 34.0% rate, and it will generate a revenue of $10,688.7 million, during the forecasted period.

Heavy investment on R&D activities by top players is one of the major factors for the growth of the global market. Charging process by DC charging system is precisely controlled by the parameters of battery control system. Furthermore, increasing number of charging stations coupled with growing popularity of clean power equipment is expected to drive the demand for DC charging system, which will eventually foster the growth of the global market.

EV charging infrastructure Market, by Charging Level:

Level 3 (300-600 V) segment will generate a revenue of $5,688.2 Mn, growing at a healthy CAGR of 36.0%, during the forecasted period

Source: Research Dive Analysis

Level 3 (300-600V) charging segment will witness a significant growth and is projected to surpass $5,688.4 million by 2026, with the rising from $487.0 million in 2018.

Level 1 (120V) charging segment has the significant market share and is projected to grow at a CAGR of 33.7% rate, and it will register a revenue of $661.3 million, over the forecasted period.

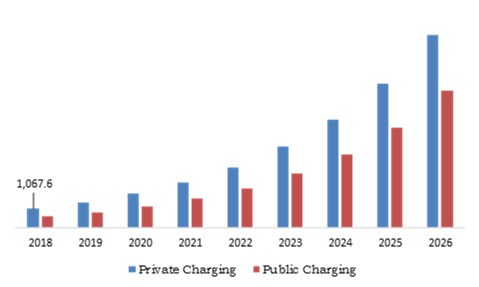

EV Charging Infrastructure Market, by Application

Private segment will generate a revenue of $10,855.9 Mn by 2026, growing at a healthy CAGR of 33.6%

Source: Research Dive Analysis

Private segment will witness a significant growth and is anticipated to account for $10,855.9 million by 2026, with an increase from $1,067.6 million in 2018.

The EV owners are consistently looking to construct efficient charging stations in their parking and garages, as per their convenience. Moreover, widespread adoption of EVs is also considered as a major factor that is making a significant impact on the growth of global market.

Public segment is expected to cross $7,733.0 million by 2026, with an increase from $632.4 million in 2018.

Extensive growth in EV production coupled with increasing necessity to install fast and ultrafast stations is boosting the growth of the global market. In addition, consistent enhancement in battery technology, the allocation of funding for research and innovation by government and key innovations in residential and commercials EV chargers are anticipated to drive the market.

EV Charging Infrastructure Market, by Region:

Asia-Pacific EV Charging Infrastructure Market will have hue opportunities for top investors to grow over the upcoming years

The EV charging infrastructure market size for Asia-Pacific is expected to experience substantial growth; this market has generated a revenue of $538.9 million in 2018 and is anticipated to account for $5,762.6 million, during the forecasted period. The transition to EV’s is progressing swiftly as these electric vehicles help to tackle climate change. Moreover, EVs are more affordable and can go longer distances on a single charge, and hence more and more people are opting for electric cars. Asian countries such as China, Taiwan and others have announced to phase out fossil fuel cars along with focusing more on zero-emission vehicles. To fulfil the increasing demand for EVs, market players of auto industry are investing at least around $90 billion in EV. These factors are anticipated to augment the EV charging infrastructure market growth for Asia region.

To explore more about North American, European and LEMEA market growth

https://www.researchdive.com/download-sample/83

Global Leaders in EV charging infrastructure Market:

Merger & acquisition and advanced product development are the frequent strategies followed by the market players

Source: Research Dive Analysis

Some of the significant EV charging infrastructure market players include ABB, Eaton., ChargePoint, Inc., ClipperCreek, Inc., GENERAL ELECTRICE, Honeywell International Inc, Rittal GmbH & Co. KG, Pod Point., Leviton Manufacturing Co., Inc., Tesla.

Market Players prefer inorganic growth strategies to expand into local markets.

EV charging infrastructure market players are focusing more on merger & acquisition and advanced product development. These are the frequent strategies followed by the established organizations, for instance, Tesla charging infrastructure is known for the largest public fast charging station in the U.S. This station recently set up twenty 50 kW stalls each with CCS/SAE and Chademo ports.

To emphasize more on the competitor analysis of market players, the porter’s five force model is explained in the report.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Charging Level |

|

| Segmentation by Application |

|

| Key Countries Covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is the size of EV charging infrastructure Market system?

A. The global EV charging infrastructure market system size was over $1,700.0 million in 2018 and is projected to reach $18,589.0 million by 2026.

Q2. Which are the leading companies in the EV charging infrastructure Market system?

A. Tesla, Pod point and Tesla. are some of the key players in the global EV charging infrastructure Market system.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Asia-Pacific region possess great investment opportunities for the investors to witness the most promising growth in the future.

Q4. What is the growth rate of Asia-Pacific market?

A. Asia-Pacific EV charging infrastructure Market is anticipated to grow at 34.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological advancements, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. ABB and Eaton companies are investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Type Trends

2.3. Charging Level Trends

2.4. Application Trends

3. Market Overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By Type

3.8.2. By Charging Level

3.8.3. By Application

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. EV Charging Infrastructure Market, by Type

4.1. AC Charging Station

4.1.1. Market size and forecast, by region, 2018-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. DC Charging Station

4.2.1. Market size and forecast, by region, 2018-2026

4.2.2. Comparative market share analysis, 2018 & 2026

5. EV Charging Infrastructure Market, by Charging Level

5.1. Level 1 (120V)

5.1.1. Market size and forecast, by region, 2018-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Level 2 (240 V)

5.2.1. Market size and forecast, by region, 2018-2026

5.2.2. Comparative market share analysis, 2018 & 2026

5.3. Level 3 (300-600 V)

5.3.1. Market size and forecast, by region, 2018-2026

5.3.2. Comparative market share analysis, 2018 & 2026

6. EV Charging Infrastructure Market, by Application

6.1. Private

6.1.1. Market size and forecast, by region, 2018-2026

6.1.2. Comparative market share analysis, 2018 & 2026

6.2. Public

6.2.1. Market size and forecast, by region, 2018-2026

6.2.2. Comparative market share analysis, 2018 & 2026

7. EV Charging Infrastructure Market, by Region

7.1. North America

7.1.1. Market size and forecast, by type, 2018-2026

7.1.2. Market size and forecast, by charging level, 2018-2026

7.1.3. Market size and forecast, by application, 2018-2026

7.1.4. Market size and forecast, by country, 2018-2026

7.1.5. Comparative market share analysis, 2018 & 2026

7.1.6. U.S.

7.1.6.1. Market size and forecast, by type, 2018-2026

7.1.6.2. Market size and forecast, by charging level, 2018-2026

7.1.6.3. Market size and forecast, by application, 2018-2026

7.1.6.4. Comparative market share analysis, 2018 & 2026

7.1.7. Canada

7.1.7.1. Market size and forecast, by type, 2018-2026

7.1.7.2. Market size and forecast, by charging level, 2018-2026

7.1.7.3. Market size and forecast, by application, 2018-2026

7.1.7.4. Comparative market share analysis, 2018 & 2026

7.2. Europe

7.2.1. Market size and forecast, by type, 2018-2026

7.2.2. Market size and forecast, by charging level, 2018-2026

7.2.3. Market size and forecast, by application, 2018-2026

7.2.4. Market size and forecast, by country, 2018-2026

7.2.5. Comparative market share analysis, 2018 & 2026

7.2.6. Germany

7.2.6.1. Market size and forecast, by type, 2018-2026

7.2.6.2. Market size and forecast, by charging level, 2018-2026

7.2.6.3. Market size and forecast, by application, 2018-2026

7.2.6.4. Comparative market share analysis, 2018 & 2026

7.2.7. UK

7.2.7.1. Market size and forecast, by type, 2018-2026

7.2.7.2. Market size and forecast, by charging level, 2018-2026

7.2.7.3. Market size and forecast, by application, 2018-2026

7.2.7.4. Comparative market share analysis, 2018 & 2026

7.2.8. France

7.2.8.1. Market size and forecast, by type, 2018-2026

7.2.8.2. Market size and forecast, by charging level, 2018-2026

7.2.8.3. Market size and forecast, by application, 2018-2026

7.2.8.4. Comparative market share analysis, 2018 & 2026

7.2.9. Spain

7.2.9.1. Market size and forecast, by type, 2018-2026

7.2.9.2. Market size and forecast, by charging level, 2018-2026

7.2.9.3. Market size and forecast, by application, 2018-2026

7.2.9.4. Comparative market share analysis, 2018 & 2026

7.2.10. Italy

7.2.10.1. Market size and forecast, by type, 2018-2026

7.2.10.2. Market size and forecast, by charging level, 2018-2026

7.2.10.3. Market size and forecast, by application, 2018-2026

7.2.10.4. Comparative market share analysis, 2018 & 2026

7.2.11. Rest of Europe

7.2.11.1. Market size and forecast, by type, 2018-2026

7.2.11.2. Market size and forecast, by charging level, 2018-2026

7.2.11.3. Market size and forecast, by application, 2018-2026

7.2.11.4. Comparative market share analysis, 2018 & 2026

7.3. Asia Pacific

7.3.1. Market size and forecast, by type, 2018-2026

7.3.2. Market size and forecast, by charging level, 2018-2026

7.3.3. Market size and forecast, by application, 2018-2026

7.3.4. Market size and forecast, by country, 2018-2026

7.3.5. Comparative market share analysis, 2018 & 2026

7.3.6. China

7.3.6.1. Market size and forecast, by type, 2018-2026

7.3.6.2. Market size and forecast, by charging level, 2018-2026

7.3.6.3. Market size and forecast, by application, 2018-2026

7.3.6.4. Comparative market share analysis, 2018 & 2026

7.3.7. India

7.3.7.1. Market size and forecast, by type, 2018-2026

7.3.7.2. Market size and forecast, by charging level, 2018-2026

7.3.7.3. Market size and forecast, by application, 2018-2026

7.3.7.4. Comparative market share analysis, 2018 & 2026

7.3.8. Australia

7.3.8.1. Market size and forecast, by type, 2018-2026

7.3.8.2. Market size and forecast, by charging level, 2018-2026

7.3.8.3. Market size and forecast, by application, 2018-2026

7.3.8.4. Comparative market share analysis, 2018 & 2026

7.3.9. Rest of Asia Pacific

7.3.9.1. Market size and forecast, by type, 2018-2026

7.3.9.2. Market size and forecast, by charging level, 2018-2026

7.3.9.3. Market size and forecast, by application, 2018-2026

7.3.9.4. Comparative market share analysis, 2018 & 2026

7.4. LAMEA

7.4.1. Market size and forecast, by type, 2018-2026

7.4.2. Market size and forecast, by charging level, 2018-2026

7.4.3. Market size and forecast, by application, 2018-2026

7.4.4. Market size and forecast, by country, 2018-2026

7.4.5. Comparative market share analysis, 2018 & 2026

7.4.6. Latin America

7.4.6.1. Market size and forecast, by type, 2018-2026

7.4.6.2. Market size and forecast, by charging level, 2018-2026

7.4.6.3. Market size and forecast, by application, 2018-2026

7.4.6.4. Comparative market share analysis, 2018 & 2026

7.4.7. Middle East

7.4.7.1. Market size and forecast, by type, 2018-2026

7.4.7.2. Market size and forecast, by charging level, 2018-2026

7.4.7.3. Market size and forecast, by application, 2018-2026

7.4.7.4. Comparative market share analysis, 2018 & 2026

7.4.8. Africa

7.4.8.1. Market size and forecast, by type, 2018-2026

7.4.8.2. Market size and forecast, by charging level, 2018-2026

7.4.8.3. Market size and forecast, by application, 2018-2026

7.4.8.4. Comparative market share analysis, 2018 & 2026

8. Company Profiles

8.1. ABB

8.1.1. Business overview

8.1.2. Financial performance

8.1.3. Product portfolio

8.1.4. Recent strategic moves & developments

8.1.5. SWOT analysis

8.2. Eaton.

8.2.1. Business overview

8.2.2. Financial performance

8.2.3. Product portfolio

8.2.4. Recent strategic moves & developments

8.2.5. SWOT analysis

8.3. ChargePoint, Inc.

8.3.1. Business overview

8.3.2. Financial performance

8.3.3. Product portfolio

8.3.4. Recent strategic moves & developments

8.3.5. SWOT analysis

8.4. ClipperCreek, Inc.

8.4.1. Business overview

8.4.2. Financial performance

8.4.3. Product portfolio

8.4.4. Recent strategic moves & developments

8.4.5. SWOT analysis

8.5. GENERAL ELECTRIC

8.5.1. Business overview

8.5.2. Financial performance

8.5.3. Product portfolio

8.5.4. Recent strategic moves & developments

8.5.5. SWOT analysis

8.6. Honeywell International Inc

8.6.1. Business overview

8.6.2. Financial performance

8.6.3. Product portfolio

8.6.4. Recent strategic moves & developments

8.6.5. SWOT analysis

8.7. Rittal GmbH & Co. KG

8.7.1. Business overview

8.7.2. Financial performance

8.7.3. Product portfolio

8.7.4. Recent strategic moves & developments

8.7.5. SWOT analysis

8.8. Pod Point.

8.8.1. Business overview

8.8.2. Financial performance

8.8.3. Product portfolio

8.8.4. Recent strategic moves & developments

8.8.5. SWOT analysis

8.9. Leviton Manufacturing Co.

8.9.1. Business overview

8.9.2. Financial performance

8.9.3. Product portfolio

8.9.4. Recent strategic moves & developments

8.9.5. SWOT analysis

8.10. Tesla

8.10.1. Business overview

8.10.2. Financial performance

8.10.3. Product portfolio

8.10.4. Recent strategic moves & developments

8.10.5. SWOT analysis

The charging station infrastructure is an Electric Vehicle Network and a battery swap station for the charging of electric vehicles. A number of government agencies, car manufacturers and infrastructure charging providers have sought to build networks. Estonia was the only country to have established a national public electrical charging network as of December 2016. The biggest fast-charging site was on the Tesla Supercharger network in Shanghai, with fifty charging stalls as of 2018.

The Charging Speeds

A charging station for electric vehicles is an element in an infrastructure that provides electrical energy for plug-in electric vehicles to be charged. It is also named as an EV charging station, electric charging site, charging point, charging stage, wireless charging station (ECS), and service facilities for electric vehicles (EVSE). These EV charging station charges pure plug-in vehicles from electric cars, electric vehicles in the city and hybrid plug-in vehicles. The charging of electric vehicles (EV) is an important aspect of EV ownership. With the power rating, type of connector, cabling requirements and vehicle specification to be considered, Zap-Map has developed a series of step-by-step guides covering key issues related to EV charging. All-electric cars don't have a gas tank–instead of charging your vehicle with gallons of gas, you're just plugging your car into its fuel station. The average EV driver charges 80% of his car at home. There are three main types of charging EVs. Rapid, fast, and slow, these are the charging speeds that are available for charging the EV. The power outputs are measured in kilowatts (kW) and hence the charging speeds.

Rapid chargers are the fastest way to charge an EV, and first and foremost they cover DC charging. It can be divided into two categories, which are rapid and ultra-rapid. Rapid points are powered at 50 kW DC, and 43 kW AC. Ultra-rapid points can be powered at 100+ kW, often at 150 kW and up to 350 kW, and are only DC. Fast chargers typically charge an EV fully in 3-4 hours delivering power from 7 kW to 22 kW. For overnight charging, slow units (up to 3 kW) are best used and usually take between 6 and 12 hours for a pure-EV. EVs charge for slow-moving devices using a cord that links the car to a 3-pin or Type 2 connector.

Recharge and go

EVs can be recharged at multiple locations, such as private storage networks, on-site charging stations or even mobile charging stations, nothing like the Internal Combustion Engine (ICE) automobiles, which are usually refueled at gas stations. The automobile companies are now installing EV chargers in public places, such as shopping centers, commercial buildings, airports, restaurants to help users travel long distances and to address these circumstances that deter the use of electric vehicles. As overnight nighttime charging is not sufficient to cover long distances so saving hours to charge a car during a trip is not considered a good idea.

Technology developments

Manufacturers are focusing on the development of new technologies such as lithium-ion batteries, stand-alone parking and charging, ultra-fast DC charging networks and wireless charging to improve EV adoption. Major automotive manufacturers are also investing heavily in the development and implementation of new charging stations. Lower operating prices, decreased depreciation and increased consumer awareness of the environmental benefits continue to attract EVs to customers. In effect, it fuels the market for charging stations for electric vehicles.

According to a new study conducted by Research Dive, the global market for electric vehicles charging infrastructure is expected to reach $18,589.0 million by 2026, increasing to CAGR by 34.9% over the forecast period. The growing focus of global economies on developing infrastructure to accelerate the adoption of electric vehicles (EVs) is contributing to growth. A number of government agencies are getting into partnerships with each other to develop highway electrical charging stations.

For example, in the U.S., the Washington State Department of Transportation has partnered with the Oregon Department of Transportation to construct the West Coast Electric Highway (WCEH) consisting of 57 EV charging stations across Oregon and Washington. Similarly, a number of governments are jointly developing intercontinental highway charging station networks.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com