Mobile Wallet Market Report

RA05953

Mobile Wallet Market by Wallet Type (Open, Closed, and Semi-closed), Payment Type (Point of Sale and Remote), Technology (NFC, QR Code, Mobile Apps, and Others (MST, BLE, and Sound Waves Based)), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Mobile Wallet Market Analysis

The global mobile wallet market size is predicted to garner a revenue of $46,006.0 million in the 2021–2028 timeframe, growing from $11,176.5 million in 2020, at a healthy CAGR of 18.9%.

Market Synopsis

Some of the primary reasons influencing market growth are connected and real-time marketing, the emergence of payment-enabled mobile phones, and the social media influence.

However, barriers like lack of understanding about the benefits as well as cyber-related crimes of mobile wallet industry might restrain the market growth during the forecast period.

According to the regional analysis of the market, the Asia-Pacific mobile wallet market share is anticipated to grow at a CAGR of 19.7%, by generating a revenue of $18,025.2 million during the review period.

Mobile Wallet Market Overview

Consumers can use a mobile wallet to do transactions while on the go, from any location, at any time. It not only offers low-cost transaction services, but it also makes it simple for customers to manage their accounts. While all of these factors are helping to propel the mobile wallet market forward, consumer worries about security and technology infancy, as well as investment and deployment challenges, which are projected to stymie the market's expansion. Despite these constraints, telecommunications businesses are working to meet the requirements of their customers with new and enhanced product/service innovation.

Covid-19 Impact on Mobile Wallet Market

In March 2020, the World Health Organization declared COVID-19 as a pandemic, which resulted in restrictions on travel and disturbances in financial markets, as well as negatively impacted supply chains and production levels. COVID-19 has sparked a public health catastrophe that has impacted practically every area of people's lives around the world, as well as putting the global economy on shaky ground. The pandemic and its effects have expedited a number of current trends in consumer and corporate behavior, as well as introduced new ones, such as supply chain restructuring and cross-border trade, in the payments industry. In the past few months, there has been a considerable increase in e-commerce, digital wallet payments (including contactless), rapid payments, and cash displacement. The mobile wallet market is anticipated to grow gradually during Covid-19 outbreak as customers are now choosing mobile wallets like PhonePe and Google Pay for financial transactions to avoid physical contact with others in order to prevent the spread of corona virus.

Increase in Mobile Transactions is Anticipated to Drive the Market Growth

The popularity of mobile wallet payments across many industry verticals is driving the growth of the mobile wallet market. By lowering processing fees, the mobile wallet, which is a virtual wallet in payment-enabled mobile phones, has improved operational efficiency and cost-effectiveness. PayPal, for example, has expanded its operations to more than 200 countries, allowing clients to link their mobile wallets to their bank accounts and carry a balance. Incentives offered by mobile wallet firms, such as discounts and cashbacks have increased the demand among users. For example, Amazon Pay pays rewards on transactions made using the service. Mobile wallets will be in high demand as a result of these types of offers and incentives.

To know more about global mobile wallet market trends, get in touch with our analysts here.

Lack of Trust on Mobile Wallet Might Restrict the Market Growth

Low confidence in mobile wallets might be a big stumbling block for the market in the coming years. According to a research published by yourgov, an application that allows one to personally report non-emergency issues and service requests, around 43% of mobile users do not trust mobile wallets, and 38% have inadequate security confidence. Similarly, most consumers are hesitant to adopt mobile wallets since contactless payment entails a significant unknown risk of fraud, such as data leakage, hacking, and e-wallet vulnerabilities. Furthermore, there is a lack of understanding about the advantages of using mobile wallets for online payment and purchasing pricey things over cash, credit cards, and debit cards. All of these factors will limit market expansion over the forecast period.

Technological Advancements are Expected to Increase the Opportunities of Mobile Wallet Market Growth

Payment services are critical to a country's economic development. With digitization and ongoing technical advancements, this technology can progressively provide consumers and organizations with a variety of personalized, convenient, and flexible transaction options. Financial inclusion, budgeting, and activities to prevent and combat economic crime can all be aided by digital payments. Furthermore, governments are aware of the rapidly increasing usage of digital payments and they want to ensure that everyone has access to the ability to pay for products and services digitally. As a result, numerous initiatives are being implemented, which have already aided in making digital payments by making them simpler, faster, and less expensive.

To know more about global mobile wallet market opportunities, get in touch with our analysts here.

Based on wallet type, the mobile wallet market has been segmented into Open, closed, and semi-closed of which the Open wallet type sub-segment is projected to generate the maximum revenue during the forecast period. Download PDF Sample ReportMobile Wallet Market

By Wallet Type

Source: Research Dive Analysis

The open wallet sub-segment is predicted to have a dominating market share in the global market and register a revenue of $16,553.8 million during the forecast period. These mobile wallets allow users to buy goods and services, transfer money, and withdraw money without any limits unlike other wallet types. Customers can utilize the funds in their digital wallet to make payments or withdraw the money transferred to the account in cash using open wallets. According to James Duthie of DT, the openness of open platforms has allowed them to rapidly increase functionality and consequently value for end users in every scenario where they have outperformed closed systems.

Mobile Wallet Market

By Payment typeBased on payment type, the market has been bifurcated into Point of sale and remote sub-segments of which the Point of sale sub-segment is projected to generate highest revenue during the forecast period.

Source: Research Dive Analysis

The point of sale (POS) sub-segment is anticipated to generate highest revenue during the forecast period. It is predicted that the market shall generate a revenue of $29,359.5 million by 2028, growing from $7,181.7 million in 2020, with a CAGR of 18.8%. Point of sale systems are used by small enterprises to take advantage of numerous capabilities they offer. Effective POS systems enable business owners spend less time on store/business management by providing relevant reports that aids in quick decision-making. Through proper inventory management, streamlined POS systems can help boost store profitability. Using client data gathered during sales transactions, solutions provide targeted and personalized marketing activities. As a result, the use of POS has been high and is expected to generate the maximum revenue during upcoming years.

Mobile Wallet Market

By TechnologyBased on Technology, mobile wallet market is divided into NFC, QR code, Mobile Apps, and others (MST, BLE, and sound waves based). Among these, QR code sub-segment is expected to be the fastest growing.

Source: Research Dive Analysis

The QR code sub-segment is anticipated to have the fastest market growth during the forecast period. It is predicted that the market shall generate a revenue of $15,866.3 million by 2028, growing from $3,595.2 million in 2020, with a CAGR of 20.0%. Payments made with QR codes are extremely safe. It is because a QR code is nothing more than a mechanism for exchanging information. Any data transferred via QR codes is encrypted, ensuring that the payment is completely secured. One of the most significant advantages of QR codes is that they allow for quick payments. When compared to other payment methods, using QR codes is exceptionally fast.

Mobile Wallet Market

By RegionThe mobile wallet market was inspected across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Mobile Wallet in Asia-Pacific to be the Fastest Growing

Asia-Pacific is anticipated to be the fastest growing market during the forecast time period and reach $18,025.2 million by 2028, with a CAGR of 19.7%. In all aspects of their digital payment transactions, APAC customers prefer equal amounts of seamlessness and security. The region's booming retail market has prompted global payment processing solution providers to concentrate their efforts in this area in order to deliver improved services in e-wallet industry. China, India, Indonesia, and Malaysia are some of the region's fastest-growing economies, with a huge number of daily mobile transactions. This has compelled the national governments to place a greater emphasis on consumer-friendly payment alternatives.

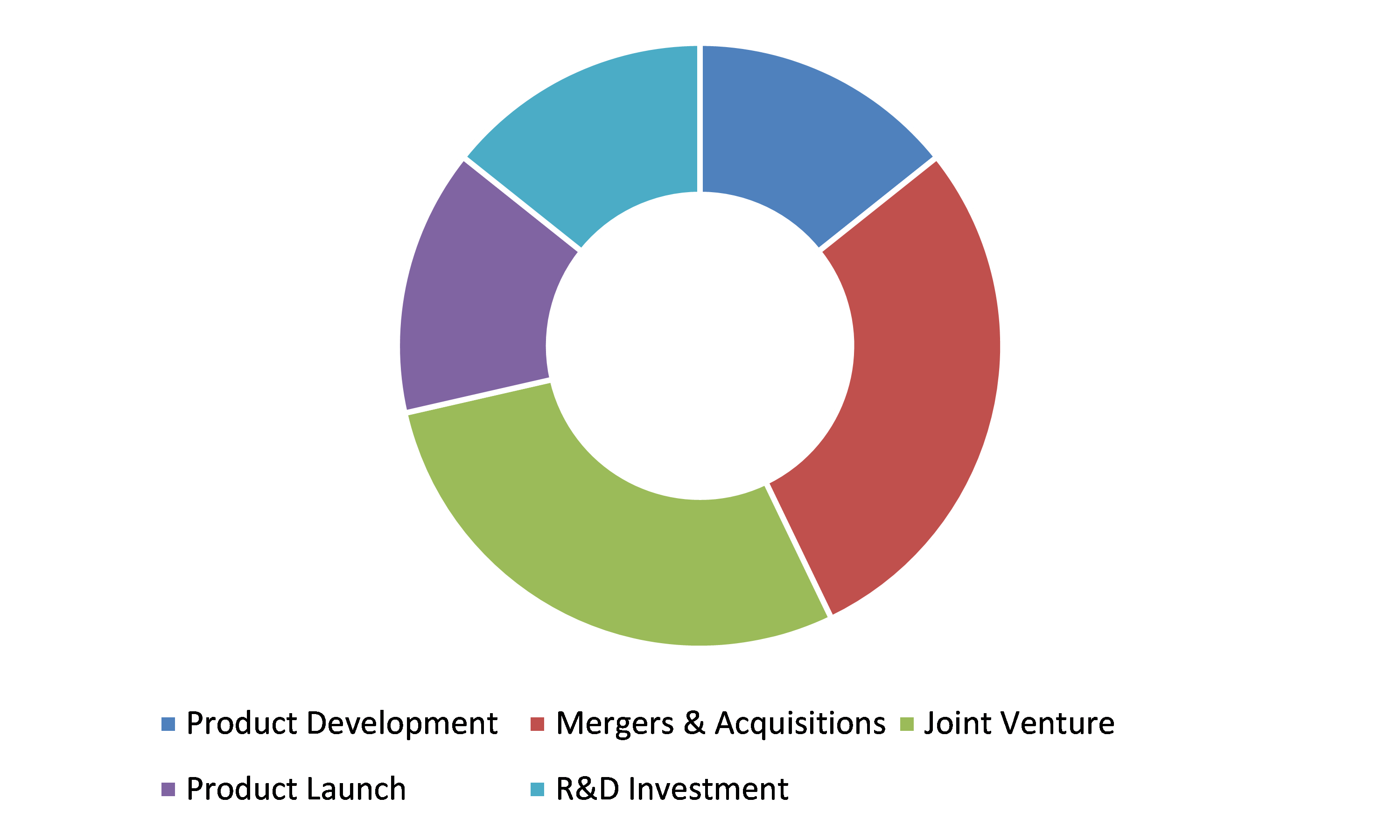

Competitive Scenario in the Global Mobile Wallet Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading mobile wallet market players are Amazon Web Services Inc., American Express Banking Corp., Apple Inc., Alipay.com, AT&T Inc., Google Inc., Mastercard Incorporated, PayPal Holdings, Inc., Samsung Electronics Co., Ltd, and Vodafone Group PLC.

Porter’s Five Forces Analysis for the Global Mobile Wallet Market:

- Bargaining Power of Suppliers: Mobile wallet market contains huge concentration of distributors & suppliers and therefore, the distributors & suppliers’ control is predicted to be reasonable, resulting in moderate bargaining power of dealers.

Thus, the bargaining power of the suppliers is considered to be moderate. - Bargaining Power of Buyers: Buyers might have great bargaining power, significantly because of high players functioning in the mobile wallet market.

Therefore, the bargaining power of the buyer is high. - Threat of New Entrants: Companies entering the mobile wallet market are adopting technological innovations to attract clients. But since the investment cost is high,

the threat of the new entrants is moderate. - Threat of Substitutes: There are fewer products for mobile wallet.

Thus, the threat of substitutes is moderate. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Apple Inc., Amazon and Google Inc. These companies are strengthening their footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Wallet Type |

|

| Segmentation by Payment type |

|

| Segmentation by Technology |

|

| Key Companies Profiled |

|

Q1. How big is the mobile wallet market?

A. The size of the global mobile wallet market was over $11,176.5 million in 2020 and is projected to reach $46,006.0 million by 2028.

Q2. Which are the major companies in the mobile wallet market?

A. Amazon Web Services Inc., American Express Banking Corp., and Apple Inc. are some of the key players in the global mobile wallet market.

Q3. Which region, among others, possesses greater investment opportunities in the near future for the Mobile Wallet Market?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific mobile wallet market?

A. Asia-Pacific mobile wallet market is anticipated to grow at 19.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the Mobile Wallet Market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which mobile wallet is best?

A. Apple pay, Samsung pay, and Paypal are few of the best mobile wallets.

Q7. Which company uses mobile wallet?

A. Alipay.com, AT&T Inc., and Google Inc. are some companies who use mobile wallet.

Q8. What is E wallet Market?

A. A computerized system that keeps a person's payment information is known as an e-wallet. Your insurance cards, loyalty cards, and driver's licence are all stored in some e-wallets.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By Wallet Type trends

2.3.By Payment Type trends

2.4.By Technology trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.By Wallet Type

3.8.2.By Payment Type

3.8.3.By Technology

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Technology analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Mobile Wallet Market, by Wallet Type

4.1.Open

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Closed

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Semi-Closed

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

5.Mobile Wallet Market, by Payment Type

5.1.Point of sale

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Remote

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

6.Mobile Wallet Market, by Technology

6.1.NFC

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.QR Code

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

6.3.Mobile Apps

6.3.1.Market size and forecast, by region, 2020-2028

6.3.2.Comparative market share analysis, 2020 & 2028

6.4.Others

6.4.1.Market size and forecast, by region, 2020-2028

6.4.2.Comparative market share analysis, 2020 & 2028

7.Mobile Wallet Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Wallet Type, 2020-2028

7.1.2.Market size and forecast, by Payment Type, 2020-2028

7.1.3.Market size and forecast, by Technology, 2020-2028

7.1.4.Market size and forecast, by Country, 2020-2028

7.1.5.Comparative market share analysis, 2020 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Wallet Type, 2020-2028

7.1.6.2.Market size and forecast, by Payment Type, 2020-2028

7.1.6.3.Market size and forecast, by Technology, 2020-2028

7.1.6.4.Market size and forecast, by country, 2020-2028

7.1.6.5.Comparative market share analysis, 2020 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Wallet Type, 2020-2028

7.1.7.2.Market size and forecast, by Payment Type, 2020-2028

7.1.7.3.Market size and forecast, by Technology, 2020-2028

7.1.7.4.Market size and forecast, by country, 2020-2028

7.1.7.5.Comparative market share analysis, 2020 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Wallet Type, 2020-2028

7.1.8.2.Market size and forecast, by Payment Type, 2020-2028

7.1.8.3.Market size and forecast, by Technology, 2020-2028

7.2.Europe

7.2.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.2.Market size and forecast, by Payment Type, 2020-2028

7.2.3.Market size and forecast, by Technology, 2020-2028

7.2.4.Germany

7.2.4.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.4.2.Market size and forecast, by Payment Type, 2020-2028

7.2.4.3.Market size and forecast, by Technology, 2020-2028

7.2.5.UK

7.2.5.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.5.2.Market size and forecast, by Payment Type, 2020-2028

7.2.5.3.Market size and forecast, by Technology, 2020-2028

7.2.6.France

7.2.6.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.6.2.Market size and forecast, by Payment Type, 2020-2028

7.2.6.3.Market size and forecast, by Technology, 2020-2028

7.2.7.Italy

7.2.7.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.7.2.Market size and forecast, by Payment Type, 2020-2028

7.2.7.3.Market size and forecast, by Technology, 2020-2028

7.2.8.Spain

7.2.8.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.8.2.Market size and forecast, by Payment Type, 2020-2028

7.2.8.3.Market size and forecast, by Technology, 2020-2028

7.2.9.Rest of Europe

7.2.9.1.Market size and forecast, by Wallet Type, 2020-2028

7.2.9.2.Market size and forecast, by Payment Type, 2020-2028

7.2.9.3.Market size and forecast, by Technology, 2020-2028

7.3.Asia-Pacific

7.3.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.2.Market size and forecast, by Payment Type, 2020-2028

7.3.3.Market size and forecast, by Technology, 2020-2028

7.3.4.Market size and forecast, by Country, 2020-2028

7.3.5.Comparative market share analysis, 2020 & 2028

7.3.6.China

7.3.6.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.6.2.Market size and forecast, by Payment Type, 2020-2028

7.3.6.3.Market size and forecast, by Technology, 2020-2028

7.3.7.Japan

7.3.7.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.7.2.Market size and forecast, by Payment Type, 2020-2028

7.3.7.3.Market size and forecast, by Technology, 2020-2028

7.3.8.India

7.3.8.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.8.2.Market size and forecast, by Payment Type, 2020-2028

7.3.8.3.Market size and forecast, by Technology, 2020-2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.9.2.Market size and forecast, by Payment Type, 2020-2028

7.3.9.3.Market size and forecast, by Technology, 2020-2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.10.2.Market size and forecast, by Payment Type, 2020-2028

7.3.10.3.Market size and forecast, by Technology, 2020-2028

7.3.11.Rest of Asia Pacific

7.3.11.1.Market size and forecast, by Wallet Type, 2020-2028

7.3.11.2.Market size and forecast, by Payment Type, 2020-2028

7.3.11.3.Market size and forecast, by Technology, 2020-2028

7.3.11.4.Market size and forecast, by country, 2020-2028

7.3.11.5.Comparative market share analysis, 2020 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Wallet Type, 2020-2028

7.4.2.Market size and forecast, by Payment Type, 2020-2028

7.4.3.Market size and forecast, by Technology, 2020-2028

7.4.4.Market size and forecast, by Country, 2020-2028

7.4.5.Comparative market share analysis, 2020 & 2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Wallet Type, 2020-2028

7.4.6.2.Market size and forecast, by Payment Type, 2020-2028

7.4.6.3.Market size and forecast, by Technology, 2020-2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Wallet Type, 2020-2028

7.4.7.2.Market size and forecast, by Payment Type, 2020-2028

7.4.7.3.Market size and forecast, by Technology, 2020-2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Wallet Type, 2020-2028

7.4.8.2.Market size and forecast, by Payment Type, 2020-2028

7.4.8.3.Market size and forecast, by Technology, 2020-2028

8.Company profiles

8.1.Amazon Web Services Inc.

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.American Express Banking Corp.

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Apple Inc.

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.Alipay.com

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Google Inc.

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.AT&T Inc.

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Mastercard Incorporated

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.PayPal Holdings, Inc.

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Samsung Electronics Co., Ltd

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.Vodafone Group PLC

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

A mobile wallet is a virtual wallet that is used to store payment card information on a mobile device. It is a type of internet business model that is used with cell phones and offers simple access & comfort to the consumers. The mobile wallet allow consumers to make transactions from any location, anytime and thus, manage their accounts easily.

COVID-19 Impact on Mobile Wallet Market

The outbreak of COVID-19 across the globe has progressively impacted the global mobile wallet market growth. This growth is majorly attributed to the substantial increase in e-commerce, cash displacement, digital payments, and rapid payments, and cash displacement. Consumers are now choosing mobile wallets like Google Pay and PhonePe for financial transactions to avoid physical contact with other people and thus prevent the spread of coronavirus.

Additionally, various companies functioning in the global mobile wallet market are taking strategic steps during the pandemic, which is driving the market growth. For example, in May 2021, Viva Wallet, the first European entirely cloud-based Neobank that provides localized payment services to businesses, announced the launch of ‘Tap on Phone’ solution for both pin and contactless payments.

Mobile Wallet Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global mobile wallet market growth in the upcoming years.

For instance, in November 2019, Paytm, a multinational technology company specializing in digital payment system, finance, and e-commerce, raised about US$ 1 billion in investor funding led by Softbank, a Japan-based multinational conglomerate holding company, and Alipay, a third-party online and mobile payment platform. Paytm utilized these funds in strengthening its e-commerce business and payments along with an aim to expand in the new South Asian markets.

In March 2020, TransferWise (Wise), a London-based financial technology company, entered into a partnership with Alipay, a hird-party online and mobile payment platform, to introduce international mobile payments by using the mobile wallet. This new feature allows the users of TransferWise to make payments in Chinese yuan and the Alipay users from 17 currencies supported by the financial technology company’s mobile wallet.

In June 2020, Stocard, one of the largest B2C start-ups and the leading mobile wallet in Europe in terms of number of users, officially announced its launch in the UK and unveiled a mobile payment feature after reaching 50 Million users across the globe. Now, the UK-based Stocard users can pay through a virtual Mastercard issued in the app, which is an option that may be rolled out across Europe in the near future.

Forecast Analysis of Global Market

The global mobile wallet market is projected to witness an exponential growth during the forecast period, owing to the ongoing digitalization and the increasing technical advancements that can provide organizations and consumers with a variety of convenient, personalized, and flexible transaction options. Conversely, the lack of trust among people regarding the usage of mobile wallets for transactions are expected to hamper the market growth in the projected timeframe.

The growing popularity of mobile wallet payments across various industry verticals and the increase in number of mobile transactions across the globe are the significant factors and mobile wallet market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global mobile wallet market is expected to garner $46,006.0 million during the forecast period (2021-2028). Regionally, the Asia Pacific region is estimated to observe the fastest growth by 2028, owing to the booming retail market of the region that has prompted the payment processing solution providers to deliver improved services.

The key players functioning in the global market include Amazon Web Services Inc., Apple Inc., American Express Banking Corp., Alipay.com, Google Inc., AT&T Inc., Mastercard Incorporated, Samsung Electronics Co., Ltd., PayPal Holdings, Inc., and Vodafone Group PLC.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com