Network Slicing Market Report

RA05670

Network Slicing Market, by Component Type (Solution, Services), Solutions (Professional services, Managed Services), Professional services (Network design and planning, Integration and Deployment, Support and Maintenance), End-User (Telecom operators, Enterprises), Applications (Healthcare, Energy and Utilities, Transportation and Logistics, Manufacturing, Media and Entertainment, Automotive, Government and Others), Regional Analysis (North America, Europe, Asia Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

The global network slicing market’s revenue forecast shall be $1,456.6 million by 2027, increasing from $270.1 million in 2019 at a healthy rate of 24.20%. The North America network slicing market is estimated to grow at a CAGR of 23.40% by registering a revenue of $410.3 million by 2027. Strategic collaborations among the market players, along with the launching of advanced network slicing services, are expected to accelerate the North America network slicing market growth.

Global Network Slicing Market Analysis:

Network slicing is utilization of network effectively for dividing single connections of single network into multiple well defined virtual connections that provide different number of resources to different types of traffic. This reduces the data traffic and increases efficiency.

Impact Analysis of COVID-19 on the Network Slicing Market:

The global network slicing market is expected to witness an upsurge in growth during the COVID-19 pandemic, owing to increasing demands for broadband services with the help of mobile networking and growing remote access services in many industries such as IT, telecom, retail and healthcare etc. Moreover, deployment of wireless networking services in the year 2020 and 2021 will positively impact the network slicing market. Due to lockdown conditions, companies are highly dependent on networks to control the burden of customer queries due to less availability of employees. These key elements showcase that the demand for network slicing in the COVID-19 health emergency is estimated to experience a decent growth.

However, several companies running in the network slicing services such as Affirmed Networks and Telefonaktiebolaget LM Ericsson are taking strategic initiatives to help customers during the COVID-19 situation. For instance, in April, 2020, Telefonaktiebolaget LM Ericsson, announced that their employees are working during the pandemic to deliver the best network service because people are entirely dependent upon the network for jobs, to access essential services, or stay connected socially. These key factors may result in a positive impact on the network slicing market during the pandemic conditions and offer lucrative opportunities for the network slicing industry, in the global marketplace.

Increasing mobile data traffic volumes may generate remarkable revenue for the global network slicing market

The network slicing market industry is witnessing massive growth mainly because of increase in the adoption of network slicing in overcoming the challenges caused by mobile data traffic. The increasing mobile data traffic, internet subscribers and government support will drive the network slicing market. According to the Ericsson Mobility Report published in 2017, in North America, the mobile data traffic is expected to increase 7.1GB per month to 48GB by the end of the year 2023. Moreover, according to Ericsson Mobility Report published in June 2018, the mobile data traffic in India will grow 5 times by 2023. This factor will provide investment opportunities in the network slicing market. Furthermore, strategic collaboration and development among market players will propel the market growth. For instance, in May 2019, The China Mobile, China Media Group and Huawei in collaboration completed UHD live streaming for the first time with the help of end-to-end real 5G network slices. These advancements may lead to an increase in the demand for network slicing services in the global market.

To know more about network slicing market drivers, get in touch with our analysts here.

Security split may restrain the growth of the global network slicing industry

Security fractures and other challenges such as information sharing and exposure constraints may obstruct the market growth, which will ultimately hamper the global network slicing market. Moreover, network slice requests brokerage may limit the growth of adoption of network slicing services and may also create a negative impact on the global network slicing market during the forecast period.

Emerging 5G network slicing for new businesses may create huge opportunities for the global network slicing market

The network slicing industry is growing at a very fast pace due to the implementation of 5G network slicing capabilities in the businesses, which offers service providers a platform for creating their own private 5G networks for real-time connectivity and security to the cloud for increasing efficiency of their operations. Key market players are offering various effective strategies for the development of 5G network slicing. For instance, in December 2018, ZTE, telecommunication company and China Mobile collaboratively announced their 5G network slice prototype system and network architecture design concept. This collaboration will help in the development of 5G network slicing. Moreover, Ericsson is working with AstraZeneca on 5G-enabled medical devices that support the predictive maintenance of products. Thus, increasing penetration of 5G network slicing offers huge opportunities in the forecast period.

To know more about Network Slicing Market Opportunities, get in touch with our analysts here.

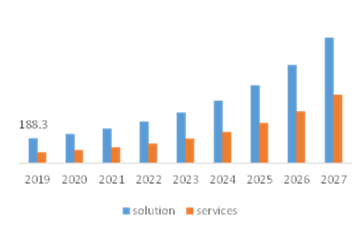

Network Slicing Market, by Component Type:

Solution sub-segment is dominating the market and it will generate 188.3 million in 2019 mainly attributed to its operational efficiency

Source: Research Dive Analysis

The services sub-segment shall have a speedy market growth and it is anticipated to generate a revenue of $513.7 million by 2027, growing from $81.7 million in 2019. The growth of this sub-segment for the global network slicing market is mainly attributed to its support to the network resources for maintaining the quality of service (QoS) and its role in 5G networks. In addition to this, certain market leaders are emphasizing mainly on the technological innovations to fulfil the needs of the organization. For instance, Nokia on October 2020, announced that they are offering very first network slicing of 4G/5G within RAN, transport and core domains. These key factors are expected to boost the demand for network slicing services in the global market, during the projected period.

Solution sub-segment shall have a dominating market share in the global market and is expected to register a revenue of $942.7 million, during the analysis timeframe. Owing to its applications in every sector, societies and industries. Also, technological advancements along with growing customer demand for quality of service (QoS), data security, energy efficiency and massive connectivity are some of the key factors are surging the demand for network slicing. These initiatives may create massive opportunities for the sub-segment, throughout the forecast period.

Network Slicing Market, by Services:

The global professional services sub segment for network slicing market will have the fastest market growth; this is mainly because it offers operators for configuring different virtual networks.

Source: Research Dive Analysis

The professional services sub-segment of the network slicing market will be the fastest growing sub-segment and it is projected to surpass $802.3 million by 2027 with CAGR of 28.10% with an increase from $61,691.0 million in 2019; this is mainly owing to its adoption of network slicing platform such as Quality of service (QoS), data security, energy efficiency and massive connectivity. In addition, these platforms help in offering improvement in efficiency of operations and delivery of 5G network services.

Managed services sub-segment shall have a dominating market share in the global market and is expected to register a revenue of $654.2 million, during the analysis timeframe. Managed service solutions provide less expenses and capital expenditure. Also, network slicing helps in building and managing networks that can meet the demands of enterprises. Many key players working in network slicing market are following notable strategies such as product innovation along with strategic tie-ups in order to grow worldwide. For instance, Nokia on November 2020, announced that they are aiming to develop ground-breaking technologies for deployment of 4G/LTE communication system on the lunar surface, for paving the way for a sustainable human presence on the Moon. All these factors are expected to boost the growth of the sub-segment and eventually the growth of the market.

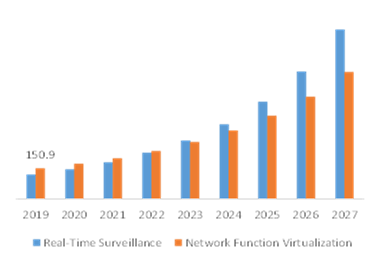

Network Slicing Market, by Application:

The network function virtualization application will have the highest growth in the global market; this is mainly because it allows multiple virtual networks to be connected in common physical infrastructure.

Source: Research Dive Analysis

The network function virtualization sub-segment shall have a dominating market share and it is anticipated to generate a revenue of $624.5 million by 2027, growing from $150.9 million in 2019. The growth of this sub-segment for the global network slicing market is mainly attributed to technologies that offer real-time control to autonomous vehicles, wireless broadband connectivity and media streaming. The key players operating in the network slicing market are following various strategic collaborations and innovation for market growth and development. Above-stated factors are expected to surge the demand for the network slicing market, during the forecast period.

However, real-time surveillance sub-segment shall have the fastest growing market share in the global market and is expected to register a revenue of $832 million during the analysis timeframe. The increase in number of internet subscribers and mobile data traffic for seamless connectivity is driving the market for network slicing. Moreover, there are many market players that are innovating modern development practices in network slicing. For instance, in February 2018, Huawei Technologies Co., Ltd. announced that they are exhibiting various end-to-end product solutions for 5G network technology. Furthermore, market players in network slicing are continuously integrating and deploying new technologies for the development of virtual networks. All these factors will positively affect the sub-segment growth in upcoming years.

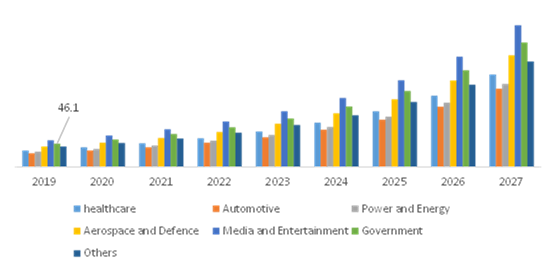

Network Slicing Market, by End-user:

The Government sub-segment shall have the highest growth in the global market and it will generate a remarkable revenue of 46.1 million in 2019 mainly due to adoption of network slicing by government, owing to increasing mobile data traffic

Source: Research Dive Analysis

The Government sub-segment shall have the dominating market share and it is predicted to generate a revenue of $246.1 million by 2027, growing from $46.1 million in 2019. The growth of this sub-segment for the global network slicing market is mainly attributed to support of the government for the development of 5G infrastructure in telecom. For instance, in February 2019, the Federal Communication Commission (FCC) adopted a strategy for facilitating 5G technology in America. This strategy included upgrading the existing telecom network infrastructure, modernizing the outdated laws & regulations and forwarding more spectrum into the market. These type of government initiatives will propel the market growth, during the forecast period.

Healthcare sub segment shall have a rapid growth in the global market and is expected to register a revenue of $182.5 million, during the analysis timeframe. Network slicing allows a custom network to be constructed that includes services such as low-latency, security and low-latency all of which can run on dedicated or shared networks. Healthcare sector in network slicing is growing rapidly due to growing prevalence of viral diseases. Moreover, lack of medical professionals to handle patients is a key factor that will propel the market growth during the forecast period. All these factors are expected to impact positively on the network slicing market.

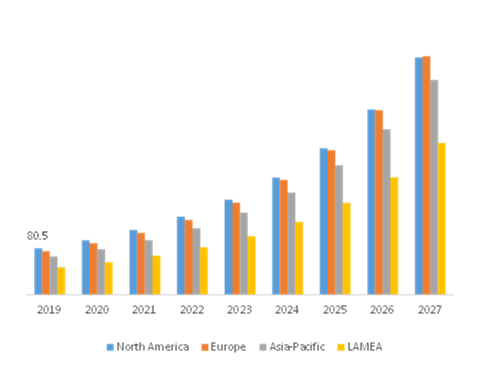

Regional Insights:

North America region has a lucrative market, and it will reach up to $410.3 million by the end of 2027 mainly owing to the extensively expanding mobile data traffic and internet subscribers for seamless connectivity

Source: Research Dive Analysis

The North America network slicing market accounted for $80.5 million in 2019 and is projected to register a revenue of $410.3 million by 2027. The extensive growth of the North America network slicing market is mainly driven by key factors such as rapid adoption of latest technologies, along with acceptance of industrial IoT, agile networks and smart connected devices in order to deploy 5G networks platforms for the business processes. Moreover, the strong presence of leading network slicing solution providers is one of the key factors for the growth of the North America network slicing market. Also, these key players are opting for effective strategies such as strategic collaborations and product launches to stronghold their presence into local as well as international market. For instance, in 2017, according to Ericsson Mobility Report, North America was recorded as the largest user of smart phones and therefore the traffic of smartphones is expected to increase 48GB from 7.1GB by the end of 2023. Such collaborative work and above-stated crucial factors may lead to huge opportunities for the network slicing platforms, in the North America region.

Asia-Pacific network slicing market is the fastest growing and it is projected to grow at a CAGR of 24.8% by registering revenue of $371.1 million by 2027. Extensively increasing acceptance of cloud-based solutions and emerging technologies such as the telecommunication, IoT, and big data analytics and mobility in the region are the factors that will drive the market growth in the Asia-pacific region. Also, APAC is one of the biggest markets for connected devices. For instance, in 2018, ZTE and China Mobile collaboratively announced that they are working on their 5G network architecture design concept and network slice system. Moreover, China network slicing market had the fastest market growth in 2020, and it is expected to generate remarkable revenue in the forecast years owing to the strong presence of innovative network slicing providers and their adoption of effective strategies. For instance, in February 2018, Huawei Technologies Co., Ltd, a Chinese multinational company, developed various product solutions that are end-to-end for 5G network technology; such key factors are expected to propel the growth of the market, over the forecast period.

Competitive Scenario in the Global Network Slicing Market:

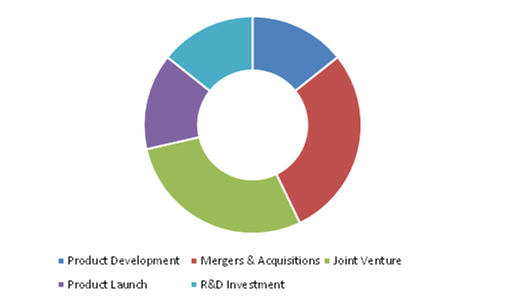

The advanced product development coupled with mergers & acquisitions are the frequent strategies followed by the significant market players

Source: Research Dive Analysis

Some of the leading network slicing market players include Nokia, Huawei, Parallel Wireless, Affirmed Networks, Mavenir, Argela, Tambora Systems, BT 2020, Cisco Systems Inc., and NTT DOCOMO, Inc, network slicing market players are focusing on Merger & acquisition and advanced product developments. These are the effective strategies followed by the startup as well as established organizations.

Porter’s Five Forces Analysis for Network Slicing Market:

- Bargaining Power of Suppliers: The network slicing service suppliers are moderate in number and established service providers of the network slicing are moderate. Thus, the bargaining power of the supplier is Moderate.

- Bargaining Power of Buyer: Buyers will have huge bargaining power, significantly because of multiple players operating in the network slicing services. The buyers can freely choose services that best fit their preferences. Thus, the bargaining power of the buyer is HIGH.

- Threat of New Entrants: The companies entering into the network slicing market are adopting technological innovations such as delivery of the 5G network services along with growing customer demand for quality of service (QoS), data security, energy efficiency and massive connectivity. Thus, the bargaining power of the new entrant is Moderate.

- Threat of Substitutes: Number of companies are into the race in developing and introducing similar technology; thereby increasing the threat of substitutes. However, such alternative options can’t offer the kind of accessibility and convenience that a network slicing service does. Thus, the threat of substitute is Low.

- Competitive Rivalry in the Market: The competitive rivalry among the industry leaders is rather intense, especially between the global players Nokia, Huawei, and Parallel Wireless. These companies are launching their value-added services in the international market and strengthening the footprint worldwide. Therefore, competitive rivalry in the market is High.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by component Type |

|

| Segmentation by Services |

|

| Segmentation by Application |

|

| Segmentation by End-user |

|

| Key Countries Covered | U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Russia, Rest of Europe, China, Japan, India, Australia, South Korea, Rest of Asia-Pacific, Brazil, Saudi Arabia, United Arab Emirates, Rest of LAMEA |

| Key Companies Profiled |

|

Q1. What is the size of the network slicing market?

A. The global network slicing market size was over $270.1 million in 2019 and is projected to reach $1,456.60 million by 2027.

Q2. Which are the major companies in the network slicing market?

A. Nokia, Huawei and Parallel Wireless, are some of the key players in the global network slicing market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for the investors to witness the most promising growth in the future.

Q4. What is the growth rate of the North America market?

A. North America network slicing market is anticipated to grow at 23.40% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Capacity expansion, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Argela, Tambora Systems and Cisco Systems Inc., companies are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By component type trends

2.3.By Services trends

2.4.By Application trends

2.5.By End-user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.By Component Type

3.8.2.By Service Type

3.8.3.By Application

3.8.4.By End-user

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Network Slicing Market, by Component Type

4.1.Solutions

4.1.1.Market size and forecast, by region, 2019-2027

4.1.2.Comparative market share analysis, 2019 & 2027

4.2.Services

4.2.1.Market size and forecast, by region, 2019-2027

4.2.2.Comparative market share analysis, 2019 & 2027

5.Network Slicing Market, by Services

5.1.Professional Services

5.1.1.Market size and forecast, by region, 2019-2027

5.1.2.Comparative market share analysis, 2019 & 2027

5.2.Managed Services

5.2.1.Market size and forecast, by region, 2019-2027

5.2.2.Comparative market share analysis, 2019 & 2027

6.Network Slicing Market, by Application

6.1.Real-Time Surveillance

6.1.1.Market size and forecast, by region, 2019-2027

6.1.2.Comparative market share analysis, 2019 & 2027

6.2.Network Function Virtualization

6.2.1.Market size and forecast, by region, 2019-2027

6.2.2.Comparative market share analysis, 2019 & 2027

7.Network Slicing Market, by Region

7.1.North America

7.1.1.Market size and forecast, by component type, 2019-2027

7.1.2.Market size and forecast, by Services, 2019-2027

7.1.3.Market size and forecast, by Application, 2019-2027

7.1.4.Market size and forecast, by End-user, 2019-2027

7.1.5.Market size and forecast, by country, 2019-2027

7.1.6.Comparative market share analysis, 2019 & 2027

7.1.7.U.S.

7.1.7.1.Market size and forecast, by component type, 2019-2027

7.1.7.2.Market size and forecast, by Services, 2019-2027

7.1.7.3.Market size and forecast, by Application, 2019-2027

7.1.7.4.Market size and forecast, by End-user, 2019-2027

7.1.7.5.Market size and forecast, by country, 2019-2027

7.1.7.6.Comparative market share analysis, 2019 & 2027

7.1.8.Canada

7.1.8.1.Market size and forecast, by component type, 2019-2027

7.1.8.2.Market size and forecast, by Services, 2019-2027

7.1.8.3.Market size and forecast, by Application, 2019-2027

7.1.8.4.Market size and forecast, by End-user, 2019-2027

7.1.8.5.Market size and forecast, by country, 2019-2027

7.1.8.6.Comparative market share analysis, 2019 & 2027

7.1.9.Mexico

7.1.9.1.Market size and forecast, by component type, 2019-2027

7.1.9.2.Market size and forecast, by Services, 2019-2027

7.1.9.3.Market size and forecast, by Application, 2019-2027

7.1.9.4.Market size and forecast, by End-user, 2019-2027

7.1.9.5.Market size and forecast, by country, 2019-2027

7.1.9.6.Comparative market share analysis, 2019 & 2027

7.2.Europe

7.2.1.1.Market size and forecast, by component type, 2019-2027

7.2.1.2.Market size and forecast, by Services, 2019-2027

7.2.1.3.Market size and forecast, by Application, 2019-2027

7.2.1.4.Market size and forecast, by End-user, 2019-2027

7.2.1.5.Market size and forecast, by country, 2019-2027

7.2.1.6.Comparative market share analysis, 2019 & 2027

7.2.2.Germany

7.2.2.1.Market size and forecast, by component type, 2019-2027

7.2.2.2.Market size and forecast, by Services, 2019-2027

7.2.2.3.Market size and forecast, by Application, 2019-2027

7.2.2.4.Market size and forecast, by End-user, 2019-2027

7.2.2.5.Market size and forecast, by country, 2019-2027

7.2.2.6.Comparative market share analysis, 2019 & 2027

7.2.3.UK

7.2.3.1.Market size and forecast, by component type, 2019-2027

7.2.3.2.Market size and forecast, by Services, 2019-2027

7.2.3.3.Market size and forecast, by Application, 2019-2027

7.2.3.4.Market size and forecast, by End-user, 2019-2027

7.2.3.5.Market size and forecast, by country, 2019-2027

7.2.3.6.Comparative market share analysis, 2019 & 2027

7.2.4.France

7.2.4.1.Market size and forecast, by component type, 2019-2027

7.2.4.2.Market size and forecast, by Services, 2019-2027

7.2.4.3.Market size and forecast, by Application, 2019-2027

7.2.4.4.Market size and forecast, by End-user, 2019-2027

7.2.4.5.Market size and forecast, by country, 2019-2027

7.2.4.6.Comparative market share analysis, 2019 & 2027

7.2.5.Spain

7.2.5.1.Market size and forecast, by component type, 2019-2027

7.2.5.2.Market size and forecast, by Services, 2019-2027

7.2.5.3.Market size and forecast, by Application, 2019-2027

7.2.5.4.Market size and forecast, by End-user, 2019-2027

7.2.5.5.Market size and forecast, by country, 2019-2027

7.2.5.6.Comparative market share analysis, 2019 & 2027

7.2.6.Italy

7.2.6.1.Market size and forecast, by component type, 2019-2027

7.2.6.2.Market size and forecast, by Services, 2019-2027

7.2.6.3.Market size and forecast, by Application, 2019-2027

7.2.6.4.Market size and forecast, by End-user, 2019-2027

7.2.6.5.Market size and forecast, by country, 2019-2027

7.2.6.6.Comparative market share analysis, 2019 & 2027

7.2.7.Rest of Europe

7.2.7.1.Market size and forecast, by component type, 2019-2027

7.2.7.2.Market size and forecast, by Services, 2019-2027

7.2.7.3.Market size and forecast, by Application, 2019-2027

7.2.7.4.Market size and forecast, by End-user, 2019-2027

7.2.7.5.Market size and forecast, by country, 2019-2027

7.2.7.6.Comparative market share analysis, 2019 & 2027

7.3.Asia Pacific

7.3.1.1.Market size and forecast, by component type, 2019-2027

7.3.1.2.Market size and forecast, by Services, 2019-2027

7.3.1.3.Market size and forecast, by Application, 2019-2027

7.3.1.4.Market size and forecast, by End-user, 2019-2027

7.3.1.5.Market size and forecast, by country, 2019-2027

7.3.1.6.Comparative market share analysis, 2019 & 2027

7.3.2.China

7.3.2.1.Market size and forecast, by component type, 2019-2027

7.3.2.2.Market size and forecast, by Services, 2019-2027

7.3.2.3.Market size and forecast, by Application, 2019-2027

7.3.2.4.Market size and forecast, by End-user, 2019-2027

7.3.2.5.Market size and forecast, by country, 2019-2027

7.3.2.6.Comparative market share analysis, 2019 & 2027

7.3.3.India

7.3.3.1.Market size and forecast, by component type, 2019-2027

7.3.3.2.Market size and forecast, by Services, 2019-2027

7.3.3.3.Market size and forecast, by Application, 2019-2027

7.3.3.4.Market size and forecast, by End-user, 2019-2027

7.3.3.5.Market size and forecast, by country, 2019-2027

7.3.3.6.Comparative market share analysis, 2019 & 2027

7.3.4.Australia

7.3.4.1.Market size and forecast, by component type, 2019-2027

7.3.4.2.Market size and forecast, by Services, 2019-2027

7.3.4.3.Market size and forecast, by Application, 2019-2027

7.3.4.4.Market size and forecast, by End-user, 2019-2027

7.3.4.5.Market size and forecast, by country, 2019-2027

7.3.4.6.Comparative market share analysis, 2019 & 2027

7.3.5.Rest of Asia Pacific

7.3.5.1.Market size and forecast, by component type, 2019-2027

7.3.5.2.Market size and forecast, by Services, 2019-2027

7.3.5.3.Market size and forecast, by Application, 2019-2027

7.3.5.4.Market size and forecast, by End-user, 2019-2027

7.3.5.5.Market size and forecast, by country, 2019-2027

7.3.5.6.Comparative market share analysis, 2019 & 2027

7.4.LAMEA

7.4.1.1.Market size and forecast, by component type, 2019-2027

7.4.1.2.Market size and forecast, by Services, 2019-2027

7.4.1.3.Market size and forecast, by Application, 2019-2027

7.4.1.4.Market size and forecast, by End-user, 2019-2027

7.4.1.5.Market size and forecast, by country, 2019-2027

7.4.1.6.Comparative market share analysis, 2019 & 2027

7.4.2.Latin America

7.4.2.1.Market size and forecast, by component type, 2019-2027

7.4.2.2.Market size and forecast, by Services, 2019-2027

7.4.2.3.Market size and forecast, by Application, 2019-2027

7.4.2.4.Market size and forecast, by End-user, 2019-2027

7.4.2.5.Market size and forecast, by country, 2019-2027

7.4.2.6.Comparative market share analysis, 2019 & 2027

7.4.3.Middle East

7.4.3.1.Market size and forecast, by component type, 2019-2027

7.4.3.2.Market size and forecast, by Services, 2019-2027

7.4.3.3.Market size and forecast, by Application, 2019-2027

7.4.3.4.Market size and forecast, by End-user, 2019-2027

7.4.3.5.Market size and forecast, by country, 2019-2027

7.4.3.6.Comparative market share analysis, 2019 & 2027

7.4.4.Africa

7.4.4.1.Market size and forecast, by component type, 2019-2027

7.4.4.2.Market size and forecast, by Services, 2019-2027

7.4.4.3.Market size and forecast, by Application, 2019-2027

7.4.4.4.Market size and forecast, by End-user, 2019-2027

7.4.4.5.Market size and forecast, by country, 2019-2027

7.4.4.6.Comparative market share analysis, 2019 & 2027

8.Company profiles

8.1.Nokia

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Huawei

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Parallel Wireless

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.Affirmed Networks

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Mavenir

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.Argela

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Tambora Systems

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.BT

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Cisco Systems Inc.

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10. NTT DOCOMO, INC

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Mobile operators and telecommunication providers are in a race for getting ready for the advent and widespread implementation of 5G network across the globe. The invention of 5G network represents the advancement of the 4G network in terms of performance, capacity, and spectrum-access in radio networks.

5G network slicing technology is equipped with a significant, ground-breaking design feature which lets network operators offer portions of their network for different customers with different needs, such as implementation of smart home, connected car, internet of things (IOT), or smart energy grid. Each of these needs require a unique set of enhanced resources and network topologies, guaranteeing coverage of the SLA-specified factors like capacity, speed, and connectivity.

With the introduction of 5G and edge computing, there are massive opportunities for new business model innovations for communication service providers (CSPs). Network slicing is a key, using which service providers can enter new market segments and develop their business across various segment.

What is Network Slicing?

Network slicing joins multiple virtual networks on top of a shared network. Each portion of the network can have its own security rules, logical topology, and performance characteristics—within the limits levied by the original physical network.

A sliced network can be achieved by transforming it into a set of logical networks on top of a shared infrastructure. Every single logical network is intended to offer services to a specific business purpose and includes all the essential network resources, configured and connected end-to-end.

Advantages of Network Slicing

- Network slicing significantly changes the overall lookout of networking by extracting, isolating, coordinating, and separating the logical network modules from the original physical network resources. This, eventually results in the enhancement of the network architecture principles and competences.

- Network providers can assign suitable amount of resources according to network slice. Thus, it aids in effective use of resources. For instance, one network slice can be organized to provide low latency & low data rate while the other network slice can be organized to supply high throughput.

- It aids network providers in decreasing expenses (i.e. OPEX) and capital expenditure (i.e. CAPEX).

- It provides enhancement in operational efficacy and offers faster delivery of the 5G network services.

What is Trending in the Network Slicing Arena?

Several top network providers are taking efforts to stay ahead of the competition by implementing several business strategies such as merges & acquisitions, partnerships, novel inventions, and geographical expansion of their service offerings. For instance, SK Telecom has implemented network slicing on its commercial 5G network, which it intends to set up all through its base stations to offer customized services.

In October 2020, Nokia, an innovative global leader in 5G, networks and phones, has revealed that it has become the first gear producer to provide automation of 4G and 5G network slicing through all network domains such as transport, RAN, and core that will allow network providers to set up network slices within minutes.

Moreover, MEF, a global industry forum for network and cloud providers, is currently working on a standard for 5G slicing, with an aim of allowing service definitions that are consistent from one service operators to another. The notion behind 5G network slicing is to deliver services with varied factors depending on the application supported.

In October 2020, Dish Network, an American television provider based in Englewood, Colorado, has opted for DigitalRoute’s Usage Data Platform to monetize 5G services and business models. DigitalRoute’s platform will combine with DISH’s network systems to orchestrate and manage the network events created by 5G services.

In July 2020, Oppo, a Chinese smartphone developer, has helped Ericsson, Qualcomm, and MediaTek to set up the UK’s first ever 5G standalone (SA) network slicing facilities in the UK’s Coventry University using Vodafone’s network. They joint efforts of these companies have created network slice switching software solutions which will allow users to switch between different slices according to their requirements.

Future of Network Slicing Industry

As telecom service providers are switching toward 5G, they are looking forward to harness the benefits of network slicing technology and opening up new growth opportunities in the networking arena. As per a report by Research Dive, the global network slicing market [WU1] is projected to garner $1,456.6 million by 2027, despite the COVID-19 pandemic crisis. This is mainly due to rising demands for broadband services with the help of mobile networking and rising remote access services in various sectors including retail, IT, telecom, healthcare, and many others.

Owing to lockdown conditions, several businesses have become greatly dependent on networks to control the burden of customer queries due to less availability of employees. Furthermore, growing implementation of wireless networking services across the globe are likely to make an optimistic impact on the network slicing industry. As a final point, the network slicing industry is soon going to reach newer heights and obtain its dominance in the world of 5G network.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com