Patient Monitoring Device Market Report

RA00546

Patient Monitoring Device Market by Product Type (Blood Glucose Monitoring, Hemodynamic Monitoring, Neuromonitoring, Cardiac Monitoring, Fetal & Neonatal Monitoring, Respiratory Monitoring, Multi-parameter Monitoring, Remote Patient Monitoring, Weight Monitoring, and Temperature Monitoring Devices), End-Users (Hospitals & Clinics, Home Settings, and Ambulatory Surgical Centers), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

Global Patient Monitoring Device Market Analysis

The global patient monitoring device market size is predicted to generate $56,376.2 million in the 2021-2028 timeframe, growing from $35,755.8 million in 2020 at a healthy CAGR of 6.0%.

Market Synopsis

Increasing cases of chronic diseases such as cardiac diseases, type 1 diabetes mellitus, and rheumatoid arthritis among people of all age, especially the geriatric population, are expected to drive the market of patient monitoring devices globally.

However, high cost of patient monitoring devices and difficult government reimbursement policies are expected to hinder the market growth.

According to the regional analysis of the market, the Asia-Pacific patient monitoring device market is anticipated to grow at a CAGR of 7.40% by generating a revenue of $12,853.8 million during the review period.

Patient Monitoring Device Overview

Patient monitoring devices are medical devices which are capable of displaying or monitoring the vital aspects of a patient’s body. These devices record data such as body temperature, pulses, blood pressure, and pulse rate. These devices are widely used in hospitals, and clinics.

Impact Analysis of COVID-19 on the Global Patient Monitoring Device Market

The COVID-19 pandemic has severely affected the business sector across the world. During the pandemic, where other businesses experienced a major decrease in their market shares, healthcare sector experienced an unexpected growth owing to increasing demand for healthcare settings and facilities. The global patient monitoring device market has been found to experience significant growth during this period. As the COVID-19 virus is spreading very fast, more people are being adversely affected from the viral infection and the number of complications has also risen due to which the hospitalization rate has also increased. In such critical scenarios, the demand for patient monitoring devices has increased tremendously. Also, the patients have experienced respiratory issues while they were infected because of which the sales of remote oximeter flourished in the last two years. Moreover, the government has also taken initiatives to provide patient monitoring devices at various places to provide proper healthcare facilities to the patients. For instance, according to a news published on Zawya, on June 09, 2021, Saudi Arabia launched the first ventilator manufactured in the country as a boost to hospitals facility for treating COVID-19 patients. Such factors are expected to raise the market growth in the pandemic times.

Increasing Rate of Hospitalization to Surge the Market Growth

Rapid increase in chronic disease cases such as heart diseases, and diabetes among old age population is expected to accelerate the growth of the patient monitoring device market globally. Also, increased rate of hospitalizations and emergency department admissions owing to serious health conditions like cancer, and cardiac attack due to factors like high stress and anxiety level is further expected to increase the market revenue of patient monitoring devices.

Apart from this, introduction of remote monitoring devices such as oximeter, blood pressure machine, and diabetes monitor to avoid unnecessary hospitals & clinic visits and hospitalizations is further expected to drive the market of patient monitoring devices in the forecast time period. For instance, according to an article published on MYhealth Intelligence, on July 05, 2021, Ochsner Health, a non-profit healthcare provider in the U.S, scaled its patient monitoring platform to a national level and has the capacity to monitor more than 20,000 patients in health plans with the help of telehealth technology across the country.

To know more about global patient monitoring device market drivers, get in touch with our analysts here.

High Cost of Patient Monitoring Devices to Restrain the Market Growth

Patient monitoring devices are expensive and can only be opted by the patients who can afford the treatment. Due to the high cost of equipment, sensors, and monitors, not many healthcare facilities like small hospitals & clinics can afford it. This factor also restrains the market growth.

Advances in Technology and Innovation in Patient Monitoring Devices to Fuel the Market Growth

Technological advancements in the development of patient monitoring devices are expected to accelerate the market growth in the future. Amid the rising demand for latest technology to be used in patient monitoring devices, the manufacturing companies have started investing a huge amount in pacing their research and development activities which has boosted the market growth further. For instance, according to a news published in EIN Press News Wire, on July 01, 2021, VoCare, a U.S. based company, introduced Vital360, world's most advanced all-in-one handheld patient health monitoring device. Vital360 is an advanced grade health monitoring tool which combines multiple biometric measurements in a single hand-held device. Such advancements are likely to accelerate the market growth of patient monitoring devices in the future.

Furthermore, changing lifestyle such as consumption of alcohol and tobacco, and fast food are increasing the risk of inflammatory disorders in the people, thereby, increasing the opportunities for the patient monitoring device market growth.

To know more about global patient monitoring devices market opportunities, get in touch with our analysts here.

Based on product type, the global patient monitoring device market is segmented into blood monitoring, hemodynamic monitoring, neuromonitoring, cardiac monitoring, fetal & neonatal monitoring, respiratory monitoring, multi-parameter monitoring, remote patient monitoring, weight monitoring, and temperature monitoring devices. Blood Glucose Monitoring Devices sub-segment is projected to generate the maximum revenue and hemodynamic monitoring devices is predicted to show the fastest growth. Get Sample ReportPatient Monitoring Device Market

By Product

Source: Research Dive Analysis

The blood glucose monitoring devices sub-segment is predicted to have a dominating market share in the global market and is expected to register a revenue of $17294.6 million during the forecast period. The growth is attributed to increasing cases of diabetes among people of all age group due to unhealthy food eating habits. The devices are used to monitor the sugar level in the blood sample of the patient.

Hemodynamic monitoring device sub-segment is anticipated to have the fastest market growth and generated a revenue of $2,827.20 million in 2020. The hemodynamic monitoring devices are used to monitor proper flow of blood in the arteries, veins and heart. The fast growth of the sub-segment owes to factors like rising patient hospitalization rate due to prevalence of severe chronic diseases such as diabetes, cardiac diseases, and cancer owing to adoption of unhealthy lifestyle.

Patient Monitoring Device Market

By End UserOn the basis of end user, the market has been sub-segmented into Hospitals & Clinics, home settings, and ambulatory surgical centers. Among the mentioned sub-segments, the ambulatory services sub-segment is predicted to show the fastest growth, whereas the Hospitals & Clinics sub-segment is projected to garner a dominant market share.

Source: Research Dive Analysis

The ambulatory services sub-segment of the global patient monitoring device market is projected to have the fastest growth and surpass $9,447.80 million by 2028, with an increase from $5,663.60 million in 2020. This fast growth is due to preference for less hospital stay time and less expenditure as treatment in ambulatory services is cost effective compared to hospitals. Also, preference for minimum invasive surgeries and advance technology due to which surgeries of body parts such as ear and throat can be performed in clinics and do not require hospital admissions is expected to drive the market in future.

The hospital & clinic sub-segment is anticipated to have a dominating market share in the global market and register a revenue of $33,242.8 million during the analysis timeframe. This sub-segment growth is attributed to increased hospital admissions rate owing to many severe diseases such as cancer, cardiac arrest, and surgeries occurring due to people’s unhealthy food eating habits and fast-paced lifestyle. Also, prevalence of COVID-19 pandemic has boosted the market growth as the hospitalization rates have increased due to which the hospitals and clinics have started bulk purchasing of devices.

Patient Monitoring Device Market

By RegionThe patient monitoring device market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Patient Monitoring Device in North America to be the Most Dominant

The North America patient monitoring device market accounted $15,053.2 million in 2020 and is projected to register a revenue of $22,325.00 million by 2028. This growth is due to high prevalence of diseases such as respiratory diseases due to factors including rising pollution levels. Also, increasing demand for better and advanced healthcare facilities by patients is likely to flourish the market growth.

The Market for Patient Monitoring Device in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific patient monitoring device market is anticipated to grow at a CAGR of 7.40% by registering a revenue of $12,853.80 million by 2028. This is due to factors such as rising prevalence of hemophilia in countries like India, and China and increasing old age population in the region as they are more susceptible to diseases due to low immunity level in the body. Also, constantly improving healthcare infrastructure and facilities will further add on to the market growth.

Competitive Scenario in the Global Patient Monitoring Device Market

Source: Research Dive Analysis

The companies involved in the patient monitoring device market are Hill-Rom Holdings, Inc., Omron Healthcare, GE Healthcare, Koninklijke Philips N.V., Masimo Corporation, A&D Medicals, Edwards Lifesciences Corporation, Abbott Laboratories and Schiller Global.

Porter’s Five Forces Analysis for the Global Patient Monitoring Device Market:

- Bargaining Power of Suppliers: The suppliers in the patient monitoring device market are high in number. Several companies are working on product innovation and development. Thus, there is less threat from the suppliers.

Thus, the bargaining power suppliers is moderate. - Bargaining Power of Buyers: Buyers are high in number and have huge bargaining power; they demand best services at low prices. This increases the pressure on the manufacturing companies to offer the best service in a cost-effective way. Thus, buyers can freely choose the convenient service that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: New companies entering the patient monitoring device market are adopting advanced technologies for innovations such as developing the best product in the minimum time frame. However, new players have to face tough competition from the already established market players as they already have built a trust with their buyers.

Thus, the threat of the new entrants is high. - Threat of Substitutes: No alternative of patient monitoring devices can substitute the function of the device.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players. These companies are launching their technologically advanced products in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product |

|

| Segmentation by End-Users |

|

| Key Companies Profiled |

|

Q1. What is the size of the patient monitoring device market?

A. The global patient monitoring devices market was valued at $35,755.8 million in 2020, and is projected to reach $56,376.2 million by 2028, registering a CAGR of 6.0%.

Q2. Which are the major companies in the patient monitoring device market?

A. Edwards Lifesciences Corporation, Masimo Corporation, and Abbott Laboratories are some of the prominent companies in the patient monitoring device market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific patient monitoring device market?

A. The share of Asia-Pacific market is anticipated to grow at a CAGR of 7.40%.

CHAPTER 1:INTRODUCTION

1.1.Research methodology

1.1.1.Desk research

1.1.2.Real-time insights and validation

1.1.3.Forecast model

1.1.4.Assumptions & forecast parameters

1.1.4.1.Assumptions

1.1.4.2.Forecast parameters

CHAPTER 2:EXECUTIVE SUMMARY

2.1.360° summary

2.2.Product trends

2.3.End users trends

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

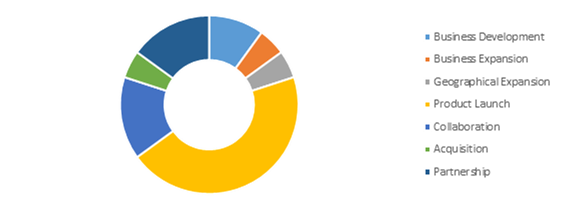

3.2.2.1.Top winning strategies, by year

3.2.2.2.Top winning strategies, by development

3.2.2.3.Top winning strategies, by company

3.2.3.Top player positioning

3.3.Porter's five forces analysis

3.4.Market dynamics

3.5.Drivers

3.6.Restraints

3.7.Opportunities

3.8.Technology landscape

3.9.Regulatory landscape

3.10.Patent landscape

3.11.Market value chain analysis

3.12.Strategic overview

CHAPTER 4:IMPACT OF COVID19 ON PATIENT MONITORING DEVICES MARKET

4.1.Introduction

4.2.COVID-19 health assessment

4.3.Impact of COVID-19 on the global economy

4.4.Impact of COVID-19 on patient monitoring devices market

4.4.1.Technological impact

4.4.2.Investment scenario

4.5.Patient monitoring device market size and forecast, by region, 2021-2028

CHAPTER 5:GLOBAL PATIENT MONITORING DEVICE MARKET, BY PRODUCT TYPE

5.1.Overview

5.1.1.Market size and forecast, by type

5.2.Blood Glucose Monitoring Device

5.2.1.Key market trends, growth factors and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market share analysis, by country

5.3.Cardiac Monitoring Device

5.3.1.Key market trends, growth factors and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market share analysis, by country

5.4.Multiparameter Monitoring Device

5.4.1.Key market trends, growth factors and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market share analysis, by country

5.5.Respiratory Monitoring Device

5.5.1.Key market trends, growth factors and opportunities

5.5.2.Market size and forecast, by region

5.5.3.Market share analysis, by country

5.6.Temperature monitoring device

5.6.1.Key market trends, growth factors and opportunities

5.6.2.Market size and forecast, by region

5.6.3.Market share analysis, by country

5.7.Hemodynamic Monitoring Device

5.7.1.Key market trends, growth factors and opportunities

5.7.2.Market size and forecast, by region

5.7.3.Market share analysis, by country

5.8.Fetal & Neonatal Monitoring Device

5.8.1.Key market trends, growth factors and opportunities

5.8.2.Market size and forecast, by region

5.8.3.Market share analysis, by country

5.9.Neuromonitoring Devices

5.9.1.Key market trends, growth factors and opportunities

5.9.2.Market size and forecast, by region

5.9.3.Market share analysis, by country

5.10.Weight Monitoring Device

5.10.1.Key market trends, growth factors and opportunities

5.10.2.Market size and forecast, by region

5.10.3.Market share analysis, by country

5.11.Remote Patient Monitoring Device

5.11.1.Key market trends, growth factors and opportunities

5.11.2.Market size and forecast, by region

5.11.3.Market share analysis, by country

CHAPTER 6:GLOBAL PATIENT MONITORING DEVICE MARKET, BY END USER

6.1.Overview

6.1.1.Market size and forecast, by end user

6.2.Hospitals & Clinics

6.2.1.Key market trends, growth factors and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market share analysis, by country

6.3.Home Settings

6.3.1.Key market trends, growth factors and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market share analysis, by country

6.4.Ambulatory Services

6.4.1.Key market trends, growth factors and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market share analysis, by country

CHAPTER 7:GLOBAL PATIENT MONITORING DEVICE MARKET, BY REGION

7.1.Overview

7.1.1.Market size and forecast, by region

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by product

7.2.3.Market size and forecast, by end user

7.2.4.Market size and forecast, by country

7.2.5.U.S.

7.2.5.1.Market size and forecast, by product

7.2.5.2.Market size and forecast, by end user

7.2.6.Canada

7.2.6.1.Market size and forecast, by product

7.2.6.2.Market size and forecast, by end user

7.2.7.Mexico

7.2.7.1.Market size and forecast, by product

7.2.7.2.Market size and forecast, by end user

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by product

7.3.3.Market size and forecast, by end user

7.3.4.Market size and forecast, by country

7.3.5.Germany

7.3.5.1.Market size and forecast, by product

7.3.5.2.Market size and forecast, by end user

7.3.6.UK

7.3.6.1.Market size and forecast, by product

7.3.6.2.Market size and forecast, by end user

7.3.7.France

7.3.7.1.Market size and forecast, by product

7.3.7.2.Market size and forecast, by end user

7.3.8.Italy

7.3.8.1.Market size and forecast, by product

7.3.8.2.Market size and forecast, by end user

7.3.9.Spain

7.3.9.1.Market size and forecast, by product

7.3.9.2.Market size and forecast, by end user

7.3.10.Rest of Europe

7.3.10.1.Market size and forecast, by product

7.3.10.2.Market size and forecast, by end user

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by product

7.4.3.Market size and forecast, by end user

7.4.4.Market size and forecast, by country

7.4.5.China

7.4.5.1.Market size and forecast, by product

7.4.5.2.Market size and forecast, by end user

7.4.6.Japan

7.4.6.1.Market size and forecast, by product

7.4.6.2.Market size and forecast, by end user

7.4.7.Australia

7.4.7.1.Market size and forecast, by product

7.4.7.2.Market size and forecast, by end user

7.4.8.South Korea

7.4.8.1.Market size and forecast, by product

7.4.8.2.Market size and forecast, by end user

7.4.9.India

7.4.9.1.Market size and forecast, by product

7.4.9.2.Market size and forecast, by end user

7.4.10.Rest of Asia-Pacific

7.4.10.1.Market size and forecast, by product

7.4.10.2.Market size and forecast, by end user

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by product

7.5.3.Market size and forecast, by end user

7.5.4.Market size and forecast, by country

7.5.5.Latin America

7.5.5.1.Market size and forecast, by product

7.5.5.2.Market size and forecast, by end user

7.5.6.Middle East

7.5.6.1.Market size and forecast, by product

7.5.6.2.Market size and forecast, by end user

7.5.7.Africa

7.5.7.1.Market size and forecast, by product

7.5.7.2.Market size and forecast, by end user

CHAPTER 8:COMPANY PROFILES

8.1.Hill-Rom Holdings Inc.

8.1.1.Company overview

8.1.2.Company snapshot

8.1.3.Operating business segments

8.1.4.Product portfolio

8.1.5.Business performance

8.1.6.Key strategic moves and developments

8.2.Becton, Dickinson and Company

8.2.1.Company overview

8.2.2.Company snapshot

8.2.3.Operating business segments

8.2.4.Product portfolio

8.2.5.Business performance

8.2.6.Key strategic moves and developments

8.3.Omron Healthcare

8.3.1.Company overview

8.3.2.Company snapshot

8.3.3.Operating business segments

8.3.4.Product portfolio

8.3.5.Business performance

8.3.6.Key strategic moves and developments

8.4.GE Healthcare

8.4.1.Company overview

8.4.2.Company snapshot

8.4.3.Operating business segments

8.4.4.Product portfolio

8.4.5.Business performance

8.4.6.Key strategic moves and development

8.5.Abbott Laboratories

8.5.1.Company overview

8.5.2.Company snapshot

8.5.3.Operating business segments

8.5.4.Product portfolio

8.5.5.Business performance

8.5.6.Key strategic moves and developments

8.6.Koninklijke Philips N.V

8.6.1.Company overview

8.6.2.Company snapshot

8.6.3.Operating business segments

8.6.4.Product portfolio

8.6.5.Business performance

8.6.6.Key strategic moves and developments

8.7.Masimo Corporation

8.7.1.Company overview

8.7.2.Company snapshot

8.7.3.Product portfolio

8.7.4.Business performance

8.7.5.Key strategic moves and development

8.8.A&D Company Ltd.

8.8.1.Company overview

8.8.2.Company snapshot

8.8.3.Product portfolio

8.8.4.Business performance

8.8.5.Key strategic moves and developments

8.9.Edwards Lifesciences Corporation

8.9.1.Company overview

8.9.2.Company snapshot

8.9.3.Product portfolio

8.9.4.Business performance

8.9.5.Key strategic moves and developments

8.10.Schiller Global

8.10.1.Company overview

8.10.2.Company snapshot

8.10.3.Product portfolio

The deadly COVID-19 pandemic has impelled the adoption of telehealth techniques. Millions of people worldwide are harnessing the benefits of virtual healthcare options since the outbreak of the pandemic in 2020. A substantial contributor to this extraordinary surge in adoption of telehealth by people is the acceptance of remote patient monitoring (RPM) technology by doctors, patients, as well as the government.

Remote patient monitoring devices possess the potential to revolutionize the delivery of healthcare. RPM makes use of several advanced devices to maintain a track of patients’ health progress and send this information to physicians. This technology is paving way for simplified patient monitoring processes and at times also permitting patients to obtain complete healthcare consultation from experts even without leaving home or from remote locations.

What is Boosting the Demand for Patient Monitoring Devices?

Patient monitoring devices offer a wide array of benefits for clinicians such as easy access to patient data, efficiency to provide enhanced healthcare to many patients with lesser risk of exhaustion, expert’s advice at lower costs, and greater efficacy, to name just a few. These outstanding benefits of patient monitoring devices are boosting their demand, which is expected to fuel the patient monitoring devices market growth. As per a report by Research Dive, the global patient monitoring device market is foreseen to garner $56,376.2 million in the 2021-2028 timeframe. The growth of the market is mainly because of the potential of these devices in decreasing the problems involved in severe medication treatments and in forming safer and more consistent processes. Moreover, these devices help improve the efficacy of the healthcare and ultimately reduce medical costs. This technology also offers the convenience and liberty to reach under-serviced populaces. This has encouraged more and more practitioners and medical experts to adopt remote patient monitoring technology.

The blend of the patient monitoring technology and other advanced technologies, such as improved internet speed with 5G technology is likely to play a massive role in fueling the notion of smarter healthcare. Apart from delivering smart healthcare services, this technology is also going to prove to be beneficial in educating medical students and junior doctors. By breaking geographic barriers, the RPM technology will make it trouble-free for people living in unreachable zones to obtain quality healthcare, thus making the diagnosis and management of chronic diseases rather easier.

Recent Trends in the Patient Monitoring Device Industry

Tech-giants, such as Google, Apple, and Amazon, and various healthcare focused companies, such as Omron Healthcare, GE Healthcare, Hill-Rom Holdings, Inc., Koninklijke Philips N.V., Masimo Corporation, Edwards Lifesciences Corporation, A&D Medicals, Abbott Laboratories, and Schiller Global are greatly investing in the patient monitoring device industry. These market players are putting efforts to develop advance RPM technologies to increase the quality of life, decrease hospitalization costs, and reduce hospital stays. Today, more and more companies are diving into the patient monitoring device market by launching novel RPM devices.

For instance,

- In December 2020, Konica Minolta, Inc., a Japanese multinational technology company, announced that the company is planning to launch VS1, a patient monitoring system, in Japan for hospitalized Covid-19 patients.

- In March 2021, Dozee, a forerunner in contactless patient monitoring and early warning system using artificial intelligence, launched Dozee Pro, a contactless vitals monitor for hospitals.

- In June 2021, Max Healthcare, a leading healthcare provider in India, launched an artificial intelligence (AI) powered device integrated patient monitoring technology, in collaboration with MyHealthcare, a digital health solutions provider.

- In May 2021, Essence SmartCare, a frontrunner in IoT-based remote care solutions, launched VitalOn, an inclusive remote patient monitoring (RPM) platform, for active seniors and elderly people suffering with chronic disorders.

The COVID-19 Pandemic Impact and Future Scope

The global patient monitoring device market growth has been positively impacted with the rise of the COVID-19 pandemic. The pandemic has resulted in the enforcement of social distancing norms, thus increasing the adoption rate of digital technologies. During the pandemic, many people are getting infected and the death rates have skyrocketed. In such perilous circumstances, the demand for patient monitoring devices has surged enormously and is expected to continue rising even in the coming years, thus booming the growth of the patient monitoring device market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com