Residential Boiler Market Report

RA03785

Residential Boiler Market by Fuel Type (Gas Fired, Oil Fired, and Others), Technology (Condensing and Non-Condensing), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Residential Boiler Market Analysis

The global residential boiler market is estimated to garner $13,849.4 million in the 2021-2028 timeframe, increasing from $8,381.4 million in 2020 at a CAGR of 6.4%.

Market Synopsis

Government involvement and advanced technology incorporations are anticipated to fuel the residential boiler market growth.

However, the availability of substitutes in the local markets is a growth-limiting factor for the industry.

Based on regional examination of the market, the Asia-Pacific residential boiler market is expected to grow at a 7.6% CAGR by generating a revenue of $3,508.1 million in the review time.

Residential Boiler Overview

Residential boiler is a self-contained low-pressure container used for supplying hot water or steam. These systems are majorly designed and developed for space heating of homes. It uses various fuels majorly natural gas and oil for steam generation and hot water. Growing utilization of renewable sources for hot water and heating spaces is generating demand for solar panels and geothermal boilers.

Impact Analysis of COVID-19 on the Global Residential Boiler Market

The COVID-19 emergency period had an undesirable impact on the global residential boiler market owing to severe disturbance of supply networks and services globally. Nevertheless, in post lockdown period, the global market is anticipated to witness significant growth as there is rise in demand for residential boiler particularly in European and American countries. Furthermore, some of the significant manufacturers are adopting different tactics such as collaborations to gain more market share in the overall industry. For example, in August 2020, Carrier, global leader in HVAC systems manufacturing, collaborated with ServiceTitan to accelerate commercial and home service industries. ServiceTitan software will provide various features to carrier such as cloud based pricebook sync, instantly deliver leads with seamless warranty process to enhance customer base across the globe.

Government Involvement and Development by Manufacturers Anticipated to Drive the Market

Government involvement in setting up standards for energy utilization for heating, ventilation and air conditioning systems is anticipated to accelerate the market growth in the analysis period. In 2020, the U.S. department of energy (DOE) initiated efforts to determine energy conservation standards and regulations for boilers and water heater manufacturers. As per DOE, the standards for consumer boilers would result in major energy savings and would be economically and technologically feasible for every customer. This aspect is estimated to provide additional support to manufacturers to develop and design new innovative boilers to save energy and money. Such factors are estimated to impel the industry growth in the analysis period. Moreover, manufacturers are continuously concentrating on new technologies for boiler coatings to offer instant heating as well as corrosion resistance to develop energy efficient boilers. For example, A.O. smith, a leading manufacturer in water treatment and boilers, is continuously updating blue diamond glass coating technology to combat sediment and scale & residue build-up on the surface of the boiler tank due to hard water. Such factors are anticipated to accelerate the residential boiler market growth in the analysis time.

To know more about residential boiler market drivers, get in touch with our analysts here.

Availability of Alternatives is Expected to Restrain the Market Growth

The availability of alternatives to residential boilers especially for gas fired boilers like solar thermal panels and IR heating panels are estimated to hamper the growth of the industry during the analysis time.

Rising Utilization of Novel Technologies to Create Huge Investment Prospects

Rising incorporation of new technologies like internet of things (IoT) to design energy efficient boilers is estimated to propel the growth opportunities for the market in the coming years. The IoT has led to the intelligent and smart homes through linking all aspects of the house from lighting or entertainment to the heating, ventilation, and air conditioning (HVAC) systems of the home. Residents are searching for innovative technology for controlling their home to save money and energy by setting IoT to their boilers or water heaters. Such factors are projected to impel market growth in the upcoming time.

To know more about residential boiler market opportunities, get in touch with our analysts here.

Residential Boiler Market

By Fuel TypeBy fuel type, the industry has been classified into Gas Fired, oil fired, and others. Among all these sub-segments, Gas Fired fuel type accounted for evident revenue share and is anticipated to be the most lucrative sub-segment in the forecast time.

Source: Research Dive Analysis

The gas fired sub-segment accounted for a leading market share in 2020, is expected to reach for a revenue of $8,008.5 million by 2028, and grow at 6.7% CAGR during the review period. This command over the market is majorly attributed to high utilization of gas fired boilers due to less energy utilization and less emissions compared to coal- and oil-fired boilers. Furthermore, rise in greenhouse gas emissions and their harmful impacts on the environment is generating demand for effective and renewable boilers like natural gas boilers and solar panels, which is estimated to propel the market growth in the future period.

Residential Boiler Market

By TechnologyBy technology, the industry has been classified into Condensing and non-Condensing sub-segments. In these both, Condensing technology accounted was a significant revenue contributor in the market and is expected to rise at a healthy rate.

Source: Research Dive Analysis

The condensing sub-segment of the global residential boiler market is predicted to have a profitable growth and surpass $11,072.2 million by 2028, with the highest CAGR of 6.6% during the review time. Wide utilization of condensing boilers owing to benefits associated with these boilers such as increased efficiency, improved control, and comfort while operating condensing boilers are estimated to drive sub-segment industry growth in the review time.

Residential Boiler Market

By RegionThe residential boiler market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Residential Boiler in Europe to be the Most Dominant

The Europe residential boiler market accounted $3,098.6 million in 2020, is anticipated to maintain its command, and produce a revenue of $4,881.9 million by the end of 2028. This dominance is mainly attributed to rising demand for most reliable and effective boilers from residents to meet the required environment regulations, Europe having some of the most cold countries in the world. This factor is predicted to impel the industry growth in the review time.

The Market for Residential Boiler in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific residential boiler market is predicted to grow at the highest CAGR of 7.6% and account for $3,508.1 million by 2028. The rising urbanization in developing countries and economic developments in countries like India and China is creating demand for smart homes like controlling of HVAC systems via smartphones which is directly expected to impel the market growth in the Asia-Pacific region.

To explore more about residential boiler market, get in touch with our analysts here.

Competitive Scenario in the Global Residential Boiler Market

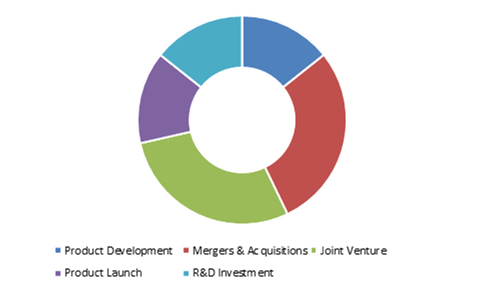

Collaborations and mergers are the most common strategies followed by the leading players in the market.

Source: Research Dive Analysis

The key global residential boiler market players are Robert Bosch GmbH, Lennox International, A. O. Smith, Ariston Thermo SpA, SPX Corporation, Viessmann Manufacturing Company Inc., DAIKIN INDUSTRIES, Ltd., Thermax Limited, NORITZ Corporation and Burnham Holdings, Inc.

Porter’s Five Forces Analysis for Residential Boiler Market:

- Bargaining Power of Suppliers: Residential boiler market has a high number of suppliers. Further, growing demand for space heating systems and accessibility of replacements and possibility for the new participants into the market are delivering the bargaining power of suppliers to be moderate.

- Bargaining Power of Consumers: Residential boiler market has a huge number of customers and product dependence is expected to be high. But, users are constantly adopting eco-friendly designs like solar water heaters are generating moderate negotiation power of consumers.

- Threat of New Entrants: The market needs moderate investments for the developing of most reliable and cost-effective heating systems but, high brand dependence among the customers is a key risk factor for the new players.

These aspects resulting moderate for the new entrants into the industry. - Threat of Substitution: Huge availability of the alternatives foe the water heater or boilers particularly for LPG boilers like heat pumps and solar powdered heating systems are resulting a high risk of substitutes.

- Competitiveness in the industry: Residential boiler industry contains a huge number of major industry players. These participants are concentrating on new product launches to rise their market share in the global industry.

Thereby, the competition in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Pest Type

|

|

| Segmentation by End User

|

|

| Key Countries covered | U.S., Canada, Germany, UK, Italy, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, Argentina, GCC and Saudi Arabia |

| Key Companies Profiled |

|

Q1. What is the size of residential boiler market?

A. The global residential boiler market size was over $8,131.3 million in 2019 and is further anticipated to reach $12,478.0 million by 2027.

Q2. Who are the leading companies in the residential boiler market?

A. Robert Bosch GmbH, A. O. Smith, Viessmann Manufacturing Company Inc., DAIKIN INDUSTRIES, Ltd. and Thermax Limited are some of the key players in the global residential boiler market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Asia-Pacific possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific residential boiler market is anticipated to grow at 7.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and collaborations are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Robert Bosch GmbH, A. O. Smith and DAIKIN INDUSTRIES, Ltd. are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data Fuel Types

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Fuel Type trends

2.3.Technology trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Residential Boiler Market, by Fuel Type

4.1.Gas Fired

4.1.1.Market size and forecast, by region, 2020 - 2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Oil Fired

4.2.1.Market size and forecast, by region, 2020 - 2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Others

4.3.1.Market size and forecast, by region, 2020 - 2028

4.3.2.Comparative market share analysis, 2020 & 2028

5.Residential Boiler Market, by Technology

5.1.Condensing

5.1.1.Market size and forecast, by region, 2020 - 2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Non-Condensing

5.2.1.Market size and forecast, by region, 2020 - 2028

5.2.2.Comparative market share analysis, 2020 & 2028

6.Residential Boiler Market, by Region

6.1.North America

6.1.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.1.2.Market size and forecast, by Technology, 2020 - 2028

6.1.3.Market size and forecast, by country, 2020 - 2028

6.1.4.Comparative market share analysis, 2020 & 2028

6.1.5.U.S.

6.1.5.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.1.5.2.Market size and forecast, by Technology, 2020 - 2028

6.1.5.3.Comparative market share analysis, 2020 & 2028

6.1.6.Canada

6.1.6.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.1.6.2.Market size and forecast, by Technology, 2020 - 2028

6.1.6.3.Comparative market share analysis, 2020 & 2028

6.1.7.Mexico

6.1.7.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.1.7.2.Market size and forecast, by Technology, 2020 - 2028

6.1.7.3.Comparative market share analysis, 2020 & 2028

6.2.Europe

6.2.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.2.Market size and forecast, by Technology, 2020 - 2028

6.2.3.Market size and forecast, by country, 2020 - 2028

6.2.4.Comparative market share analysis, 2020 & 2028

6.2.5.Germany

6.2.5.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.5.2.Market size and forecast, by Technology, 2020 - 2028

6.2.5.3.Comparative market share analysis, 2020 & 2028

6.2.6.UK

6.2.6.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.6.2.Market size and forecast, by Technology, 2020 - 2028

6.2.6.3.Comparative market share analysis, 2020 & 2028

6.2.7.France

6.2.7.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.7.2.Market size and forecast, by Technology, 2020 - 2028

6.2.7.3.Comparative market share analysis, 2020 & 2028

6.2.8.Spain

6.2.8.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.8.2.Market size and forecast, by Technology, 2020 - 2028

6.2.8.3.Comparative market share analysis, 2020 & 2028

6.2.9.Italy

6.2.9.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.9.2.Market size and forecast, by Technology, 2020 - 2028

6.2.9.3.Comparative market share analysis, 2020 & 2028

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.2.10.2.Market size and forecast, by Technology, 2020 - 2028

6.2.10.3.Comparative market share analysis, 2020 & 2028

6.3.Asia Pacific

6.3.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.3.2.Market size and forecast, by Technology, 2020 - 2028

6.3.3.Market size and forecast, by country, 2020 - 2028

6.3.4.Comparative market share analysis, 2020 & 2028

6.3.5.China

6.3.5.1.Market size and forecast, by Product, 2020 - 2028

6.3.5.2.Market size and forecast, by Technology, 2020 - 2028

6.3.5.3.Comparative market share analysis, 2020 & 2028

6.3.6.India

6.3.6.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.3.6.2.Market size and forecast, by Technology, 2020 - 2028

6.3.6.3.Comparative market share analysis, 2020 & 2028

6.3.7.Japan

6.3.7.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.3.7.2.Market size and forecast, by Technology, 2020 - 2028

6.3.7.3.Comparative market share analysis, 2020 & 2028

6.3.8.Australia

6.3.8.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.3.8.2.Market size and forecast, by Technology, 2020 - 2028

6.3.8.3.Comparative market share analysis, 2020 & 2028

6.3.9.South Korea

6.3.9.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.3.9.2.Market size and forecast, by Technology, 2020 - 2028

6.3.9.3.Comparative market share analysis, 2020 & 2028

6.3.10.Rest of Asia Pacific

6.3.10.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.3.10.2.Market size and forecast, by Technology, 2020 - 2028

6.3.10.3.Comparative market share analysis, 2020 & 2028

6.4.LAMEA

6.4.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.4.2.Market size and forecast, by Technology, 2020 - 2028

6.4.3.Market size and forecast, by country, 2020 - 2028

6.4.4.Comparative market share analysis, 2020 & 2028

6.4.5.Latin America

6.4.5.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.4.5.2.Market size and forecast, by Technology, 2020 - 2028

6.4.5.3.Comparative market share analysis, 2020 & 2028

6.4.6.Middle East

6.4.6.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.4.6.2.Market size and forecast, by Technology, 2020 - 2028

6.4.6.3.Comparative market share analysis, 2020 & 2028

6.4.7.Africa

6.4.7.1.Market size and forecast, by Fuel Type, 2020 - 2028

6.4.7.2.Market size and forecast, by Technology, 2020 - 2028

6.4.7.3.Comparative market share analysis, 2020 & 2028

7.Company profiles

7.1.Robert Bosch GmbH

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Lennox International

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.A. O. Smith

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.Ariston Thermo SpA

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.SPX Corporation

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.Viessmann Manufacturing Company Inc.

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.DAIKIN INDUSTRIES, Ltd.

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8. Thermax Limited

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.NORITZ Corporation

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.Burnham Holdings, Inc.

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

As winter comes, residential boilers become the utmost thing of interest in the homes of the American and European countries. Boilers are hydronic heating systems, which transfer heat by using water. Heating system of these types comes with many benefits—the most important one is maintaining the temperature at a constant level.

Residential boiler system is designed mainly for space heating of the homes in countries with low temperature. Fuels such as natural gas and oil are used in this system for steam and hot water generation. Increasing need of renewable sources for hot water and heating spaces is generating demand for geothermal boilers and solar panels.

Factors Enhancing the Growth of the Residential Boiler Market

Initiatives and investments by the governments in the energy usage in ventilation, air conditioning, and heating systems are anticipated to attribute to the growth of the market during the analysis period.

In 2020, the U.S. Department of energy (DOE) took a brilliant initiative to regulate the energy conservation standards and regulations for the manufacturers of water heaters and manufacturers. DOE believes that consumer boilers should be standardized as major energy saving technologies. These boilers should be technologically and financially feasible for every customer. The DOE has provided further support to the manufacturers to design innovative boilers which will help in saving energy and money.

The top manufacturers are focusing on the development of new technologies for boilers coating that will provide benefits such as instant heating and corrosion resistance to develop energy efficient boilers. A.O. smith, a leading manufacturer in water treatment and boilers, keeps constantly upgrading its blue diamond glass coating technology to fight against sediment, scale, and residue build-up on the surface of the boiler tank. These factors are contributing to the growth of the global residential boiler market.

Recent Trends and Developments in Residential Boiler Market

According to a recent report by Research Dive, the leading players of the global residential boiler market include Lennox International, Robert Bosch GmbH, Ariston Thermo SpA, SPX Corporation, A. O. Smith, Viessmann Manufacturing Company Inc., Thermax Limited, Daikin Industries, Ltd., Burnham Holdings, Inc., and NORITZ Corporation among others.

These industry players are investing a lot of efforts on the research and development of smart and unique strategies to sustain the growth of the market. These strategies include product launches, mergers and acquisitions, collaborations, partnerships, and refurbishing of existing technology.

Some of the recent developments of the market are as follows:

- As per a recent press release, in April 2021, SPX Corporation, a supplier of highly engineered infrastructure equipment and technologies, completed the acquisition of Sealite Pty Ltd and affiliated entities- Star2M Pty Ltd. and Avlite Systems. Sealite is a leader in the design and manufacture of marine and aviation products with worldwide presence. This acquisition is expected to enhance the product development and extend the customer base.

- According to another news, in January 2021, Daikin North America LLC, a subordinate of the world’s largest producer of cooling, heating, and refrigerant products, announced about a strategic orientation with ABCO HVACR Supply + Solutions, a US-based leading distributor of HVAC and refrigeration systems and supplies.

This collaboration aims to combine the fineness of Daikin manufacturing and product development with ABCO’s intensity and integrity in the marketplace. This strategic development is expected to reinforce Daikin’s opportunity for enhanced association in the local regions, ABCO branches, Daikin group companies, and the entire local customer base of Daikin.

Impact Analysis of Covid-19 on the Industry

The Covid-19 has impacted the global residential boiler market in a negative way. This is mainly because of the restrictions on supply chains and networks at a global level.

However, the market will recover from the slight decline once the pandemic ends as the demand of residential boiler will never cease to rise in American and European countries where the temperature level is always low. With the rising environment concern, people are leaning toward green boilers which will keep the market afloat.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com