Organ Care System Market For Liver Report

RA00034

Organ Care System Market for Liver, By Mode Handling (Portable, Trolley Based): Regional Analysis (North America, Europe, Asia Pacific, LAMEA) Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Global Organ Care System Market Forecast 2026:

Global Market size of Organ Care System for liver was of $ 21.1 million in 2018, and is estimated to reach up to $ 40.5 million by the end of year 2026.

The organ care system is a state-of-the-art-technology that allows donor organ to be maintained in human-like state. This device simulates human physiology along with this device allows organs to functions as they normally do. This technology supports to monitoring organ such as heart, liver, lung coupled with ensure transplant team can preserve organ in the optimal condition.

Driving factors of Organ Care System Market for Liver

Rising demand for liver transplants, coupled with constant growth in donation after Circulatory Deaths (DCD) are giving significant boost to the growth of Global OCS Liver Market

Increasing incidences of end stage liver failure around the globe due to rising heavy alcohol consumption, growing prevalence of obesity and the metabolic syndrome are some of the major factors which can upsurge the growth of global organ care system for liver. According to the European Association for the Study of Liver, Cirrhosis is the 11th most common reason of death around the world along with liver cancer is the 16th leading reason of death. In addition, encouragement of Collaboration programs between and health care and transplantation centers along with constant increase in donation after circulatory death (DCD) can drive the global market. Liver can survive outside the human body for 12 to 15 hours. Considering the geographical factor, liver can travel farther than hearts and lungs.

Market Restraints:

Shortage of human donors, high degree of risk and uncertainty, cultural prohibition against deceased donor donation are some factors that can hamper the growth of market. As per the OPTN data reports published in July 2019, around 11.6% liver disease patients are waiting for the liver transplantation.

Investment Opportunities in Organ Care System Market for Liver:

In People of Republic China, factors such as high incidence of liver diseases and improvisation in living standards are rising the demand for liver transplantation. PRC has various aspects such as medical, ethical and social and the advancements in this practices it is estimated that PRC will continue to grow in the rankings of countries which performs transplantation of liver. Thus, PRC can be considered as lucrative market for investors of organ care system market for liver.

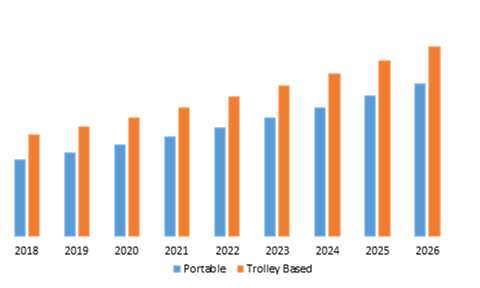

Organ Care System Market for Liver, by Mode of Handling Segment:

The trolley based organ care system for liver reached upto $12.0 million by the end of 2018, and is estimated to generate a revenue of $22.4 million in 2026.

Portable organ care system market for liver generated a revenue of $9.1 million by the end of 2018, and it is anticipated to generate revenue of $18.1 million by 2026. Factors such as easy to handle and less space acquisition compared to trolley along with latest inventions, will drive the growth of organ care system market in the future.

OCS Market for Liver, by Region:

North America market will reach up to $17.4 million by the end of 2026:

North America OCS market size for Liver was $8.9 million in 2018 and is further projected to generate revenue of $17.4 million by 2026. In this region, the U.S. and Canada are mainly heading the Organ Care systems market for liver. Factors such as the adoption of liberal policies for allowing transplantation in recipients older than 65 & rising improvements in the post-transplant results are the most significant factors for the growth of the organ care systems market for the liver. In the U.S., the age of liver transplant recipients increasing constantly. For instance, In the U.S., the liver transplant recipients age of 65 or more were grew from 9% in 2002 to 20% in 2017.

Asia-Pacific’s organ care system market size for liver was of $6.0 million till 2026:

Asia Pacific region will have enormous opportunities for the market investors to grow over the coming years

This market is developing market for organ care system for liver because western countries are more regulated, organized and have reached a plateau of transplant volume, whereas developing countries of Asia-Pacific are less systematic and growing rapidly in both their volumes and capabilities. Countries such as China, Taiwan, and India are more focusing on advanced liver transplant facility, state of the art infrastructure with best surgeons, to reduce surgical complications & improve patient safety. Thus, it is anticipated to witness a rapid growth of organ care system market for liver in Asia-Pacific region.

Key participants in Global OCS Market for Liver:

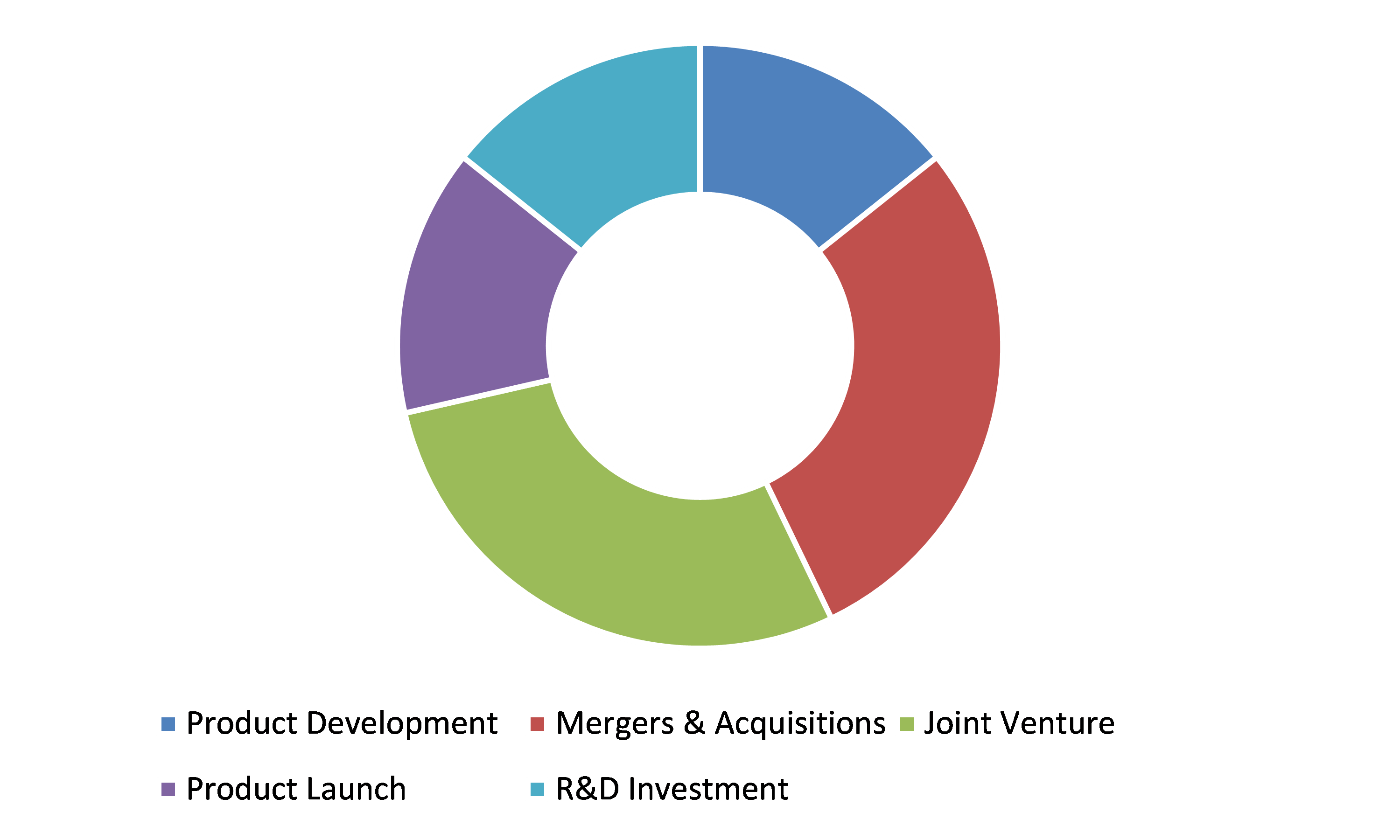

Product development and joint ventures are the most common strategies followed by the market players

Source: Research Dive Analysis

The organ care system market for liver key players include TransMedics Inc., XVIVO Perfusion AB, Bridge to Life Ltd., Paragonix Technologies Inc.Organ Assist B.V., Preservation Solution Inc., Organ Recovery Systems Inc., Organ Transport System Inc., Water Medical System LLC, OrganOx Limited, Preservation Solution Inc. These players are initiating various steps in order strengthen their presence such as merger & acquisitions, new product development. For instance, in January 2019, the UK’s national institute for Health and care excellence approved OrganOx’s liver perfusion machine.

Scope of the Market Research Report:

| Aspect | Particulars |

| Historical Market Estimations | 2016-2018 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Mode of Handling |

|

| Key Countries covered | Australia, U.S. New Zealand, Canada Brazil, Germany, India, Ireland, Japan, Spain, the United Kingdom, Taiwan |

| Key Players in Organ Care System Market for Liver: |

|

Q1. Which technique segment will dominate the Organ Care System Market for the Liver in the future?

A. Trolley based mode of handling segment will dominate the Organ Care System Market for the Liver in the projected timeframe.

Q2. What are the upcoming products in the Organ Care System Market for the Liver?

A. Preserving organ in cold storage is upcoming product in the Organ Care System Market for the Liver

Q3. What is the most common reason for a liver transplant?

A. Cirrhosis is the most common reason for a liver transplant.

Q4. What is the cutoff age for a liver transplant?

A. A liver transplant is the only treatment for end-stage liver disease. It is rare to offer liver transplant after 70 years.

Q5. What are the Current trends, opportunities, challenges in the Organ Care System Market for Liver?

A. Increaing demand for liver transplants is predicted to boost the market growth in the forecast period. Unavalabilty of donor is predicted to be biggest challenge for the market in the forecast period. Preserving organ in cold storage is preidcted to create more investment opportunity for teh investors in the forecast period.

Q6. What are the symptoms of a bad liver?

A. Dark urine color and Pale stool color with Abdominal pain and swelling are the common symptoms of a bad liver.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Mode of Handling

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.8.1. Stress point analysis

3.9. Strategic overview

4. Organ Care System Market for Liver, by Mode of Handling

4.1. Portable

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Trolley Based

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

5. Organ Care System Market of Liver, by Region

5.1. North America

5.1.1. Market size and forecast, by type of handling, 2016-2026

5.1.2. Market size and forecast, by country, 2016-2026

5.1.3. Comparative market share analysis, 2018 & 2026

5.1.4. U.S.

5.1.4.1. Market size and forecast, by type of handling,2016-2026

5.1.4.2. Comparative market share analysis, 2018 & 2026

5.1.5. Canada

5.1.5.1. Market size and forecast, by type of handling,2016-2026

5.1.5.2. Comparative market share analysis, 2018 & 2026

5.1.6. Mexico

5.1.6.1. Market size and forecast, by type of handling,2016-2026

5.1.6.2. Comparative market share analysis, 2018 & 2026

5.2. Europe

5.2.1. Market size and forecast, by type of handling,2016-2026

5.2.2. Market size and forecast, by country, 2016-2026

5.2.3. Comparative market share analysis, 2018 & 2026

5.2.4. Germany

5.2.4.1. Market size and forecast, by type of handling,2016-2026

5.2.4.2. Comparative market share analysis, 2018 & 2026

5.2.5. Spain

5.2.5.1. Market size and forecast, by type of handling,2016-2026

5.2.5.2. Comparative market share analysis, 2018 & 2026

5.2.6. France

5.2.6.1. Market size and forecast, by type of handling,2016-2026

5.2.6.2. Comparative market share analysis, 2018 & 2026

5.2.7. Italy

5.2.7.1. Market size and forecast, by type of handling,2016-2026

5.2.7.2. Comparative market share analysis, 2018 & 2026

5.2.8. Rest of the Europe

5.2.8.1. Market size and forecast, by type of handling,2016-2026

5.2.8.2. Comparative market share analysis, 2018 & 2026

5.3. Asia-Pacific

5.3.1. Market size and forecast, by type of handling,2016-2026

5.3.2. Market size and forecast, by country, 2016-2026

5.3.3. Comparative market share analysis, 2018 & 2026

5.3.4. China

5.3.4.1. Market size and forecast, by type of handling,2016-2026

5.3.4.2. Comparative market share analysis, 2018 & 2026

5.3.5. Japan

5.3.5.1. Market size and forecast, by type of handling,2016-2026

5.3.5.2. Comparative market share analysis, 2018 & 2026

5.3.6. India

5.3.6.1. Market size and forecast, by type of handling,2016-2026

5.3.6.2. Comparative market share analysis, 2018 & 2026

5.3.7. Australia

5.3.7.1. Market size and forecast, by type of handling,2016-2026

5.3.7.2. Comparative market share analysis, 2018 & 2026

5.3.8. South Korea

5.3.8.1. Market size and forecast, by type of handling,2016-2026

5.3.8.2. Comparative market share analysis, 2018 & 2026

5.3.9. Rest of the Asia Pacific

5.3.9.1. Market size and forecast, by type of handling,2016-2026

5.3.9.2. Comparative market share analysis, 2018 & 2026

5.4. LAMEA

5.4.1. Market size and forecast, by type of handling,2016-2026

5.4.2. Market size and forecast, by country, 2016-2026

5.4.3. Comparative market share analysis, 2018 & 2026

5.4.4. Brazil

5.4.4.1. Market size and forecast, by type of handling,2016-2026

5.4.4.2. Comparative market share analysis, 2018 & 2026

5.4.5. Saudi Arabia

5.4.5.1. Market size and forecast, by type of handling,2016-2026

5.4.5.2. Comparative market share analysis, 2018 & 2026

5.4.6. South Africa

5.4.6.1. Market size and forecast, by type of handling,2016-2026

5.4.6.2. Comparative market share analysis, 2018 & 2026

5.4.7. Rest of LAMEA

5.4.7.1. Market size and forecast, by type of handling,2016-2026

5.4.7.2. Comparative market share analysis, 2018 & 2026

6. Company profiles

6.1. TransMedics Inc.

6.1.1. Business overview

6.1.2. Financial performance

6.1.3. Product portfolio

6.1.4. Recent strategic moves & developments

6.1.5. SWOT analysis

6.2. Bridge to life and Ltd.

6.2.1. Business overview

6.2.2. Financial performance

6.2.3. Product portfolio

6.2.4. Recent strategic moves & developments

6.2.5. SWOT analysis

6.3. Paragonix Technologies Inc.

6.3.1. Business overview

6.3.2. Financial performance

6.3.3. Product portfolio

6.3.4. Recent strategic moves & developments

6.3.5. SWOT analysis

6.4. Preservation Solution Inc.,

6.4.1. Business overview

6.4.2. Financial performance

6.4.3. Product portfolio

6.4.4. Recent strategic moves & developments

6.4.5. SWOT analysis

6.5. Organ Transport System Inc.

6.5.1. Business overview

6.5.2. Financial performance

6.5.3. Product portfolio

6.5.4. Recent strategic moves & developments

6.5.5. SWOT analysis

6.6. Preservation Solution Inc.

6.6.1. Business overview

6.6.2. Financial performance

6.6.3. Product portfolio

6.6.4. Recent strategic moves & developments

6.6.5. SWOT analysis

6.7. XVIVO Perfusion AB

6.7.1. Business overview

6.7.2. Financial performance

6.7.3. Product portfolio

6.7.4. Recent strategic moves & developments

6.7.5. SWOT analysis

6.8. Organ Assist B.V.

6.8.1. Business overview

6.8.2. Financial performance

6.8.3. Product portfolio

6.8.4. Recent strategic moves & developments

6.8.5. SWOT analysis

A few lines of Introduction and History

Liver transplantation is the most effective therapy for any end-stage liver disease. Liver transplantation is widely accepted as a therapeutic treatment for certain patients diagnosed with the symptoms of hepatocellular carcinoma. With recent advances in the therapeutic field of medicine and the efforts to rise the number of the donor pool, liver transplantation has been carefully extended to patients with other primary or secondary ailments in the liver. Cholangiocarcinoma, hepatic epithelioid haemangioendothelioma, and colorectal and neuroendocrine liver metastases are amongst the most significant new indications.

As per the record, the first successful living donor liver transplantation (LDLT) was performed in 1989 in a child in Brisbane and in an adult in 1994 by the Shinshu group. In recent years, with the increase of LDLT worldwide has established an alternative to the deceased donor liver transplantation.

Liver can survive outside the human body for 12 to 15 hours. Considering the geographical factor, liver can travel farther than hearts and lungs. Since decades, an insulated container was used to place a donor liver which was a cooler quite literally while being transported over relatively short distances within regions, and thus ensuring their preservation.

The arrival of the OCS transportation system changes that standard. OCS places the liver in a heated portable carrier where the organ is connected to a pumping system that maintains a steady flow of oxygen-rich blood from the donor along with stabilizing fluid (a complex mixture of nutrients, electrolytes and hormones), mimicking the liver’s natural function in the body. Theoretically, the system allows for transportation over much greater distances and for longer periods of time to a waiting patient without compromising the organ’s viability.

Major Growth Drivers

The rising intake of heavy alcohol, growing instances of obesity, and the metabolic syndrome are some of the major factors which are going to contribute in the growth of the global organ care system for liver. According to the European Association for the Study of Liver, Cirrhosis is the 11th most common reason of death around the world along with liver cancer is the 16th leading reason of death.

- Alcoholic Liver Disease

Liver cirrhosis, fatty liver, and alcoholic hepatitis are the most prevailing types of alcoholic liver disease. As people adhere to heavy alcohol intake, they develop diseases like fatty liver which leads to hepatitis and finally, to cirrhosis. These diseases can also occur subsequently.

Research found that around 20 percent of alcoholics and heavy drinkers develop fatty liver, or steatosis. However, fatty liver can be cured properly if the alcohol consumption rate is reduced in a significant way. On the contrary, the condition can be fatal if alcohol consumption continues. Some biopsies from people with fatty liver display inflammatory changes which is typically an early sign of more serious liver disease.

Alcoholic hepatitis is diagnosed when inflammatory changes, fibrosis, liver degeneration, and other changes to the liver cells are displayed in a liver biopsy. The rate of mortality in severe cases goes up to 50 percent. If the drinking habit is not taken care of, about 40 percent of cases of alcoholic hepatitis develops into cirrhosis.

Cirrhosis of the liver is the most serious form of Alcoholic Liver Disease which is responsible for many deaths and critical illnesses. Liver cirrhosis defines a disease when scar tissue replaces normal liver tissue which disrupts blood flow through the liver and prevents it from working properly.

Liver cirrhosis is counted as a major cause of death in the United States. Higher rates of death have been recorded in countries such as France, Spain, and Italy- the countries where people traditionally consume more alcohol than in the United States.

- Growing prevalence of obesity

Another liver disease becoming more and more prevalent in the U.S. is the one by obesity. Researchers surveyed nationwide health survey data collected in five cycles between 1988 and 2016. During this period, the proportion of adults with what’s known as non-alcoholic fatty liver disease (NAFLD) rose from 20% to 28.3%, mirroring increases in rates of obesity and diabetes over the same period. The proportion of the population with obesity rose from 22.2% to 38.9%, a recent report states.

- Metabolic syndrome

The pervasiveness of the metabolic syndrome (MetS) can be defined as a cluster of cardiovascular risk factors associated with obesity and insulin resistance. This syndrome is intensely increasing in Western and developing countries. This disorder is not only associated with a higher risk of appearance of type 2 diabetes and cardiovascular events, but impacts on the liver in different ways.

Nonalcoholic fatty liver disease (NAFLD) is the major hepatic disorder in patients with metabolic syndrome, and indeed it is the most common cause of abnormal liver function tests in the working population in industrialized countries.

PRC expected to become the most lucrative market for Organ Care System market for Liver

Countries such as China, India, and Taiwan are seen to be more focused on the advanced liver transplant facility, state of the art infrastructure with best surgeons, to reduce surgical complications & improve patient safety. Thus, it is anticipated to witness a rapid growth of organ care system market for liver in Asia-Pacific region.

In People of Republic China, factors such as high incidence of liver diseases and improvisation in living standards are rising the demand for liver transplantation. PRC has various aspects such as medical, ethical and social and the advancements in this practices it is estimated that PRC will continue to grow in the rankings of countries which performs transplantation of liver. Thus, PRC can be considered as lucrative market for investors of organ care system market for liver.

China is to upsurge the number of organ transplant hospitals from 169 to about 300 by 2020, according to the chairman of the National Organ Donation and Transplantation Committee.

Future Perspective

According to a report published by the ResearchDive, the key players include

- TransMedics Inc.

- Bridge to Life Ltd.

- XVIVO Perfusion AB

- Preservation Solution Inc.

- Paragonix Technologies Inc.

- Organ Assist B.V.

- Organ Recovery Systems Inc.

- Organ Transport System Inc.

- Water Medical System LLC

- OrganOx Limited

- Preservation Solution Inc.

These players are initiating various steps in order strengthen their presence such as merger & acquisitions, new product development. For instance, in January 2019, the UK’s national institute for Health and care excellence approved OrganOx’s liver perfusion machine. With all these stats, the report also predicts that the global organ care system market will garner $40.5 million by 2026 from $21.2 million in 2018. In addition, encouragement of Collaboration programs between and health care and transplantation centers along with constant increase in donation after circulatory death (DCD) can drive the global market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com