Automotive Switch Market Report

RA02932

Automotive Switch market by Switch Type (Toggle Switches, Push Switches, Rotary Switches, Rocker Switches, and Others), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), Distribution Channel (Original Equipment Manufacturers and Aftermarket), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

Global Automotive Switch Market Analysis

The Global Automotive Switch Market forecast is projected to be $13,602.4 million in the 2021-2028 timeframe, growing from $7,560.0 million in 2020, at a healthy CAGR of 7.8%.

Market Synopsis

The growing utilization of electronics components in the automobile is projected to augment the demand for automotive switches and increase the growth of the automotive switch market size.

However, the introduction of virtual assistants and voice recognition technology can hamper the automotive switch market growth in forth coming years.

According to the regional analysis of the market, the Asia-Pacific automotive switch market share is anticipated to grow at a CAGR of 8.2%, by generating a revenue of $4,750.0 million during the forecast period.

Automotive Switches Overview

Automotive switches are one of the basic components of a vehicle. They regulate all electrical equipment inside the automobile. Vehicle switches play a vital role in vehicle lighting management and almost all of them work in a vehicle. They are also used for IC engine starting and stopping applications and various other automotive functions. The automotive switches are used in the dashboards as well as interior components of the vehicles mainly passenger cars, light commercial vehicles, and heavy commercial vehicles. Based on switch type, automotive switch market is divided in to toggle switches, push switches, rotary switches, rocker switches, and other. The automotive switches are suppled through the original equipment manufacturers and aftermarket by the distribution channel.

Covid-19 Impact on Automotive Switch market

The Covid-19 impact on automotive switch market has been moderate. The global reduction in automotive sales in 2020 due to the lockdowns and restrictions during the pandemic has drastically significantly impacted the sales of automotive switches globally. During the pandemic the disturbance in international supply chains for transportation of essential components that are utilized in automotive switches such as semiconductors has also impacted the Global Automotive Switch Market size.

However, during this pandemic period, the businesses across the world are experiencing the need for digital management of their operations. The need for implementation of technologies such as industrial internet of things (IIOT) that will enable real-time monitoring of manufacturing process of electronics devices such as automotive switches, virtual control of production, these factors are expected to have a positive impact on the market growth as well as desirable impact on the automotive switch market share in the COVID-19 pandemic period.

The Growth in Utilization of Electronics Components in the Automobiles is Expected to Augment the Demand for the Automotive Switch market

The growth in share of electronics components in vehicles is expected to aid the growth of automotive switch market in the forecast period. The monitoring and control of various systems of the automobiles such as vehicle performance, ignition, security features ad others are done by the electronics systems and automotive switches are used to operate them. Nowadays, the original equipment manufacturers (OEMs) have started replacing mechanical switches with electrical. With the rising demand for more convenient and smart operability of different functions in an automobile, numerous manufacturers are installing more electronics-based switches in their vehicles. They are more responsive, fast in operation, and more economical than mechanical switches.

To know more about Global Automotive Switch Market insight and drivers, get in touch with our analysts here.

The Replacement of Automotive Switches with New Technologies to Restrain the Market Growth.

The introduction of new technologies such as advanced driver assistance systems and voice recognition systems for incorporating technologies in to a car ensures the safety of passengers. The application voice recognition technology and artificial intelligence reduce the utilization of switches in the automobile and can hamper the growth of the automotive switch market in the forthcoming years.

The Increasing Number of Vehicle Production in Developing Countries is Expected to Create Opportunities for Automotive Switch market

The growing vehicle production and sales of the vehicles in the developing countries such as China, India, Vietnam, and others due to increased disposable income of consumers, industrialization, and urbanization are expected to create opportunities for automotive switch market. Rapid technological advancements and infrastructure growth in developing countries have led to rise in the demand for vehicles. As per International Organization of Motor Vehicle Manufacturers, an international trade association headquartered in Paris, France, in 2019, around 35 million vehicles were produced in the region making “Asia-Pacific” the highest automobile producing continent in the world. Major manufacturing countries were China and India.The automotive switches are based on electronics and China is the major producer of electronics system in the world. These factors are expected to open new scope of opportunities for the automotive switch market in the forecast period.

To know more about Global Automotive Switch Market opportunity, get in touch with our analysts here.

Based on switch type, the market has been divided into rocker switches, rotary switches, toggle switches, Push Switches, and other switches. Among these, the Push Switches sub-segment is anticipated to generate the maximum revenue as well as show the fastest growth. Download PDF Sample ReportAutomotive Switch market by Switch Type

By Switch Type

Source: Research Dive Analysis

The push switches sub-segment is predicted to have a dominating share in the global market as well as attain the fastest growth and register a revenue of $5,579.5 million in 2028, growing from $2,997.1 million in 2020 during the forecast period.

Push switch uses a unique sealing technology that makes it waterproof, oil-proof, as well as anti-static and it cannot be easily contaminated and interfered.Push on switch also has good electrical conductivity. Its circuit can be printed with carbon paste, silver paste, or copper foil. The conductive layer can be folded freely without problems, and the unique membrane switch can withstand higher voltage. These advantages of the push switches make them more reliable by providing optimal performance in the automobile. These factors are expected to aid the growth of push switches sub-segment.

Automotive Switch market by Switch Type

By Vehicle TypeBased on vehicle type, the market has been divided into Passenger Cars, light commercial vehicles, and heavy commercial vehicles. The Passenger Cars sub-segment is expected to be the most dominating and heavy commercial vehicles is projected to be the fastest growing during the forecast period.

Source: Research Dive Analysis

The passenger cars sub-segment is estimated to have a dominating market share in the global market and register a revenue of $8,629.7 million in year 2028, with a healthy CAGR of 7.6% during the forecast period.

The large-scale utilization of passenger cars as a medium of mobility across the world is expected to aid the growth of passenger cars sub-segment in the forecast period. As per the International Organization of Motor Vehicle Manufacturers, an international trade association headquartered in Paris, France, in year 2020, around 53 million passenger vehicles were sold across the globe. The automotive switches have wide variety of applications in the passenger cars like security, vehicle performance, infotainment, and others, that make the passenger cars the largest consumer of automotive switches in vehicles. These factors are expected to aid the growth of passenger cars sub-segment in the forecast period.

The heavy commercial vehicles sub-segment is estimated to have the fastest growing market and register a revenue of $955.7 in year 2028, with a healthy CAGR of 8.4% during the forecast period.

The rising production of heavy commercial vehicles in the UK will increase the growth opportunities for market players in automotive switches. Vehicles nowadays are implemented with various advanced features, such as infotainment and electronic system switches, which will increase the demand for automotive switches in the region.In July 2021 Us based firm Dana Incorporated, and Switch Mobility Ltd., the electrified commercial vehicles company and subsidiary of Ashok Leyland Ltd, a leading commercial-vehicle manufacturer, made a strategic agreement for investment in switch mobility for becoming a become a preferred supplier of e-Axles, gearboxes, motors, inverters, software and controls, and electronics cooling. These developments are expected to contribute in the development of heavy commercial vehicles sub-segment.

Automotive Switch market by Switch Type

By Distribution ChannelBased on distribution channel, the market has been sub-segmented into Original Equipment Manufacturers and aftermarket. Among the mentioned sub-segments, the Original Equipment Manufacturers sub-segment is estimated to show a dominant share, whereas the aftermarket sub-segment is projected to garner the fastest growth.

Source: Research Dive Analysis

The original equipment manufacturers sub-segment is anticipated to have a dominating share in the global market and surpass $7,851.9 million by 2028, with an increase from $ 4,510.0 million in 2020. The growth in all the major modes of road transportation such as passenger cars, light commercial vehicles, and heavy commercial vehicles is expected to aid the growth of original equipment manufacturer (OEM) sub-segment. As per International Organization of Motor Vehicle Manufacturers, an international trade association headquartered in Paris, France, the total number of vehicle registrations around the world that include passenger cars, light commercial vehicles, heavy commercial vehicles, electric vehicles, and zero emission vehicles was around 77,971,234 globally in the year 2020. The increasing number vehicles has aided the growth of original equipment manufacturer sub-segment in the forecast period.

The aftermarket sub-segment of the Global Automotive Switch Market is projected to have the fastest growth and register a revenue of $5,750.5 million during the analysis timeframe, growing at a healthy CAGR of 8.4%.The growing need for upgradation of existing automotive electronics systems that include automotive switches is expected to aid the growth of aftermarket sub-segment in the forecast period. In recent developments, for instance, in June 2021, USA based firm C&K, manufacturer of automotive electrical switches, developed a new navigation switch, the SAMXD (seat adjustment module rustproof). These switches are made for automotive applications, allowing for more space and cost savings. New developments like these are expected to positively impact the growth of the market.

Automotive Switch market by Switch Type

By RegionThe automotive switch market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Automotive Switches in Asia-Pacific to be the Most Dominating and Fastest Growing

The Asia-Pacific automotive switch market generated $2,571.2 million in 2020 and is projected to register a revenue of $4,750.0 million by 2028, along with this the market of Asia-Pacific region is growing with a healthy CAGR of 8.2% in the forecast period. The rapid urbanization and increasing demand for mobility in the developing markets such as India and China, with increased per capita income of the population, have resulted in the population upgrading from two wheelers to four wheelers. These factors are expected to aid the growth of automotive switch market in the Asia-Pacific region and make it the most dominating as well as lucrative region in the forecast period.

Competitive Scenario in the Global Automotive Switch Market

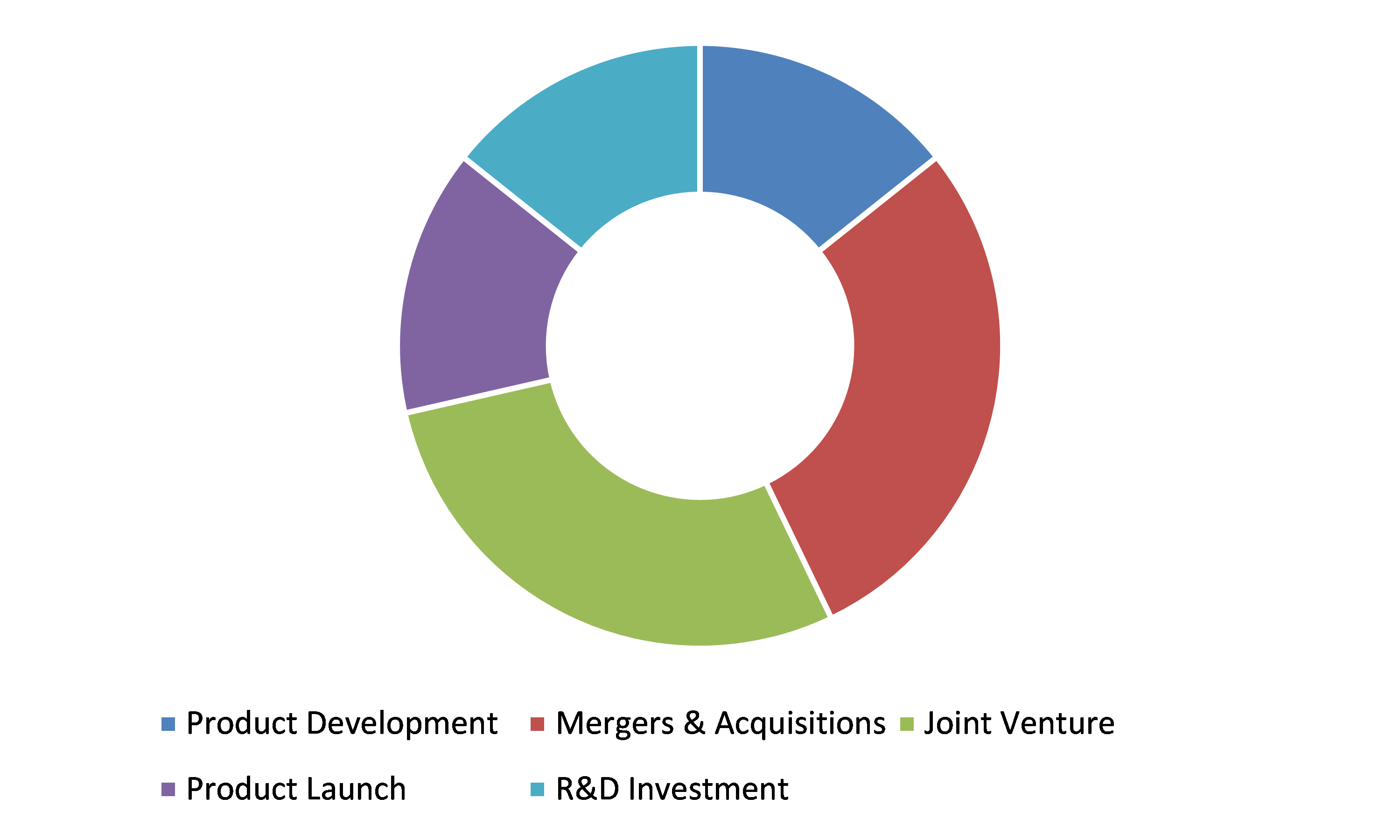

Agreement and acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading automotive switch market players are Robert Bosch GmbH, Tokai Rika Co. Ltd, Alps Electric Co. Ltd, Continental AG, Omron Corp., HELLA GmbH & Co. KGaA, ZF Friedrichshafen AG., Eaton Corporation PLC, Leopold Kostal GmbH & Co. Kg, and Johnson Electric Holdings Limited.

Porter’s Five Forces Analysis for the Global Automotive Switch Market:

- Bargaining Power of Suppliers: The suppliers in the automotive switch market are high in number. Several companies that manufacture engine vehicles are working on new methodologies such as multifunction automotive switches to gain the major market share.

Thus, the bargaining power of suppliers is moderate. - Bargaining Power of Buyers: Buyers demand cost-effective services. This increases the pressure on the automotive switches’ providers to offer the best service in a cost-effective way. Thus, buyers can choose the most convenient service that best fits their preference.

Thus, the bargaining power of buyers is high. - Threat of New Entrants: Companies entering the automotive switch market are adopting working on cost reduction for automotive switches for attracting clients. The initial investment in the automotive switches is moderate.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: Technologies such as use of touchpad display and voice recognition technology can act as an alternative product for automotive switches solutions.

Thus, the threat of substitutes is moderate. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Continental AG, HELLA GmbH & Co. KGaA and ZF Friedrichshafen AG Companies in the automotive switches do acquisitions to gain major market share.

Therefore, competitive rivalry in the market is high

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Switch Type |

|

| Segmentation by Vehicle Type |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. Which country is capturing the highest market share in the automotive switch market?

A. USA is capturing the highest market share in the automotive switch market.

Q2. What is the total market value of automotive switch market?

A. The automotive switch market is around $13,602.4 million in the year 2028.

Q3. What is the current size of the automotive switch market?

A. The current size of the automotive switch market is around $7,560.0 million in the base year 2020.

Q4. Which is the fastest-growing product segment in the automotive switch market?

A. The push switches is the fastest growing product sub-segment growing with a healthy growth rate of CAGR 8.3%

Q5. Which is the leading region in automotive switch market?

A. The Asia -pacific region is the is the leading regional in automotive switch market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Product trends

2.3.Vehicle Type trends

2.4.Caliber trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Application landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.8.1.Stress point analysis

3.8.2.Raw material analysis

3.8.3.Manufacturing process

3.8.4.Distribution channel analysis

3.8.5.Operating vendors

3.8.5.1.Raw material suppliers

3.8.5.2.Product manufacturers

3.8.5.3.Product distributors

3.9.Strategic overview

4.Automotive Switch Market, by Switch Type

4.1.Toggle switches

4.1.1.Market size and forecast, by region, 2021-2028

4.1.2.Comparative market share analysis, 2021-2028

4.2.Push switches

4.2.1.Market size and forecast, by region, 2021-2028

4.2.2.Comparative market share analysis, 2021-2028

4.3.Rotary switches

4.3.1.Market size and forecast, by region, 2021-2028

4.3.2.Comparative market share analysis, 2021-2028

4.4.Rocker switches

4.4.1.Market size and forecast, by region, 2021-2028

4.4.2.Comparative market share analysis, 2021-2028

4.5.Others

4.5.1.Market size and forecast, by region, 2021-2028

4.5.2.Comparative market share analysis, 2021-2028

5.Automotive Switch Market, by Vehicle Type

5.1.Passenger Cars

5.1.1.Market size and forecast, by region, 2021-2028

5.1.2.Comparative market share analysis, 2021-2028

5.2.Light Commercial Vehicles

5.2.1.Market size and forecast, by region, 2021-2028

5.2.2.Comparative market share analysis, 2021-2028

5.3.Heavy Commercial Vehicles

5.3.1.Market size and forecast, by region, 2021-2028

5.3.2.Comparative market share analysis, 2021-2028

6.Automotive Switch Market, by Distribution Channel

6.1.Original Equipment Manufacturers

6.1.1.Market size and forecast, by region, 2021-2028

6.1.2.Comparative market share analysis, 2021-2028

6.2.Aftermarket

6.2.1.Market size and forecast, by region, 2021-2028

6.2.2.Comparative market share analysis, 2021-2028

7.Automotive Switch Market, by region

7.1.North Region

7.1.1.Market size and forecast, by Switch Type, 2021-2028

7.1.2.Market size and forecast, by Vehicle Type, 2021-2028

7.1.3.Market size and forecast, by Distribution Channel, 2021-2028

7.1.4.Market size and forecast, by country, 2021-2028

7.1.5.Comparative market share analysis, 2021-2028

7.1.6.U.S

7.1.6.1.Market size and forecast, by Switch Type, 2021-2028

7.1.7.Market size and forecast, by Vehicle Type, 2021-2028

7.1.7.1.Market size and forecast, by Distribution Channel, 2021-2028

7.1.8.Canada

7.1.9.Market size and forecast, by Switch Type, 2021-2028

7.1.9.1.Market size and forecast, by Vehicle Type, 2021-2028

7.1.9.2.Market size and forecast, by Distribution Channel, 2021-2028

7.1.10.Mexico

7.1.10.1.Market size and forecast, by Switch Type, 2021-2028

7.1.10.2.Market size and forecast, by Vehicle Type, 2021-2028

7.1.10.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.Europe

7.2.1.Market size and forecast, by Switch Type, 2021-2028

7.2.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.4.Market size and forecast, by country, 2021-2028

7.2.5.Comparative market share analysis, 2021-2028

7.2.6.UK

7.2.6.1.Market size and forecast, by Switch Type, 2021-2028

7.2.6.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.6.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.7.Germany

7.2.7.1.Market size and forecast, by Switch Type, 2021-2028

7.2.7.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.7.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.8.France

7.2.8.1.Market size and forecast, by Switch Type, 2021-2028

7.2.8.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.8.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.9.Spain

7.2.9.1.Market size and forecast, by Switch Type, 2021-2028

7.2.9.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.9.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.10.Italy

7.2.10.1.Market size and forecast, by Switch Type, 2021-2028

7.2.10.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.10.3.Market size and forecast, by Distribution Channel, 2021-2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Switch Type, 2021-2028

7.2.11.2.Market size and forecast, by Vehicle Type, 2021-2028

7.2.11.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.Asia-Pacific

7.3.1.Market size and forecast, by Switch Type, 2021-2028

7.3.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.4.Market size and forecast, by Country, 2021-2028

7.3.5.Comparative market share analysis, 2021-2028

7.3.6.China

7.3.6.1.Market size and forecast, by Switch Type, 2021-2028

7.3.6.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.6.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.7.India

7.3.7.1.Market size and forecast, by Switch Type, 2021-2028

7.3.7.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.7.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.8.Japan

7.3.8.1.Market size and forecast, by Switch Type, 2021-2028

7.3.8.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.8.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Switch Type, 2021-2028

7.3.9.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.9.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Switch Type, 2021-2028

7.3.10.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.10.3.Market size and forecast, by Distribution Channel, 2021-2028

7.3.11.Rest of Asia-Pacific

7.3.11.1.Market size and forecast, by Switch Type, 2021-2028

7.3.11.2.Market size and forecast, by Vehicle Type, 2021-2028

7.3.11.3.Market size and forecast, by Distribution Channel, 2021-2028

7.4.LAMEA

7.4.1.Market size and forecast, by Switch Type, 2021-2028

7.4.2.Market size and forecast, by Vehicle Type, 2021-2028

7.4.3.Market size and forecast, by Distribution Channel, 2021-2028

7.4.4.Market size and forecast, by Country, 2021-2028

7.4.5.Comparative market share analysis, 2021-2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Switch Type, 2021-2028

7.4.6.2.Market size and forecast, by Vehicle Type, 2021-2028

7.4.6.3.Market size and forecast, by Distribution Channel, 2021-2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Switch Type, 2021-2028

7.4.7.2.Market size and forecast, by Vehicle Type, 2021-2028

7.4.7.3.Market size and forecast, by Distribution Channel, 2021-2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Switch Type, 2021-2028

7.4.8.2.Market size and forecast, by Vehicle Type, 2021-2028

7.4.8.3.Market size and forecast, by Distribution Channel, 2021-2028

8.Company profiles

8.1.Robert Bosch GmbH

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Operating Segments

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Tokai Rika Co. Ltd,

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Operating Segments

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Alps Electric Co. Ltd,

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Operating Segments

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4. Continental AG

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Operating Segments

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Omron Corp.,

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Operating Segments

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.HELLA GmbH & Co. KGaA

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Operating Segments

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.ZF Friedrichshafen AG.

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Operating Segments

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.Eaton Corporation PLC

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Operating Segments

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Leopold Kostal GmbH & Co. Kg

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Operating Segments

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.Johnson Electric Holdings Limited

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Operating Segments

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Automotive switches are one of the primary components of a vehicle that regulate all electrical equipment that are installed in an automobile. These switches play a vital role in managing the vehicle lighting and almost all the working inside an automotive. Automotive switches are also used for engine start and stop applications, and various other automobile functions. These switches are also used in the dashboards and interior components of the vehicles mainly in light commercial vehicles, passenger cars, and heavy commercial vehicles. The increasing technological upgrades and the growing demand for installing car accessories across the globe are expected to propel the growth of the automotive switch market in the coming future.

COVID-19 Impact on Automotive Switch market

The outbreak of COVID-19 across the globe has moderately impacted the global automotive switch market growth. The global reduction in automotive sales due to restrictions and lockdowns during the pandemic period has drastically impacted the sales of automotive switches across the globe. The disturbance in international supply chains during the pandemic for transportation of essential components utilized in automotive switches, such as semiconductors has also affected the automotive switch market size.

However, various businesses across the world are undergoing the need for digital management of their operations during the pandemic period. The rising need for implementation of advanced technologies such as industrial internet of things (IIOT) that enables real-time monitoring of electronics devices’ manufacturing process are expected to have a progressive impact on the automotive switch market share during the unprecedented times.

Automotive Switch market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global automotive switch market growth in the upcoming years.

For instance, in April 2019, Standard Motor Products, Inc., a manufacturer & distributor of automotive parts in the automotive aftermarket industry, completed the acquisition of Pollak business of an automotive part manufacturer, Stoneridge, Inc. for around USD 40 million. With this acquisition, the company is aiming to expand its business facilities in MA, Canton, El Paso, Juarez, TX, and Mexico while distributing a broad range of engine management products including sensors, automotive switches, and connectors.

In July 2019, Alps Alpine Co., Ltd., a leading manufacturer of electronic components, developed an SPVQ8 Series detector automotive switch for usage in detecting the opening & closing of hoods, side doors, and other vehicle doors. The SPVQ8 Series detector switch has an optimized terminal shape, which is achieved using high-precision die stamping and manufacturing technology. This has reduced the overall thickness by 25%, thereby contributing to lighter, thinner customer equipment.

In September 2021, STMicroelectronics, the leading electronics and semiconductor manufacturer, announced the launch of a new generation of automotive intelligent switches, the ‘VN9D5D20FN’ and ‘VN9D30Q100F,’ which are the first on the market with digital current sensing. The automotive switches are designed for high-side connection in applications powered from a 12V battery, the drivers are intended to simplify the hardware & software design of electronic control units (ECUs) and improve system reliability.

Forecast Analysis of Global Market

The global automotive switch market is projected to witness an exponential growth during the forecast period, owing to the increasing production vehicle and its sales in the developing countries such as India, China, Vietnam, and others. Besides, the rapid technological advancements and growth in infrastructure in the emerging economies have led to rise in the demand for vehicles, which is thereby predicted to boost the automotive switch market growth by 2028. Conversely, the replacement of automotive switches with novel technologies is expected to hamper the market growth in the projected timeframe.

The increasing utilization of electronics components in the automobile around the world and the growing demand for more convenient & smart operability of different functions in an automobile are the significant factors and automotive switch market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global automotive switch market is expected to garner $13,602.4 million during the forecast period (2021-2028). Regionally, the Asia-Pacific region is estimated to observe the rapid growth by 2028, owing to the rapid urbanization and rising demand for mobility in the developing markets such as China and India, with increased per capita income of the population in the region.

The key players functioning in the global market include Robert Bosch GmbH, Tokai Rika Co. Ltd, Alps Electric Co. Ltd, Continental AG, Omron Corp., HELLA GmbH & Co. KGaA, ZF Friedrichshafen AG., Eaton Corporation PLC, Leopold Kostal GmbH & Co. Kg, and Johnson Electric Holdings Limited.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com