Aerospace Avionics Market Report

RA02838

Aerospace Avionics Market by Systems (Flight Control System, Communication System, Navigation System, Monitoring System, and Others), Application (Commercial Aviation, Military Aviation, and Business Jets & General Aviation), Distribution Channel (OEM and Aftermarket), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2030

Global Aerospace Avionics Market Analysis

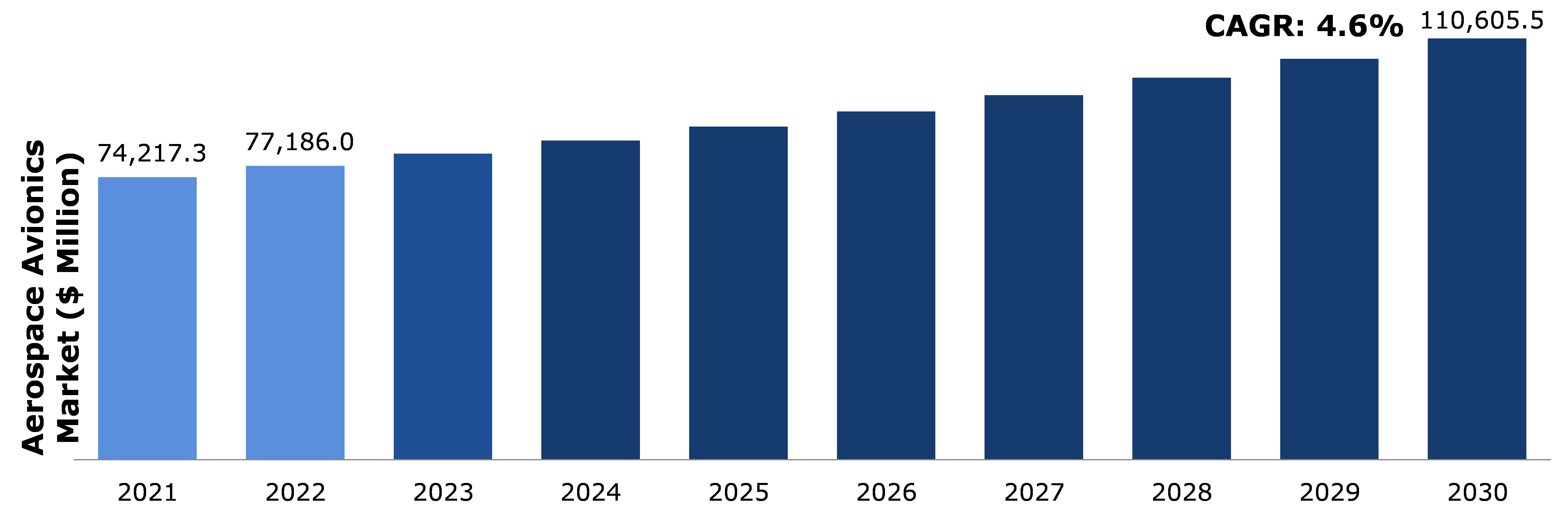

The aerospace avionics market forecast is estimated to be $110,605.5 million in the 2022-2030 timeframe, growing from $74,217.3 million in 2021, at a healthy CAGR of 4.6%.

Global Aerospace Avionics Market Synopsis

Aircraft avionics is the most important component of aircraft systems, assisting in the provision of various operational and virtual information in flight and on the ground. The avionics system utilizes the data from the air traffic management system and provides it to the pilot in order for him to choose an approach path to the destination. Navigation, communication, and surveillance systems, as well as other electrical systems and in-flight entertainment systems, are all part of aerospace avionics. These systems necessitate regular system maintenance and software upgrades. Aircraft manufacturers include complete avionics systems with the aircraft, and some avionics systems, such as the in-flight entertainment system can be customized to meet the needs of the consumer. These factors are anticipated to boost the aerospace avionics market size during the forecast period.

Increasing size & complexity of software running on aerospace avionics is anticipated to restrain the market growth. For instance, the hardware and software elements nowadays have become inextricably linked in huge multithreaded code bases as they have been integrated into a single SoC. The large software footprint of today's avionics systems will necessitate the use of external memory resources, most commonly DDR memory, in many cases. This begs the question of what cache memory architecture and methodology will be used to ensure the system's performance and throughput requirements are met.

The growth and developments in the flight management system is anticipated to generate excellent growth opportunities in the coming years. This is majorly owing to the introduction of low-cost airlines and an increase in the demand for new aircraft from developing economies. In order to provide better passenger services, most developed regions are focusing on upgrading their existing aircraft fleets. With the advancement of existing systems and the delivery of new aircraft, the surveillance system market in the aerospace avionics market will experience significant growth. During the analysis period, these factors are expected to generate excellent growth opportunities in the aerospace avionics market.

According to regional analysis, the Asia-Pacific aerospace avionics market accounted for $17,159.0 million in 2021 and is predicted to grow with a CAGR of 5.9% in the projected timeframe. This is because the Asia-Pacific countries majorly China is one of the fastest growing markets for civil aerospace & aviation.

Aerospace Avionics Overview

The aerospace avionics includes flight control systems, engine controls, navigation, flight recorders, communications, weather radar, fuel systems, lighting systems, threat detection, electro-optic (EO/IR) systems, performance monitors, and systems. The market for aerospace avionics is divided into three key segments: aircraft, spacecraft, and artificial satellites. Commercial aircraft, unmanned aerial vehicles (UAV), helicopters, business jets, military fighter jets, and spacecraft all use avionics.

Covid-19 Impact on Aerospace Avionics Market

The impact of Covid-19 on the aerospace avionics market was moderate. According to the International Air Transport Association, the leading trade association based in Canada, international passenger demand in 2021 was 75.6% lower than in 2019. Domestic demand in 2021 was down 48.85 from 2019. As a result, demand for avionics hardware and software in the commercial aviation sector has decreased, limiting the growth of the aerospace avionics market.

Businesses all over the world have experienced the need for digital management of their operations during the pandemic period. The need for the implementation of advanced technologies such as industrial internet of things (IIOT) to facilitate the real-time monitoring of aerospace avionics product manufacturing processes and virtual control of production is predicted to have a positive impact on aerospace avionics market growth post pandemic times.

Robust Growth in the Commercial Aviation for Passenger Travel to Drive the Market Demand

A significant rise in the passenger traffic especially in the commercial aviation is anticipated to boost the market growth. This is because the commercial aircrafts are equipped with advanced technologies such as flight management systems, communication systems, navigation systems, surveillance systems, and electrical systems that enhances the customers travel experience and ensures travel safety. This could lead to an increase in the number of passengers in commercial aviation, increasing demand for more aircrafts and thus assisting the growth of the aerospace avionics market. For instance, in 2021, Airbus SE, the leading multinational aerospace corporation, delivered 566 commercial aircraft during 2021. This depicts the rise in the demand for commercial aviation despite the uncertainties brought by COVID-19 pandemic. These aspects are anticipated to propel the aerospace avionics market growth during the forecast period.

To know more about global aerospace avionics market insight and drivers, get in touch with our analysts here.

Aerospace Avionics is a Capital-Intensive Industry which is Anticipated to Restrain the Market Growth.

The commercial aircrafts are sophisticated and the cost involved in manufacturing and operations is quite high. Owing to this, the cost of overall aerospace avionics system increases and maintenance cost is also high. The increasing cost is majorly due to the presence of navigation systems, flight management systems, engine health monitoring, surveillance systems, and others. In addition, other technical constraints such as reliability, dependability, and limiting or eliminating the processing interference are anticipated to hamper the aerospace avionics market size during the forecast period.

Growing Demand from Developing Countries to Generate Excellent Growth Opportunities

The increasing demand for commercial and military aircraft, as well as the gradual increase in passenger numbers is expected to boost the aerospace avionics globally. For instance, The International Air Transport Association (IATA), a trade association headquartered in Canada, stated that the airline industry is expected to deliver approximately 1300+ aircraft by the start of 2022. In addition, the rise in per capita income in developing countries such as Brazil, Russia, India, China, and South Africa (BRICS) is expected to increase the number of air passengers as well as the number of aircrafts. Most developed countries such as the U.S., Germany, UK, and others are focusing on upgrading their existing aircraft fleets in order to provide better passenger services. These trends are anticipated to generate excellent opportunities in the aerospace avionics market during the forecast period.

To know more about global aerospace avionics market trends, get in touch with our analysts here.

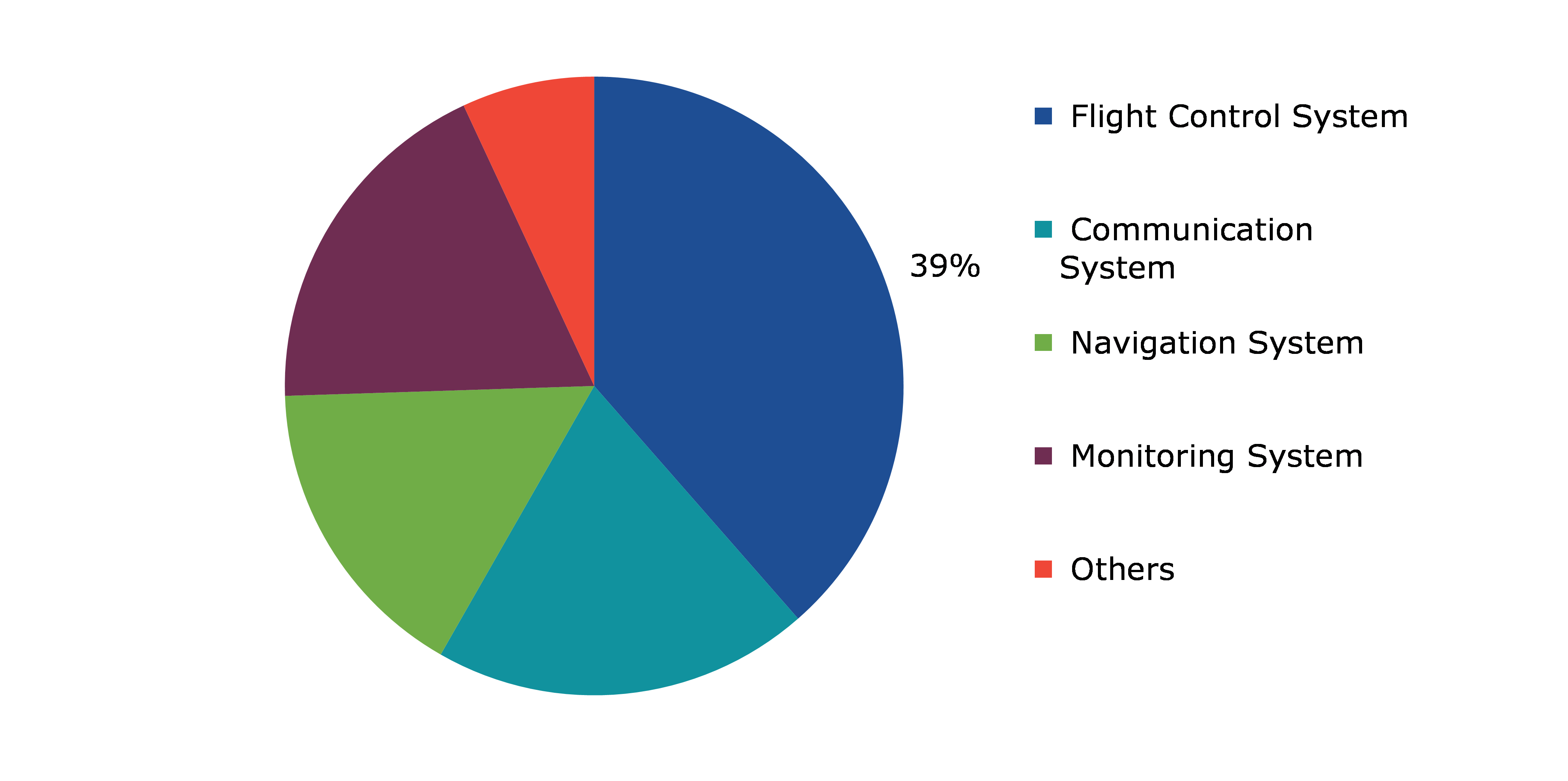

Global Aerospace Avionics Market, by Systems

Based on systems, the market has been divided into flight control system, communication system, navigation system, monitoring system, and others. Among these, the flight control system sub-segment accounted for the highest revenue share in 2021 and the navigation system sub-segment is expected to show the fastest growth during 2022-2030.

Global Aerospace Avionics Market Share, By Systems, 2021

Source: Research Dive Analysis

The flight control system sub-segment is predicted to have a dominating share in the global market and register a revenue of $39,930.8 million in 2030, growing from $28,608.0 million in 2021 during the forecast period. This growth is majorly owing to growing emphasis on enhancing the aircraft operations across military aviation and commercial sector. Some of the major developments in military aviation and commercial aviation include advancements in the aircraft navigation routes, weather systems, flight & aircraft design, and others. In addition, the advancements in flight control systems such as the launch of wing circulation control and fluidic thrust vectoring technologies to boost the demand for flight control system sub-segment during the forecast period.

The navigation system sub-segment is anticipated to have the fastest market growth and generate a revenue of $19,451.8 million by 2030, growing from $12,040.6 million in 2021, at a healthy CAGR of 5.5% in the forecast period. This growth can be attributed to the growing demand for high accuracy in the aircraft navigation especially for armed forces aviation and commercial aviation sectors.

Global Aerospace Avionics Market, by Application

Based on application, the market has been divided into commercial aviation, military aviation, and business jets & general aviation. The commercial aviation sub-segment is anticipated to be the most dominating as well as fastest growing sub-segment.

Global Aerospace Avionics Market Share, By Application, 2021

Source: Research Dive Analysis

The commercial aviation sub-segment is anticipated to register a revenue of $60,068.3 in year 2030, growing with a healthy CAGR of 5.0% during the forecast period. The increasing number of passengers and cargo worldwide is expected to drive the growth in the commercial aviation sub-segment during the forecast period. In addition, The International Air Transport Association, headquartered in Montreal, Canada, predicts 8.2 million air travelers in 2037 in its "20-Year Air Passenger Forecast" published in 2018.

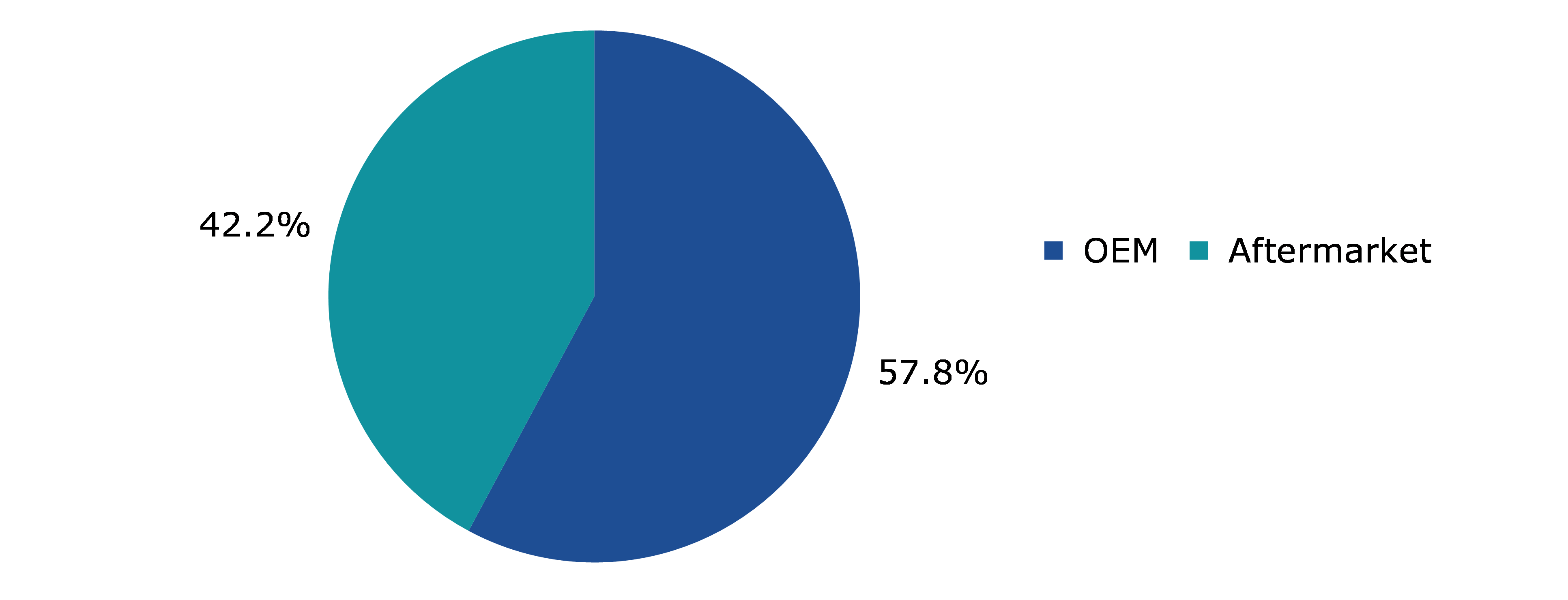

Global Aerospace Avionics Market, by Distribution Channel

Based on distribution channel, the market has been divided into original equipment manufacturer (OEM) and aftermarket. Among the mentioned sub-segments, the OEM original equipment manufacturer sub-segment is estimated to acquire a dominant share, whereas the aftermarket sub-segment is projected to garner the fastest growth during the analysis timeframe.

Global Aerospace Avionics Market Share, By Distribution Channel, 2021

Source: Research Dive Analysis

The original equipment manufacturer (OEM) sub-segment is anticipated to have a dominating share in the global market and surpass $63,139.4 million by 2030, with an increase from $42,925.4 million in 2021. Rapid growth anticipated across the major aviation sectors, such as military aviation, commercial aviation, and general aviation, will drive the original equipment manufacturer (OEM) sub-segment growth. The key aerospace original equipment manufacturers, such as Boeing and Airbus S.A.S. anticipate a large number of commercial aircraft orders. Additionally, in 2021, Boeing and Airbus, the leading aerospace companies, together delivered 951 aircrafts compared to 723 aircrafts in 2020. These factors are anticipated to boost the growth of the OEM sub-segment during the forecast period.

The aftermarket sub-segment of the global aerospace avionics market is estimated to show the fastest growth and register a revenue of $47,466.1 million during the forecast period, growing at a healthy CAGR of 4.8%. The growing need for upgrading existing avionics systems in military and commercial aviation which includes upgradation of tactical systems, collision avoidance systems, engine health monitoring, flight management systems, weather systems, and others is estimated to boost the growth of the aftermarket sub-segment. While the pandemic has had an impact on the aerospace and defense industry, continued technological developments in 2021 are expected to drive excellent opportunities in the aftermarket sub-segment of aerospace avionics system.

Global Aerospace Avionics Market, Regional Insights:

The aerospace avionics market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Aerospace Avionics Market Size & Forecast, By Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The Market for Aerospace Avionics in Asia-Pacific to be the Fastest Growing

The Asia-Pacific aerospace avionics market generated $17,159.0 million in 2021 and is projected to register a revenue of $28,702.1 million by 2030. Commercial aviation expansion and a surge in military aviation modernization programmes by countries such as China, India, and Japan are expected to aid the growth of the Asia-Pacific aerospace avionics market. According to the International Air Transport Association's (IATA) 20-Year Air Passenger Forecast report, Asia-Pacific will see an additional growth of 1,836 million passengers, with China being the leader, adding 817 million new passengers by 2035. The significant increase in air passenger numbers is expected to boost demand for air travel as well as the number of aerospace avionics equipment manufacturers in the Asia-Pacific commercial aviation market.

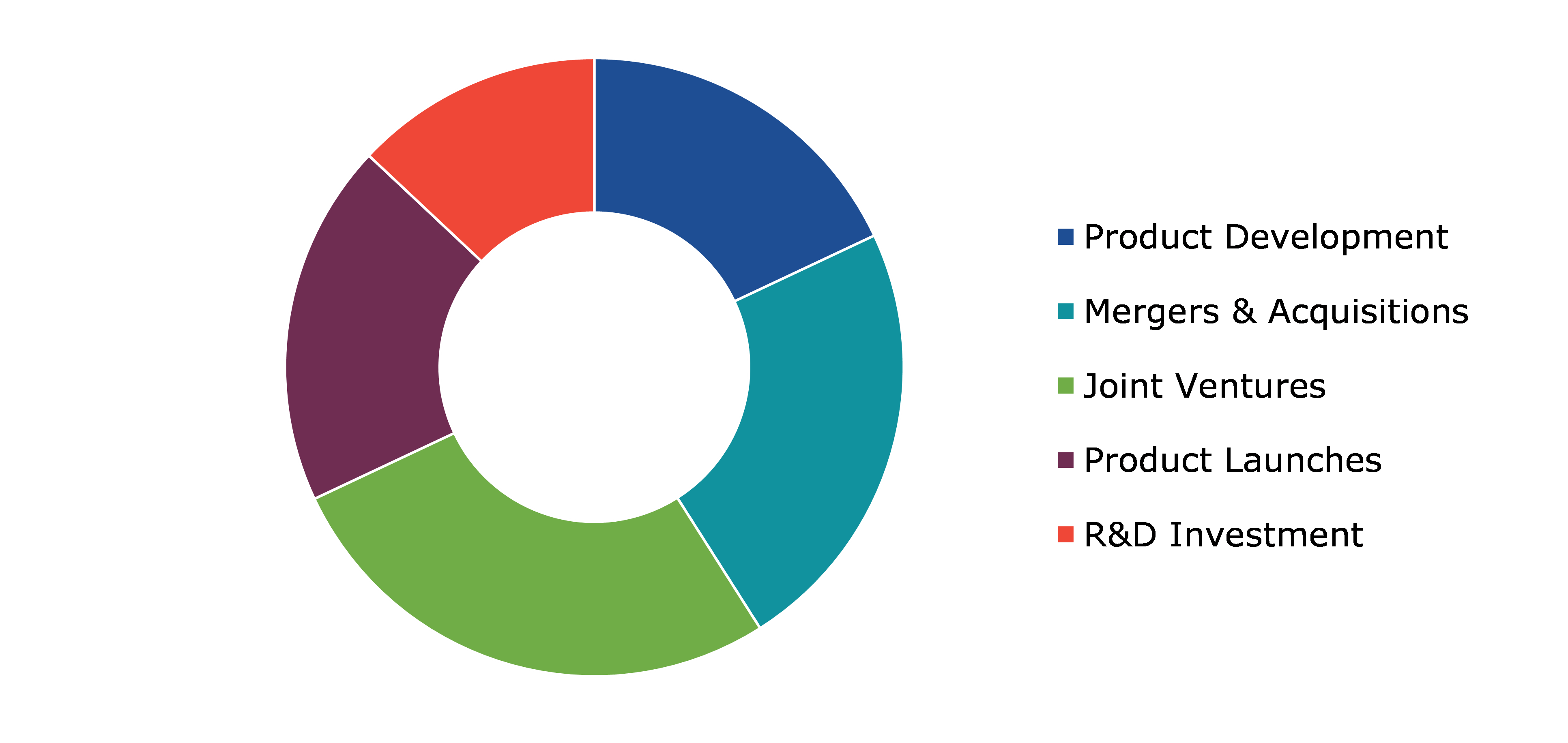

Competitive Scenario in the Global Aerospace Avionics Market

Acquisition and agreement are common strategies followed by major market players. For instance, in April 2022, Boeing, the leading American multinational aerospace company, announced an agreement with Spirit AeroSystems, Inc., the leading manufacturer of aerostructures, to combine aftermarket resources and boost the company growth.

Source: Research Dive Analysis

Some of the leading aerospace avionics market players are NORTHROP GRUMMAN CORPORATION, L3Harris Technologies, Inc., General Dynamics Corporation, BAE Systems, Thales Group, Leonardo S.P.A, Elbit Systems Ltd., Airbus, General Electric, and Boeing.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Systems |

|

| Segmentation by Application |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. What are the latest technological trends in the market?

A. The aerospace avionics market is driven by latest technological trends such as hyper sonics technology and advanced aerial mobility (AAM).

Q2. Why will aerospace avionics deployment increase among the low-cost carriers?

A. The cost-effectiveness offered by low-cost carriers and high fuel efficiency are the major factors to boost the aerospace avionics deployment in the forecast period.

Q3. How has commercial aviation driven global aerospace avionics industry trends?

A. The significant growth in the number of passengers across the globe in the commercial aviation sector is aiding the expansion of the commercial aviation sub-segment.

Q4. What are the growth prospects of the avionics market?

A. The growing demand in the commercial and military aviation has aided the growth of avionics market.

Q5. What is the difference between aerospace and avionics?

A. Aerospace is a field that provides knowledge and skills for the design and development of aircraft, spacecraft, and missiles whereas avionics process the hardware or electronic parts of a spacecraft or aircraft.

Q6. Which country is best for aerospace engineering?

A. Russia is considered to be the best country for aerospace engineering and also for becoming an avionics engineer.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global aerospace avionics market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of component providers

4.3.2.List of service providers

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on aerospace avionics market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Aerospace Avionics Market Analysis, by Systems

5.1.Overview

5.2.Flight Control System

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Communication System

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Navigation System

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Monitoring System

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region

5.5.3.Market share analysis, by country

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Aerospace avionics Market Analysis, by Application

6.1.Commercial Aviation

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Military Aviation

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Business Jet and General Aviation

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Aerospace Avionics Market Analysis, by Distribution Channel

7.1.Overview

7.2.OEM

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Aftermarket

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Aerospace avionics Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Systems

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by Distribution Channel

8.1.2.Canada

8.1.2.1.Market size analysis, by Systems

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by Distribution Channel

8.1.3.Mexico

8.1.3.1.Market size analysis, by Systems

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by Distribution Channel

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Systems

8.2.1.2.Market size analysis, by Application

8.2.1.3.Market size analysis, by Distribution Channel

8.2.2.UK

8.2.2.1.Market size analysis, by Systems

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by Distribution Channel

8.2.3.France

8.2.3.1.Market size analysis, by Systems

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by Distribution Channel

8.2.4.Spain

8.2.4.1.Market size analysis, by Systems

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by Distribution Channel

8.2.5.Italy

8.2.5.1.Market size analysis, by Systems

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by Distribution Channel

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Systems

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by Distribution Channel

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Systems

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by Distribution Channel

8.3.2.Japan

8.3.2.1.Market size analysis, by Systems

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by Distribution Channel

8.3.3.India

8.3.3.1.Market size analysis, by Systems

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by Distribution Channel

8.3.4.Australia

8.3.4.1.Market size analysis, by Systems

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by Distribution Channel

8.3.5.South Korea

8.3.5.1.Market size analysis, by Systems

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by Distribution Channel

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Systems

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by Distribution Channel

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Systems

8.4.1.2.Market size analysis, by Application

8.4.1.3.Market size analysis, by Distribution Channel

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Systems

8.4.2.2.Market size analysis, by Application

8.4.2.3.Market size analysis, by Distribution Channel

8.4.3.UAE

8.4.3.1.Market size analysis, by Systems

8.4.3.2.Market size analysis, by Application

8.4.3.3.Market size analysis, by Distribution Channel

8.4.4.South Africa

8.4.4.1.Market size analysis, by Systems

8.4.4.2.Market size analysis, by Application

8.4.4.3.Market size analysis, by Distribution Channel

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Systems

8.4.5.2.Market size analysis, by Application

8.4.5.3.Market size analysis, by Distribution Channel

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.NORTHROP GRUMMAN CORPORATION

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.L3Harris Technologies, Inc.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.General Dynamics Corporation

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.BAE Systems

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Thales Group

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Leonardo S.P.A

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Elbit Systems Ltd.

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Airbus

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.General Electric

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Boeing

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Aerospace avionics system includes flight control systems, communications, lighting systems, electro-optic (EO/IR) systems, engine controls, navigation, weather radar, fuel systems, threat detection, and performance monitors. The main application areas of this system are respectively spacecraft, commercial airlines, military fighter jets, unmanned aerial vehicles (UAV), and business jets.

In recent years, the number of air travelers have been increased all across the world, surging the demand of commercial aircrafts. More and more fighter jets are being manufactured for military and defense industry. There’s a rise in the demand for unmanned aerial vehicles and business planes with the growing industrialization in the developed countries. These are the main factors expected to contribute to the growth of the aerospace avionics market during the forecast period from 2022-2030.

Impact Analysis of COVID-19 on the Market

The Covid-19 has affected the global aerospace avionics market in a moderate way. The main reason behind this moderate effect on the market growth is the decline in air passenger traffic during the pandemic. In order to curb the spread of the virus, restrictions were imposed in travel across borders by the governments. According to data released by International Air Transport Association, the international passenger demand in 2020 dropped to below 75.6% of the demand in 2019. This downfall in passenger traffic resulted in decreased demand of avionics software and hardware in the manufacturing of commercial aviation. However, the rising need for the implementation of advanced technologies, such as IIOT to facilitate the real-time monitoring of aerospace avionics product manufacturing processes and virtual control of production is likely to have a positive impact on the global aerospace avionics market growth in the post-pandemic period.

Aerospace Avionics Market Trends and Developments

According to a report published by Research Dive, the topmost players of the global aerospace avionics market include NORTHROP GRUMMAN CORPORATION, General Dynamics Corporation, L3Harris Technologies, Inc., BAE Systems, Leonardo S.P.A, Thales Group, Elbit Systems Ltd., General Electric, Airbus, and Boeing.

These industry players are investing a lot of efforts on the research and development of smart and unique strategies to sustain the growth of the market. These strategies include product launches, mergers and acquisitions, collaborations, partnerships, and refurbishing of existing technology. Some of the recent developments of the market are as follows:

- In December 2019, Airbus, a global pioneer in the aerospace sector, acquired MTM Robotics, an industrial automation company. This step reflects the dedication of Airbus’ in the expansion of advanced robotics competences within its industrial processes. The motif behind this acquisition was to leverage the benefits of using robotics in the manufacturing process of commercial aircraft.

- In April 2021, Elbit Systems Ltd, an Israel-based international defense electronics company, announced that its U.S. subsidiary, Elbit Systems of America, LLC, completed the acquisition of Sparton Corporation from an affiliate of Cerberus Capital Management, L.P. Sparton is a premier producer, developer, and supplier of systems helping Undersea Warfare for the U.S. Navy and allied military forces. This acquisition is aimed at the enhancement of Elbit Systems’ portfolio by the addition of the technological strength of Sparton to the long-term strategy of the company.

- In August 2021, Boeing, the largest aerospace company in the world, entered into a strategic partnership with AE Industrial Partners (AEI), a private equity firm specializing in aerospace, defense & government services, space, power generation, to manage and expand its HorizonX venture capital arm. The aim behind this partnership is to multiply Boeing’s venture capital investing in space and connectivity, mobility, industrial tech, and enterprise digital solutions, with a greater focus on sustainability.

- In August 2021, Northrop Grumman Corporation, an America-based global aerospace and defense technology company, provided the Arrays at Commercial Timescales Integration and Validation (ACT-IV) system to the Air Force Research Laboratory (AFRL) and Defense Advanced Research Projects Agency (DARPA). The system is based on a cutting-edge automatically scanned array (AESA) that completed numerous successful demonstrations and acceptance testing at the test facilities of Northrop Grumman.

Forecast Analysis of the Global Market

The key players of the global aerospace avionics market are focusing on remodeling and redefining their business structure and strategy to cope with changing scenario of the industry. Implementation of advanced technologies such as Internet of Things (IoT) will create many opportunities for the market in the post pandemic period. Conversely, the high cost involved in manufacturing & operations and maintenance of aerospace avionics systems are expected to hamper the market growth in the projected timeframe.

The significant rise in the passenger traffic especially in the commercial aviation and the growing demand for commercial & military aircrafts from the developing countries across the globe are the significant factors and aerospace avionics market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global aerospace avionics market is expected to garner $110,605.5 million during the forecast period (2022-2030). Regionally, the Asia-Pacific aerospace avionics market is estimated to observe fastest growth by 2030, owing to the commercial aviation expansion and an upsurge in the military aviation modernization programmes by countries, such as India, China, and Japan.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com